CANAAN INC Reports Financial Results for 4th Quarter of 2022

March 20, 2023

Earnings Overview

On March 7, 2023, CANAAN INC ($BER:35J) released its financial results for the fourth quarter of their fiscal year 2022, which ended on December 31, 2022. Total revenue was CNY -0.4 billion, down 136.7% compared to the same quarter of the previous year, while their net income decreased 82.1% year-on-year to CNY 0.4 billion.

Stock Price

The market responded to the news by sending the stock price dropping 5.6% from its previous closing price of €2.5. The company attributed the decline in revenue and net income to adverse macroeconomic conditions, particularly in Europe and the United States. Despite these challenges, CANAAN INC is confident that their strong portfolio of innovative products and services can help them weather the storm and capitalize on potential growth opportunities. Moving forward, CANAAN INC is well-positioned to navigate the current economic climate and further execute on its strategy for long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Canaan Inc. More…

| Total Revenues | Net Income | Net Margin |

| 4.38k | 658.25 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Canaan Inc. More…

| Operations | Investing | Financing |

| 519.83 | 5.12 | 905.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Canaan Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.87k | 462.46 | 26.49 |

Key Ratios Snapshot

Some of the financial key ratios for Canaan Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.5% | 93.8% | 12.7% |

| FCF Margin | ROE | ROA |

| 10.0% | 7.5% | 7.2% |

Analysis

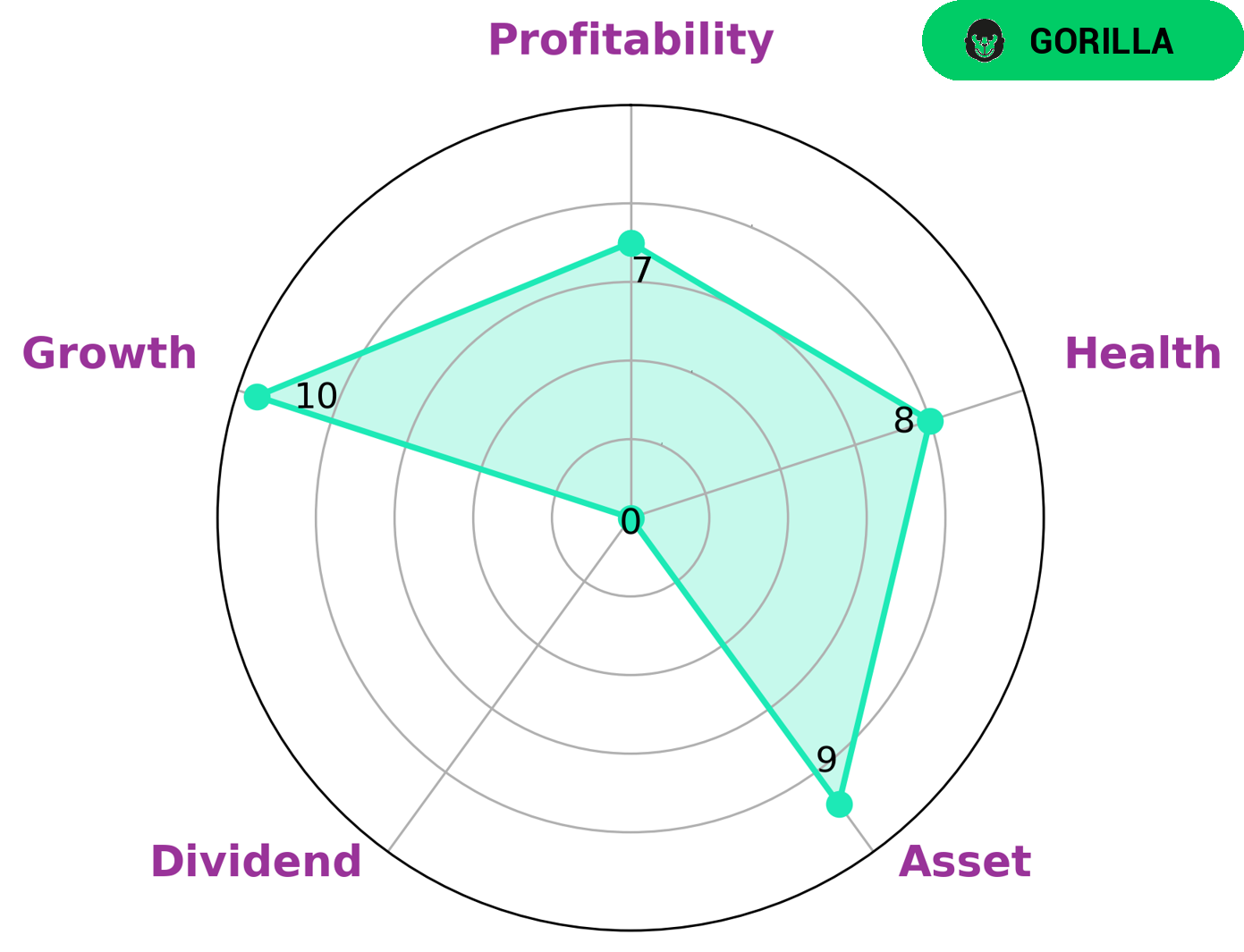

GoodWhale conducted an analysis of CANAAN INC’s fundamentals and the results were positive. Our Star Chart showed that CANAAN INC is strong in asset, growth, and profitability and weak in dividend. CANAAN INC has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of paying off its debt and funding future operations. Furthermore, CANAAN INC is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in long-term growth should consider investing in a company like CANAAN INC that has a strong and healthy financial position and a proven track record of success. Moreover, investors who have an appetite for dividends might be disappointed since CANAAN INC does not have a strong dividend yield. Nevertheless, the potential upside of CANAAN INC’s strong performance and strong competitive position makes it an attractive option for many investors. More…

Summary

CANAAN INC reported dismal financial results for the fourth quarter of 2022, with total revenue declining by 136.7% and net income dropping 82.1%, year-on-year. Investors reacted quickly to the news, with the stock price dropping on the same day. The results indicate that the company is facing significant financial struggles, which could be a cause for concern for potential investors. As such, it is important to analyze the company’s financials, growth prospects, and competitive position before making any investment decisions.

In addition, investors should keep an eye on the stock’s performance over time to get a better picture of how it is performing in the market.

Recent Posts