STRATASYS LTD Reports First Quarter Earnings for Fiscal Year 2023.

June 3, 2023

🌥️Earnings Overview

On May 16 2023, STRATASYS LTD ($NASDAQ:SSYS) reported their first quarter earnings of fiscal year 2023 (ending March 31 2023). Total revenue for the quarter was USD 149.4 million, an 8.6% decrease from the same period in the previous year. Net income was reported at -22.2 million, an improvement over the prior year’s net loss of -21.0 million.

Market Price

The stock opened at $15.2 and closed at $15.8, a 9.7% increase from the previous closing price of $14.4. This marked a significant jump for the company, which saw their share prices wavering throughout the last quarter. This was driven by an increase in demand for their 3D printing solutions, which have become increasingly popular for a variety of applications. STRATASYS LTD also provided an outlook for the upcoming quarters.

Additionally, the company has invested in research and development to continue creating innovative products that meet the ever-changing needs of their customers. Overall, the first quarter earnings report for STRATASYS LTD was good news for investors, with their stock prices rising by 9.7%. With an optimistic outlook and investments in research and development, there is much potential for the company to continue to grow in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stratasys Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 637.43 | -30.25 | -8.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stratasys Ltd. More…

| Operations | Investing | Financing |

| -75.41 | -7.21 | -2.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stratasys Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.24k | 292.63 | 13.87 |

Key Ratios Snapshot

Some of the financial key ratios for Stratasys Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | – | -8.5% |

| FCF Margin | ROE | ROA |

| -14.9% | -3.6% | -2.7% |

Analysis

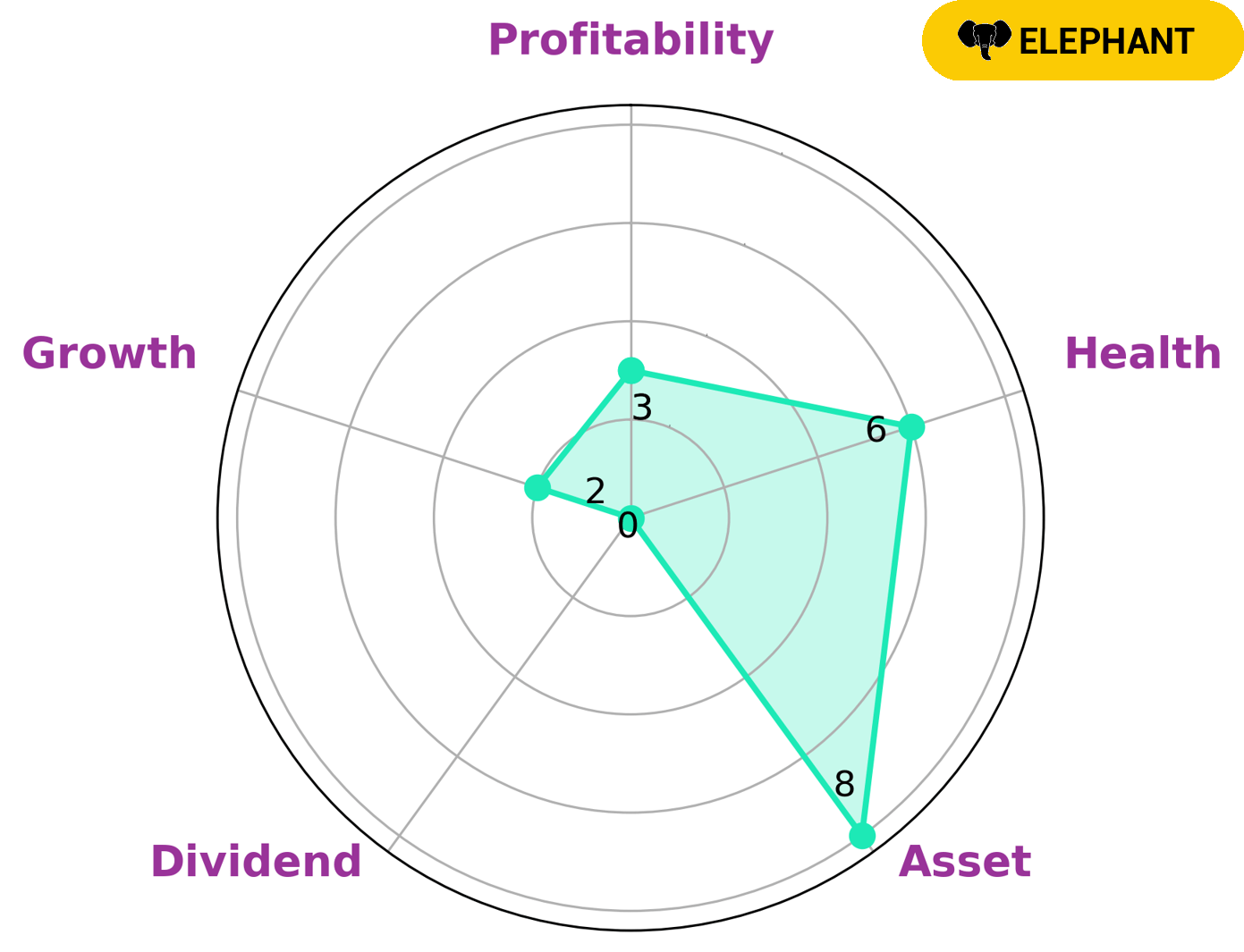

At GoodWhale, we conducted an analysis of STRATASYS LTD‘s financials and classified the company as an ‘elephant’, based on its rich assets after deducting off liabilities. We believe this type of company will be attractive to investors seeking value in long-term investments and stability. STRATASYS LTD’s financial performance is strong in terms of assets but weak in dividend, growth, and profitability. Their intermediate health score of 6/10 considers their cash flow and debt, giving us confidence that they are likely to sustain future operations in times of crisis. More…

Peers

The company’s products are used in a variety of industries, including aerospace, automotive, healthcare, and consumer products. Stratasys Ltd has a wide range of competitors, including WEP Solutions Ltd, MGI Digital Graphic Technology SA, and HiTi Digital Inc.

– WEP Solutions Ltd ($BSE:532373)

WEP Solutions Ltd is an information technology company that provides a range of services, including software development, enterprise resource planning, and cloud computing. The company has a market cap of 839.61M as of 2022 and a Return on Equity of 6.32%.

– MGI Digital Graphic Technology SA ($OTCPK:FRIIF)

MGI Digital Graphic Technology SA is a Swiss manufacturer of digital printing and finishing solutions for the graphic arts industry. The company has a market capitalization of 184.68 million as of 2022 and a return on equity of 4.79%. MGI Digital Graphic Technology SA designs, manufactures, and markets a range of digital printing and finishing solutions, including printers, print heads, inks, and software. The company’s products are used in a variety of applications, such as signage, packaging, labels, and commercial printing.

– HiTi Digital Inc ($TWSE:3494)

HiTi Digital Inc is a publicly traded company with a market cap of 1B as of 2022. The company has a Return on Equity of -23.92%. HiTi Digital Inc is engaged in the business of digital textile printing, photo printing, and ID card printing.

Summary

STRATASYS LTD recently reported their first quarter earnings for the fiscal year 2023. Total revenue for the quarter was 149.4 million, a 8.6% decrease from the same period last year. Net income for the quarter was reported at -22.2 million, compared to the net loss of -21.0 million in the previous year.

Despite the negative earnings results, the stock price moved up on the same day, indicating the market is still positive on the company’s future. Investors should note that STRATASYS LTD has had a rocky financial performance in recent quarters and should conduct further research before investing in the company.

Recent Posts