JCI Stock Fair Value – B.O.S.S. Retirement Advisors LLC Adds to Uncertainty Around Johnson Controls International with Recent Stake Acquisition

May 7, 2023

Trending News 🌧️

Recent news of B.O.S.S. Retirement Advisors LLC acquiring a stake in Johnson Controls International ($NYSE:JCI) has caused a stir in the market. Johnson Controls International is a global leader in the development of smart, sustainable and connected buildings. The company provides innovative products, services and solutions for buildings, batteries, HVAC equipment and power generation. Johnson Controls’ portfolio ranges from integrated HVAC solutions to fire protection and security solutions, making them the leading provider of total building solutions. B.O.S.S. Retirement Advisors LLC is a private equity firm that specializes in investing in stocks and assets with high potential returns.

This acquisition could potentially lead to changes in Johnson Controls International’s structure, ownership, and operations in the future, further complicating the situation for stockholders and investors. The addition of B.O.S.S. Retirement Advisors LLC to Johnson Controls International causes uncertainty in the market, as investors are left wondering what the implications of this move will be for the future of the company and its stock value. It is still unclear how this acquisition will affect Johnson Controls International and its stock, but it certainly adds a level of complexity for potential investors. In order to make an informed decision on whether or not to invest, investors and stockholders must consider the implications of this move and weigh them against their own goals and risk tolerance.

Market Price

On Monday, shares in Johnson Controls International (JCI) opened at $59.8 and closed at $59.6, down 0.4% from the previous day’s closing price of $59.8. This decline comes after B.O.S.S. Retirement Advisors LLC announced they had acquired a significant stake in JCI. The news has created a certain amount of uncertainty around the company, with investors unsure what the stake acquisition means for JCI’s future prospects. It is yet unclear what kind of impact B.O.S.S. Retirement Advisors LLC’s stake acquisition will have on the company and investors are watching for any new developments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JCI. More…

| Total Revenues | Net Income | Net Margin |

| 25.5k | 1.27k | 7.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JCI. More…

| Operations | Investing | Financing |

| 1.3k | -664 | -150 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JCI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.8k | 25.55k | 23.35 |

Key Ratios Snapshot

Some of the financial key ratios for JCI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.9% | 15.9% | 6.4% |

