DZSI Gains Attention of Investors with Fosters Research

January 31, 2023

Trending News ☀️

DZS ($NASDAQ:DZSI) Inc., a leading provider of broadband access and technology solutions, has been gaining the attention of investors due to its research conducted by Fosters Research. By leveraging the company’s deep industry knowledge and expertise, Fosters Research has enabled DZSI to gain insight into the latest trends and developments in the industry. DZSI’s comprehensive research into the broadband access and technology sector has resulted in numerous successful investments in the industry. Its success has been driven by a focus on understanding customer needs, identifying opportunities for growth, and developing innovative products and services. The company has also invested heavily in research and development, creating a portfolio of products and services that are both cost-effective and reliable. Its products are designed to meet the current and future needs of customers, while also promoting sustainability. DZSI has also established partnerships with leading providers in the industry, such as Cisco, AT&T and Verizon, to ensure quality and reliability for its customers.

DZSI has also been successful in expanding its customer base by offering competitive pricing, excellent customer service, and a wide range of products and services. The company has also established a global presence, with offices in the United States, Europe, Australia, Asia, and Latin America. The success of DZSI’s research conducted by Fosters Research has attracted investors from around the world. As a result, the company’s stock has been steadily increasing over the past few years. Its impressive performance has been praised by analysts and investors alike, and it is likely that DZSI will continue to attract investors in the future.

Price History

DZS INC has been gaining the attention of investors, thanks to its research and development initiatives. News sentiment around the company has been largely positive, as investors recognize the potential of the company’s products and services. On Thursday, DZS INC’s stock opened at $12.3 and closed at $12.4, up by 2.0% from its previous closing price of 12.2. This increase in stock price is an indication of the investors’ confidence in the company’s future prospects. The company has made considerable investments in research and development, allowing it to stay ahead of the competition and remain competitive in the market. Its products and services have been well received in the market and have garnered a lot of attention among investors.

DZS INC has also rolled out several new products, which have been met with positive feedback from consumers. The company has also been investing heavily in marketing activities to increase its visibility in the market and reach out to more potential customers. It has adopted a customer-centric approach in order to ensure that it meets the needs of its customers and build long-term relationships with them. Overall, DZS INC is making all the right moves to ensure that it remains competitive and profitable in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dzs Inc. More…

| Total Revenues | Net Income | Net Margin |

| 373.58 | -25.16 | -7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dzs Inc. More…

| Operations | Investing | Financing |

| -36.9 | -25.41 | 33.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dzs Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.07 | 235.79 | 3.95 |

Key Ratios Snapshot

Some of the financial key ratios for Dzs Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | – | -8.9% |

