Tronox Holdings plc’s Stock Price On the Rise, Reaching Toward Old Highs.

February 2, 2023

Trending News ☀️

Tronox Holdings ($NYSE:TROX) plc is a global leader in the production of titanium dioxide pigment and related products for use in many industries, including paint, plastics, paper, and more. The company has made tremendous progress in recent years, and its stock price has been on the rise. As of the close of business yesterday, Tronox Holdings plc’s stock had risen to $16.74, a modest 0.06% increase from its previous closing price of $16.73, signifying the potential for the stock to return to its previous highs. This is a remarkable development for a company that has had some significant ups and downs in the past. Since then, it has been on a steady upward trajectory, with its stock rising steadily over the past two years. It is also a testament to the company’s commitment to creating a stable and reliable product for its customers.

This is evidenced by the fact that Tronox Holdings plc is the world’s leading producer of titanium dioxide pigment, which is used in a variety of industries. The potential for Tronox Holdings plc’s stock to return to its previous highs is an exciting prospect for investors. The company has proven its resilience and ability to weather tough times and emerge stronger than ever. As long as the company continues to produce quality products and remain competitive in its industry, there is no reason why its stock price should not continue to rise. With its stock price steadily on the rise, Tronox Holdings plc is setting itself up for success.

Share Price

On Wednesday, TRONOX HOLDINGS stock opened at $17.0 and closed at $17.4, up by 1.2% from prior closing price of 17.2. This is a significant increase in the stock price for the company, and could indicate that the company is headed in a positive direction. The increase in TRONOX HOLDINGS stock price is indicative of the company’s strong financial performance over the past year. The company has reported positive earnings per share, a strong balance sheet, and a consistent flow of cash flow. Additionally, the company has also seen an increase in its market share and has been able to expand into new markets. Investors have taken note of the stock price increase for TRONOX HOLDINGS plc and have been bullish about the company’s future prospects. Analysts have been optimistic about the company’s future prospects and believe that it is positioned to grow and expand further in the future.

In addition, there has been an uptick in investor interest in the company, as more investors are looking to add TRONOX HOLDINGS plc to their portfolios. Investors should continue to watch the company closely as it moves forward, as this could be an indication of future growth and success for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tronox Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 3.69k | 595 | 18.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tronox Holdings. More…

| Operations | Investing | Financing |

| 497 | -399 | -309 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tronox Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.16k | 3.84k | 14.7 |

Key Ratios Snapshot

Some of the financial key ratios for Tronox Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 69.3% | 14.8% |