| FCF Margin | ROE | ROA |

| 2.8% | 6.3% | 2.4% |

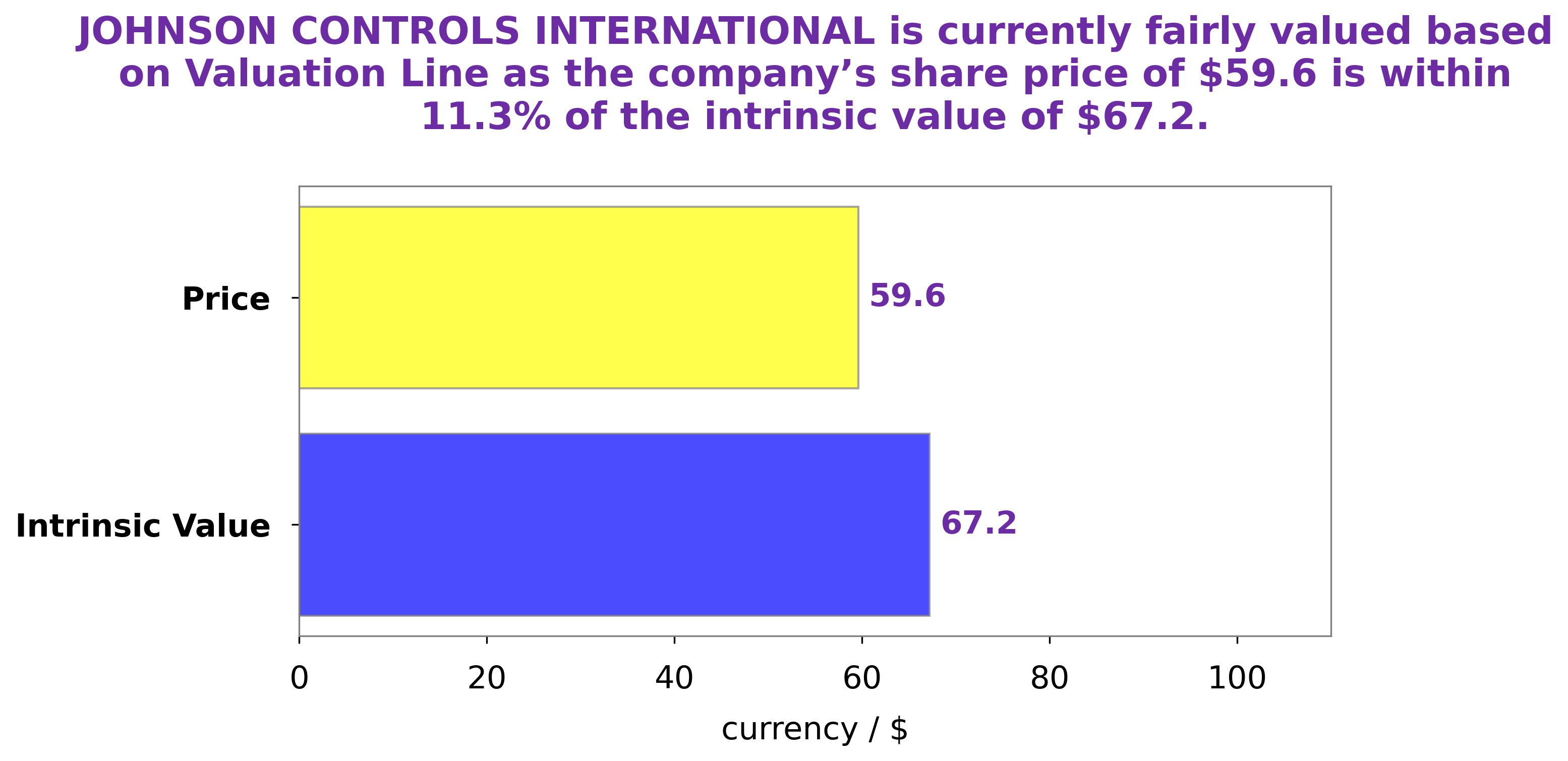

Analysis – JCI Stock Fair Value

At GoodWhale, we have conducted an analysis of JOHNSON CONTROLS INTERNATIONAL’s wellbeing. Our proprietary Valuation Line has determined that the intrinsic value of JOHNSON CONTROLS INTERNATIONAL share is around $67.2. Currently, the company’s stock is being traded at $59.6, a price that represents a fair value but is 11.3% undervalued compared to the intrinsic value of the shares. Therefore, GoodWhale believes that JOHNSON CONTROLS INTERNATIONAL’s stock represents a good opportunity for investors. More…

Peers

Johnson Controls International PLC is a leading provider of controls and technology solutions for a variety of industries. The company’s products and services are used in a wide range of applications, including HVAC, security, fire, and energy management. Johnson Controls International PLC has a strong competitive position in the market and is well-positioned to continue its growth. The company’s competitors include Hochiki Corp, Geberit AG, and Rockwool AS.

– Hochiki Corp ($TSE:6745)

Hochiki Corp is a Japanese company that manufactures and sells fire protection equipment. The company has a market cap of 36.64 billion as of 2022 and a return on equity of 9.08%. Hochiki was founded in 1918 and is headquartered in Tokyo, Japan. The company’s products include fire alarm systems, fire extinguishers, and fire sprinklers. Hochiki also provides services such as fire safety consulting and training.

– Geberit AG ($OTCPK:GBERY)

Geberit AG is a Swiss company that manufactures and sells sanitary products. The company has a market cap of 15.16B as of 2022 and a Return on Equity of 29.76%. Geberit’s products include toilets, sinks, showers, and other plumbing products. The company has a strong presence in Europe and Asia.

– Rockwool AS ($LTS:0M09)

Rockwool International A/S is a Denmark-based company engaged in the manufacture of stone wool. The Company’s products are used for thermal and acoustic insulation, as well as for fire protection and horticultural substrates. It operates through two segments: Insulation and horticulture. The Insulation segment focuses on the manufacture of products for thermal and acoustic insulation in buildings, ships, cars and industrial applications. The Horticulture segment offers substrates for professional horticulture, including growers of fruit, vegetables and flowers. Rockwool International A/S has a market cap of 29.48B as of 2022, a Return on Equity of 10.81%.

Summary

Johnson Controls International has experienced a surge in interest from investors recently, as evidenced by B.O.S.S. Retirement Advisors LLC’s acquisition of a stake in the company. Analysts suggest that the investment may be a sign of increased confidence in Johnson Controls International’s financial prospects.

However, the specifics of the investment remain perplexing, which has in turn left many investors uncertain about the company’s future. Analysts are currently studying the company’s financials to gain better insight into their overall performance before making any predictions. In the meantime, investors should keep an eye on Johnson Controls International to stay up to date on the latest developments.

Recent Posts