UBIQUITI INC Reports Strong Earnings Results for Q2 FY2023

March 12, 2023

Earnings Overview

For the second quarter of the fiscal year 2023, UBIQUITI INC ($NYSE:UI) reported total revenue of USD 112.2 million, representing an 8.2% increase compared to the same period in the previous year. Furthermore, net income increased by 14.4% year over year to USD 493.6 million.

Price History

On Friday, UBIQUITI INC reported strong earnings results for the second quarter of FY2023. The company’s stock opened at $298.5 and closed at $283.9, a drop of 6.4% from its last closing price of 303.3. Despite the declines, investors were still optimistic about the company’s performance as UBIQUITI INC reported revenue growth that surpassed analysts’ expectations. This impressive performance was mainly attributed to the strong growth in its enterprise technology solutions, which saw a double-digit growth in sales compared to the previous quarter. The company also announced plans to invest more in research and development, with an increased focus on its cloud-based services which have seen remarkable growth in recent years.

UBIQUITI INC also stated that it will continue to focus on product innovation and expanding its customer base across international markets. Overall, UBIQUITI INC’s strong performance in the second quarter of FY2023 is an encouraging sign for investors who are looking for a long-term investment option that offers good returns. The company’s impressive growth has been driven by its commitment to innovation and customer satisfaction and analysts are expecting the trend to continue through the rest of the year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ubiquiti Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.79k | 348.25 | 19.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ubiquiti Inc. More…

| Operations | Investing | Financing |

| 176.47 | -18.1 | -211.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ubiquiti Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.27k | 1.52k | -4.1 |

Key Ratios Snapshot

Some of the financial key ratios for Ubiquiti Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.2% | 0.5% | 24.7% |

