Hitachi Cooling and Heating Powers Up With Delhivery Partnership in 2023.

March 26, 2023

Trending News 🌥️

In 2023, Johnson Controls-Hitachi ($TSE:6501) Air Conditioning is entering into a strategic partnership with Delhivery in order to strengthen their presence in the Indian market. Hitachi Cooling and Heating, the leading air-conditioner brand in India, will be able to increase their reach and provide more efficient customer service through this partnership. This will give Hitachi the ability to easily distribute their goods on a larger scale. Furthermore, the partnership will also ensure that Hitachi Cooling and Heating products reach their customers faster and in better condition.

This partnership is part of Hitachi’s overall strategy to bolster their presence in the Indian market. By using Delhivery’s reliable and efficient logistics network, Hitachi will be able to increase their customer base and reach more people than ever before. This collaboration between two renowned companies is likely to have a positive impact on both brands and will prove beneficial for Hitachi Cooling and Heating in the long run.

Price History

Media sentiment for the news has been overwhelmingly positive, with many praising the strategic move. At the time of writing, HITACHI stock opened at JP¥6855.0 on Friday and closed at JP¥6849.0, down by 0.2% from its prior closing price of 6863.0. While this minor dip may appear insignificant, it is indicative of the market’s confidence in Hitachi’s future growth prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hitachi. More…

| Total Revenues | Net Income | Net Margin |

| 11.03M | 424.92k | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hitachi. More…

| Operations | Investing | Financing |

| 852.88k | -166.41k | -768.25k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hitachi. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.28M | 8.11M | 4.99k |

Key Ratios Snapshot

Some of the financial key ratios for Hitachi are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.8% | 5.5% | 6.8% |

