Honeywell International’s Stock Falls 1.52% Amid Negative Pressures

June 8, 2023

🌧️Trending News

It is headquartered in Charlotte, North Carolina USA, and operates in many industries across the world. The company’s stock has been under pressure due to negative developments in the market, resulting in a drop of 1.52% in the latest session. This saw the stock settle at 191.60 points, down 2.95 points from the previous day’s close. Analysts attribute the decline of Honeywell International ($NASDAQ:HON)’s stock to a number of factors, such as rising geopolitical tensions, global economic uncertainty, and the volatile nature of the market. These factors have weighed on the company’s share prices, leading to the drop in the latest session.

Additionally, the company’s earnings reports have been declining in recent quarters, which is also likely to have played a role in the stock’s underperformance. Overall, Honeywell International’s stock has been under pressure due to negative market pressures and its own lackluster performance. The company will need to take steps to address these issues if it hopes to achieve a sustained recovery in its stock price.

Analysis

At GoodWhale, we have conducted a thorough analysis of HONEYWELL INTERNATIONAL‘s fundamentals. We are pleased to report that, based on our Risk Rating, HONEYWELL INTERNATIONAL is a low risk investment in terms of financial and business aspects. We highly recommend that any investor interested in HONEYWELL INTERNATIONAL should register on goodwhale.com to review our detailed assessment of the company’s financial and operational risk factors. With our user-friendly platform, you will be able to quickly identify potential areas of risk and make informed decisions that are in line with your own investment strategies. We at GoodWhale are committed to helping investors protect their investments by providing accurate and comprehensive analyses of the risks associated with individual companies. Our Risk Rating system is designed to provide investors with up-to-date information on the financial and operational risk levels of the companies in which they are investing. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Honeywell International. More…

| Total Revenues | Net Income | Net Margin |

| 35.95k | 5.23k | 15.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Honeywell International. More…

| Operations | Investing | Financing |

| 4.45k | -112 | -6.58k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Honeywell International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 59.88k | 42.36k | 25.42 |

Key Ratios Snapshot

Some of the financial key ratios for Honeywell International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | -0.3% | 19.9% |

| FCF Margin | ROE | ROA |

| 10.2% | 26.6% | 7.5% |

Peers

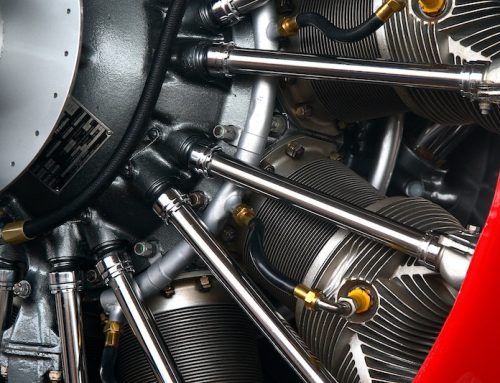

Honeywell International Inc is an American multinational conglomerate company that produces a variety of commercial and consumer products, engineering services and aerospace systems for a wide variety of customers, from private consumers to major corporations and governments. Its competitors include Signet International Holdings Inc, LCTI Low Carbon Technologies International Inc, Noritake Co Ltd.

– Signet International Holdings Inc ($OTCPK:LWCTF)

Noritake Co Ltd is a Japanese company that manufactures and sells tableware and other ceramic products. The company has a market cap of 58.36 billion as of 2022 and a return on equity of 6.39%. Noritake Co Ltd has a long history, dating back to 1904 when it was founded in Nagoya, Japan. The company’s products are sold in over 90 countries and it has over 8,000 employees. Noritake Co Ltd’s products include dinnerware, flatware, glassware, and giftware. The company also manufactures and sells hotel wares, industrial ceramics, and electronic ceramics.

Summary

Honeywell International‘s stock has been subject to negative pressures recently, with the stock falling 1.52% in the last session and settling at 191.60. Investment analysts suggest that investors should consider different factors before investing in the company, including its financial performance, management, industry dynamics, risks, and potential returns. Other key points of interest include its dividend yield, estimated future earnings, current and future competitive landscape, and the company’s competitive advantages. It is advisable for investors to do their own due diligence and research before making any decisions.

Recent Posts