Dow Inc Intrinsic Stock Value – Dow Posts Unexpected Q1 Earnings Despite Year-Over-Year Decline in Net Sales

May 2, 2023

Trending News 🌥️

Dow Inc ($NYSE:DOW). has posted unexpected Q1 earnings despite a year-over-year decline in net sales. The company reported non-GAAP earnings of $0.58 per share, below the $2.34 reported a year earlier. This was higher than the estimated $0.37 per share according to analysts polled by Capital IQ. Dow Inc. is a leading global science and technology company that provides innovative solutions to customers around the world.

The company is comprised of three distinct businesses: Dow, Dow Corning and DuPont. With its strong presence in plastics and chemicals, Dow Inc. is well placed to benefit from the growing demand for sustainable solutions in these industries. Despite the overall decline in net sales, Dow Inc. was able to post unexpectedly high earnings due to cost reduction measures and its resilient portfolio of products and services.

Stock Price

On Monday, DOW INC stock opened at $54.5 and closed at $54.1, down by 0.5% from its previous closing price of 54.4. Although the company reported a decrease in net sales compared to the same quarter last year, the earnings were better than the analysts’ expectations. Despite this, the stock market was not impressed and the stock price dropped slightly. This could be due to the uncertainty surrounding the company’s future performance as it continues to face a challenging economic environment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dow Inc. More…

| Total Revenues | Net Income | Net Margin |

| 53.49k | 2.92k | 6.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dow Inc. More…

| Operations | Investing | Financing |

| 6.41k | -2.75k | -3.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dow Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 59.32k | 38.6k | 29.39 |

Key Ratios Snapshot

Some of the financial key ratios for Dow Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.6% | 7.1% | 8.6% |

