CHINA GALAXY SECURITIES CO., LTD. Sees Surge in 6881 Stock Price

January 28, 2023

Trending News ☀️

The company provides a wide range of financial services, including brokerage, investment banking, asset management, and research. This surge has been driven by the company’s strong performance and the increasing demand for Chinese securities firms as the economy continues to recover from the pandemic-induced recession.

In addition, the company has successfully implemented a series of cost-cutting and efficiency measures, which have further improved its financial position. The company has established a good reputation in the industry by providing quality services and keeping up with the latest trends. This has attracted a large number of investors who are confident in the company’s future prospects. The company is expanding its presence in the country by setting up new branches in key cities such as Beijing, Shanghai, and Guangzhou. With the growing demand for services, the company is expected to continue to benefit from the rising 6881 stock price. Going forward, the company is expected to continue to benefit from the increasing demand for financial services in China ($SEHK:06881).

Price History

At the time of writing, media coverage on this stock has mostly been positive. On Wednesday, CHINA GALAXY SECURITIES stock opened at HK$4.2 and closed at HK$4.3, up by 1.4% from its previous closing price of 4.2. The surge in stock prices may be attributed to investor confidence in the company’s future prospects. The company has an established presence in the Chinese securities market and is well-positioned to capitalize on the opportunities that arise from the country’s growing economy. The positive sentiment surrounding the company’s stock price could also be attributed to increasing demand for its products and services.

With its wide array of offerings and competitive pricing, CHINA GALAXY SECURITIES has been able to attract customers from all over the world, giving it a competitive edge over its competitors. The company’s recent efforts to diversify its portfolio, introducing new products and services, have also been well-received by investors. This has contributed to the positive sentiment and driven up the stock price. This could be attributed to investor confidence in the company’s future prospects, increasing demand for its products and services, and its efforts to diversify its portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Galaxy Securities. More…

| Total Revenues | Net Income | Net Margin |

| 22.98k | 9.84k | 45.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Galaxy Securities. More…

| Operations | Investing | Financing |

| 55.54k | -62.47k | 12.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Galaxy Securities. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 615.58k | 514.81k | 9.94 |

Key Ratios Snapshot

Some of the financial key ratios for China Galaxy Securities are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.0% | – | – |

