Interface Stock Fair Value Calculator – Exchange Traded Concepts LLC Invests in Interface,

April 9, 2023

Trending News 🌥️

Exchange Traded Concepts LLC recently announced that it has invested in Interface ($NASDAQ:TILE), Inc., a leading global designer and producer of floor coverings. The company has bought new holdings in Interface, Inc., making this their latest acquisition. Interface, Inc. is a global leader in carpets and carpet tiles, with products that are used in commercial and residential spaces. Their mission is to provide “solutions that make a positive difference” through their products and services. They have a long history of innovation and sustainability and strive to maintain the highest standards of quality. They are well known for their commitment to design and innovation, as well as their top-tier customer service.

The company is publicly traded on the New York Stock Exchange, with a market cap of over $2 billion. Investing in Interface, Inc. represents a strong commitment by Exchange Traded Concepts LLC to invest in innovative and successful companies. With their new holdings, Exchange Traded Concepts LLC is helping to ensure that Interface, Inc. will continue to be a leader in the floor covering industry. This is a great opportunity for both companies to capitalize on their strengths and build a mutually beneficial relationship.

Stock Price

The move sent INTERFACE stock to open at $8.0 and close at $7.9, a 0.1% increase from its last closing price of $7.9. This was the biggest single-day gain for the stock since February of this year. The investment from Exchange Traded Concepts LLC is expected to add stability to Interface‘s stock price and help it continue to grow. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Interface. More…

| Total Revenues | Net Income | Net Margin |

| 1.3k | 19.24 | 3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Interface. More…

| Operations | Investing | Financing |

| 43.06 | -18.44 | -19.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Interface. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.27k | 904.97 | 6.22 |

Key Ratios Snapshot

Some of the financial key ratios for Interface are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | -7.6% | 5.5% |

