Allspring Global Investments Holdings LLC Sells 832 Shares of Tronox Holdings plc

January 30, 2023

Trending News ☀️

Tronox Holdings ($NYSE:TROX) plc (TROX) recently reported that Allspring Global Investments Holdings LLC has sold 832 of its shares. Tronox Holdings is a global mining and inorganic chemicals company, producing a range of minerals and chemicals that are used in everyday products from toothpaste to paints. The company has operations in various countries across the world, including the United States, Australia, South Africa, and Namibia. The company’s stock price has been on a steady decline over the past few months, due to weak demand in the global economy and a challenging operating environment. The company is focused on improving operational efficiency and reducing costs in order to maximize shareholder value.

In addition, Tronox has announced plans to expand its global footprint by entering new markets, such as India and China. The company is also investing in research and development in order to develop new products that meet the changing needs of its customers. Tronox Holdings is well-positioned to benefit from any future economic growth. Its diversified portfolio of products and its presence in multiple markets give it an advantage over its competitors. The company has also taken steps to reduce its debt load, which further strengthens its balance sheet and financial position. With a strong management team and a sound strategy, Tronox Holdings should continue to benefit from growth opportunities in the years ahead.

Market Price

At the time of writing, the media exposure regarding the sale has been mostly positive. On Monday, TRONOX HOLDINGS stock opened at $16.5 and closed at $16.6, up by 0.5% from its last closing price of 16.5. The company is engaged in the production and marketing of titanium bearing mineral sands and titanium dioxide pigment, which are used in a variety of industrial and consumer applications. It produces and markets titanium dioxide pigment both in its own plants and through toll manufacturing agreements, as well as through third-party suppliers. The company also produces and sells TiO2 pigment, which is used for coloration, opacity, whiteness, and brightness in paints, coatings, plastics, paper, printing inks, fibers, and other specialty products. The company has grown significantly over the past few years and has a strong presence in the titanium dioxide industry.

It is also one of the largest producers of titanium dioxide pigment globally. The company’s product portfolio includes a wide range of titanium based products that are used across various industries, including automotive, packaging, paper, and cosmetics. Overall, Allspring Global Investments Holdings LLC is bullish on the future performance of TRONOX HOLDINGS stock and expects the company to continue to generate strong returns in the future. The company’s strong presence in the titanium dioxide industry is expected to drive its growth going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tronox Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 3.69k | 595 | 18.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tronox Holdings. More…

| Operations | Investing | Financing |

| 497 | -399 | -309 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tronox Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.16k | 3.84k | 14.7 |

Key Ratios Snapshot

Some of the financial key ratios for Tronox Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 69.3% | 14.8% |

