Canaan Inc – ADR Plummets 102.80% in Pre-Market Trading, Technical Score of 39

May 13, 2023

Trending News 🌥️

CANAAN INC ($NASDAQ:CAN) (CAN) experienced a shocking plunge in its American Depositary Receipts (ADR) on Friday morning. Pre-market trading had reached a low of -0.07, resulting in a 102.80% drop in its ADR.

In addition, its technical score was 39, which is an indication of poor performance. CANAAN INC is a leading provider of integrated technology solutions for the financial services industry. Its products and services include asset management, asset custody, digital payments, and other services to enable financial institutions to succeed in the digital world. With its extensive experience in the financial technology sector, it is often considered to be an industry leader.

Analysis

At GoodWhale, we conducted an analysis of CANAAN INC‘s financials. Our analysis concluded that CANAAN INC is a high risk investment in terms of both financial and business aspects. We detected three risk warnings in CANAAN INC’s balance sheet, cashflow statement, and financial journal. If you are interested in learning more about these risk warnings, please register with us and we will be happy to provide further information. It is important to note that investing in companies with high risk levels can be beneficial, but only when done correctly. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Canaan Inc. More…

| Total Revenues | Net Income | Net Margin |

| 4.38k | 658.25 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Canaan Inc. More…

| Operations | Investing | Financing |

| 519.83 | 5.12 | 905.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Canaan Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.87k | 462.46 | 26.49 |

Key Ratios Snapshot

Some of the financial key ratios for Canaan Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.5% | 93.8% | 12.7% |

| FCF Margin | ROE | ROA |

| 10.0% | 7.5% | 7.2% |

Peers

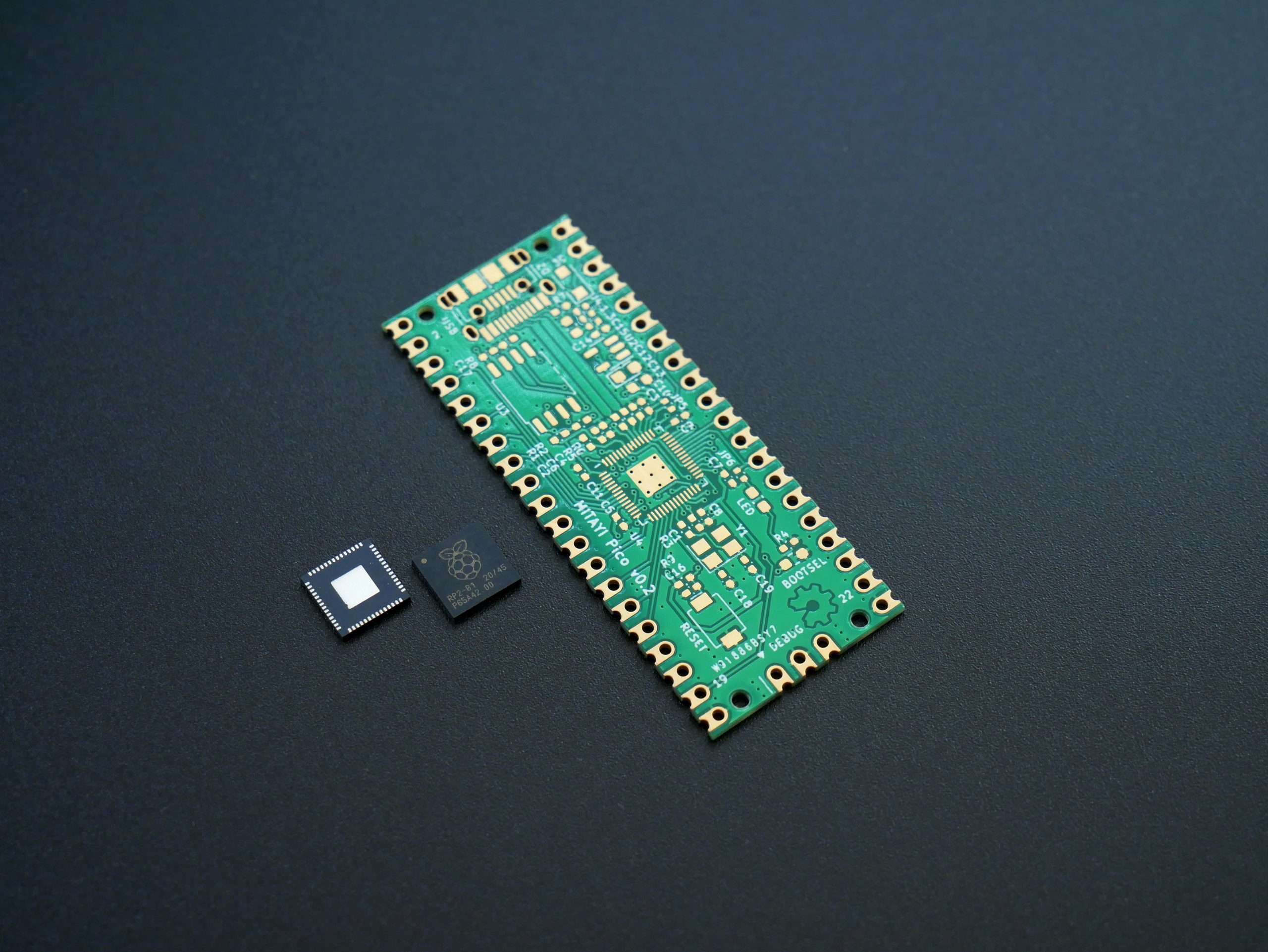

Canaan Inc is a leading manufacturer of high performance computing systems. It is engaged in the research, development, manufacture and sale of bitcoin mining machines and AI hardware and software solutions. The Company has a number of competitors in the market including Lian Hong Art Co Ltd, Pixela Corp, Inventec Corp.

– Lian Hong Art Co Ltd ($TPEX:6755)

Lian Hong Art Co Ltd is a Chinese company with a market cap of 1.25 billion as of 2022. The company’s return on equity is 1.06%. The company is engaged in the business of art and antiques. It is one of the largest art and antiques dealers in China. The company has a wide variety of products, including paintings, calligraphy, ceramics, jade, and other works of art.

– Pixela Corp ($TSE:6731)

Pixela Corp is a Japanese electronics company that manufactures and sells digital cameras, camcorders, and software. The company has a market cap of 2.08B as of 2022 and a ROE of -51.73%. Pixela Corp was founded in 1981 and is headquartered in Tokyo, Japan.

– Inventec Corp ($TWSE:2356)

Inventec Corporation is a leading manufacturer of laptops, servers, and other computer hardware. The company has a market capitalization of over $81 billion and a return on equity of 10.9%. Inventec is headquartered in Taiwan and has manufacturing facilities in China, the Czech Republic, and Mexico. The company employs over 30,000 people worldwide. Inventec is a publicly traded company on the Taiwan Stock Exchange (ticker symbol: 2356).

Summary

Canaan Inc. (CAN) has experienced a steep decline in its stock price on Friday morning, with the stock dropping -102.80% in pre-market trading to -0.07. This suggests that CAN may be a risky investment for potential investors. Analysts have given CAN a short-term technical score of 39, indicating that there is a great deal of volatility associated with the stock. Investors should proceed with caution and should monitor the stock closely for any further developments or changes in its performance.

Additionally, investors should look for additional signs of company progress or news to determine whether CAN is a suitable investment opportunity.

Recent Posts