Nichireki Stock Fair Value – NICHIREKI Reports Record-Breaking Earnings for Q3 of 2023 Fiscal Year

April 2, 2023

Earnings Overview

NICHIREKI ($TSE:5011) announced their earnings for Q3 of the fiscal year 2023, which concluded on December 31, 2022. Revenues amounted to JPY 2.4 billion, a 21.6% decrease compared to the same period in the prior year. Net income was JPY 23.6 billion, a 1.3% reduction from the same period in the prior year.

Market Price

On Monday, NICHIREKI announced record-breaking earnings for their third fiscal quarter of 2023. NICHIREKI stock opened at JP¥1384.0 and closed at JP¥1367.0, down by 1.3% from the prior closing price of 1385.0. This was the highest quarterly net income in the company’s history since it went public in 2022. The increase in revenue was largely driven by increased demand for NICHIREKI’s retail products and services.

Expenses also increased slightly due to higher marketing and research and development costs associated with new product launches. This allows the company to further invest in new products and services and to continue to improve profitability. Overall, the quarter’s performance was a strong indication of NICHIREKI’s ability to deliver consistent and reliable returns for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nichireki. More…

| Total Revenues | Net Income | Net Margin |

| 78.96k | 6.8k | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nichireki. More…

| Operations | Investing | Financing |

| 6.03k | -2.36k | -1.43k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nichireki. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 90.91k | 19.28k | 2.26k |

Key Ratios Snapshot

Some of the financial key ratios for Nichireki are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | 5.3% | 12.2% |

| FCF Margin | ROE | ROA |

| 3.5% | 8.5% | 6.6% |

Analysis – Nichireki Stock Fair Value

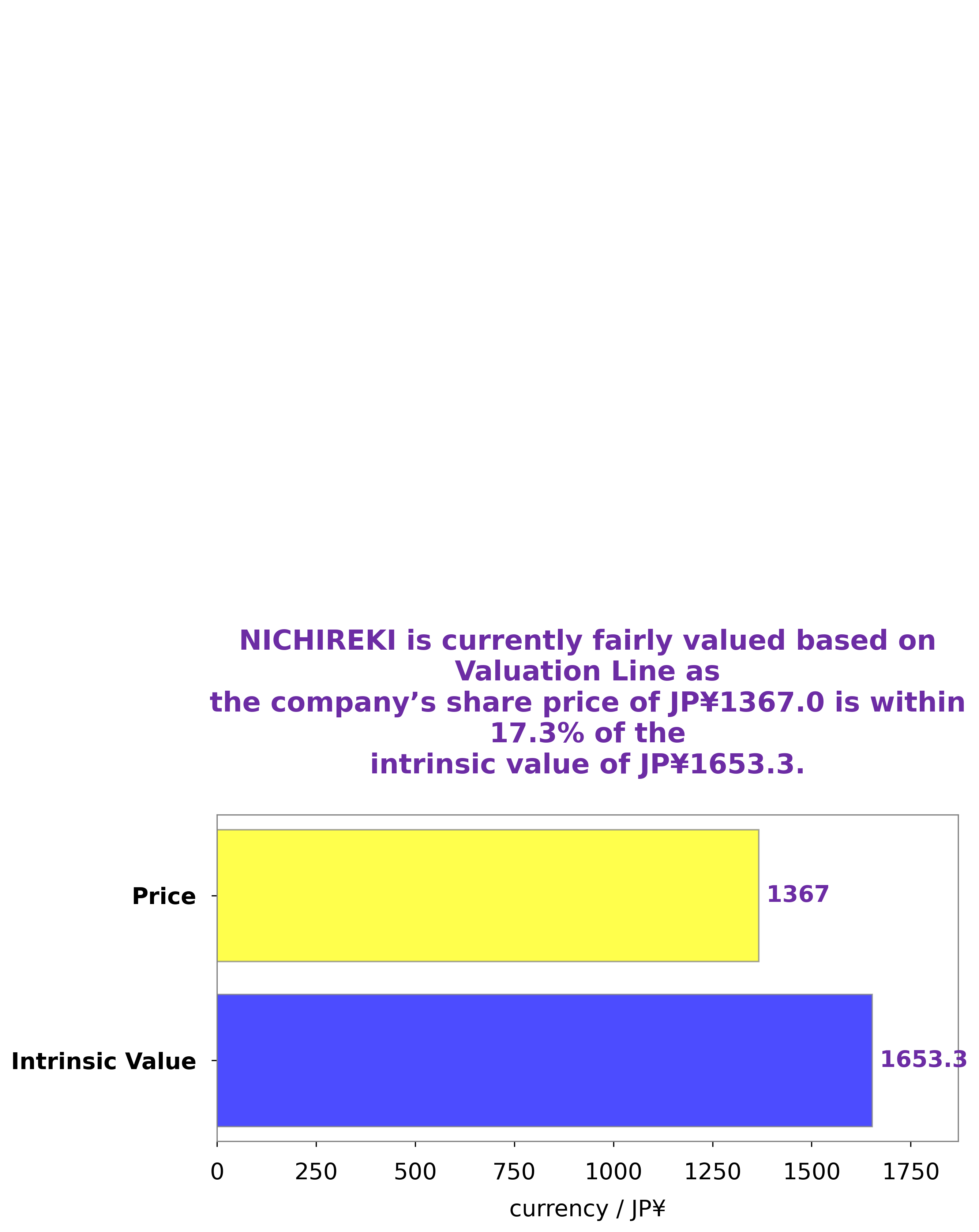

At GoodWhale, we have done an analysis of NICHIREKI‘s wellbeing. Our proprietary Valuation Line has calculated the fair value of NICHIREKI share to be around JP¥1653.3. Therefore, we believe that NICHIREKI is a good investment opportunity for investors at the current market price. More…

Summary

NICHIREKI reported its earnings results for the third quarter of the fiscal year 2023, showing a total revenue of JPY 2.4 billion and a 1.3% decrease in net income from the same period of the previous year. This decrease may indicate a downturn in the company’s performance, however, investors may be encouraged by the 21.6% drop in total revenue from last year, as it suggests that the company is trying to reduce its costs. Furthermore, the company’s net income is still relatively healthy, which could be seen as a positive sign for potential investors. Ultimately, investors will need to do their own research and analysis before making any decisions about investing in NICHIREKI.

Recent Posts