Shin-Etsu Chemical Develops Optimal Silicone Rubber for High-Voltage Automotive Cable Insulation.

March 3, 2023

Trending News ☀️

SHIN-ETSU ($TSE:4063): Shin-Etsu Chemical has developed a silicone rubber that is optimal for use in automotive cable insulation. This silicone rubber has unique properties that make it well-suited for the demanding environment of high-voltage cables in automotive applications. The silicone rubber is able to be molded into the desired shape and form, and performs excellently in the sets of requirements of automotive cables.

Additionally, the silicone rubber has superior thermal stability and excellent ageing resistance, making it much more reliable and dependable than other insulation materials. It also holds up in extreme temperature and humidity conditions, making it even more suitable for automobile cables. Shin-Etsu Chemical’s new silicone rubber has been extensively tested and proven, making it an ideal insulation material for automotive cable applications. It meets the safety requirements and has a low dielectric constant which makes it an ideal choice for automotive cables.

Price History

So far, the media sentiment towards this development has been mostly positive. This shows that the market has taken positively to the development, and remains confident in Shin-Etsu Chemical‘s ability to deliver successful products. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shin-etsu Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 2.75M | 725.5k | 26.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shin-etsu Chemical. More…

| Operations | Investing | Financing |

| 655.97k | -253.72k | -122.5k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shin-etsu Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.77M | 684.85k | 9.28k |

Key Ratios Snapshot

Some of the financial key ratios for Shin-etsu Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.8% | 36.2% | 36.5% |

