Honeywell International Shares Slip 0.68% to $208.26 in Mixed Trading Session

July 28, 2023

☀️Trending News

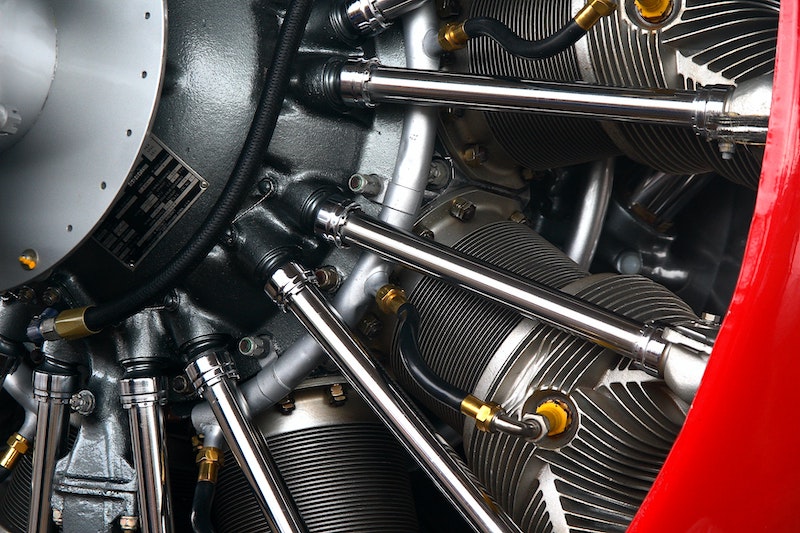

Honeywell International ($NASDAQ:HON) Inc. saw its shares slip 0.68% to $208.26 on Wednesday as the stock market experienced a mixed trading session. Honeywell International is a global leader in engineering and technology, providing products and services for aerospace, home and building, and safety and productivity solutions. Their products and services are used in a variety of industries, such as automotive, aviation, energy, healthcare, and others. The company has various divisions and subsidiaries that are focused on developing innovative products and services to meet the needs of their customers. Their commitment to innovation has made them a leader in their field, as they consistently strive to improve their offerings.

Honeywell International Inc.’s share price has been volatile in recent months, as investors have closely watched the company’s performance. Despite the challenges facing the company, they remain confident in their ability to continue delivering value for their shareholders. Honeywell International continues to be a leading player in the engineering and technology space, and investors will be watching to see how the company performs in the coming months.

Analysis

After conducting a comprehensive analysis of HONEYWELL INTERNATIONAL‘s fundamentals, GoodWhale has arrived at the following conclusion. According to the Star Chart, HONEYWELL INTERNATIONAL has an impressive health score of 8/10. This indicates that the company has strong cash flows and low debt, allowing it to pay off its existing debt and fund future operations. Furthermore, HONEYWELL INTERNATIONAL scored high in dividend and profitability, medium in assets, and weak in growth. This categorizes the company as a ‘cow’, or a company with a track record of paying out consistent and sustainable dividends. Investors who may be interested in such a company are those who value income security and stability. These could be individuals looking for consistent income, such as retirees who need to supplement their pensions, or institutional investors who are keen on long-term investments. Additionally, those who are looking for a low risk investment with reliable returns may find HONEYWELL INTERNATIONAL appealing. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Honeywell International. More…

| Total Revenues | Net Income | Net Margin |

| 35.95k | 5.23k | 15.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Honeywell International. More…

| Operations | Investing | Financing |

| 4.45k | -112 | -6.58k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Honeywell International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 59.88k | 42.36k | 25.42 |

Key Ratios Snapshot

Some of the financial key ratios for Honeywell International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | -0.3% | 19.9% |

| FCF Margin | ROE | ROA |

| 10.2% | 26.6% | 7.5% |

Peers

Honeywell International Inc is an American multinational conglomerate company that produces a variety of commercial and consumer products, engineering services and aerospace systems for a wide variety of customers, from private consumers to major corporations and governments. Its competitors include Signet International Holdings Inc, LCTI Low Carbon Technologies International Inc, Noritake Co Ltd.

– Signet International Holdings Inc ($OTCPK:LWCTF)

Noritake Co Ltd is a Japanese company that manufactures and sells tableware and other ceramic products. The company has a market cap of 58.36 billion as of 2022 and a return on equity of 6.39%. Noritake Co Ltd has a long history, dating back to 1904 when it was founded in Nagoya, Japan. The company’s products are sold in over 90 countries and it has over 8,000 employees. Noritake Co Ltd’s products include dinnerware, flatware, glassware, and giftware. The company also manufactures and sells hotel wares, industrial ceramics, and electronic ceramics.

Summary

Honeywell International Inc. saw a 0.68% decline in share prices on Wednesday, closing at $208.26. Despite the minor dip, Honeywell remains a good investment opportunity for those looking for a well-established company with a diverse range of products and services. It has a long history of providing innovative solutions in the aerospace, building technologies, performance materials, and safety and productivity solutions industries.

Its financials are also sound, with a strong balance sheet, healthy operating cash flow, and consistent dividend payouts. Investors should look to Honeywell as a reliable long-term choice in the market.

Recent Posts