Arista Networks Soars 1.9% in Postmarket Action After Posting Impressive Q4 Earnings and Guiding to Continued Strength in 2023 with 54% Revenue Increase.

February 14, 2023

Trending News ☀️

Arista Networks ($NYSE:ANET) (ANET) is an American technology company that develops, markets and sells software-driven and cloud-centric networking solutions for large datacenter, storage area networks and high-performance computing applications. The company has experienced strong growth over the past few years and is now a leading provider of cloud networking solutions. On Monday, investors in Arista Networks were rewarded with a 1.9% increase in their postmarket activity due to their impressive fourth-quarter earnings report, which exceeded analysts’ expectations for both revenue and profit. The strong financial results were driven by continued demand for Arista Networks’ software-driven solutions, as well as increased adoption of its flagship Network Cloud System, which allows customers to deploy and manage their cloud networks with greater flexibility and scalability. The company also recorded a record high number of new customer wins during the quarter and continued to expand its customer base both within the enterprise and in the public cloud space.

In addition to the impressive fourth quarter results, Arista Networks also forecasted that the positive trend would continue into the start of 2023, with revenues increasing by 54% year-on-year. The company attributed this growth to increased investments in its engineering and sales teams, as well as the strong momentum of its flagship products. With their strong fourth quarter performance and guidance for continued strength in the coming year, investors in Arista Networks have plenty of reasons to be optimistic about the company’s prospects in the near future.

Market Price

The stock opened at $134.5 and closed at $136.0, up by 2.0% from previous closing price of 133.3. Media sentiment has so far been positive regarding the company’s performance, with analysts applauding its solid fundamentals and forward guidance. Arista’s outlook is being fueled by a surge in demand for cloud-based networking products driven by the growth of remote working and a shift towards digital transformation. With such positive outlook, the company is well-positioned for further growth in 2023 and beyond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arista Networks. More…

| Total Revenues | Net Income | Net Margin |

| 3.93k | 1.16k | 28.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arista Networks. More…

| Operations | Investing | Financing |

| 677.58 | 234.95 | -820.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arista Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.16k | 1.78k | 13.16 |

Key Ratios Snapshot

Some of the financial key ratios for Arista Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.0% | 17.2% | 31.4% |

