Harmonic: Time to Take Profits as Limited Upside Remains

June 12, 2023

☀️Trending News

Harmonic Inc ($NASDAQ:HLIT) is a publicly traded company that specializes in video delivery infrastructure and advanced advertising solutions. Recent stock performance of the company has been strong, but analysts are now suggesting that it’s time to take profits and not anticipate any significant gains ahead. While the share price of Harmonic has increased in the past, there are limited upside potentials in the short term and investors should be aware of this. The company has, however, made some successful efforts in diversifying its product portfolio.

In addition, they have also achieved steady growth in their businesses in the recent years, thanks to their strong customer base. Nevertheless, the stock market can be unpredictable and the current market conditions should be taken into account when considering an investment in Harmonic. Overall, although Harmonic has seen some positive gains in its stock price, it may be time to take profits and not expect a significant increase in the near future. Investors should keep in mind that they should weigh their risks carefully and make sure that they understand the current market conditions before investing.

Stock Price

Harmonic Inc, which opened at $18.0 on Thursday, closed at $18.1, a 0.1% increase from the prior closing price of $18.0. With limited upside remaining, it may be time to take profits from the stock. This implies that investors should look to sell their shares in Harmonic Inc before any further declines in the stock price occur. Analysts are not predicting any major price movements in the near future, meaning that it may be best to take profits now while the stock is still trading at a relatively high price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Harmonic Inc. More…

| Total Revenues | Net Income | Net Margin |

| 635.17 | 34.8 | 5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Harmonic Inc. More…

| Operations | Investing | Financing |

| 39.23 | -1.18 | -44.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Harmonic Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 703.82 | 368.03 | 3.02 |

Key Ratios Snapshot

Some of the financial key ratios for Harmonic Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.6% | 98.6% | 9.1% |

