Socket Mobile Intrinsic Value – Socket Mobile Introduces Wearable Barcode Scanner DuraScan Wear DW930

June 10, 2023

🌥️Trending News

Socket Mobile ($NASDAQ:SCKT) Inc., a leading provider of data capture and delivery solutions for enhanced productivity, recently announced the launch of its latest product, the DuraScan Wear DW930 wearable barcode scanner. This product is designed to help streamline and simplify inventory management and other related tasks. The DuraScan Wear DW930 is a lightweight and versatile scanner that allows users to read barcodes on various surfaces with ease. It is built for durability and can be worn either as a wrist-mounted device or as a pocket-mounted device. The scanner is equipped with advanced scanning technology, providing fast and accurate barcode recognition. It also features wireless connectivity, allowing users to access data from anywhere.

The company is well regarded for its quality products and exceptional customer service. It is publicly traded on the NASDAQ Global Market under the ticker symbol SCKT. Socket Mobile’s mission is to make data capture easier, faster, and more efficient, allowing companies to save time and money. With the introduction of the DuraScan Wear DW930, they are continuing to lead the way in this area.

Market Price

On Tuesday, SOCKET MOBILE, an industry leader in mobile data capture solutions, announced the launch of its newest product, the DuraScan Wear DW930, a wearable barcode scanner. This product is designed to provide users with a hands-free, flexible approach to scanning barcodes, making it perfect for applications that require professionals to move freely without having to hold a scanner. It is also durable and water-resistant, ensuring that it will stand up to the rigors of a tough work environment. Furthermore, the device is compatible with both Android and iOS operating systems, giving users the flexibility to use their preferred operating system.

Upon the announcement of the DuraScan Wear DW930, SOCKET MOBILE’s stock opened at $1.4 and closed at $1.4, down by 0.4% from last closing price of $1.4. Despite this minor dip, SOCKET MOBILE remains confident that its newest product will be well received in the market due to its innovative features and cost-effective price point. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Socket Mobile. More…

| Total Revenues | Net Income | Net Margin |

| 19.26 | -1.23 | -6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Socket Mobile. More…

| Operations | Investing | Financing |

| -0.11 | -1.18 | -1.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Socket Mobile. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.93 | 8.48 | 2.73 |

Key Ratios Snapshot

Some of the financial key ratios for Socket Mobile are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.7% | -68.4% | -9.7% |

