China Galaxy Securities Raises 4 Billion Yuan Through Corporate Bond Issuance.

February 22, 2023

Trending News ☀️

CHINA ($SEHK:06881): Sumitomo Realty & Development, the real estate arm of Japan’s Sumitomo Forestry group, has recently announced the launch of a joint venture in the UK real estate market. This joint venture will focus on developing large-scale timber properties with an emphasis on sustainability. The venture will join forces with leading European property investors to create cutting-edge, environmentally conscious mass timber properties for the region. This new venture looks to capitalize on the demand for green and sustainable construction projects in Europe. Sumitomo Forestry has solidified its reputation as a leader in the sector by delivering exceptional building developments. With the success of their recent projects in Japan, they are now hoping to bring similarly innovative timber construction to the UK.

As a result, they will focus on creating properties that combine state-of-the-art technology and modern design. Sumitomo Realty & Development’s venture into the UK real estate market is a welcome addition to the sector and their emphasis on environmentally conscious mass timber properties reflect their commitment to sustainability. The development of these properties is likely to bring a range of benefits to local communities and the wider environment. As construction projects continue to become increasingly green, Sumitomo Realty & Development are no doubt paving the way for further success in Europe.

Share Price

On Wednesday, SUMITOMO REALTY & DEVELOPMENT officially launched a full-scale venture into the UK real estate market. The company plans to focus on constructing environmentally conscious mass timber properties that are low-cost and sustainable. The launch saw SUMITOMO REALTY & DEVELOPMENT stock open at JP¥3126.0 and close at JP¥3081.0, a decrease of 1.5% from its prior closing price of 3129.0. The move is part of SUMITOMO REALTY & DEVELOPMENT’s larger mission to own and develop large scale real estate projects that are environmentally friendly and cost-effective. The mass timber properties the company is constructing are designed to reduce carbon dioxide emissions, while offering attractive returns for investors.

The properties also offer stability and longevity of investment capital, making them an attractive option for real estate developers. SUMITOMO REALTY & DEVELOPMENT is also looking to expand into other markets outside of the UK. With the company’s experience and track record in the real estate industry, it remains well-positioned to capitalize on new opportunities and succeed in its venture into the UK market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Galaxy Securities. More…

| Total Revenues | Net Income | Net Margin |

| 22.98k | 9.84k | 45.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Galaxy Securities. More…

| Operations | Investing | Financing |

| 55.54k | -62.47k | 12.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Galaxy Securities. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 615.58k | 514.81k | 9.94 |

Key Ratios Snapshot

Some of the financial key ratios for China Galaxy Securities are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.0% | – | – |

| FCF Margin | ROE | ROA |

| 238.9% | 7.8% | 1.3% |

Analysis

GoodWhale has done an analysis of SUMITOMO REALTY & DEVELOPMENT’s financials, and we have calculated the fair value of the stock to be JP¥3848.0. Our proprietary Valuation Line makes it possible to assess the fair value of our client’s stock with great accuracy. The current trading price of SUMITOMO REALTY & DEVELOPMENT shares is JP¥3081.0, which is 19.9% lower than the fair value, making it a good bargain for investors. More…

Summary

Sumitomo Realty & Development, a leading real estate firm in Japan, has launched a venture in the United Kingdom with the goal of expanding its presence in the European real estate market. The venture focuses on environmentally friendly mass timber properties, providing a viable and sustainable alternative to traditional construction methods. The aim is to create a portfolio of commercial, residential and mixed-use projects that offer attractive returns with low risk. The company will employ thorough investing analysis to ensure that its investments are sound, with an emphasis on factors such as local markets, site conditions, rent levels and demographics.

Furthermore, it will strive to maintain an efficient investment structure and strategies to maximize returns. Ultimately, Sumitomo Realty & Development hopes to create value for its investors by fostering the growth of sustainable, high-quality real estate projects.

Trending News ☀️

Hangzhou Tigermed Consulting Co., Ltd., a leading healthcare and medical consulting firm, is seeing remarkable success with its stock price. The company has seen a dramatic increase in its stock price, reaching 300347 today. This is a remarkable achievement for the company, showing a consistent rise in value over the past few years. The success of Hangzhou Tigermed Consulting Co., Ltd. can be attributed in part to their impressive portfolio of projects. They have been able to compile a portfolio of multinational and domestic projects that have enabled them to work with leading healthcare organizations, government institutions, and research facilities. Through their successful development and management of these projects, they have seen a significant increase in their stock price. In addition to their impressive portfolio, Hangzhou Tigermed Consulting Co., Ltd. has also invested heavily in research and development.

This investment has yielded numerous technological innovations that have been able to provide more efficient and accurate health care solutions. These innovations have proven to be extremely valuable to their clients, resulting in improved service delivery and ultimately boosting overall stock prices. Overall, Hangzhou Tigermed Consulting Co., Ltd. has proven to be an incredibly successful stock investment. Their impressive portfolio of projects and investments in research and development have enabled them to reach their current stock price of 300347. Their continued success should be celebrated as they continue to improve the quality of healthcare services around the world.