| FCF Margin | ROE | ROA |

| 238.9% | 7.8% | 1.3% |

VI Analysis

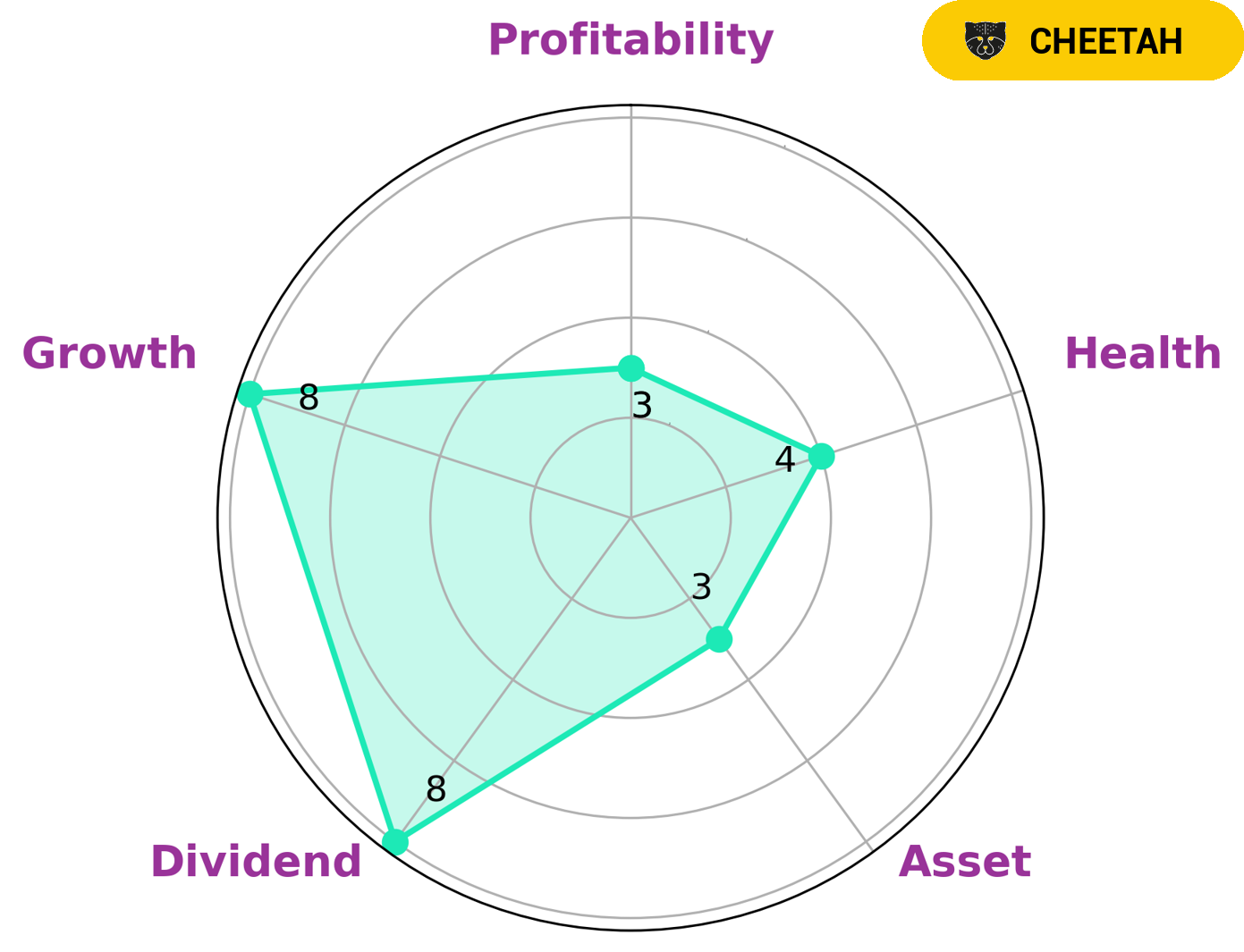

CHINA GALAXY SECURITIES is a company whose fundamentals reflect its long term potential. According to the VI Star Chart, CHINA GALAXY SECURITIES has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. The company is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in such companies may be attracted to its strong performance in the area of dividend and growth, while they may be wary of its weaker performance in the area of asset and profitability. Investors who are looking for a high growth opportunity with a lesser degree of risk may be interested in investing in CHINA GALAXY SECURITIES. On the other hand, investors who prefer stability and reliability may wish to look for a more traditional business with higher levels of profitability and asset protection. In conclusion, CHINA GALAXY SECURITIES is an attractive investment opportunity for those looking for a high growth opportunity with some risk attached, while those seeking more stability and reliability may want to look elsewhere. More…

VI Peers

China Galaxy Securities Co Ltd faces stiff competition from Orient Securities Co Ltd, Ho Chi Minh City Securities Corp, and PetroVietnam Securities Inc. As the Chinese securities market has become increasingly competitive, all four companies are determined to achieve the highest levels of success in their respective areas. In order to do so, each company is leveraging its strengths and competitive advantages in order to gain a competitive edge over its rivals.

– Orient Securities Co Ltd ($SHSE:600958)

Orient Securities Co Ltd is a Chinese investment bank founded in 1991 and based in Shanghai. The company provides securities brokerage, investment banking, futures, asset management and other financial services. As of 2023, the company has a market cap of 80.91B and a return on equity of 2.86%. Orient Securities Co Ltd has an impressive market cap and is doing well in terms of its return on equity. The company is well-positioned to continue to grow and provide exceptional financial services to its customers.

– Ho Chi Minh City Securities Corp ($HOSE:HCM)

Ho Chi Minh City Securities Corp is a Vietnamese financial services firm based in Ho Chi Minh City that provides a range of services including securities brokerage, asset management, corporate finance, and investment banking. With a market cap of 10.45T as of 2023, the company is one of the largest publicly traded companies in Vietnam. Furthermore, its Return on Equity (ROE) is -1.6%, which is below the average for the industry as a whole. This suggests that the company may not be performing as well as its peers, but whether this is due to external factors or internal issues remains to be seen.

Summary

Investors have been closely monitoring the stock performance of CHINA GALAXY SECURITIES CO., LTD. (6881) which has seen a significant surge in its stock price. Analysts are attributing the increase to positive media coverage and increased investor confidence. The company’s financials are strong, with revenues increasing year-over-year and a healthy balance sheet.

Its attractive dividend yield, coupled with the potential for further share price appreciation, has made it an attractive investment option. Analysts believe that the company is well-positioned to capitalize on China’s economic growth and could be a good long-term investment. Investors should monitor the company’s progress and evaluate its fundamentals before making an investment decision.

Recent Posts