Jardine Matheson Leads STI Surge with 0.09% Increase

January 30, 2023

Trending News ☀️

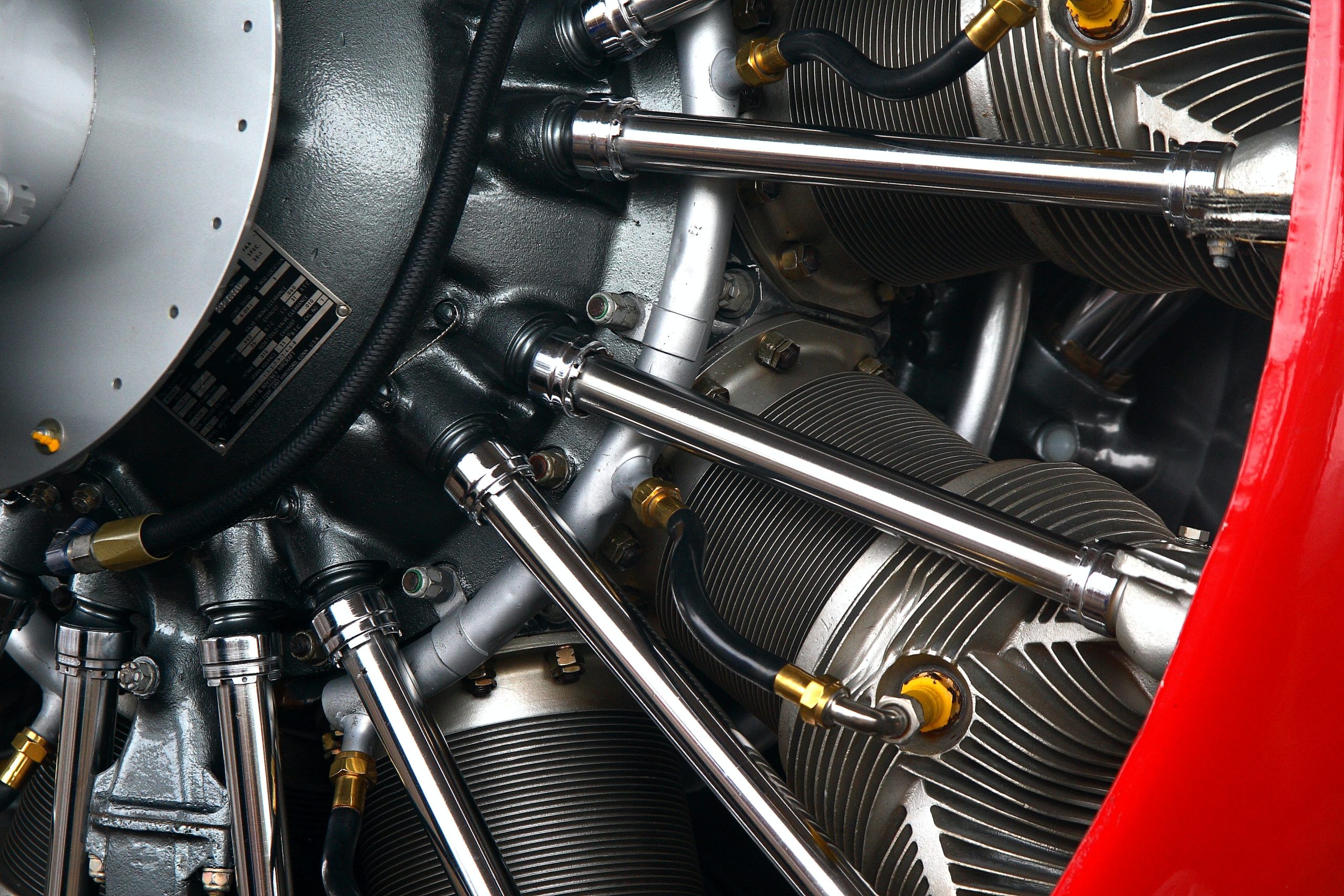

Today, the Straits Times Index (STI) saw a 0.09% surge, with Jardine Matheson ($SGX:J36) leading the pack. It is one of the oldest companies in Asia and is a conglomerate of different businesses ranging from hotels to transport and infrastructure. The company is listed on the Singapore Exchange and is also a component stock of the STI. Jardine Matheson’s success is due to its diversified portfolio, which helps to spread risk across different markets and industries. This strategy has allowed the company to remain resilient in times of market volatility.

In addition, the company has a strong presence in emerging markets such as China and Southeast Asia, giving it a first-mover advantage in these markets. The company has also been active in mergers and acquisitions, allowing it to expand its operations while strengthening its market position. Jardine Matheson also has strong financials, with solid profits and healthy balance sheets. This stability has enabled it to weather economic downturns and remain a strong performer in the stock market. Overall, Jardine Matheson is an iconic company with a long history of success. Its diversified portfolio and presence in emerging markets have enabled it to remain resilient in times of market volatility. Its strong financials and active M&A strategy have enabled it to remain a strong performer in the STI and other markets.