| FCF Margin | ROE | ROA |

| -6.7% | -5.9% | -4.2% |

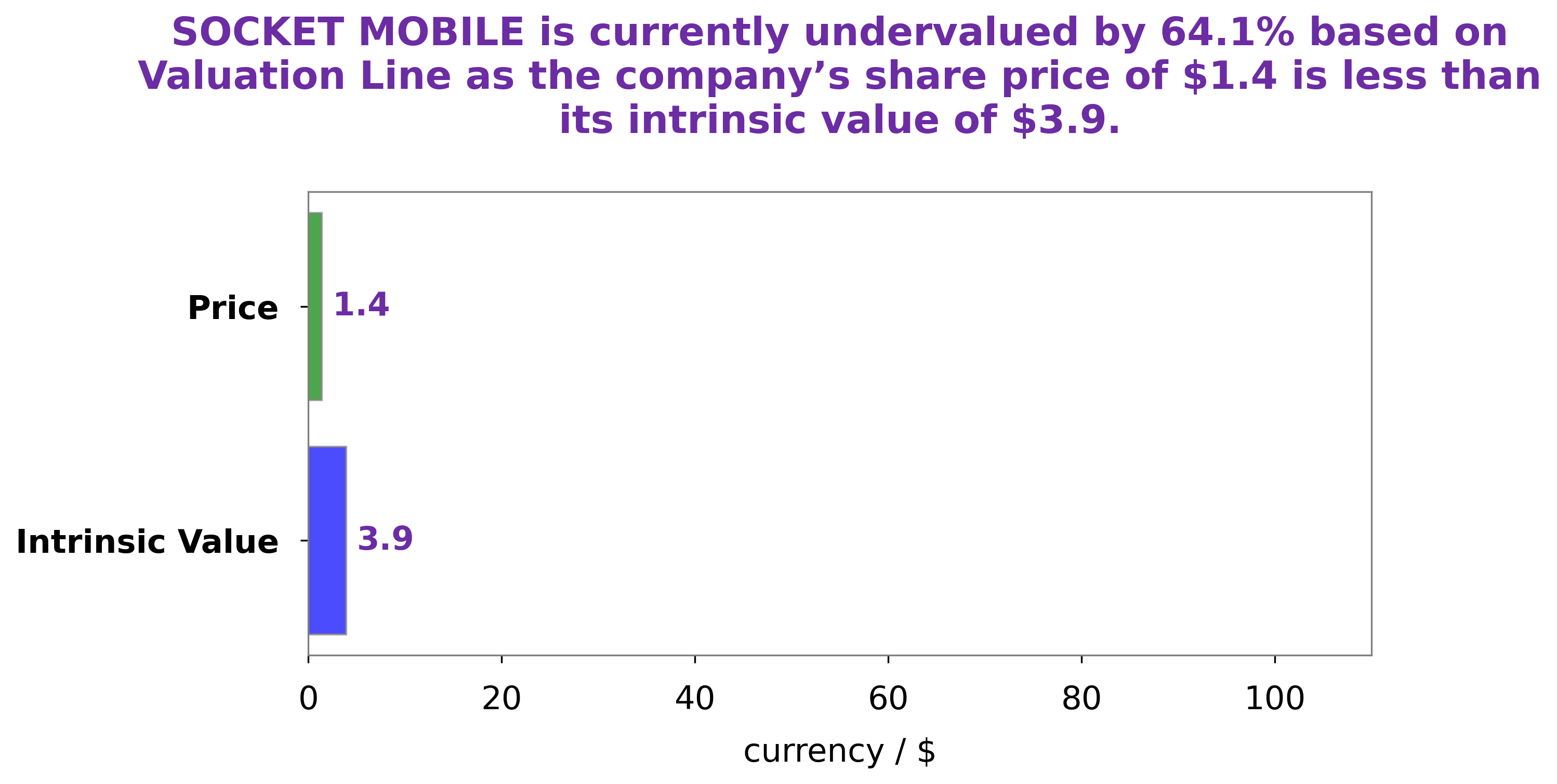

Analysis – Socket Mobile Intrinsic Value

At GoodWhale, we have done a financial analysis of SOCKET MOBILE and found that the fair value of its share is around $3.9. This value is calculated on the basis of our proprietary Valuation Line. Currently, SOCKET MOBILE stock is traded at $1.4, which means that the stock is undervalued by 63.8%. This presents an opportunity for investors to take advantage of the undervaluation and cash in on potential profits. We urge potential investors to look into SOCKET MOBILE and assess their own risk appetite before investing. More…

Peers

The company has a wide range of products that cater to different needs of its customers. Socket Mobile Inc competes with many other companies in the market, some of which are Sonim Technologies Inc, Twinhead International Corp, and MICT Inc. The company has a strong customer base and a wide variety of products that give it a competitive edge over its competitors.

– Sonim Technologies Inc ($NASDAQ:SONM)

Founded in 2004, Sonim Technologies Inc is a developer and manufacturer of rugged mobile phones. The company’s products are designed for use in extreme conditions and are used by a variety of industries, including construction, mining, public safety, and utilities. Sonim’s products are known for their durability and reliability, and the company has a strong reputation in the market for rugged mobile phones. Sonim’s market cap is 16.91M as of 2022, and its ROE is -234.74%. The company has a strong focus on product quality and customer satisfaction, and it has a loyal customer base. Sonim is a publicly traded company, and its shares are listed on the Nasdaq Stock Market.

– Twinhead International Corp ($TWSE:2364)

Twinhead International Corp is a Taiwanese company that manufactures and sells a variety of computer products, including laptops, desktop PCs, and servers. The company has a market cap of 2.6B as of 2022 and a return on equity of 12.96%. Twinhead has a strong presence in the Taiwanese market and is also a major supplier of OEM products to international markets. The company’s products are well-regarded for their quality and reliability.

– MICT Inc ($NASDAQ:MICT)

MICT, Inc. is a holding company, which engages in the provision of mobile and Internet services. It operates through the following segments: Mobile Communications and Internet Services. The Mobile Communications segment provides digital cellular services. The Internet Services segment covers fixed-line broadband, Internet protocol television, and data center services. The company was founded on February 15, 2001 and is headquartered in Taipei, Taiwan.

Summary

Socket Mobile, Inc. is a provider of data capture and delivery solutions for enhanced productivity in mobile environments. The company offers a range of products and services, including scanners, adaptors, software, and applications, to enable businesses to capture and analyze data. Socket Mobile’s products are used in retail, hospitality, healthcare, and other markets. Investment analysis of Socket Mobile reveals the company has strong financial performance across its business segments, including significant growth in revenue and profits in its most recent fiscal year.

Additionally, the company has adopted an aggressive strategy to increase market share and expand its product offering. Socket Mobile’s strong financial position combined with its growth initiatives make it an attractive investment option.

Recent Posts