Acer Inc stock dividend – Acer Inc Announces 0.24513 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 2 2023, Acer Inc ($BER:AC5G) announced a cash dividend of 0.24513 per share. This is the third consecutive year that ACER INC has issued an annual dividend per share; 11.26 TWD in 2021, 11.26 TWD in 2022, and 7.53 TWD in 2023. The dividend yields for 2021, 2022, and 2023 are 7.83%, 7.83%, and 5.82%, respectively, with an average dividend yield of 7.16%. ACER INC provides a steady income and offers potential capital appreciation as well.

If you are looking for dividend-yielding stocks, consider ACER INC as an option; the ex-dividend date is June 29 2023. Thus, shareholders of record on that date will be entitled to receive the dividend payment. As such, investing in ACER INC stocks can be beneficial for those who are looking for a long-term investment opportunity.

Price History

This announcement was met with a positive response from investors as the stock opened at €5.0 and closed at €4.9, rising by 8.3% from the prior closing price of €4.6. The announcement was welcomed by investors and has been seen as a sign of confidence in the company’s continued success. It is also an indication that ACER INC is committed to returning value to its shareholders and rewarding them for their loyalty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Acer Inc. More…

| Total Revenues | Net Income | Net Margin |

| 249.5k | 3.28k | 1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Acer Inc. More…

| Operations | Investing | Financing |

| 24.33k | -5.93k | -6.68k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Acer Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 187.46k | 119.56k | 105.23 |

Key Ratios Snapshot

Some of the financial key ratios for Acer Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | 18.7% | 2.4% |

| FCF Margin | ROE | ROA |

| 9.4% | 5.8% | 2.0% |

Analysis

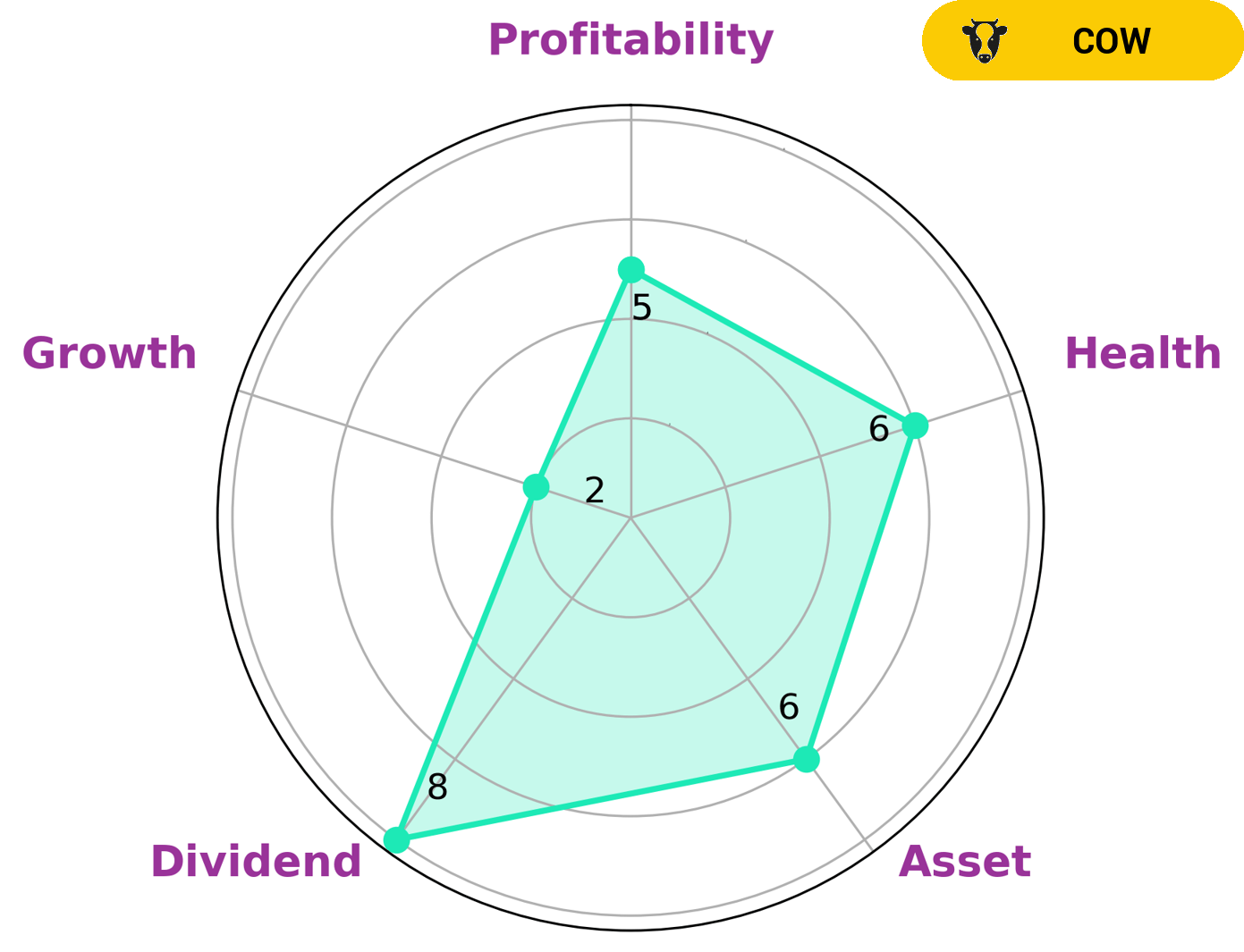

At GoodWhale, we have analyzed the fundamentals of ACER INC and classified it as a ‘cow’ according to our Star Chart. We deem this type of company to have the track record of paying out consistent and sustainable dividends. This makes it an ideal investment for investors who are looking for regular income, such as retirees and income-seeking investors. ACER INC’s overall financial performance is classified as strong in dividend, medium in asset, profitability and weak in growth. This means that while investors can expect steady income in dividends, they should not expect any substantial capital gains in the short-term. In terms of financial health, ACER INC has an intermediate health score of 6/10 with regard to its cashflows and debt. This means that it is likely to safely ride out any crisis without the risk of bankruptcy. More…

Summary

Investing in ACER INC may prove to be a good choice due to their consistent dividend payments over the past three years. Dividend yields for 2021, 2022, and 2023 are 7.83%, 7.83%, and 5.82%, respectively, with an average dividend yield of 7.16%. Investors can expect to receive relatively stable returns from ACER INC as their dividend payments have remained consistent in the years leading up to 2021.

Furthermore, investors can benefit from the high dividend yield as compared to other companies in the same industry. Overall, ACER INC is a great choice for investors looking for a steady and reliable source of income.

Recent Posts