2023: Lumentum Holdings Proves It Can Manage Debt Responsibly.

March 14, 2023

Trending News 🌧️

Lumentum Holdings ($NASDAQ:LITE) has proven itself capable of managing its debt responsibly in 2023. As a leading provider of optical and photonic products and services, the company has utilized innovative strategies to optimize its financial resources and invest in long-term growth. Lumentum Holdings has managed its debt prudently by focusing on financial discipline, maintaining a strong balance sheet, and creating a solid foundation for future success. The company has adopted a disciplined approach to managing its debt. It has been strategic in limiting the amount of debt taken on and ensuring that the debt is used efficiently to fund growth initiatives. Lumentum Holdings has focused on debt management by regularly assessing cash flow and liquidity, analyzing the risk associated with debt, and taking steps to reduce interest expenses, such as refinancing at lower rates. To further ensure that its debt is managed responsibly, Lumentum Holdings has maintained a strong balance sheet.

This includes managing its current liabilities, providing adequate liquidity to meet its obligations, and remaining well-capitalized. The company has also taken steps to ensure that it can meet its long-term debt obligations, such as refinancing and restructuring existing debt to help reduce interest expenses. Finally, the company has invested in a solid foundation for future success by staying competitive with its peers and continuing to innovate in order to remain competitive in the marketplace. Investing in research and development activities and pursuing new markets are two examples of how Lumentum Holdings has invested in long-term growth. By taking these steps, Lumentum Holdings has proven itself capable of managing its debt responsibly in 2023. The company is well-positioned to continue leveraging its financial resources to invest in long-term growth and remain competitive in the marketplace for many years to come.

Share Price

Lumentum Holdings has been under scrutiny lately, with most of the media exposure being negative. Despite this, the company proved its ability to manage debt responsibly on Monday. The stock opened at $50.7 and closed at $50.3, a decline of 2.3% from its previous closing price of 51.5.

This showed that they can take responsibility for their financial obligations, even in these uncertain market times. Such proactive steps demonstrate their commitment to upholding financial excellence and could provide further confidence in the company’s ability to grow in the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lumentum Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.83k | 28.6 | 2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lumentum Holdings. More…

| Operations | Investing | Financing |

| 306.6 | -631.6 | 365.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lumentum Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.42k | 2.87k | 22.57 |

Key Ratios Snapshot

Some of the financial key ratios for Lumentum Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.6% | 5.3% | 6.6% |

