Velo3d Intrinsic Value Calculator – VELO3D Stock Price Soars 42.6% After Recent Lows – What’s Next?

April 1, 2023

Trending News 🌧️

VELO3D ($NYSE:VLD) Inc. (NYSE:VLD) has experienced a significant stock price rebound of 42.6% after recently hitting lows. This has left investors wondering what the future of the company holds and whether the stock price can be sustained. VELO3D is a leader in the additive manufacturing industry and offers a variety of solutions for metal 3D printing. The company’s products are used by a range of industries, including aerospace, medical and automotive, to enable cost savings and increased speed in production. Investors are now wondering how Velo3D Inc. will continue to perform in the coming months and years. The company has recently announced several strategic partnerships and investments that could help to drive future growth and success.

Additionally, VELO3D is continuing to invest in research and development of its 3D printing technology to ensure its products remain competitive. Overall, the 42.6% rebound in VELO3D’s stock price has been encouraging for investors, but only time will tell if the stock can sustain its current levels or even exceed them in the future. With the company’s expanding product offering and strategic partnerships, VELO3D looks well-positioned to continue as a leader in the 3D printing industry.

Share Price

The opening price of VELO3D stock was $2.3, and closed at $2.3, up by 1.8% from its prior closing price of $2.2. This increase in stock price comes after the company faced recent lows in its stock value, creating a great deal of curiosity about what is next for the company. Analysts have suggested that the recent surge in VELO3D’s stock price could be attributed to the company’s potential to benefit from a strong shift towards 3D printing technology. Several investors have expressed their positive outlook on VELO3D’s future prospects and continue to show their confidence in the company’s ability to provide revolutionary solutions in the area of 3D printing.

It will be interesting to see how the company fares in the future and how its stock price reacts to the changing macroeconomic environment. In spite of recent lows, the surge in stock price appears to be a good sign for the company, and investors are keenly watching VELO3D’s progress in the coming months. velo3d-stock-price-soars-42.6%-after-recent-lows-–-what’s-next?”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Velo3d. More…

| Total Revenues | Net Income | Net Margin |

| 80.76 | 10.02 | -127.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Velo3d. More…

| Operations | Investing | Financing |

| -123.96 | -53.02 | 1.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Velo3d. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 225.11 | 84.27 | 0.75 |

Key Ratios Snapshot

Some of the financial key ratios for Velo3d are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 12.9% |