| FCF Margin | ROE | ROA |

| 2.5% | 15.0% | 5.5% |

Analysis

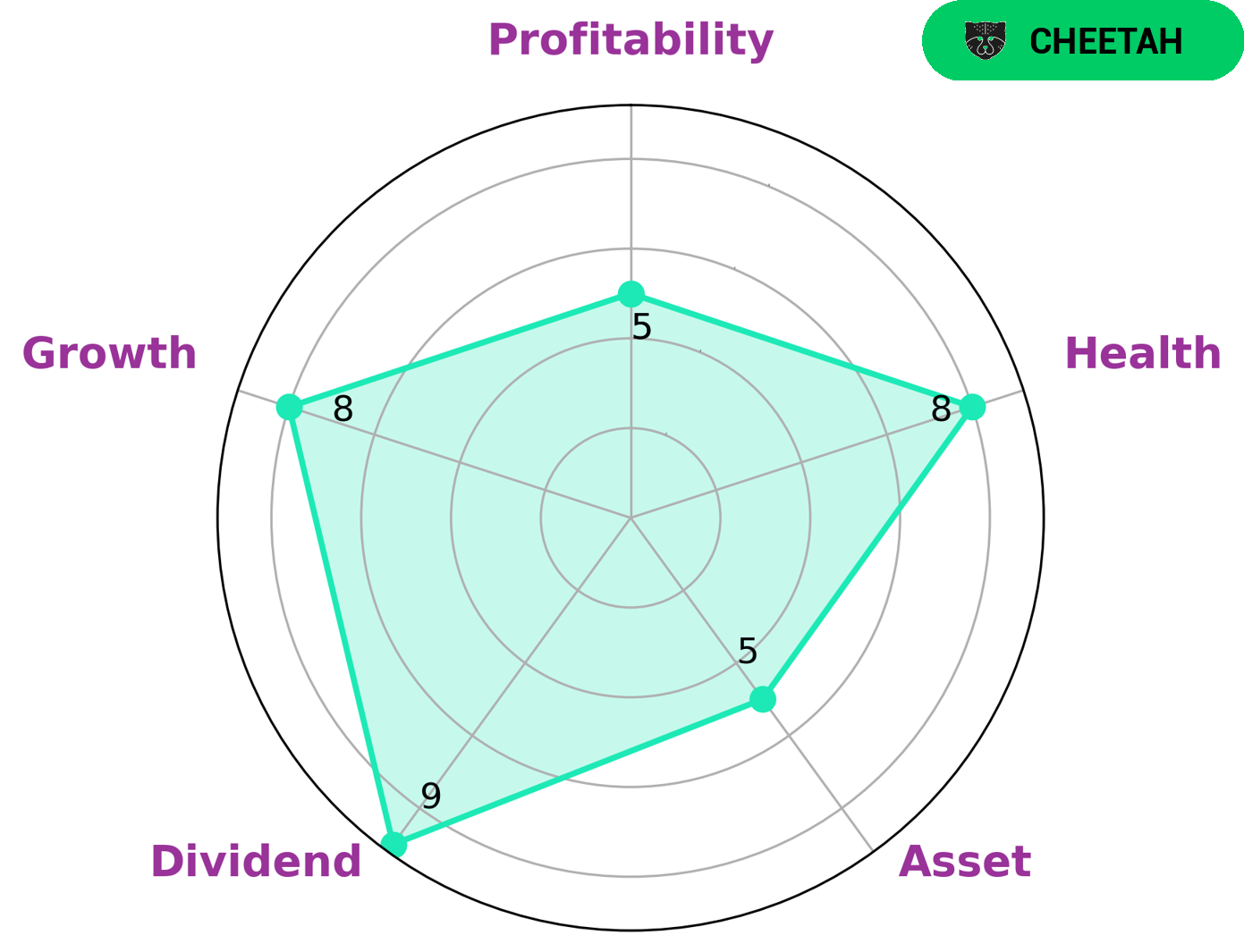

GoodWhale has conducted an analysis of TRONOX HOLDINGS‘s wellbeing and classified them as a ‘cheetah’ type of company due to their rapid growth, but lower profitability. Such a classification may make the company attractive to a certain type of investors, such as those who are looking for high dividend payouts or rapid growth in earnings. TRONOX HOLDINGS is strong in terms of dividend, growth and medium in terms of asset and profitability. The company has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations in times of crisis. Overall, TRONOX HOLDINGS appears to be an attractive option for investors looking for a combination of high dividend payouts, rapid growth in earnings and good health. It is important to note, however, that higher returns come with higher risks, so investors should conduct their own due diligence before investing in this company. More…

Peers

The company has strong competition from Hartalega Holdings Bhd, WD-40 Co, and Iofina PLC, all of which offer similar products and services. Despite the strong competition, Tronox Holdings PLC has managed to remain a leader in its industry thanks to its commitment to innovation and customer service.

– Hartalega Holdings Bhd ($KLSE:5168)

Hartalega Holdings Bhd is a Malaysian-based glove manufacturer that produces various types of gloves for medical, industrial and food service use. As of 2023, the company has a market capitalization of 5.33 billion and a Return on Equity (ROE) of 9.26%, indicating that the company is generating a good return on its investments. The company has been able to achieve such high returns due to its efficient operations, management and sales strategies. Its ability to remain competitive in the market has made it one of the leading glove manufacturers in Malaysia.

– WD-40 Co ($NASDAQ:WDFC)

WD-40 Co is a multinational corporation that specializes in the production of lubricants, cleaners, and degreasers. It has a current market cap of 2.37 billion, making it one of the largest publicly traded companies in its industry. WD-40 Co’s return on equity over the last year has been 26.96%, indicating that the company is efficiently utilizing its assets to generate a return on investment. This high return on equity and sizable market cap are indicative of WD-40 Co’s strong and profitable operations.

– Iofina PLC ($LSE:IOF)

Iofina PLC is a specialty chemical company that produces iodine, iodide and derivatives. The company has a market capitalization of 47.01M as of 2023 and a return on equity of 9.17%. This market capitalization indicates that the company has a large presence in the market, and a return on equity of 9.17% shows that it is making a good return on its investments. The company is well-positioned to continue to grow and expand its business.

Summary

TRONOX Holdings plc is an American chemical company that produces and markets titanium dioxide pigment, a white pigment used in paints, plastics and paper. The company’s stock price has been on the rise in recent months, nearing its previous all-time high. Analysts cite the company’s strong financial performance, as well as its positive outlook for the future, as key drivers of the increased stock price.

Additionally, TRONOX has been able to capitalize on strong demand for titanium dioxide pigment from the automotive and construction industries, which have been steadily growing. Despite minor concerns over global trade tensions, analysts are largely optimistic about the long-term prospects of TRONOX and its stock price.

Recent Posts