0NLZ dividend – Vassilico Cement Works PCL Announces 0.13 Cash Dividend

June 2, 2023

🌥️Dividends Yield

On June 1 2023, Vassilico Cement Works ($LTS:0NLZ) PCL announced a 0.13 EUR cash dividend for its shareholders. For the years 2020 to 2022, the company has consistently paid an annual dividend per share of 0.19 EUR – making this a slight reduction in returns.

However, with a dividend yield of 8.65%, it may still be worth considering for those looking for high-yield dividend stocks. The ex-dividend date is June 7 2023, and all shareholders must hold their positions prior to that date in order to receive the dividend. Vassilico Cement Works PCL is a cement manufacturing company based in Cyprus, and their business model is focused on providing durable and affordable cement products.

Market Price

The announcement sent their stock price soaring, with the stock opening at €2.1 and closing at the same price. This news was welcomed by investors and analysts alike, as it shows that the company is well-positioned to weather any economic downturn. It also reaffirms the company’s commitment to delivering long-term value to shareholders. The company is well-positioned for continued growth and is expected to keep exceeding expectations in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 0NLZ. More…

| Total Revenues | Net Income | Net Margin |

| 142.66 | 12.9 | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 0NLZ. More…

| Operations | Investing | Financing |

| 20.99 | -10.06 | -2.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 0NLZ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 301.5 | 52.96 | 3.45 |

Key Ratios Snapshot

Some of the financial key ratios for 0NLZ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.2% | -12.9% | 10.9% |