| FCF Margin | ROE | ROA |

| 4.7% | 10.9% | 5.1% |

Analysis

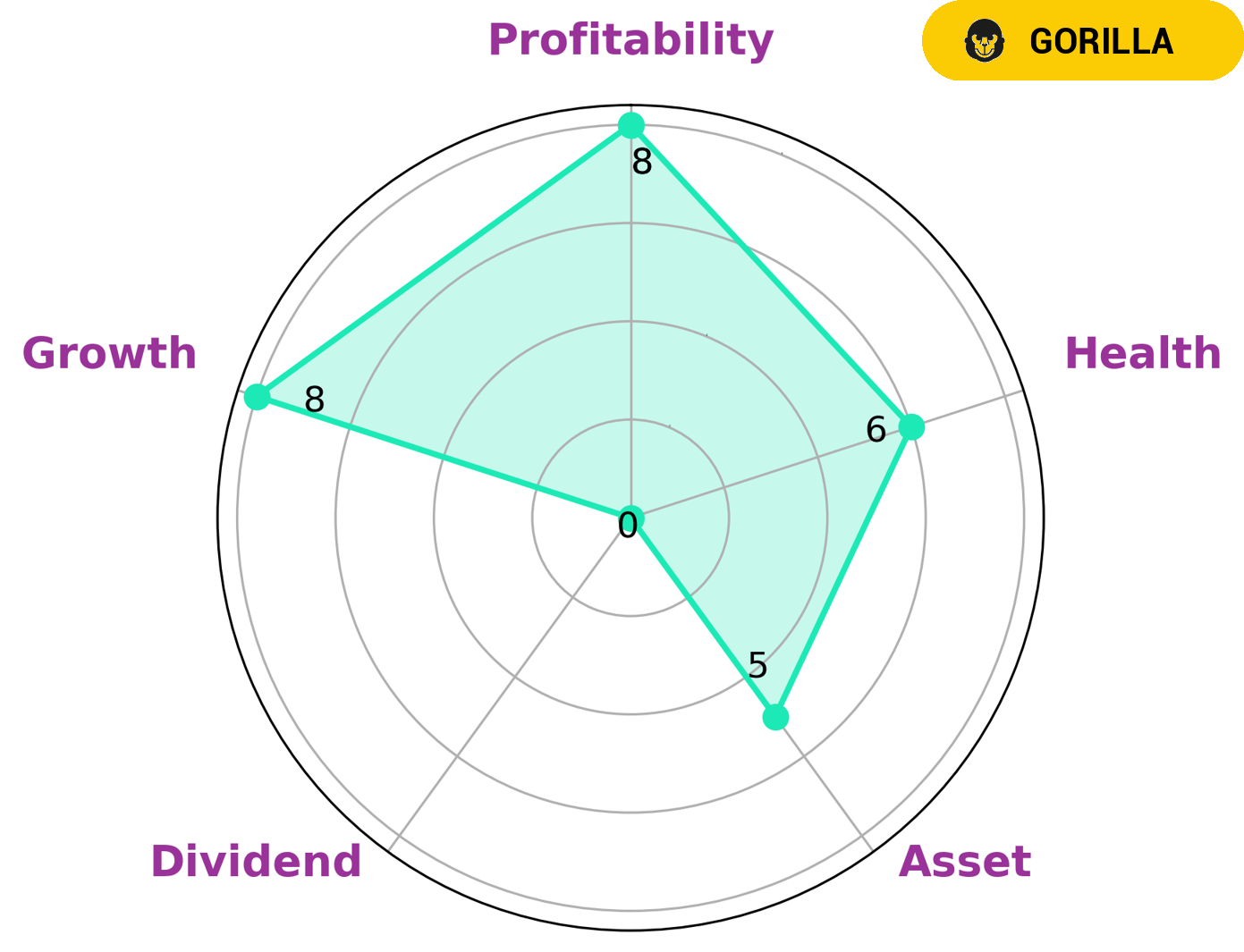

At GoodWhale, we conducted an analysis of HARMONIC INC‘s financials. Our Star Chart classified HARMONIC INC as a ‘gorilla’, which suggests that the company has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes HARMONIC INC an attractive investment for many types of investors, as they can expect good returns on their investment. In terms of performance indicators, HARMONIC INC scored highly in growth as well as profitability, moderately in assets, and weakly in dividend. This indicates that the company is well-positioned to take advantage of any growth opportunities in the market. In terms of health, we have given HARMONIC INC an intermediate health score of 6/10. This suggests that the company might be able to safely ride out any crisis without the risk of bankruptcy, provided it is able to manage its cashflows and debts effectively. More…

Peers

The company has been competing against its competitors, Radiation Technology Inc, Teleste Oyj, and Eutelsat Communications, for the past several years. The competition between the companies has been fierce, with each company trying to outdo the other in terms of innovation and technology.

– Radiation Technology Inc ($TPEX:6514)

Radiation Technology Inc is a company that specializes in the production of radiation products and services. The company has a market capitalization of 1.45 billion as of 2022 and a return on equity of 13.65%. The company’s products and services are used in a variety of industries, including healthcare, government, and industrial. Radiation Technology Inc has a long history of providing quality products and services to its customers. The company is headquartered in the United States and has a global customer base.

– Teleste Oyj ($LTS:0K1Q)

Founded in 1984, Teleste is a Finnish company that provides broadband video and data communication systems and services. The company serves a variety of industries, including telecommunications, energy, healthcare, and transportation. Teleste has a market capitalization of 61.06 million euros as of 2022 and a return on equity of 3.58%. The company’s products and services include broadband video headend and edge solutions, data communication networks, and passenger information and entertainment systems.

– Eutelsat Communications ($LTS:0JNI)

Eutelsat Communications is a leading satellite operator, providing reliable and secure satellite-based connectivity solutions for broadcast, telecom, corporate and government customers worldwide.

Eutelsat Communications has a market capitalization of 2.16 billion as of 2022 and a return on equity of 9.77%. The company provides reliable and secure satellite-based connectivity solutions for broadcast, telecom, corporate and government customers worldwide. Eutelsat Communications is headquartered in Paris, France.

Summary

Harmonic Inc. provides investors with a unique opportunity to benefit from short-term profits. Analyzing the company’s stock performance, one can see that it has been relatively stable, though with minimal upside potential. It may be wise to cash out profits after a few months, given that long-term gains seem unlikely.

Investors should also be aware of Harmonic Inc.’s potential risks and should ensure that they limit their exposure appropriately. Ultimately, it is up to the individual investor to decide whether or not to invest in Harmonic Inc., based on their own personal risk levels and goals.

Recent Posts