LPL Financial LLC Decreases Stake in Lumentum Holdings by 1.5%

May 17, 2023

Trending News 🌥️

Lumentum Holdings ($NASDAQ:LITE) Inc. is a leading global provider of innovative photonic and optical products for a diverse set of markets ranging from consumer electronics to communication networks. On May 12, 2023, LPL Financial LLC, a leading independent broker-dealer, reported a 1.5% decrease of Lumentum Holdings Inc. in its most recent filing with the U.S. Securities and Exchange Commission. These products include lasers, optical amplifiers, and components used in 3D sensing, communications, industrial, and consumer electronics applications. The company’s products are mainly used by communications providers and data center operators, as well as medical device manufacturers, defense contractors, and entertainment companies. Lumentum’s products are designed to help customers increase their efficiency and reduce their energy consumption.

The company has also developed cutting-edge technology such as optical interconnects, advanced data center switching solutions, and quantum computing components. By providing innovative solutions that help customers stay ahead of the curve, Lumentum has become a leader in the industry. LPL Financial LLC’s 1.5% decrease in its stake in Lumentum Holdings Inc. reflects the current market capitalization of the company and the changing landscape of the photonics and optics industry. As more customers turn to Lumentum for their advanced technology needs, investors are recognizing the potential of this leading global provider of innovative photonics and optical products.

