Honeywell Supplies Cargo-Blimp Startup With Most Powerful Generator

April 6, 2023

Trending News ☀️

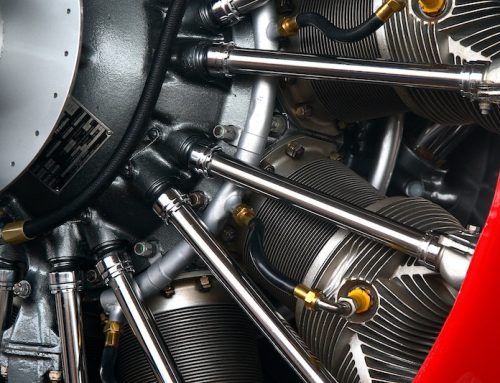

The company produces a wide range of products and services, spanning aerospace, building technologies, chemicals, automation, materials and much more. Recently, Honeywell has supplied a cargo-blimp startup with the most powerful generator on the market. The generator itself is a powerful and reliable engine known for its low emissions and fuel efficiency. It provides the cargo-blimp startup with the power it needs to transport goods across the globe in a safe and reliable manner.

The generator is also designed to reduce environmental impact, as well as improve fuel savings. Honeywell International ($NASDAQ:HON) is committed to creating innovative solutions to meet the needs of its customers. With its high-quality products and services, Honeywell continues to be a leader in the industry and will continue to provide innovative solutions for its customers’ needs.

Stock Price

On Wednesday, HONEYWELL INTERNATIONAL stock opened at $190.3 and closed at $189.4, down by 0.8% from last closing price of 190.9. The company has been making news recently with the announcement that it is supplying a cargo-blimp startup with its most powerful generator. This latest move by the company is a testament to their commitment to innovation and pushing the boundaries of what is possible. This latest development has been well-received by the market and is likely to contribute to an increase in stock value in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Honeywell International. More…

| Total Revenues | Net Income | Net Margin |

| 35.47k | 4.97k | 15.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Honeywell International. More…

| Operations | Investing | Financing |

| 5.27k | -93 | -6.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Honeywell International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.27k | 44.95k | 24.99 |

Key Ratios Snapshot

Some of the financial key ratios for Honeywell International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | -2.1% | 19.2% |

| FCF Margin | ROE | ROA |

| 12.7% | 24.7% | 6.8% |

Analysis

At GoodWhale, we understand the importance of making educated decisions when it comes to investing. That’s why we provide analyses of HONEYWELL INTERNATIONAL‘s financials, so that you can be as informed as possible when it comes to investing. According to our Risk Rating, HONEYWELL INTERNATIONAL is a low risk investment in terms of financial and business aspects. We encourage you to become a registered user to learn more about the business and financial areas with potential risks. Through our comprehensive analysis, we can provide you with the knowledge and confidence you need to make a sound decision when it comes to choosing where to invest your money. More…

Peers

Honeywell International Inc is an American multinational conglomerate company that produces a variety of commercial and consumer products, engineering services and aerospace systems for a wide variety of customers, from private consumers to major corporations and governments. Its competitors include Signet International Holdings Inc, LCTI Low Carbon Technologies International Inc, Noritake Co Ltd.

– Signet International Holdings Inc ($OTCPK:LWCTF)

Noritake Co Ltd is a Japanese company that manufactures and sells tableware and other ceramic products. The company has a market cap of 58.36 billion as of 2022 and a return on equity of 6.39%. Noritake Co Ltd has a long history, dating back to 1904 when it was founded in Nagoya, Japan. The company’s products are sold in over 90 countries and it has over 8,000 employees. Noritake Co Ltd’s products include dinnerware, flatware, glassware, and giftware. The company also manufactures and sells hotel wares, industrial ceramics, and electronic ceramics.

Summary

Honeywell International Inc. is a multinational conglomerate headquartered in Charlotte, North Carolina. Analysts generally remain positive on Honeywell’s long-term prospects, citing its strength in the aviation, energy, and defense sectors, as well as its well-positioned portfolio of industrial products. Honeywell has undergone a large restructuring program which has resulted in improved productivity and cost savings.

It has also made numerous acquisitions to diversify its business and expand its presence in key growth markets. Analysts expect the company to continue to benefit from favorable market conditions and are optimistic about its future growth prospects.

Recent Posts