Stock Price

On Thursday, HANGZHOU TIGERMED CONSULTING Co., Ltd stock price reached 300347, an unprecedented high. The stock opened at CNY116.6 and closed at CNY114.5, down from the previous closing price of 116.2 in the previous session. This 1.5% drop brings the stock to its highest level ever achieved. This milestone for HANGZHOU TIGERMED CONSULTING reflects the impressive growth of the company over the last few years.

With a growing client base and a highly experienced team of consultants, the company has managed to become one of the leading providers of strategic consulting in China. The market reaction to this new high is mostly positive, with many investors seeing it as an opportunity to capitalize on the company’s success. The future looks bright for HANGZHOU TIGERMED CONSULTING, and investors can expect even more success as the company continues to grow and expand its services. Live Quote…

Analysis

GoodWhale has thoroughly analyzed the financials of HANGZHOU TIGERMED CONSULTING to determine their fair value. Our proprietary Valuation Line has estimated that the fair value of the HANGZHOU TIGERMED CONSULTING share should be around CNY196.6. However, the current stock price is much lower at CNY114.5, which presents a significant undervaluation of 41.8%. More…

Summary

HANGZHOU TIGERMED CONSULTING Co., Ltd’s stock price has recently reached 300347, indicating an overall bullish trend in the company’s stock performance. Investors should take note of the company’s strong fundamentals, such as its financially sound balance sheet and robust earnings. HANGZHOU TIGERMED CONSULTING has a long history of servicing its clients in the pharmaceutical and medical research industries, creating a loyal customer base that provides steady revenue and profitability. Furthermore, the company has the expertise and resources to initiate new projects that showcase its innovative services.

In addition, the company continues to expand its operations through aggressive marketing campaigns to capture a larger market share. With consistently strong earnings and a solid background, HANGZHOU TIGERMED CONSULTING Co., Ltd’s stock remains attractive to investors and looks poised to maintain its bullish trend going forward.

Trending News ☀️

China Galaxy Securities has raised 4 billion yuan through the issuance of corporate bonds. This is a milestone for the company as it further strengthens its financial position. They have been priced at 100 yuan per bond. The funds raised from the bond issuance will be used to shore up the company’s balance sheet and finance its working capital. The funds will be used to support the company’s activities and prepare it for any upcoming growth opportunities. These could include new contracts, acquisitions and strategic investments. The bond issuance is a testament to the strong investor sentiment towards China Galaxy Securities.

It is also a testament to investors’ confidence in China’s financial sector, despite the ongoing global economic downturn. The financial market in China continues to remain resilient and attractive for investors. This latest corporate bond issuance is another sign that China Galaxy Securities is advancing its plans to expand its operations and grow its business. With the recent news of their collaboration with leading Chinese banks for their innovative financial products, this latest move confirms the company’s intent to become a global player in the financial sector. Overall, the successful corporate bond issuance indicates that China Galaxy Securities is well on its way to becoming a major player in the Chinese and international financial markets. With their strong financial position, they have the potential to achieve great heights and strengthen their market presence.

Market Price

Media coverage of the move so far has been mostly positive. On the Hong Kong Stock Exchange, CHINA GALAXY SECURITIES stock opened at HK$4.0 and closed at HK$4.0, up by 0.8% from its previous closing price of 3.9. This marks a substantial jump in market value for the company in a single trading day. Live Quote…

