Honeywell International Receives Average Brokerage Recommendation of ‘Hold’

October 29, 2023

🌥️Trending News

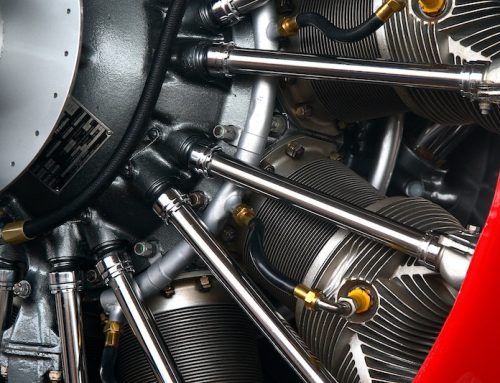

Honeywell International ($NASDAQ:HON) Inc. is a multinational conglomerate with its headquarters located in Charlotte, North Carolina. It is a technology and manufacturing giant with operations in aerospace, building technologies, performance materials and technologies, safety and productivity solutions, and specialty materials. Recently, brokerages have given Honeywell International an average recommendation of “Hold”. Brokerages typically issue ratings on a company’s stock based on their expected performance. This rating is mostly based on the company’s financials, past performance, and expected future developments. In the case of Honeywell International, the brokerages have taken into account the company’s impressive financials, strong past performance, and potential for future growth.

However, they have concluded that the current stock price may not be enough to justify a “Buy” rating. Overall, while Honeywell International has received a “Hold” rating from brokerages, the company has numerous strengths that should be taken into consideration. These include its strong financials, past performance, and potential for future growth. Investors considering investing in Honeywell International should be aware of these factors before making any decisions.

Stock Price

On Monday, HONEYWELL INTERNATIONAL Inc. (HON) opened at $181.6 and closed at $180.5, down by 0.4% from last closing price of 181.3. The recommendation states that investors should neither buy nor sell the stock. Analysts have considered several factors including the stock’s current market price, potential future earnings, expected performance of the company in the future, as well as the business environment. After taking into account these factors, analysts have determined that HONEYWELL INTERNATIONAL’s stock is currently trading at an average price, and therefore, investors should not take a risk by investing in it. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Honeywell International. More…

| Total Revenues | Net Income | Net Margin |

| 36.15k | 5.45k | 15.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Honeywell International. More…

| Operations | Investing | Financing |

| 5.03k | -1.22k | -3.36k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Honeywell International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.34k | 44.44k | 26.05 |

Key Ratios Snapshot

Some of the financial key ratios for Honeywell International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.5% | 5.0% | 20.6% |

| FCF Margin | ROE | ROA |

| 11.5% | 27.2% | 7.5% |

Analysis

GoodWhale recently performed an analysis of HONEYWELL INTERNATIONAL‘s fundamentals. Using our Star Chart, we determined that HONEYWELL INTERNATIONAL is strong in dividend and profitability, medium in asset, and weak in growth. Furthermore, HONEYWELL INTERNATIONAL has a high health score of 9/10, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. Based on this analysis, we concluded that HONEYWELL INTERNATIONAL is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. Therefore, investors who are looking for a company with a track record of consistent dividends may be interested in HONEYWELL INTERNATIONAL. More…

Peers

Honeywell International Inc is an American multinational conglomerate company that produces a variety of commercial and consumer products, engineering services and aerospace systems for a wide variety of customers, from private consumers to major corporations and governments. Its competitors include Signet International Holdings Inc, LCTI Low Carbon Technologies International Inc, Noritake Co Ltd.

– Signet International Holdings Inc ($OTCPK:LWCTF)

Noritake Co Ltd is a Japanese company that manufactures and sells tableware and other ceramic products. The company has a market cap of 58.36 billion as of 2022 and a return on equity of 6.39%. Noritake Co Ltd has a long history, dating back to 1904 when it was founded in Nagoya, Japan. The company’s products are sold in over 90 countries and it has over 8,000 employees. Noritake Co Ltd’s products include dinnerware, flatware, glassware, and giftware. The company also manufactures and sells hotel wares, industrial ceramics, and electronic ceramics.

Summary

Honeywell International Inc. has recently been given an average recommendation of “Hold” by brokerages. Investors should be cautious when considering investing in this company and stay informed of the current market trends. Honeywell is an international conglomerate that provides products and services related to energy efficiency, safety, and security. Although the company has seen strong growth in recent years, investors should be wary of its overall financial health.

Its cash flow and debt levels are moderate, and it is exposed to macroeconomic and geopolitical risks that could impact its profitability. Investors also need to consider Honeywell’s competition in the industry, as other companies may offer similar products and services at a lower cost. All in all, investors should research carefully before making any decisions about investing in Honeywell International Inc.

Recent Posts