| FCF Margin | ROE | ROA |

| 15.8% | 16.3% | 13.2% |

Analysis

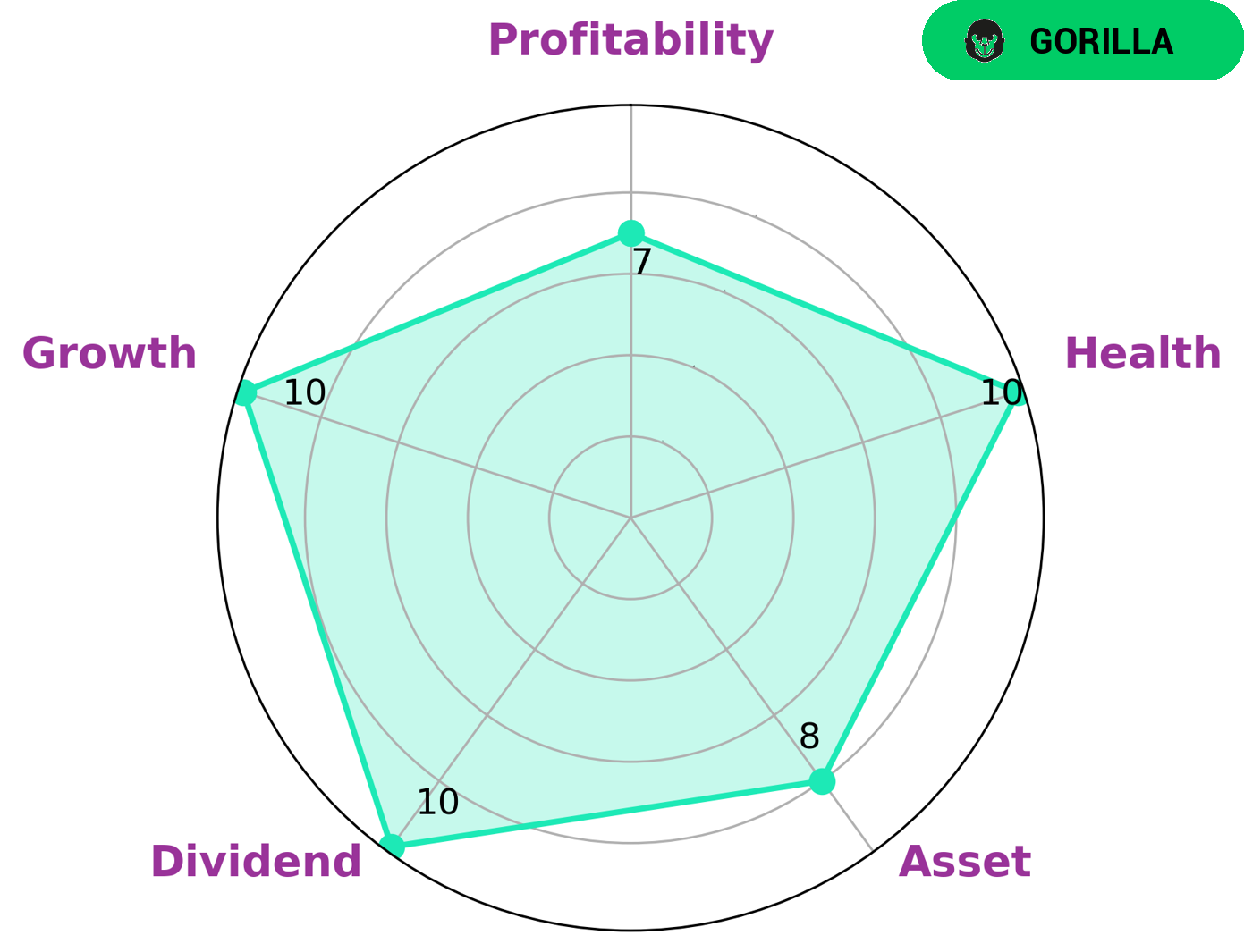

GoodWhale ran an analysis of SHIN-ETSU CHEMICAL‘s wellbeing and based on our Star Chart, we classified it as a ‘gorilla’ – a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This classification makes SHIN-ETSU CHEMICAL an attractive investment for those looking to enter the markets. With a high health score of 10/10 in terms of its cashflows and debt, SHIN-ETSU CHEMICAL is in a strong position to sustain its operations during times of economic crisis. Furthermore, the company has strong assets, dividends, growth and profitability rates which add to its overall attractiveness as an investment opportunity. All in all, SHIN-ETSU CHEMICAL presents a solid investment opportunity for those interested in capitalizing on the company’s competitive advantage and strong financial position. More…

Peers

It is the largest chemical company in Japan and the second largest in the world. It has a strong presence in Asia, Europe and North America. Shin-Etsu Chemical‘s main competitors include Fuso Chemical Co Ltd, Yuki Gosei Kogyo Co Ltd, and Chin Yang Chemical Corp, all of which are prominent chemical companies in the industry.

– Fuso Chemical Co Ltd ($TSE:4368)

Fuso Chemical Co Ltd is a Japanese chemical company that produces various products, ranging from plastics and synthetic resins to pharmaceuticals. The company has a market cap of 123.35B as of 2023, reflecting its strong financial performance in recent years. In addition, the company’s Return on Equity (ROE) is 14.05%, indicating the company is generating a healthy return on its shareholders’ investments. Fuso Chemical Co Ltd is well-positioned to continue its growth in the near future.

– Yuki Gosei Kogyo Co Ltd ($TSE:4531)

Yuki Gosei Kogyo Co. Ltd. is a Japanese manufacturing company which produces automotive parts and components. The company has a market cap of 6.33 billion dollars as of 2023, making it one of the leading automotive parts manufacturers in Japan. Yuki Gosei Kogyo Co. Ltd. also has a very impressive Return on Equity (ROE) of 3.85%, indicating that the company has been able to generate a strong return on each dollar of shareholders’ equity. This is a testament to the company’s ability to create value for its shareholders and investors.

– Chin Yang Chemical Corp ($KOSE:051630)

Chin Yang Chemical Corp is a chemical manufacturing company that produces industrial chemicals such as solvents, lubricants and fuel additives. As of 2023, the company has a market capitalization of 57.99B. This indicates that the company is highly valued by investors due to its strong performance in the industry. The Return on Equity of -0.69% shows that the company is not generating a satisfactory return on its equity investment. This suggests that the company needs to improve its operational efficiency in order to increase its profitability.

Summary

Shin-Etsu Chemical has recently developed optimal silicone rubber for high-voltage automotive cable insulation, which has been met with positive media sentiment. Investing in Shin-Etsu Chemical could offer investors a good return on investment due to their ability to come up with innovative solutions for the automotive industry, as well as the growth potential for the company. The high-voltage insulation technology provided by Shin-Etsu will enable automotive manufacturers to meet stringent safety requirements and enable them to design cost-effective vehicles. Furthermore, Shin-Etsu’s commitment to developing advanced products for automotive industry should ensure sustainability of its business. The company also stands to benefit from its long-standing customer relationships with major automakers and global presence.

However, before investing, potential investors should take into account potential risks such as market uncertainty, political risk or other external factors. The result of this would be a well-informed decision that would lead to a profitable investment in Shin-Etsu Chemical.

Recent Posts