Despite Recent Uptick, Analysts Remain Bearish on Lumentum Holdings

February 1, 2023

Trending News 🌥️

Lumentum Holdings ($NASDAQ:LITE) Inc. is a technology company that specializes in 3D sensing and laser technologies for consumer electronics applications. It is best known for powering the facial recognition technology in Apple’s iPhone X. The company’s stock has recently had a notable upswing, however, most analysts remain bearish on the future of its stock. Analysts are concerned that the company’s growth may not be sustainable due to the limited number of applications for its laser and 3D sensing technologies.

Additionally, the company is reliant on a few large customers for a large portion of its revenue, which could be a risk factor in the long-term if these customers decide to switch suppliers. Furthermore, the company’s higher-margin products have been under pressure due to weak demand from the telecom and consumer markets. This has resulted in slower sales growth compared to its peers and also weighed on profit margins. Additionally, the company’s new products have yet to gain any traction in the market, which could be a sign of long-term problems. Overall, analysts remain bearish on Lumentum Holdings Inc, despite its recent uptick. While the company’s stock could still see some short-term gains, many are concerned about the long-term prospects of the company given its reliance on a few large customers and limited opportunities for growth. As such, investors should proceed with caution before investing in Lumentum Holdings Inc.

Price History

Despite recent positive media sentiment, analysts remain bearish on Lumentum Holdings Inc. On Tuesday, the stock opened at $59.0 and closed at $60.2, up by 1.4% from the prior closing price of 59.4. This uptick in price has not been enough to convince analysts that the company is a good investment. Analysts are concerned about the overall financial health of the company. While it has reported strong revenue growth over the past few years, it has also reported declining profits and cash flow. Furthermore, its debt levels remain high, indicating that the company may not have the financial flexibility to pursue new business opportunities. The company’s stock performance has been volatile in recent months. Analysts have also noted that the company is heavily dependent on its customers in the telecommunications and data center sectors, which could be vulnerable to a downturn in the economy.

Additionally, if demand for Lumentum’s products declines, the company could face significant headwinds. They are concerned about the company’s financial health and its dependence on key customers in the telecommunications and data center sectors. Until these issues are addressed, investors should exercise caution when considering investing in Lumentum Holdings Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lumentum Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.77k | 117 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lumentum Holdings. More…

| Operations | Investing | Financing |

| 418.2 | -756 | 332.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lumentum Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.39k | 2.86k | 22.38 |

Key Ratios Snapshot

Some of the financial key ratios for Lumentum Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 68.8% | 12.8% |