| FCF Margin | ROE | ROA |

| -10.9% | -11.4% | -3.9% |

VI Analysis

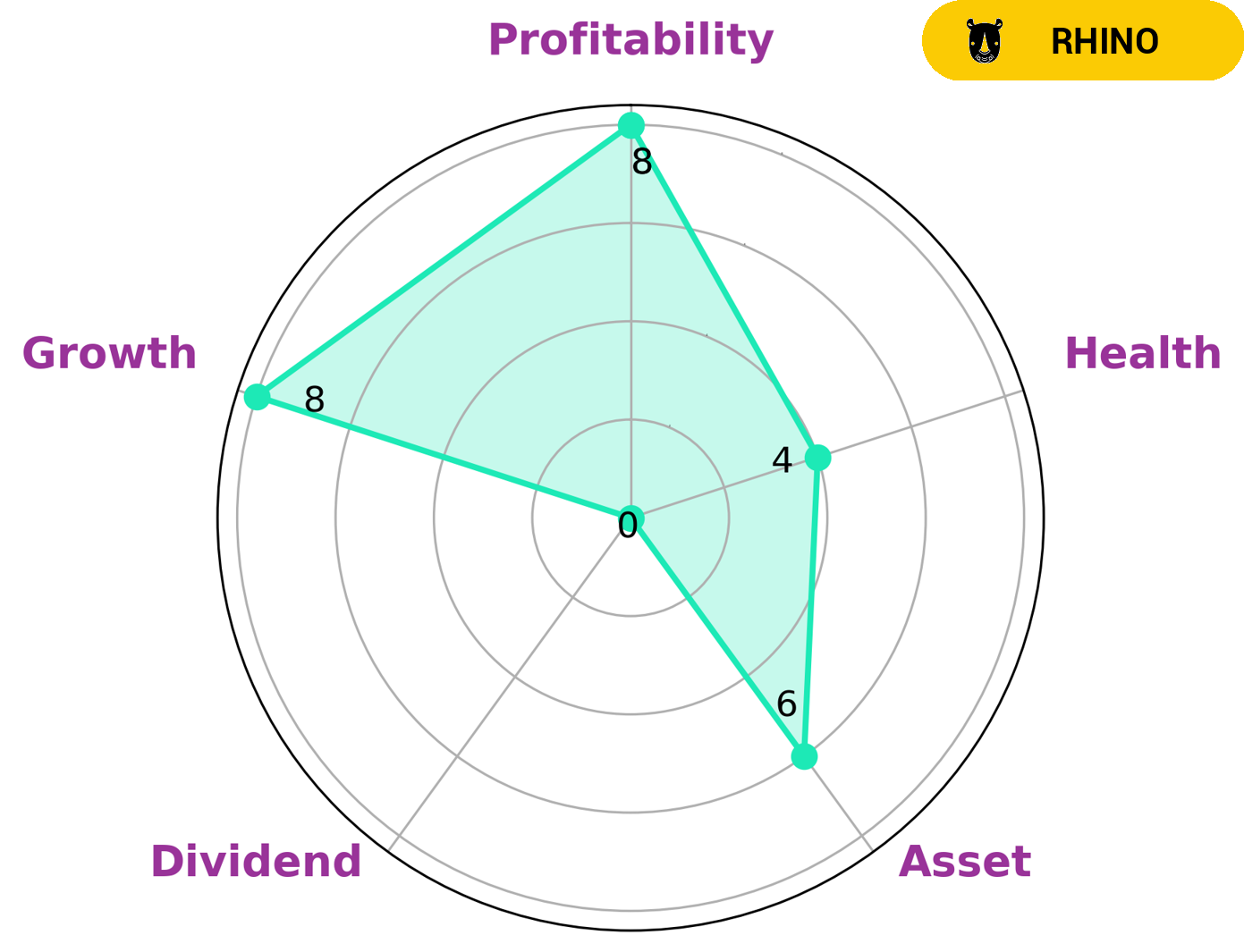

Company fundamentals are important for investors to assess a company’s long-term potential. VI app simplifies this process by providing a simple analysis of a company’s fundamentals. DZS INC is classified as a ‘rhino’ company, one that has achieved moderate revenue or earnings growth. Their VI Star Chart shows they are strong in growth, profitability and medium in asset but weak in dividend. The company has an intermediate health score of 4/10, indicating they are able to safely ride out any crisis without the risk of bankruptcy. Investors considering investing in DZS INC should take into account its weak dividend, however, its strong growth potential could be attractive for investors looking for higher returns. Investors who prefer lower-risk investments may also be interested in DZS INC as its intermediate health score indicates it is less likely to go bankrupt. Overall, DZS INC is a company that has achieved moderate growth and has an intermediate health score, making it attractive for investors who are looking for higher returns with lower risk. However, investors should take into account the weak dividend yield before making an investment decision. More…

VI Peers

The competition in the telecommunications industry is fierce. DZS Inc. is up against some of the biggest names in the business, including Extreme Networks Inc., ADVA Optical Networking SE, and Ciena Corp. Each company is striving to provide the best products and services to their customers. While DZS Inc. has a strong presence in the market, its competitors are not far behind.

– Extreme Networks Inc ($NASDAQ:EXTR)

With a market cap of $2.5 billion and a return on equity of 40.12%, Extreme Networks is a publicly traded networking company that provides software-driven networking solutions to enterprise customers. The company delivers high-performance switching, routing, and security solutions that enable customers to build agile, data-driven networks that connect their people, applications, and devices.

– ADVA Optical Networking SE ($LTS:0NOL)

ADVA Optical Networking SE has a market cap of 1.08B as of 2022, a Return on Equity of 4.24%. The company provides optical and Ethernet-based networking solutions.

– Ciena Corp ($NYSE:CIEN)

Ciena is a network specialist that provides equipment, software and services that support mission-critical applications for communications service providers, enterprises and governments worldwide. Its products and services enable its customers to drive revenue, reduce expenses and improve efficiency by delivering high-capacity, high-speed networking solutions. Ciena’s common stock is listed on the NASDAQ Global Select Market under the symbol CIEN and is included in the S&P 500 index.

ROE is return on equity and is a measure of how well a company uses investment funds to generate profits. A company with a higher ROE is using funds more effectively to generate profits. Ciena’s ROE of 6.6% indicates that it is using funds efficiently to generate profits.

Ciena’s market cap is 6.64B as of 2022. This means that the market value of Ciena’s outstanding shares is 6.64B. Ciena’s market cap is a good indicator of the company’s size and its position in the market.

Summary

DZS Inc. has been gaining attention from investors due to its focus on research and development. The overall sentiment from news outlets has been positive, indicating potential growth for the company. Analysts have noted that the company’s focus on developing next-generation solutions could enable it to stay ahead of its competitors in the long-term.

Furthermore, the company has a strong balance sheet and is well-positioned in the current market. Investors are encouraged to do their own research before investing in DZS Inc., as the stock is considered a high-risk investment.

Recent Posts