| FCF Margin | ROE | ROA |

| -177.5% | 5.1% | 2.9% |

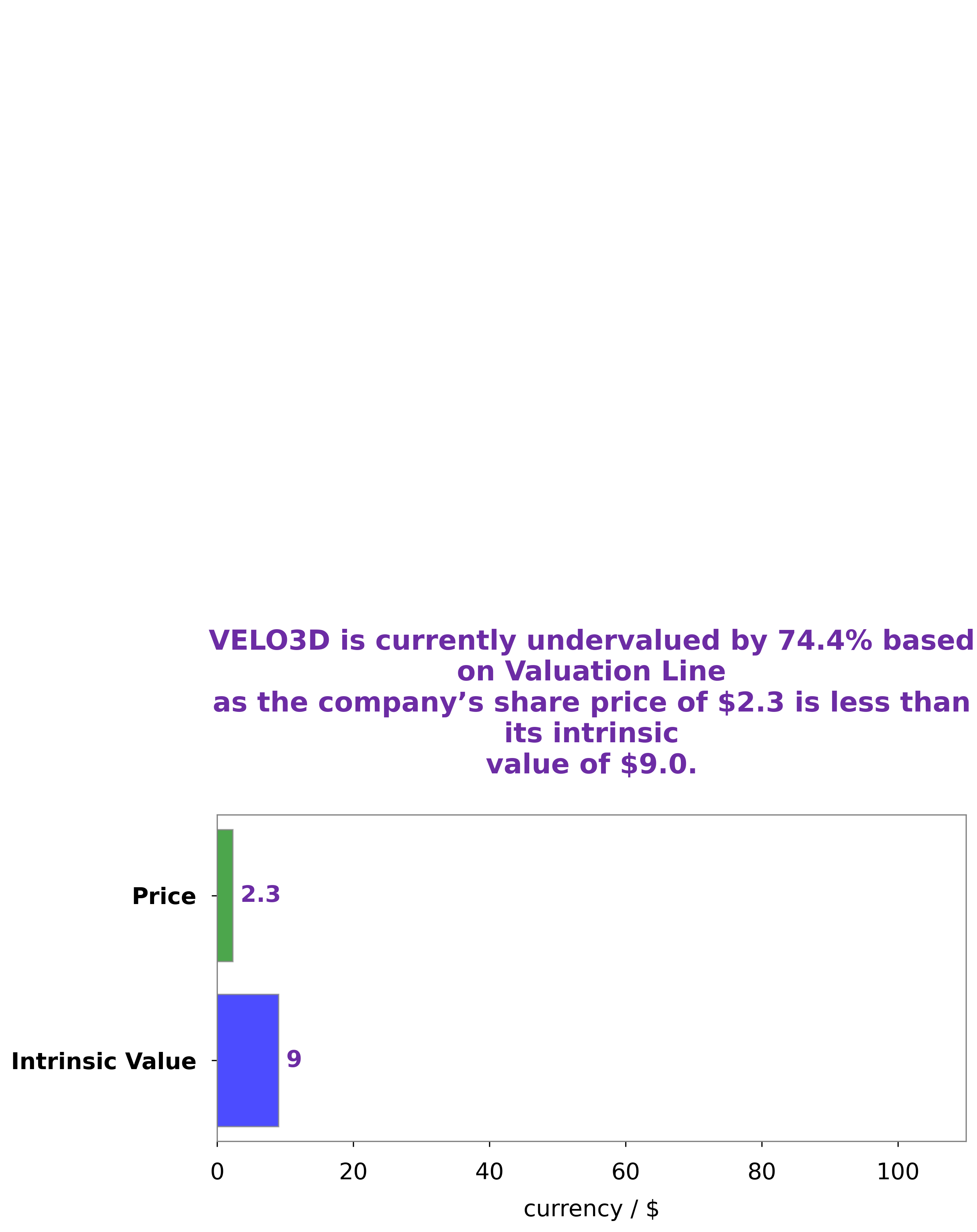

Analysis – Velo3d Intrinsic Value Calculator

GoodWhale recently conducted a comprehensive analysis of the financials of VELO3D. After careful consideration of the financials, our proprietary Valuation Line analysis showed that the intrinsic value of VELO3D share is around $9.0. However, at the time of writing, the stock is currently trading at $2.3 — a 74.3% discount to its actual intrinsic value. This indicates that VELO3D’s stock is currently undervalued, presenting a potential opportunity for investors. velo3d-stock-price-soars-42.6%-after-recent-lows-–-what’s-next?”>More…

Peers

The company competes with 3DX Industries Inc, Markforged Holding Corp, and Cognex Corp.

– 3DX Industries Inc ($OTCPK:DDDX)

3DX Industries Inc is a publicly traded company with a market capitalization of $631,910 as of March 2021. The company has a return on equity of 16.98% as of the same date. 3DX Industries Inc is engaged in the business of providing 3D printing and related services to the aerospace, defense, and other industries.

– Markforged Holding Corp ($NYSE:MKFG)

Markforged Holding Corp is a 3D printing company that produces machines that print metal and carbon fiber. The company has a market cap of 425.61M as of 2022 and a Return on Equity of 8.01%. Markforged was founded in 2013 by Greg Mark and is headquartered in Watertown, Massachusetts.

– Cognex Corp ($NASDAQ:CGNX)

Cognex Corp is a leading provider of industrial machine vision systems. Their products are used in a variety of industries, including automotive, electronics, food and beverage, and pharmaceuticals. Cognex’s market cap is 8.17B as of 2022, and their ROE is 14.01%. The company’s products are used to automate tasks and improve productivity.

Summary

Velo3D Inc. (NYSE:VLD) recently experienced a significant upswing in share prices, as they rebounded 42.6% from their lows. This surge has gained the attention of many investors, who have been looking to take advantage of this buying opportunity. Analysts are divided on the future of the company, but most agree that their portfolio of products and services is a strength that could pull the stock higher. Investors should also consider the company’s financials and cash flow, which are both healthy.

Furthermore, the company has seen a rapid expansion, which has been driven by increasing demand for its services, and this could help spur further gains. Finally, the company’s recent partnership with HP could also prove to be a powerful catalyst for growth. Overall, the outlook for Velo3D appears positive, and those investors who take advantage of this buying opportunity may reap strong returns in the long run.

Recent Posts