Stock Price

On Thursday, JARDINE MATHESON, one of the biggest conglomerates in Singapore, led the STI surge with a 0.09% increase. The stock opened at SG$51.0 and closed at SG$51.9, up by 0.9% from the previous closing price of 51.4. At the moment, media exposure towards JARDINE MATHESON is mostly positive due to their impressive stock performance. The company’s portfolio consists of several sectors such as motor vehicles and related products, property, hotel and restaurants, engineering and construction, financial services, trading and distribution, and transportation.

This diversified portfolio allows the company to spread its risk across multiple sectors and to benefit from the various industries. The company’s outlook for the future looks bright as the economic situation in Singapore slowly recovers from the pandemic. JARDINE MATHESON are well positioned to take advantage of any potential growth opportunities in the future and investors should keep a close eye on their stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jardine Matheson. More…

| Total Revenues | Net Income | Net Margin |

| 36.65k | 2.42k | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jardine Matheson. More…

| Operations | Investing | Financing |

| 4.34k | -392 | -5.03k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jardine Matheson. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 90k | 32.92k | 100.98 |

Key Ratios Snapshot

Some of the financial key ratios for Jardine Matheson are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.0% | 1.4% | 16.9% |

| FCF Margin | ROE | ROA |

| 9.2% | 13.1% | 4.3% |

VI Analysis

Jardine Matheson is a medium risk investment according to the VI Risk Rating. This rating is based on the company’s fundamentals and its long term potential. With the help of the VI App, assessing the company’s financial and business aspects is made easier. The app has detected two risk warnings which can be seen in the income sheet and the balance sheet. By becoming a registered user, one can access the warnings to understand them better. The VI Risk Rating provides users with an overview of the company’s financial and business performance, helping them to make informed investment decisions. It takes into account various factors such as profitability, liquidity and leverage, as well as the company’s market position and competitive environment. This information is presented in a simplified form, making it easier to assess the company’s risk profile. In conclusion, Jardine Matheson is a medium risk investment according to the VI Risk Rating. Although the app has detected two risk warnings, registered users can access them to understand them better. The VI Risk Rating provides users with a comprehensive overview of the company’s financial and business performance and helps them to make informed investment decisions. More…

VI Peers

In 1841, two Scottish merchants founded Jardine, Matheson & Co. in Canton, China. The company flourished in the Far East during the 19th century, and by the early 20th century, it had become one of the most powerful mercantile houses in Asia. The company’s principal competitors are Guoco Group Ltd, CJ Corp, and CK Hutchison Holdings Ltd.

– Guoco Group Ltd ($SEHK:00053)

Guoco Group Ltd is a Hong Kong-based investment holding company principally engaged in property businesses. The Company operates its businesses through four segments. The Property Development and Investment segment is engaged in the development of properties for sale, as well as the investment in properties. The Property Management segment is engaged in the provision of property management services. The Hotel Operations segment is engaged in the operation of hotels. The Others segment includes investment holding, as well as the provision of corporate and other services. The Company mainly operates businesses in Hong Kong, Mainland China, Malaysia, Singapore and the United Kingdom.

– CJ Corp ($KOSE:001040)

CJ Corp is a South Korean conglomerate with a market cap of 2.27T as of 2022. The company has a Return on Equity of 103.33%. CJ Corp is involved in a variety of businesses including food and food service, pharmaceuticals, biotechnology, entertainment, and logistics. The company has a strong presence in South Korea and has been expanding its operations internationally in recent years.

– CK Hutchison Holdings Ltd ($SEHK:00001)

CK Hutchison Holdings Ltd is a conglomerate holding company headquartered in Hong Kong. It was founded in 2015 by the merger of Cheung Kong Holdings and Hutchison Whampoa. It is the largest conglomerate in Hong Kong, with businesses in a variety of industries including telecommunications, ports and related services, retail, infrastructure, energy, and chemicals.

CK Hutchison has a market cap of 166.99B as of 2022. Its return on equity is 6.66%. The company is involved in a variety of businesses including telecommunications, ports and related services, retail, infrastructure, energy, and chemicals.

Summary

Jardine Matheson has seen a 0.09% increase in its stock prices, indicating a surge in investor confidence. The gain is likely due to the company’s recent positive media exposure and its strong financial performance. Investors have been attracted to Jardine Matheson’s diverse portfolio of industries, which includes motor vehicles, property, engineering and construction, as well as hotels and restaurants.

The company’s strategic investments in both existing and emerging markets have also made it attractive to investors looking for long-term growth opportunities. Jardine Matheson’s commitment to innovation, along with its sound management practices and solid financials, is likely to continue to draw investors to the company in the near future.

Recent Posts