| FCF Margin | ROE | ROA |

| 2.5% | 15.0% | 5.5% |

VI Analysis

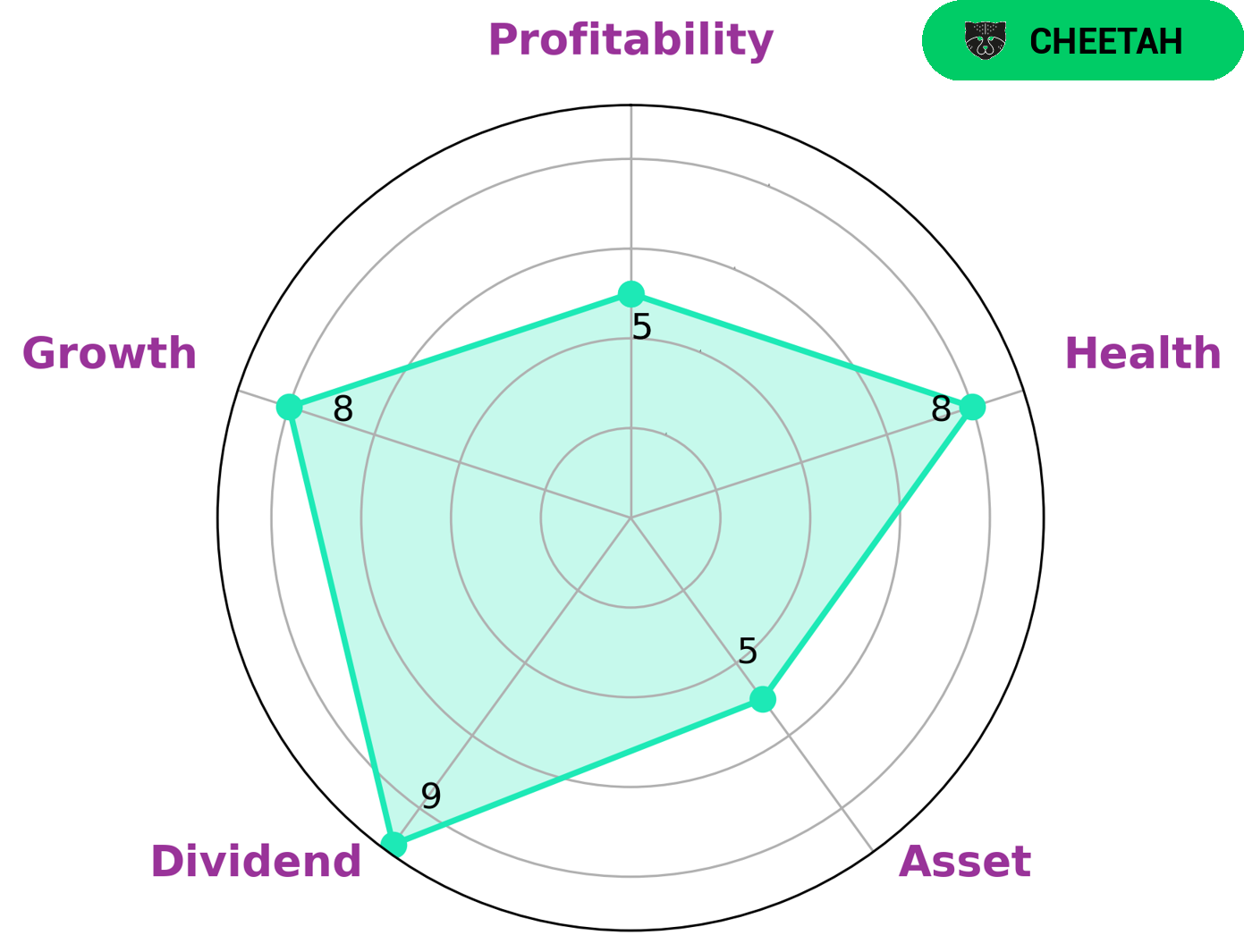

TRONOX HOLDINGS is a company with strong fundamentals that reflect its long term potential. The VI Star Chart shows that TRONOX HOLDINGS has a high health score of 8/10, meaning it is capable of safely riding out any crisis without the risk of bankruptcy. Furthermore, it is classified as a ‘cheetah’ company – a type of business that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Due to its strong dividend, growth, and medium asset and profitability, TRONOX HOLDINGS is an ideal investment for investors who are looking for a higher return on their capital, such as venture capitalists and growth-oriented investors. For more risk-averse investors, TRONOX HOLDINGS may still be an attractive option due to its high health score and relatively low risk of bankruptcy. Overall, TRONOX HOLDINGS has strong fundamentals and is a viable investment for many types of investors. Despite its lower profitability, its high health score and strong dividends make it an attractive option for those looking for higher returns on their capital or those looking for a more secure investment. More…

VI Peers

The company has strong competition from Hartalega Holdings Bhd, WD-40 Co, and Iofina PLC, all of which offer similar products and services. Despite the strong competition, Tronox Holdings PLC has managed to remain a leader in its industry thanks to its commitment to innovation and customer service.

– Hartalega Holdings Bhd ($KLSE:5168)

Hartalega Holdings Bhd is a Malaysian-based glove manufacturer that produces various types of gloves for medical, industrial and food service use. As of 2023, the company has a market capitalization of 5.33 billion and a Return on Equity (ROE) of 9.26%, indicating that the company is generating a good return on its investments. The company has been able to achieve such high returns due to its efficient operations, management and sales strategies. Its ability to remain competitive in the market has made it one of the leading glove manufacturers in Malaysia.

– WD-40 Co ($NASDAQ:WDFC)

WD-40 Co is a multinational corporation that specializes in the production of lubricants, cleaners, and degreasers. It has a current market cap of 2.37 billion, making it one of the largest publicly traded companies in its industry. WD-40 Co’s return on equity over the last year has been 26.96%, indicating that the company is efficiently utilizing its assets to generate a return on investment. This high return on equity and sizable market cap are indicative of WD-40 Co’s strong and profitable operations.

– Iofina PLC ($LSE:IOF)

Iofina PLC is a specialty chemical company that produces iodine, iodide and derivatives. The company has a market capitalization of 47.01M as of 2023 and a return on equity of 9.17%. This market capitalization indicates that the company has a large presence in the market, and a return on equity of 9.17% shows that it is making a good return on its investments. The company is well-positioned to continue to grow and expand its business.

Summary

Investing in Tronox Holdings plc (TROX) might be a good idea as the company has recently been sold 832 shares by Allspring Global Investments Holdings LLC. This signals a positive outlook for the company and has resulted in increased media coverage, indicating investors are optimistic about its future prospects. Tronox Holdings is one of the world’s largest producers of titanium products and is known for its strong and diverse portfolio of products, services, and technology solutions.

It has a strong presence in the global market and is well-positioned to benefit from economic growth in emerging markets. Tronox Holdings has a long history of success and is a reliable investment opportunity with a solid return on investment potential.

Recent Posts