| FCF Margin | ROE | ROA |

| 10.7% | 5.0% | 1.7% |

Analysis

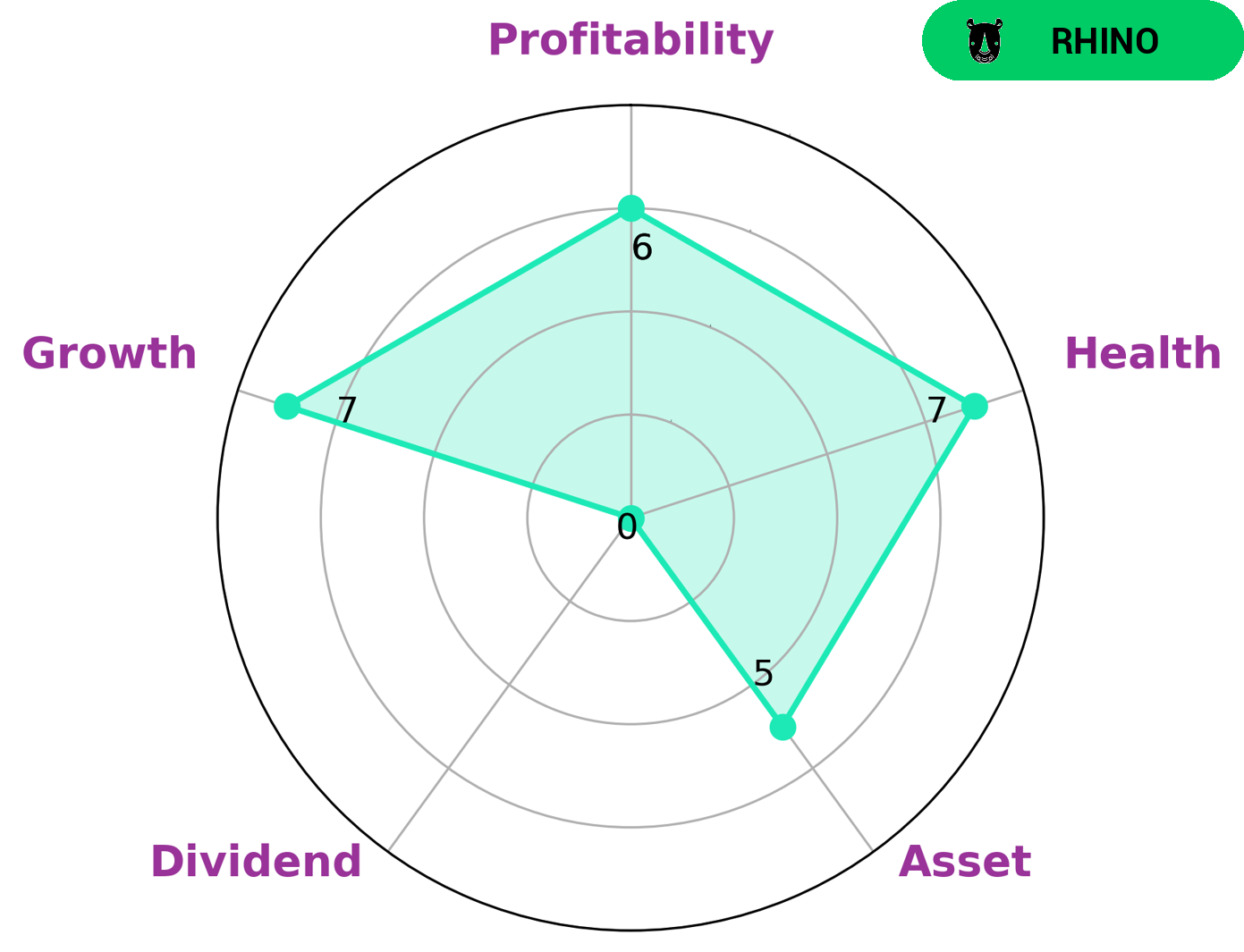

I recently performed an analysis of LUMENTUM HOLDINGS‘s wellbeing, and the results were quite encouraging. Based on the Star Chart, LUMENTUM HOLDINGS scored strong in growth, medium in asset, profitability and weak in dividend. The good news is that the company has a high health score of 7/10 with regard to its cashflows and debt; meaning it is capable to pay off debt and fund future operations. We classified LUMENTUM HOLDINGS as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. Such companies are typically attractive to value investors looking for stable returns and long-term investments. Additionally, growth investors may also be interested in such companies as there may be opportunities for price appreciation over time. More…

Peers

The company’s products are used in a variety of applications, including fiber-optic telecommunications, data communications, industrial lasers, and medical lasers.

– Advanced Fiber Resources (Zhuhai) Ltd ($SZSE:300620)

Advanced Fiber Resources (Zhuhai) Ltd is a leading manufacturer of advanced fiber-based products and materials. The company has a market cap of 6.59B as of 2022 and a return on equity of 5.23%. Advanced Fiber Resources (Zhuhai) Ltd manufactures a wide range of products, including fiber optic cable, data center equipment, and telecommunications equipment. The company’s products are used in a variety of applications, including data communications, computing, and networking.

– APAC Opto Electronics Inc ($TPEX:4908)

PAC Opto Electronics Inc is a Taiwanese company that manufactures and sells opto-electronic products. The company has a market cap of 2.39B as of 2022 and a Return on Equity of 12.6%. PAC Opto Electronics Inc’s products include semiconductor lasers, light emitting diodes, photo detectors, and optical communication components. The company’s products are used in a variety of applications including telecommunications, data storage, industrial, and medical.

– Cowell e Holdings Inc ($SEHK:01415)

Cowell e Holdings Inc is a holding company that operates through its subsidiaries. The company has a market cap of 10.95B as of 2022 and a ROE of 13.79%. The company’s subsidiaries engage in the business of providing financial services, including banking, lending, and investing. The company’s operations are conducted through its subsidiaries, which include Cowell e Bank, Cowell e Credit Union, and Cowell e Investment Services.

Summary

Lumentum Holdings is a technology company that designs and manufactures optical and photonic products. The company has recently come under scrutiny after reports of mounting debt and media exposure that has largely been negative. For investors considering the company, a closer look at their financials reveals that Lumentum has demonstrated sound management of its debt.

In the past two years, the company has increased its cash balance, reduced debt, and maintained a healthy balance sheet. Overall, Lumentum has shown that it is capable of managing its debt responsibly, providing investors with a measure of confidence in the company’s future prospects.

Recent Posts