| FCF Margin | ROE | ROA |

| 18.2% | 8.3% | 3.2% |

VI Analysis

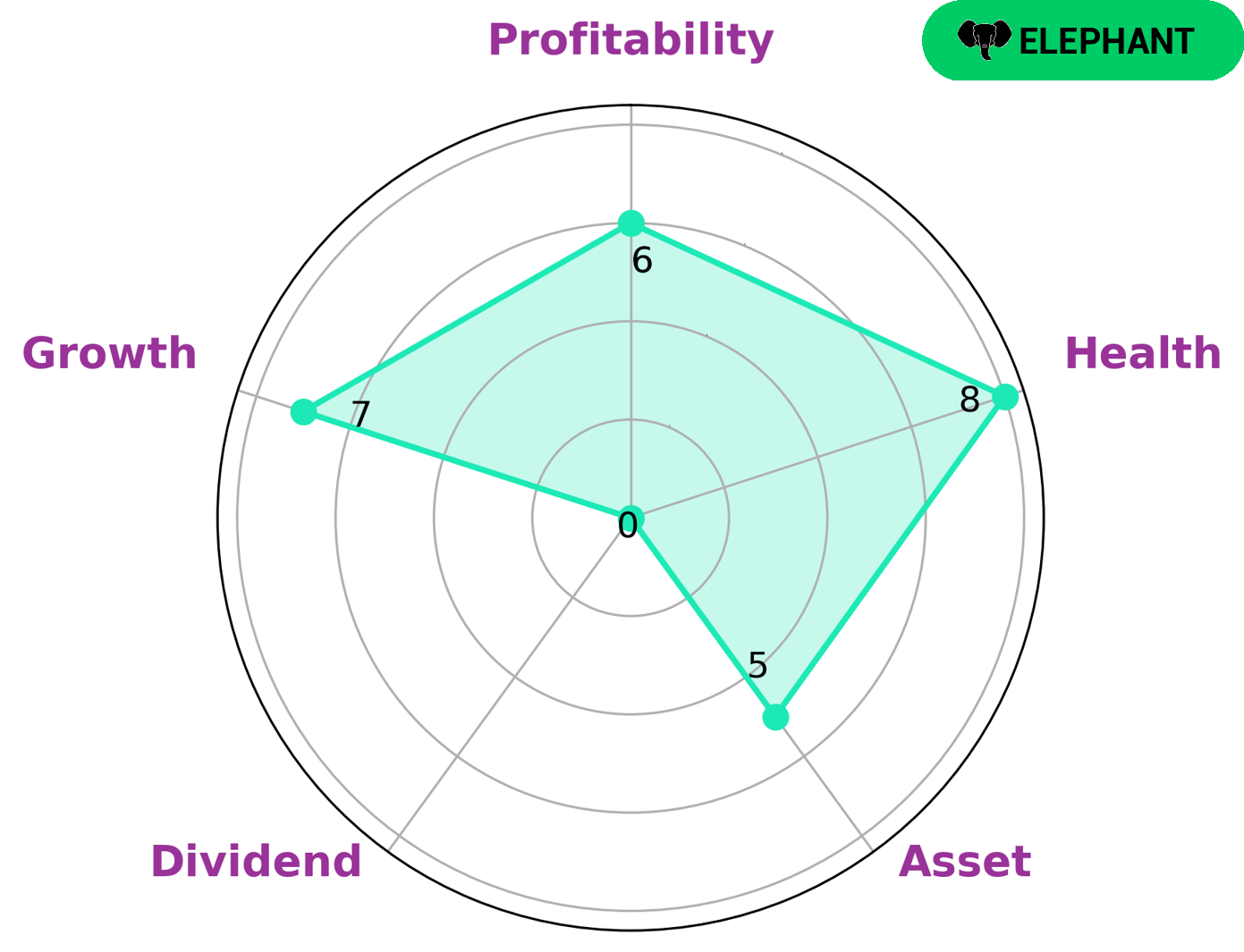

The VI app makes analyzing a company’s fundamentals and long term potential simple. It provides a comprehensive analysis of a company’s health score, cash flows, debt, growth, asset, profitability, and dividend. According to VI Star Chart, LUMENTUM HOLDINGS has a high health score of 8/10 considering its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. LUMENTUM HOLDINGS is strong in growth and medium in asset, profitability, and dividend. It is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. This makes it an attractive choice for long-term investors looking for a safe haven for their investments.

Value investors may be interested in LUMENTUM HOLDINGS as it has healthy financials, low debt, and consistent growth. This makes it a great choice for those looking for long-term returns. On the other hand, growth investors may be interested in LUMENTUM HOLDINGS because of its strong growth potential and potential for higher returns. In conclusion, LUMENTUM HOLDINGS is an attractive option for both value and growth investors due to its strong financials, low debt, and potential for long-term returns. It is important to note that all investments come with their own risks and investors should conduct their own due diligence before investing in any company.

Peers

The company’s products are used in a variety of applications, including fiber-optic telecommunications, data communications, industrial lasers, and medical lasers.

– Advanced Fiber Resources (Zhuhai) Ltd ($SZSE:300620)

Advanced Fiber Resources (Zhuhai) Ltd is a leading manufacturer of advanced fiber-based products and materials. The company has a market cap of 6.59B as of 2022 and a return on equity of 5.23%. Advanced Fiber Resources (Zhuhai) Ltd manufactures a wide range of products, including fiber optic cable, data center equipment, and telecommunications equipment. The company’s products are used in a variety of applications, including data communications, computing, and networking.

– APAC Opto Electronics Inc ($TPEX:4908)

PAC Opto Electronics Inc is a Taiwanese company that manufactures and sells opto-electronic products. The company has a market cap of 2.39B as of 2022 and a Return on Equity of 12.6%. PAC Opto Electronics Inc’s products include semiconductor lasers, light emitting diodes, photo detectors, and optical communication components. The company’s products are used in a variety of applications including telecommunications, data storage, industrial, and medical.

– Cowell e Holdings Inc ($SEHK:01415)

Cowell e Holdings Inc is a holding company that operates through its subsidiaries. The company has a market cap of 10.95B as of 2022 and a ROE of 13.79%. The company’s subsidiaries engage in the business of providing financial services, including banking, lending, and investing. The company’s operations are conducted through its subsidiaries, which include Cowell e Bank, Cowell e Credit Union, and Cowell e Investment Services.

Summary

Investment analysts have recently become more bullish on Lumentum Holdings Inc., as the company’s stock price has seen an uptick. Despite this, many analysts remain bearish on the stock, citing concerns about the company’s long-term prospects. Investors should consider doing their own research before making a decision to invest in the company, as media sentiment is mostly positive. Lumentum Holdings Inc. offers innovative photonic and optical technology solutions that enable customers to improve their products and services.

It boasts a wide range of products and services, including optical communications, lasers, photonic integration platforms, and optical sensing technologies. Investors should carefully evaluate Lumentum Holdings’ financials, management team, competitive landscape, and future prospects before investing.

Recent Posts