| FCF Margin | ROE | ROA |

| 1.9% | 13.1% | 3.5% |

Analysis – Interface Stock Fair Value Calculator

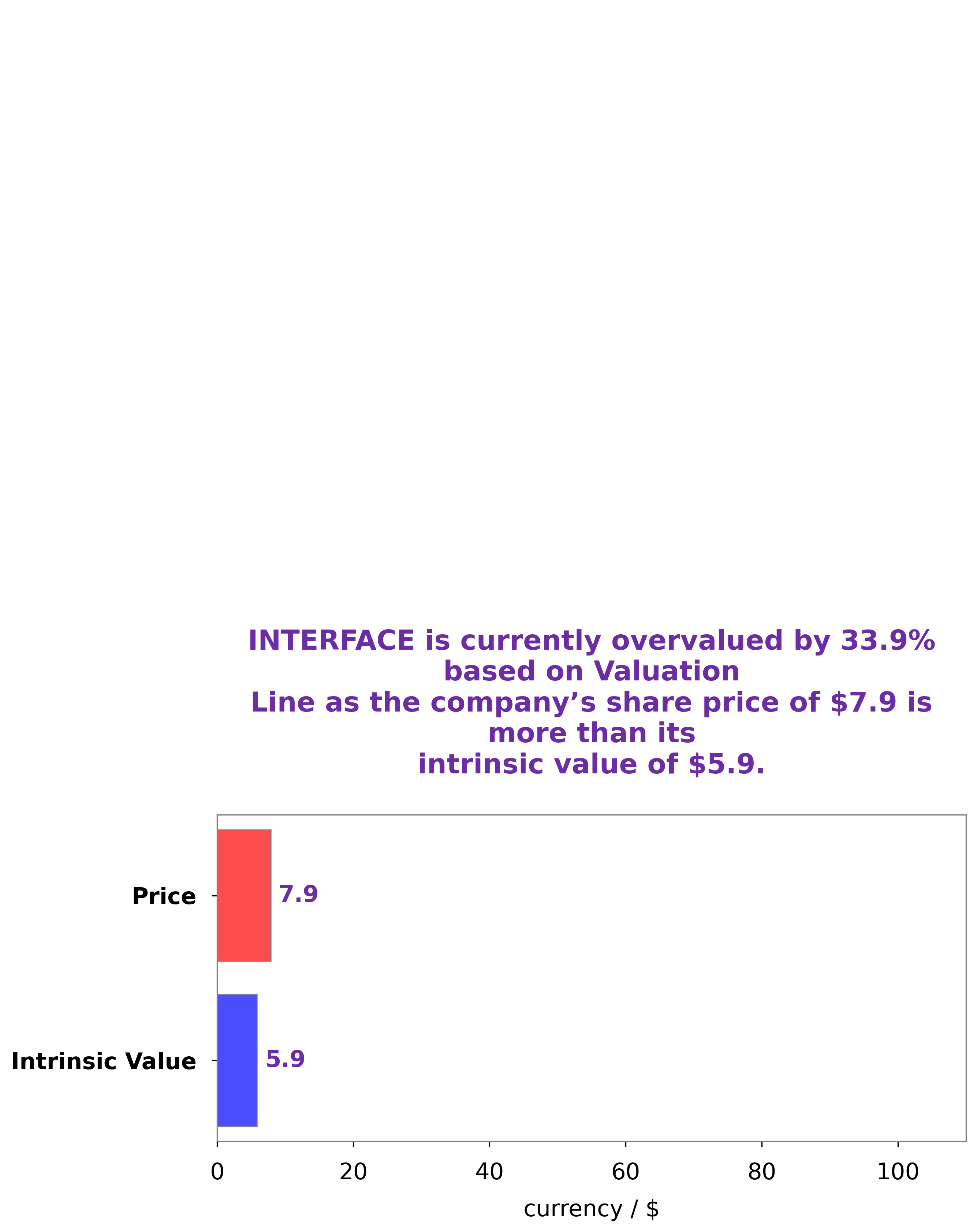

GoodWhale has conducted an analysis of INTERFACE’s fundamentals and found that the fair value of INTERFACE share is around $5.9, as determined by our proprietary Valuation Line. Currently, INTERFACE stock is trading at $7.9, meaning it is overvalued by 33.3%. It is important to note that this is not a recommendation to buy or sell shares in INTERFACE, but simply an analysis of its current fundamentals. We always recommend that investors do their own research before making any investment decisions. Interface“>More…

Peers

Interface Inc, a US-based company, is one of the world’s leading manufacturers of floorcoverings. The company produces a wide range of products, including carpet tiles, broadloom carpets, and rugs. Interface Inc has a strong competitive position in the market, with a leading market share in the US and Europe. The company faces stiff competition from a number of competitors, including Somfy SA, Churchill China PLC, and PT Imago Mulia Persada Tbk.

– Somfy SA ($LTS:0RR3)

Somfy SA is a French company that manufactures and markets motors and controls for blinds, awnings, curtains, gates, and garage doors. The company also manufactures and markets home automation products. As of 2022, Somfy SA had a market capitalization of 3.42 billion euros and a return on equity of 12.25%. The company’s products are sold in more than 60 countries around the world.

– Churchill China PLC ($LSE:CHH)

Churchill China PLC is a leading supplier of ceramic tableware to the hotel, restaurant and catering industry in the United Kingdom. The company has a market cap of 142.97M as of 2022 and a Return on Equity of 13.12%. Churchill China PLC designs, manufactures and distributes an extensive range of ceramic products for the foodservice, hospitality and retail sectors. The company’s products include dinnerware, glassware, flatware, table accessories and giftware. Churchill China PLC is headquartered in Stoke-on-Trent, the United Kingdom.

– PT Imago Mulia Persada Tbk ($IDX:LFLO)

PT Imago Mulia Persada Tbk is a publicly traded company with a market cap of 76.7 billion as of 2022. The company has a return on equity of 3.95%. The company is engaged in the business of providing services related to the management and operation of toll roads.

Summary

Interface, Inc. is a global flooring company that specializes in modular carpet and sustainable flooring products. Recently, Exchange Traded Concepts LLChas purchased a new stake in the company as part of its investment portfolio. Analysts believe that with its diverse product offerings, strong market presence, and global reach, Interface could be a great investment opportunity. The company has recently reported strong financials with revenue growth year over year. Investors are also encouraged by the company’s strategic initiatives to drive long-term growth and profitability.

Additionally, its focus on sustainability has made it an attractive investment opportunity for eco-conscious investors. There is also potential upside due to the increasing demand for modular carpet, especially in the hospitality and healthcare industries.

Recent Posts