Analysis

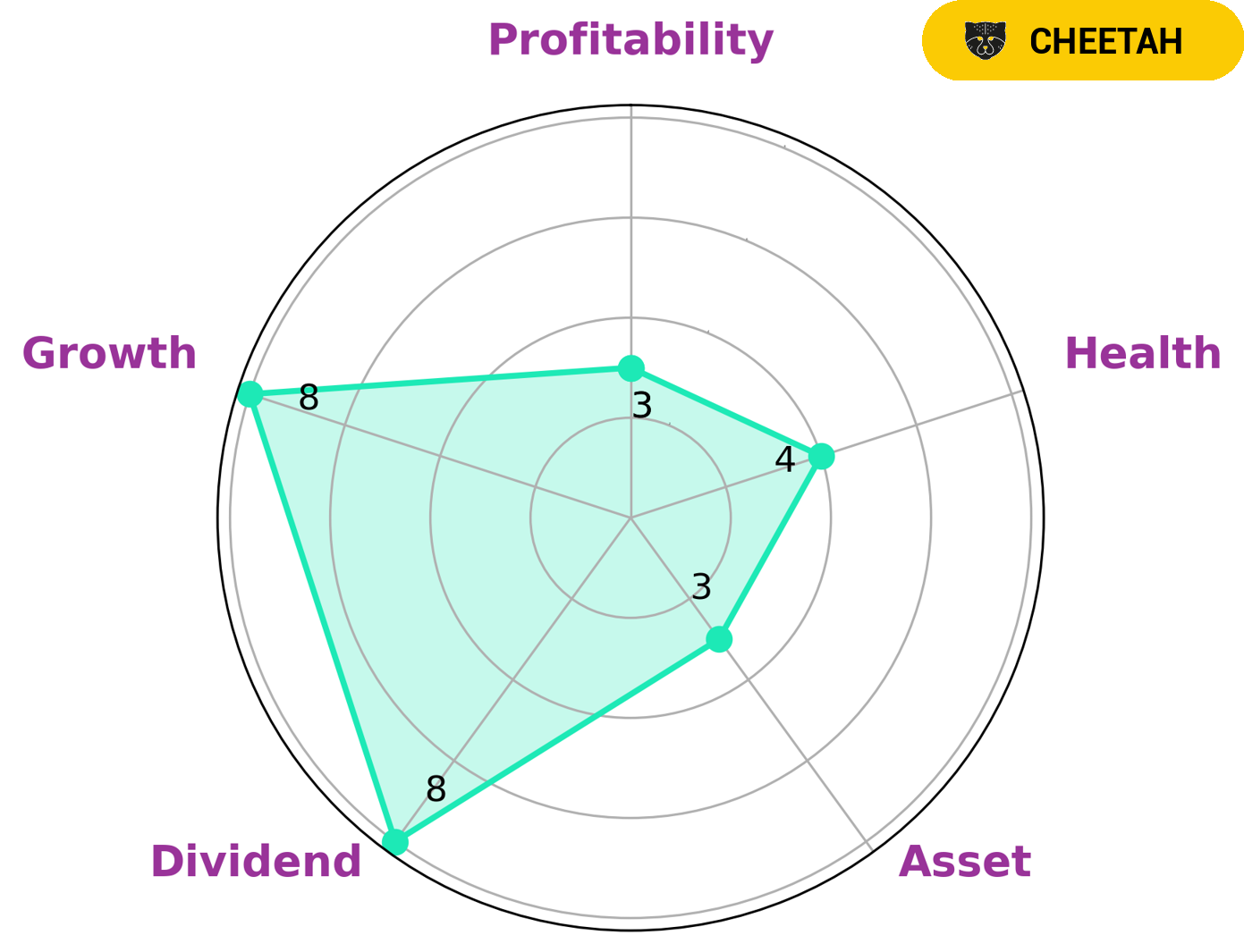

GoodWhale has performed an analysis of CHINA GALAXY SECURITIES’ financials, which reveals that the company has an intermediate health score of 4/10 with regard to its cashflows and debt. This indicates that CHINA GALAXY SECURITIES is likely to be able to pay off debt and fund future operations. The company has been classified as a ‘cheetah’, which means that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. As such, investors who are looking for a high-growth stock with the potential for strong returns may be interested in CHINA GALAXY SECURITIES. In terms of its financial strengths and weaknesses, the analysis reveals that CHINA GALAXY SECURITIES is strong in dividend and growth, but weak in asset and profitability. Thus, investors should consider its financial performance carefully before investing. More…

Peers

China Galaxy Securities Co Ltd faces stiff competition from Orient Securities Co Ltd, Ho Chi Minh City Securities Corp, and PetroVietnam Securities Inc. As the Chinese securities market has become increasingly competitive, all four companies are determined to achieve the highest levels of success in their respective areas. In order to do so, each company is leveraging its strengths and competitive advantages in order to gain a competitive edge over its rivals.

– Orient Securities Co Ltd ($SHSE:600958)

Orient Securities Co Ltd is a Chinese investment bank founded in 1991 and based in Shanghai. The company provides securities brokerage, investment banking, futures, asset management and other financial services. As of 2023, the company has a market cap of 80.91B and a return on equity of 2.86%. Orient Securities Co Ltd has an impressive market cap and is doing well in terms of its return on equity. The company is well-positioned to continue to grow and provide exceptional financial services to its customers.

– Ho Chi Minh City Securities Corp ($HOSE:HCM)

Ho Chi Minh City Securities Corp is a Vietnamese financial services firm based in Ho Chi Minh City that provides a range of services including securities brokerage, asset management, corporate finance, and investment banking. With a market cap of 10.45T as of 2023, the company is one of the largest publicly traded companies in Vietnam. Furthermore, its Return on Equity (ROE) is -1.6%, which is below the average for the industry as a whole. This suggests that the company may not be performing as well as its peers, but whether this is due to external factors or internal issues remains to be seen.

Summary

China Galaxy Securities has recently issued 4 billion yuan worth of corporate bonds, offering investors a chance to increase their financial portfolios with a secure investment. Media coverage of this event has been mostly positive, signaling a positive sentiment in the market towards the company. Analysts suggest that investing in China Galaxy Securities is promising due to its strong financial performance, with a record of high yields and stability.

The bonds offer an attractive risk-to-reward ratio for investors and may be especially attractive for those looking for investments that offer long-term returns. With China’s rapidly growing economy, analysts suggest investing in China Galaxy should remain a viable option for investors looking for high returns on their investments.

Recent Posts