Green Plains Poised to Reach All-Time Highs in 2023.

March 17, 2023

Trending News ☀️

Green Plains ($NASDAQ:GPRE) Inc. closed at $31.50 in the most recent trading session, a decrease of -2.08% from its prior closing price of $32.17. This hints at the company’s potential to reach its former highs and suggests that it is poised to reach all-time highs in 2023. Analysts are bullish on the prospects of Green Plains and believe that the company will be able to capitalize on the current market conditions to achieve its goals. The company has been investing heavily in research and development, as well as production and distribution. Its efforts have resulted in well-received products that have been sold in numerous countries across the globe.

As a result, revenues have grown steadily over the past several years and its stock price has been on an upward trend. Green Plains has also been actively expanding its customer base, entering new markets and developing relationships with new suppliers. This has allowed them to expand their product offerings and reach out to potential customers who may not have otherwise known about the company. Finally, Green Plains has developed a diversified portfolio of investments that will ensure the company can continue to grow and expand even further in the future.

Share Price

On Thursday, GREEN PLAINS stock opened at $30.8 and closed at $31.2, down by 1.1% from previous closing price of 31.5. This could be indicative of a slight decrease in investor confidence which may be attributed to various factors including market volatility or concerns over the company’s future prospects. Despite this recent dip in stock price, investors remain optimistic about the company’s ability to reach new highs in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Green Plains. More…

| Total Revenues | Net Income | Net Margin |

| 3.66k | -127.22 | -3.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Green Plains. More…

| Operations | Investing | Financing |

| 69.71 | -105.25 | -25.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Green Plains. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.12k | 1.06k | 15.35 |

Key Ratios Snapshot

Some of the financial key ratios for Green Plains are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.9% | -47.4% | -1.8% |