| FCF Margin | ROE | ROA |

| 8.7% | -96.4% | 21.8% |

Analysis

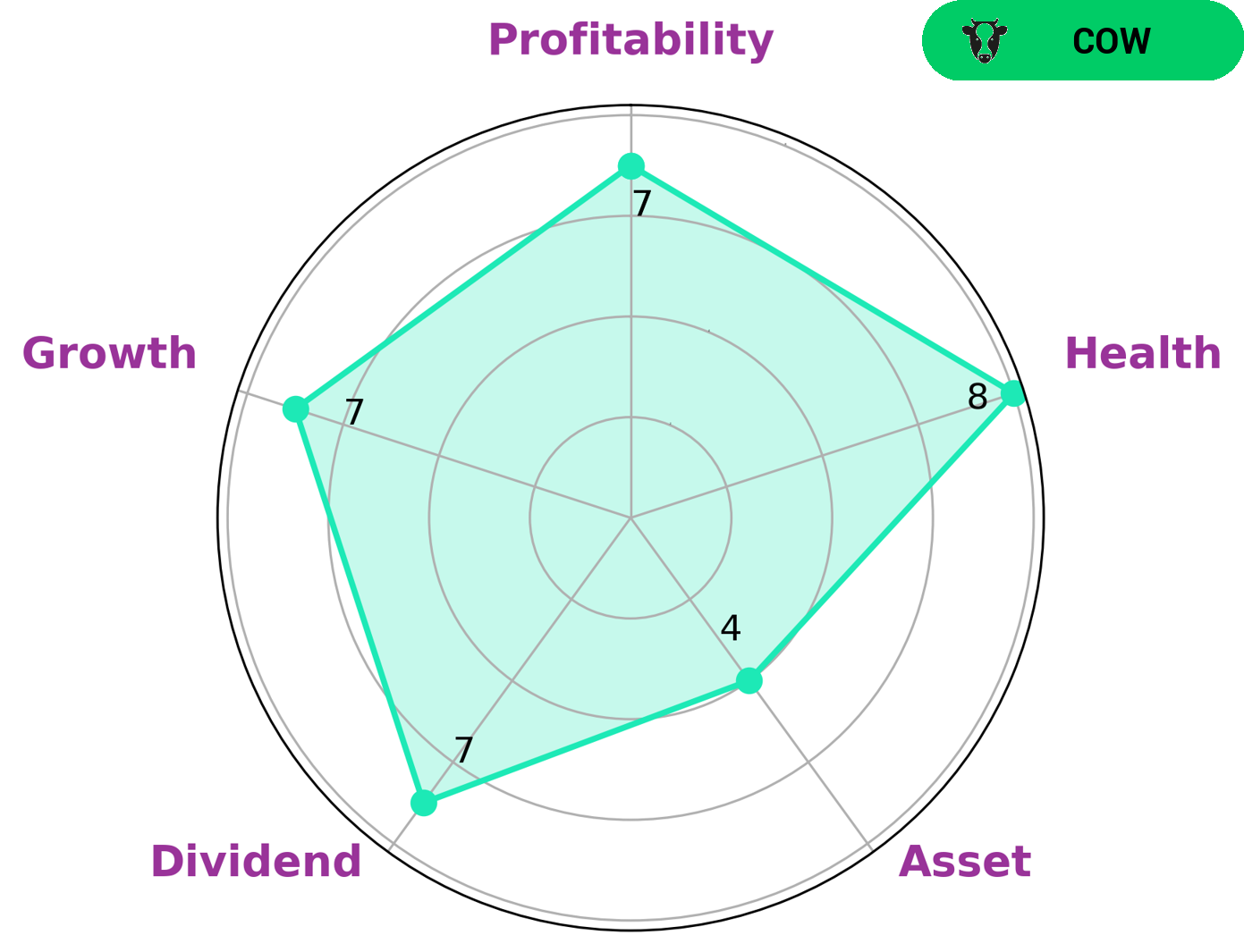

At GoodWhale, we have conducted an analysis of UBIQUITI INC‘s wellbeing. According to our Star Chart, UBIQUITI INC is classified as a ‘cow’, meaning the company has a track record of paying out consistent and sustainable dividends. Therefore, this type of company will be attractive to long-term investors seeking a steady income stream. Moreover, UBIQUITI INC has a high health score of 8/10 in terms of its cash flows and debt, allowing it to safely ride out any crisis situation without the risk of bankruptcy. We rate UBIQUITI INC highly in terms of dividend, growth, and profitability, with a medium rating for assets. This makes it an ideal choice for investors with a focus on both capital and income growth. More…

Peers

The company offers its services to residential, business and government customers in more than 140 countries. Ubiquiti has a strong presence in the Americas, Europe, Asia-Pacific and Africa. The company’s main competitors are Ceragon Networks Ltd, Eutelsat Communications and Saf Tehnika.

– Ceragon Networks Ltd ($NASDAQ:CRNT)

Ceragon Networks Ltd is a leading global provider of wireless backhaul solutions that enable mobile operators and other wireless service providers to deliver voice and data services. The company’s solutions are based on its proprietary IP-based wireless technology and are designed to meet the challenges of the most demanding backhaul applications. Ceragon’s solutions have been deployed in more than 150 countries and support over 2,000 customers, including many of the world’s largest mobile operators.

– Eutelsat Communications ($OTCPK:EUTLF)

Eutelsat Communications is a leading satellite operator, providing reliable and secure satellite-based connectivity to fixed and mobile customers around the world. The company has a market cap of 2.29B as of 2022 and a Return on Equity of 9.77%. Eutelsat Communications is headquartered in Paris, France.

– Saf Tehnika ($BER:VTZ)

Saf Tehnika is a publicly traded company with a market capitalization of $38.02 million as of 2022. The company has a return on equity of 29.08%. Saf Tehnika is a provider of critical communications solutions for mission-critical applications in government, defense, public safety, and utility markets worldwide. The company’s products and solutions are used by customers in more than 100 countries.

Summary

UBIQUITI INC reported strong second quarter earnings results, with total revenue up 8.2% and net income up 14.4%. Despite this, the stock price moved down the same day. Investors should be cautious when considering UBIQUITI INC as a potential investment due to the high level of competition in the industry and the rapidly changing technology landscape. It is important to carefully analyze the company’s financial performance, compare its growth rate to the industry average, and consider the potential risks associated with investing in the company.

Recent Posts