| FCF Margin | ROE | ROA |

| 7.9% | 14.0% | 4.8% |

Analysis – Dow Inc Intrinsic Stock Value

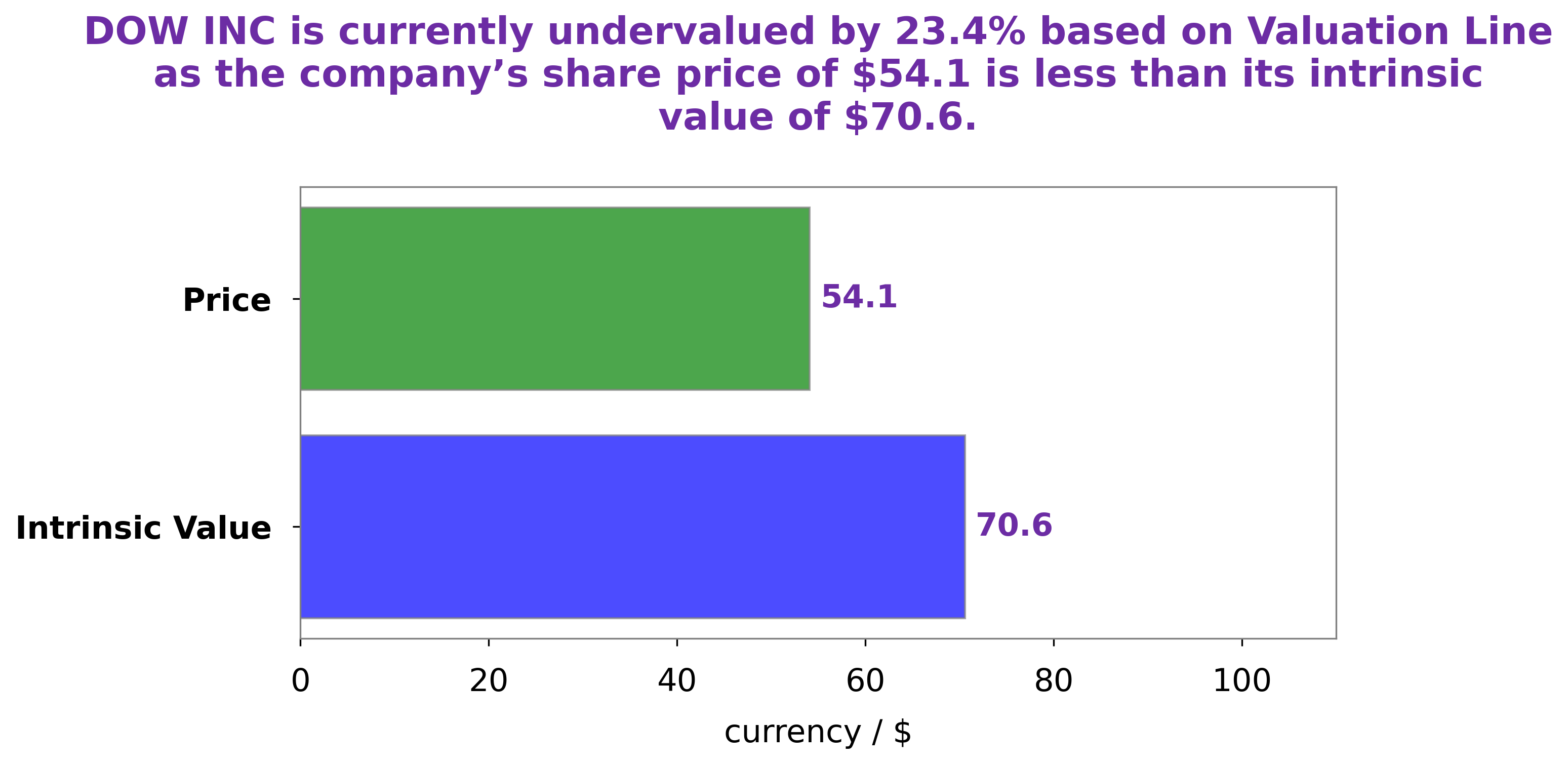

At GoodWhale, we have carefully analyzed the fundamentals of DOW INC and have come to the conclusion that the intrinsic value of a share is around $70.6. Our proprietary Valuation Line was used to reach this conclusion. Presently, the stock is being traded at $54.1, which implies that it is undervalued by 23.4%. This could be an opportune moment for investors to buy into this stock and potentially benefit from a price appreciation as the market catches up with the real value of the stock. More…

Peers

In the world of petrochemical manufacturing, Dow Inc. is one of the big players. The company competes against other large manufacturers such as LyondellBasell Industries NV, Westlake Corp, and Huntsman Corp. While each company has its own strengths and weaknesses, Dow Inc. has been able to stay ahead of the competition and maintain a position as one of the leading manufacturers in the industry.

– LyondellBasell Industries NV ($NYSE:LYB)

LyondellBasell Industries is a large, publicly traded chemical company with operations in over 20 countries. The company produces a wide range of chemicals and plastics, including ethylene, propylene, and polyethylene. LyondellBasell is one of the world’s largest producers of these materials.

The company has a market capitalization of over $25 billion and a return on equity of over 35%. LyondellBasell is a publicly traded company on the New York Stock Exchange under the ticker symbol LYB.

– Westlake Corp ($NYSE:WLK)

Westlake Corp is a publicly traded company with a market capitalization of $11.86 billion as of 2022. The company has a return on equity of 27.65%. Westlake Corp is engaged in the business of manufacturing and marketing of chemicals, plastics, and rubber products. The company has operations in North America, Europe, Asia, and South America.

– Huntsman Corp ($NYSE:HUN)

The company, Huntsman Corporation, is a publicly traded company with a market capitalization of 5.28 billion as of 2022. The company has a return on equity of 24.15%. Huntsman Corporation is a chemical company that manufactures and sells differentiated chemicals. The company operates in four segments: Polyurethanes, Performance Products, Advanced Materials, and Textile Effects. The company was founded in 1970 and is headquartered in The Woodlands, Texas.

Summary

This result was significantly lower than the analyst estimates of $0.37 per share. This was attributed to significant weakness in demand across multiple end markets, including automotive, industrial and construction, and consumer durables sectors. In light of the current environment, Dow has implemented rigorous cost control measures, reducing discretionary spending and taking other steps to mitigate the impact of the pandemic. With economic activity expected to remain subdued in the near term, it is likely that further upside in the stock is limited.

Recent Posts