| FCF Margin | ROE | ROA |

| -3.9% | -4.4% | -1.9% |

Analysis

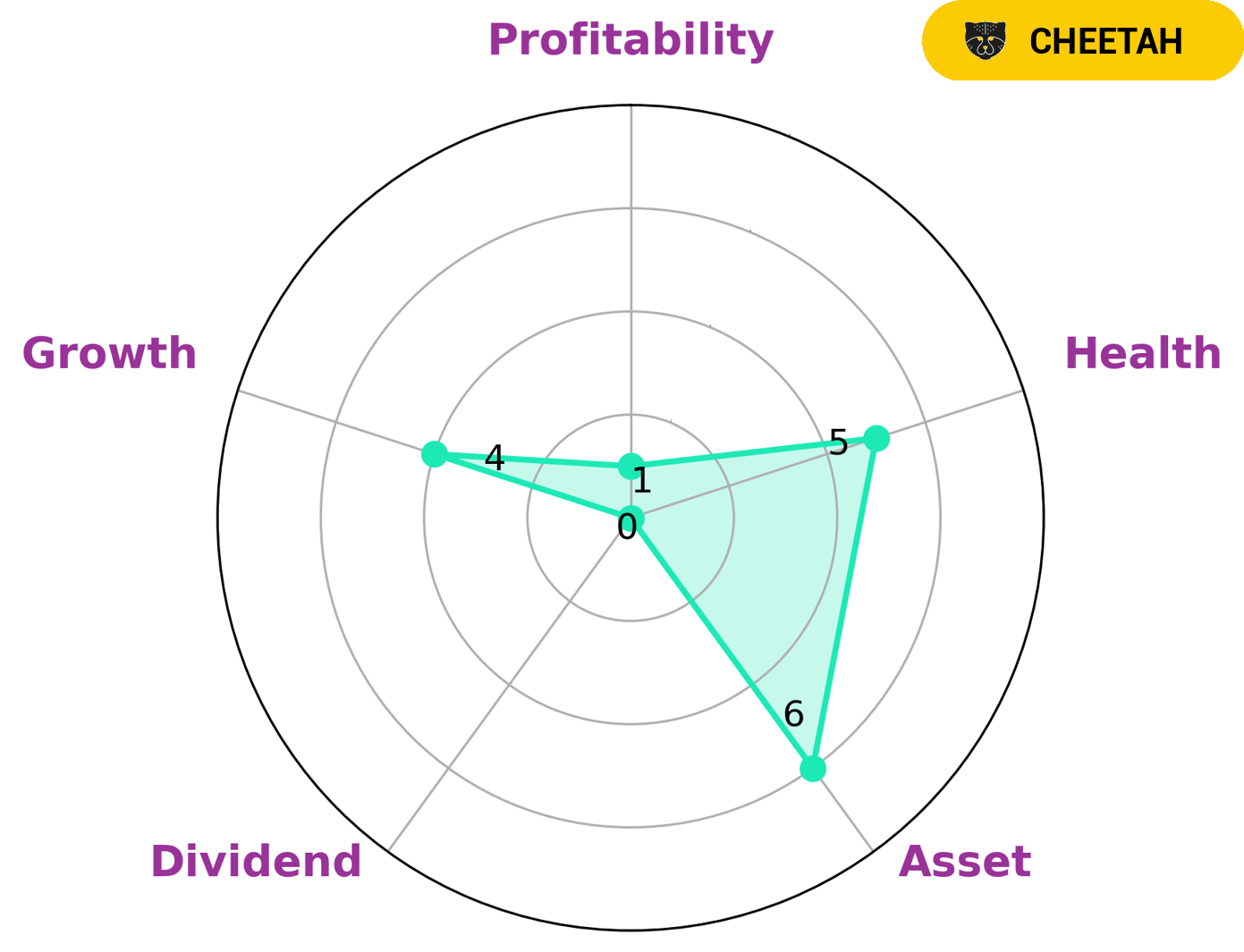

GoodWhale recently conducted an in-depth analysis of GREEN PLAINS to examine its welfare. Our analysis resulted in the classification of GREEN PLAINS as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. For investors considering GREEN PLAINS, it is important to recognize that it has an intermediate health score of 5/10, considering its cashflows and debt. This indicates that despite its lower profitability, GREEN PLAINS might be able to pay off debt and fund future operations. Furthermore, our analysis shows that GREEN PLAINS is strong in asset, medium in growth and weak in dividend and profitability. Overall, GREEN PLAINS is an interesting proposition for investors looking for companies with potential for higher than average growth, but with a certain level of risk due to its lower profitability. More…

Peers

Green Plains Inc is an American-based biofuel company and is the fourth largest ethanol producer in the United States. Green Plains Inc has three main competitors: REX American Resources Corp, Hypower Fuel Inc, Alto Ingredients Inc. All three companies are based in the United States and are engaged in the business of biofuel production.

– REX American Resources Corp ($NYSE:REX)

REX American Resources Corp is a publicly traded company that explores for, develops, and produces oil and natural gas. The company has a market capitalization of 536.43 million as of 2022 and a return on equity of 9.35%. The company’s primary operations are located in the United States.

– Hypower Fuel Inc ($OTCPK:HYPF)

Alto Ingredients Inc is a food and beverage company with a market cap of 303.4M as of 2022. The company has a return on equity of 9.76%. Alto Ingredients Inc produces and sells food and beverage products. The company offers a variety of food and beverage products, including processed foods, beverages, and snacks. Alto Ingredients Inc also provides a range of services, including food and beverage processing, packaging, and distribution.

Summary

Green Plains Inc. is a promising investment opportunity with positive news coverage and a high likelihood of reaching all-time highs in the next three years. Analysts project strong performance for the company, citing increasing demand for their products and services, new business partnerships, and improved efficiency in their operations. Recent reports of increased sales and profits indicate that this is an attractive option for investors looking to benefit from long-term growth. With a good track record and a promising outlook, Green Plains is an attractive stock for investors looking to diversify their portfolios.

Recent Posts