| FCF Margin | ROE | ROA |

| 3.8% | 9.9% | 3.5% |

Analysis

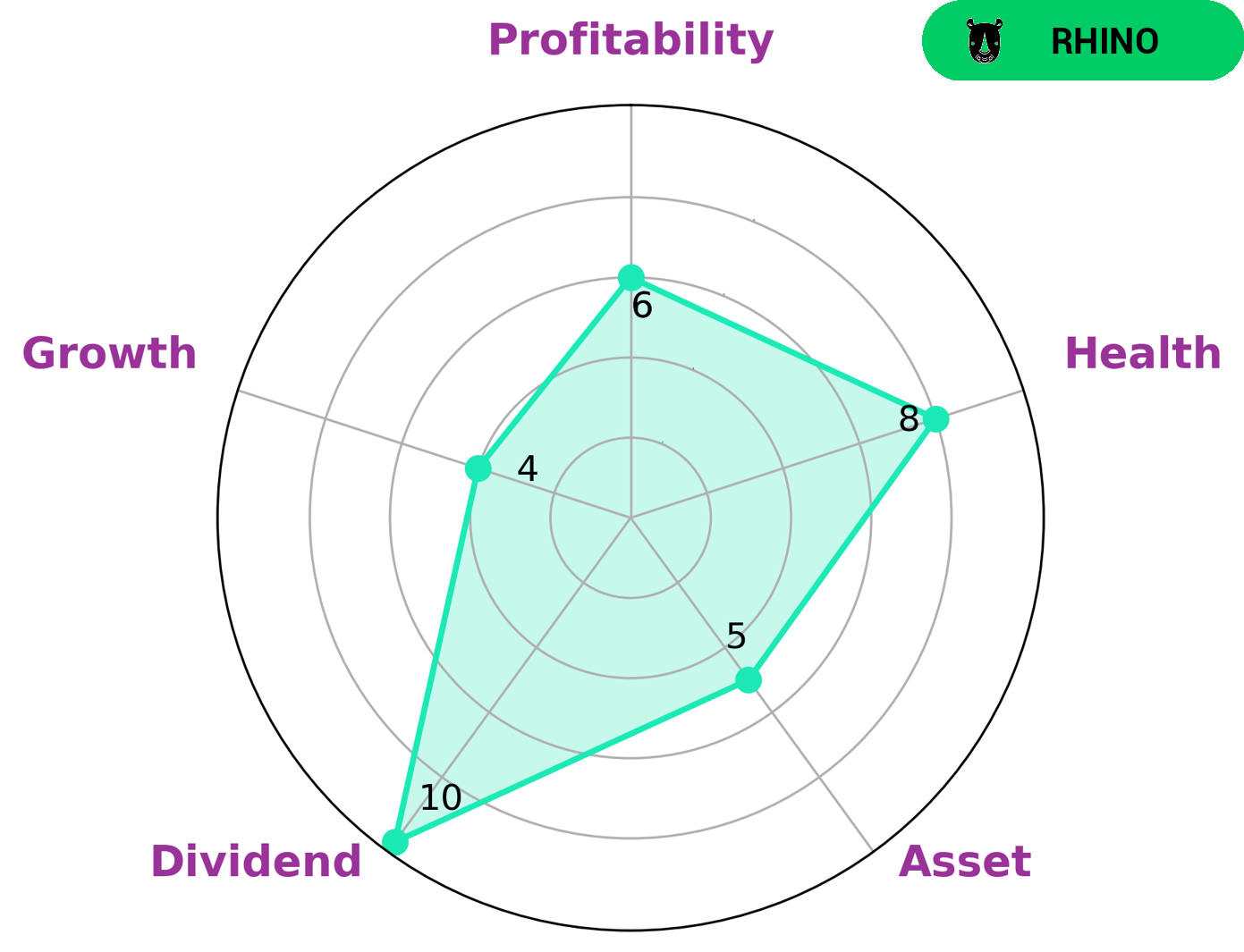

At GoodWhale, we have done an analysis of HITACHI‘s financials and according to our Star Chart, they have a high health score of 8/10 with regard to their cashflows and debt, indicating their capability to pay off debt and fund future operations. Additionally, HITACHI is strong in dividend and medium in asset, growth, and profitability. After further analysis, we classified HITACHI as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. We believe that these characteristics make HITACHI attractive to the following types of investors: value investors, dividend investors, and long-term investors. Value investors may be interested in HITACHI due to its high health score and its low share price relative to its book value. Dividend investors may be interested in HITACHI’s strong dividend payouts. Lastly, long-term investors may be attracted to HITACHI’s consistent medium performance in asset, growth, and profitability. These are all factors that may make HITACHI attractive to potential investors. More…

Peers

Hitachi Ltd is one of the largest multinational conglomerates in the world. It is a major player in the technology, electronics, and automotive industries, competing against companies such as Digistar Corp Bhd, Kanaden Corp, and ShinMaywa Industries Ltd. These companies bring their own unique set of strengths to the table, presenting a formidable challenge to Hitachi’s dominance in the global market.

– Digistar Corp Bhd ($KLSE:0029)

Digistar Corp Bhd is a Malaysian-based technology and services provider that specializes in digital media, consumer electronics, and communications solutions. With a market cap of 31.25 million as of 2023, the company has seen considerable growth in value over the past few years. In addition, Digistar Corp Bhd has a Return on Equity (ROE) of 13.16%, demonstrating that the company is generating a good return on its investments. This makes Digistar Corp Bhd an attractive option for investors looking for a profitable technology and services provider.

– Kanaden Corp ($TSE:8081)

Kanaden Corp is a multinational corporation based in Japan that provides a wide range of products and services for the automotive, industrial, and electronics industries. In 2023, the company had a market capitalization of 28.66 billion dollars and a return on equity of 5.12%. The company’s market cap is a reflection of its strong financial performance and ability to generate returns for its shareholders. Furthermore, its return on equity indicates that it is able to effectively utilize the capital invested in the company to generate profits.

– ShinMaywa Industries Ltd ($TSE:7224)

ShinMaywa Industries Ltd is a Japanese industrial firm specializing in the production of aircraft, ships, and other transportation-related products. The company has a market cap of 67.87B as of 2023, indicating a strong presence in the market. Its Return on Equity (ROE) of 7.42% illustrates that the company is making efficient use of its shareholders’ funds, allowing it to generate significant profits. The high market cap and ROE of ShinMaywa Industries Ltd are a testament to its success in the industry.

Summary

Investing in Hitachi is looking more attractive following the announcement of their partnership with Delhivery in 2023. This new collaboration is creating a lot of positive media buzz, and the potential for growth is clear. Analysts believe the move could help Hitachi expand its reach into new markets and allow them to capitalize on the rapidly growing home services market.

Investors should also be aware that this partnership could open up additional avenues for Hitachi to target for future growth opportunities. Overall, Hitachi appears to be in a prime position to benefit from the new partnership, and investors should consider adding the company to their portfolios.

Recent Posts