Analysis

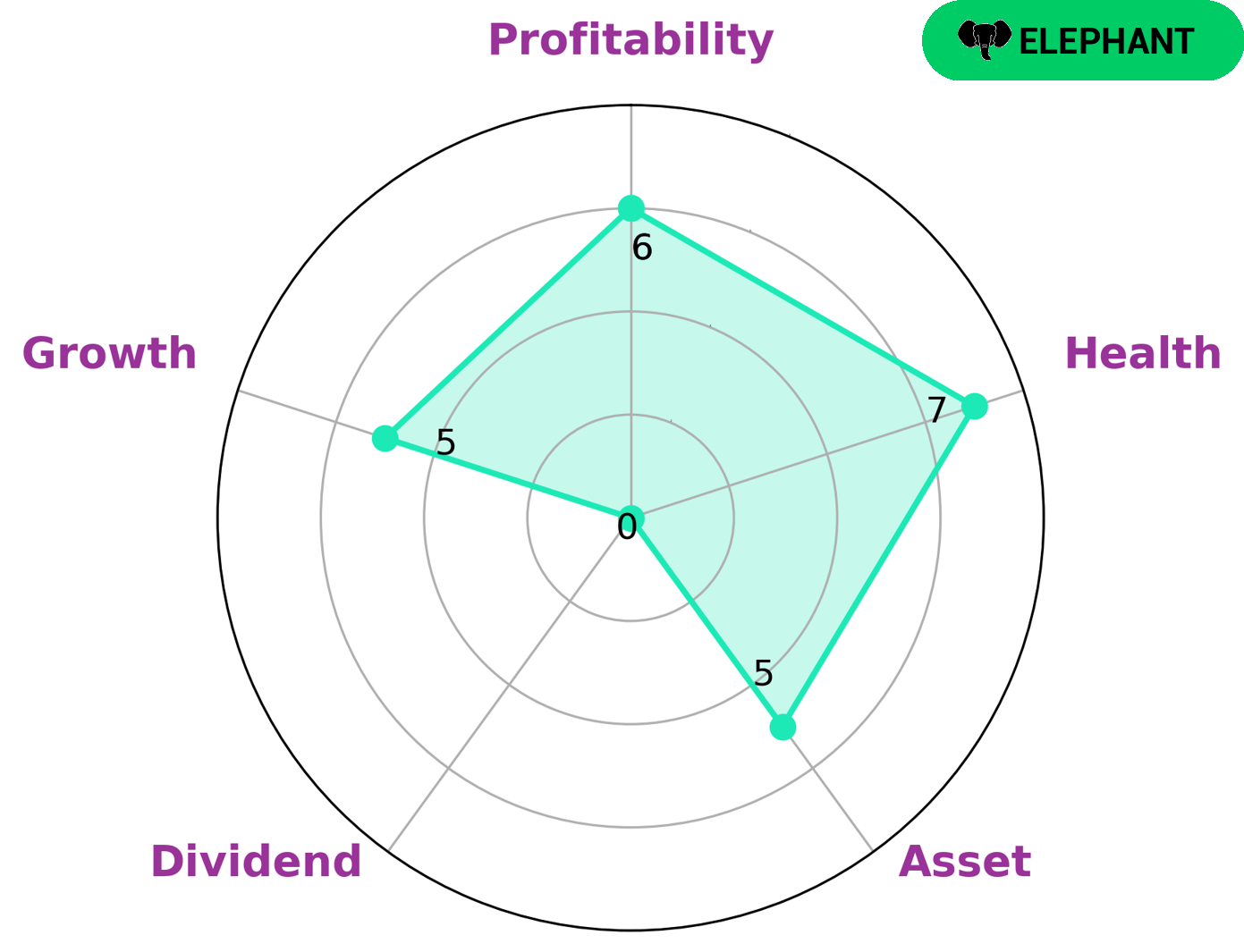

GoodWhale has conducted an evaluation of LUMENTUM HOLDINGS‘s fundamentals, and the results have been encouraging. According to our Star Chart, LUMENTUM HOLDINGS is strong in asset, growth, and profitability while weak in dividend. We have also given the company a health score of 7/10 based on its cashflows and debt – indicating that it is probably capable of paying off debt and funding future operations. LUMENTUM HOLDINGS falls into the category of ‘elephants’, which are companies with plenty of assets after liabilities have been deducted. Given the strengths of LUMENTUM HOLDINGS, we can conclude that it would be an attractive target for investors seeking a solid investment opportunity. Investors looking for a company with a good balance between growth and profitability would find such a company to be an ideal choice. Moreover, given its size, the company is likely to be attractive to investors seeking stability and long-term growth. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lumentum Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.82k | -36.7 | -1.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lumentum Holdings. More…

| Operations | Investing | Financing |

| 244.9 | -660.4 | -165.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lumentum Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.35k | 2.82k | 22.39 |

Key Ratios Snapshot

Some of the financial key ratios for Lumentum Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | -50.9% | 1.8% |

| FCF Margin | ROE | ROA |

| 6.8% | 1.3% | 0.5% |

Peers

The company’s products are used in a variety of applications, including fiber-optic telecommunications, data communications, industrial lasers, and medical lasers.

– Advanced Fiber Resources (Zhuhai) Ltd ($SZSE:300620)

Advanced Fiber Resources (Zhuhai) Ltd is a leading manufacturer of advanced fiber-based products and materials. The company has a market cap of 6.59B as of 2022 and a return on equity of 5.23%. Advanced Fiber Resources (Zhuhai) Ltd manufactures a wide range of products, including fiber optic cable, data center equipment, and telecommunications equipment. The company’s products are used in a variety of applications, including data communications, computing, and networking.

– APAC Opto Electronics Inc ($TPEX:4908)

PAC Opto Electronics Inc is a Taiwanese company that manufactures and sells opto-electronic products. The company has a market cap of 2.39B as of 2022 and a Return on Equity of 12.6%. PAC Opto Electronics Inc’s products include semiconductor lasers, light emitting diodes, photo detectors, and optical communication components. The company’s products are used in a variety of applications including telecommunications, data storage, industrial, and medical.

– Cowell e Holdings Inc ($SEHK:01415)

Cowell e Holdings Inc is a holding company that operates through its subsidiaries. The company has a market cap of 10.95B as of 2022 and a ROE of 13.79%. The company’s subsidiaries engage in the business of providing financial services, including banking, lending, and investing. The company’s operations are conducted through its subsidiaries, which include Cowell e Bank, Cowell e Credit Union, and Cowell e Investment Services.

Summary

Lumentum Holdings Inc. has been the subject of some recent investor analysis. On May 12, 2023, it was revealed that LPL Financial LLC had sold off 1.5% of its position in Lumentum, although the stock price moved up the same day. This could be further evidence that investors are bullish about the company’s future prospects.

It is worth keeping an eye on the stock to see what other investors do, especially in light of the long-term growth potential that this company offers. It may be wise to diversify investments and put some money into a well-performing stock like Lumentum Holdings.

Recent Posts