| FCF Margin | ROE | ROA |

| 7.4% | 4.0% | 3.2% |

Analysis

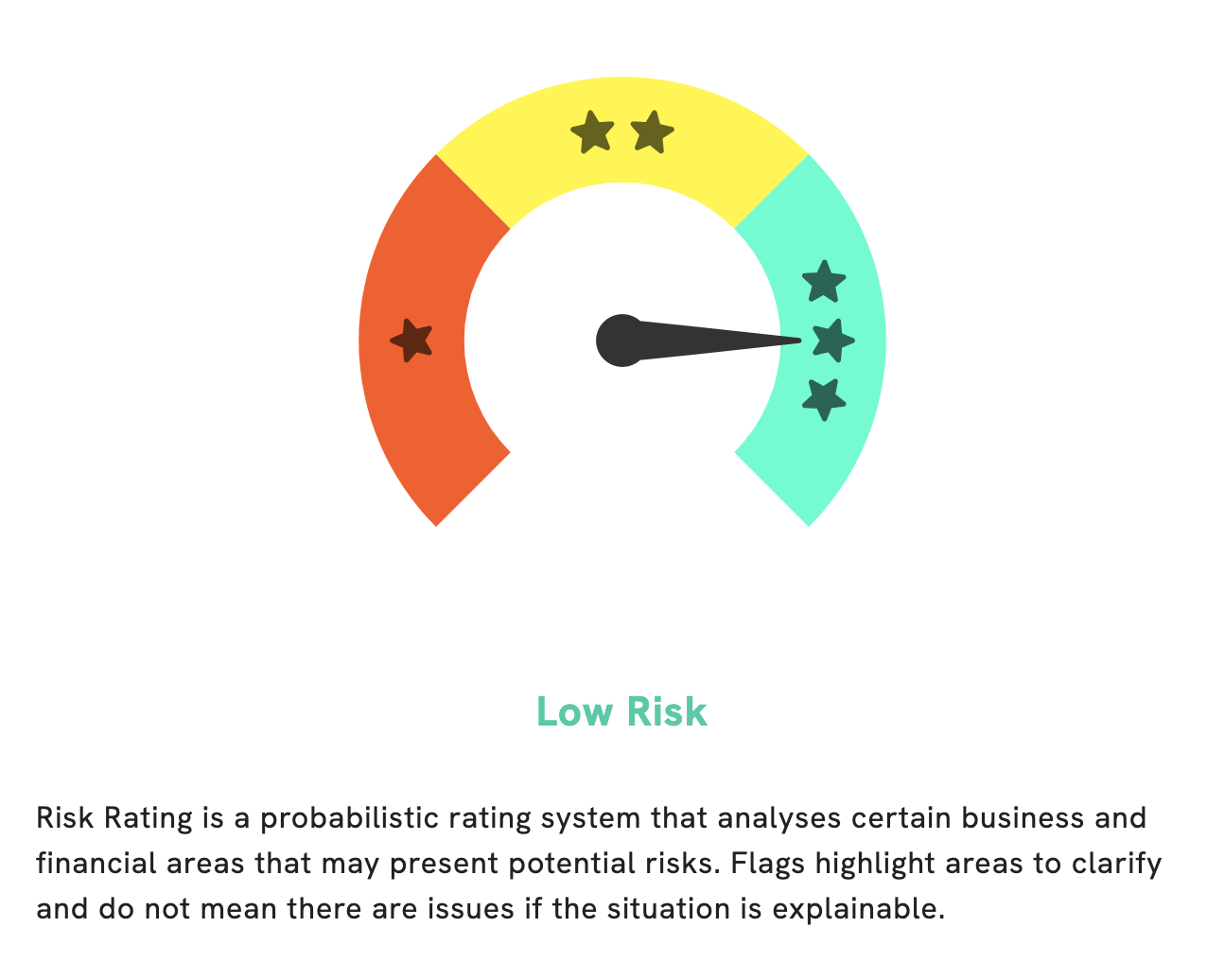

At GoodWhale, we take the analysis of the fundamentals of VASSILICO CEMENT WORKS PCL very seriously. After a thorough investigation, we have come to the conclusion that this is a low risk investment in terms of financial and business aspects. However, there are 2 risk warnings in the income sheet and balance sheet that we have detected. To gain access to this information, you need to become a registered user of GoodWhale. We hope that this information helps you make an informed decision about investing in VASSILICO CEMENT WORKS PCL. More…

Peers

All four companies are engaged in producing cement and related materials for the construction industry, and have established themselves as some of the largest and most successful cement producers in the world.

– Dongwu Cement International Ltd ($SEHK:00695)

Dongwu Cement International Ltd is a Chinese cement production and distribution company, specializing in the production and sale of cement, clinker, and cement related products. The company has a market cap of 2.13 billion dollars as of 2023, indicating the company’s market value and its potential to generate profits for shareholders. In addition, Dongwu Cement International Ltd has a Return on Equity (ROE) of -4.61%, which suggests that the company is not utilizing its assets efficiently, and is not generating returns for its shareholders.

– Lionhead Technology Development Co Ltd ($SHSE:600539)

Lionhead Technology Development Co Ltd is a leading provider of cutting-edge technology solutions. The company has a market capitalization of 1.49 billion as of 2023, making it one of the larger players in the technology sector. Its Return on Equity (ROE) of 6.47% is indicative of the company’s strong financial performance and financial stability. Furthermore, Lionhead Technology Development Co Ltd has a strong focus on innovation and customer service, which has enabled them to become one of the most successful technology companies in the industry. The company provides a wide range of products and services, ranging from software and hardware to bespoke solutions for businesses.

– Cementos Pacasmayo SAA ($NYSE:CPAC)

Cementos Pacasmayo SAA is a public company that produces and sells cement, concrete, and other construction materials in Peru. As of 2023, the company has a market capitalization of 462.36M and a Return on Equity (ROE) of 18.42%. This suggests that Cementos Pacasmayo SAA is capable of generating a relatively high profit on the equity invested in its business. The company’s strong ROE reflects its ability to efficiently generate profits for its investors.

Summary

VASSILICO CEMENT WORKS PCL is an attractive option for those looking for dividend stocks. The company has consistently paid out an annual dividend per share of 0.19 EUR for the years 2020 to 2022, giving it a dividend yield of 8.65%. This makes it one of the highest yielding dividend stocks in the market, and investors can look forward to not only regular income but also the potential of long-term capital gains on the stock, as long as market conditions remain favourable. As such, investors should do thorough research before investing in this company.

Recent Posts