| FCF Margin | ROE | ROA |

| 16.1% | 19.7% | 13.4% |

Analysis

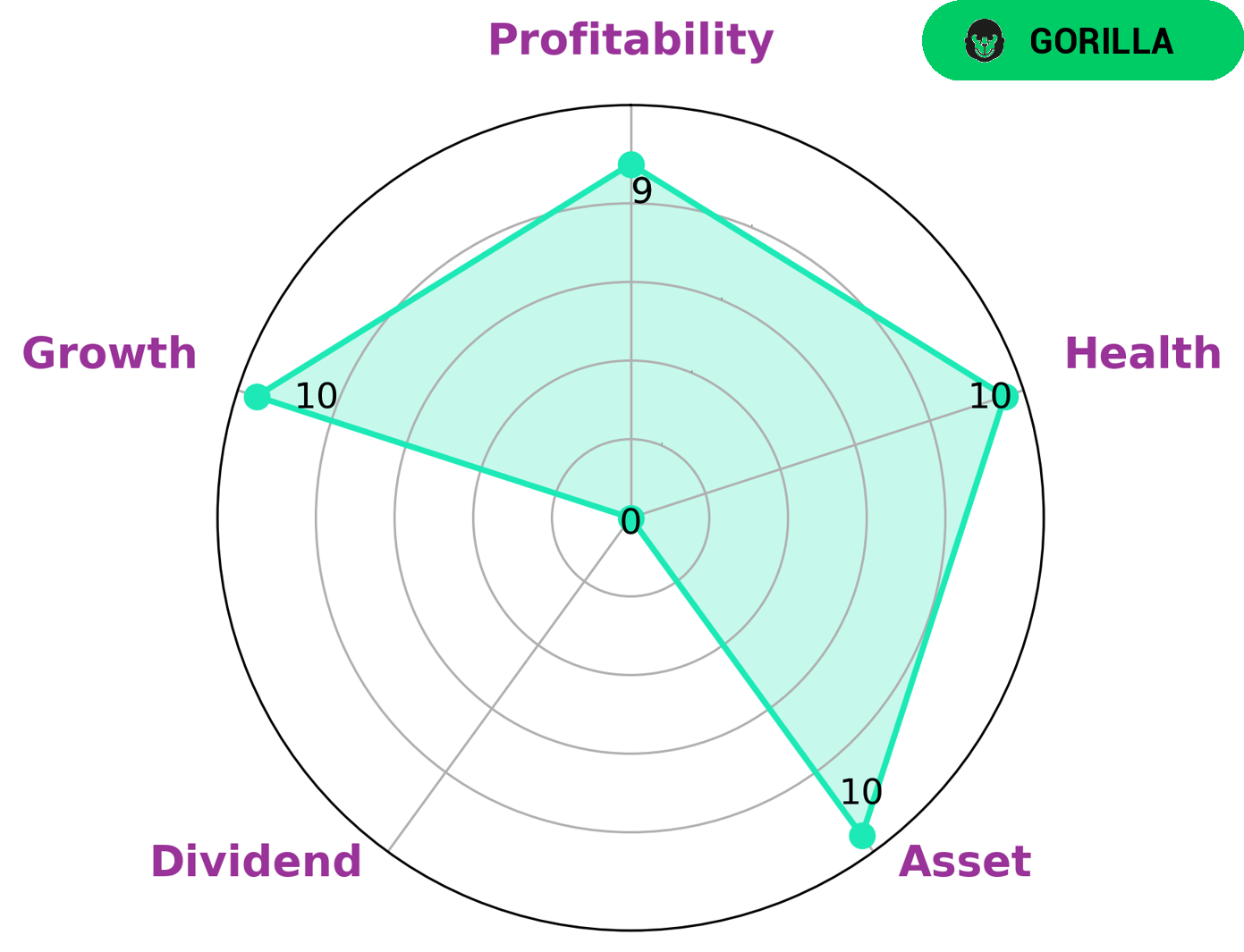

ARISTA Networks is an impressive company as evidenced by its strong fundamentals. According to the Star Chart, ARISTA Networks has strong assets, growth, and profitability, but weak dividend. This company can be classified as a ‘gorilla’, meaning it has achieved steady and high revenue or earning growth due to its competitive advantage. Investors may be interested in ARISTA Networks for these reasons, as well as its high health score of 10/10 in terms of cashflows and debt, and its ability to sustain future operations despite crisis. The strong asset quality of ARISTA Networks makes it an attractive choice for investors. It has a high current ratio, which measures the ability of a company to pay its short-term liabilities. Its debt to equity ratio is low, indicating a healthy balance between debt and equity financing. Along with this, ARISTA Networks has seen a healthy growth rate in earnings over the past several years and a consistent return on equity. The company’s dividend is weaker than other areas, however, it does have a dividend yield that is slightly above the industry average. Additionally, ARISTA Networks has a low payout ratio, meaning it is reinvesting more of its profits back into the business. The company has also been able to maintain a healthy cash flow, making it a reliable investment option. Its competitive advantage has allowed it to maintain steady and high revenue or earning growth, while also having a healthy balance between debt and equity financing as well as a solid cash flow. More…

Peers

The telecommunications industry is highly competitive, with Arista Networks Inc competing against Ciena Corp, Eutelsat Communications, Novra Technologies Inc, and others. Arista Networks Inc has a strong product portfolio and a history of innovation, which has helped it to maintain a leading position in the market.

– Ciena Corp ($NYSE:CIEN)

Ciena is a network specialist that provides equipment, software, and services that support the transport, switching, aggregation, and management of voice, video, and data traffic on communications networks. The company has a market cap of $6.08B as of 2022 and a ROE of 6.6%. Ciena’s products are used in a variety of network architectures, including point-to-point, metro, and core networks.

– Eutelsat Communications ($LTS:0JNI)

Eutelsat Communications is a French-based company that provides satellite communication services to broadcasters, content providers, Internet service providers, mobile operators, and business and government customers. As of 2022, the company had a market cap of 1.93 billion and a return on equity of 9.77%. Eutelsat Communications operates a fleet of 38 satellites that provide coverage over Europe, the Middle East, Africa, Asia-Pacific, and the Americas. The company also provides ground infrastructure and teleport services.

– Novra Technologies Inc ($TSXV:NVI)

Novra Technologies Inc is a publicly traded company with a market capitalization of 3.01 million as of 2022. The company has a return on equity of 28.3%. Novra Technologies Inc is a technology company that specializes in the development and commercialization of products and solutions for the satellite and cable television markets. The company’s products and solutions are used by broadcasters, network operators, and content providers to distribute video, audio, and data signals.

Summary

Arista Networks, a computer networking company, recently reported impressive fourth-quarter earnings results, with revenues increasing by 54%, and guiding to continued strength in 2023. In response, the stock price rose 1.9%. Analysts note that Arista Networks remains a solid investment opportunity given their current financial performance and potential for future growth.

Their cloud-enabled products have seen increased demand due to the current shift to remote working, and they remain well-positioned to capitalize on the growing need for cloud-based solutions. With a growing customer base and strong financials, Arista Networks is a promising investment for the future.

Recent Posts