Y-mAbs Therapeutics Reports Impressive Financial Results, Beats Expectations

March 31, 2023

Trending News ☀️

Y-MABS ($NASDAQ:YMAB): Y-mAbs Therapeutics reported a major financial success this quarter, with GAAP earnings per share of -$2.19, surpassing estimates of -$2.65 by $0.46, and revenue of $65.27M, which exceeded expectations of $53.39M by $11.88M. This impressive performance is a testament to the success of the company and its leadership. Y-mAbs Therapeutics is a biopharmaceutical company focused on the development, manufacture and commercialization of innovative antibody-based therapeutics for the treatment of cancer. Y-mAbs’s proprietary technology platform allows for the development of high-affinity, full-length monoclonal antibodies to specifically target tumor cells and deliver effective treatments to cancer patients.

The company currently has two lead product candidates in its pipeline, both of which have been granted orphan drug status by the US Food and Drug Administration. The impressive financial results reported by Y-mAbs Therapeutics demonstrate the strength of its business model and its ability to capitalize on new opportunities in the healthcare sector. This strong performance bodes well for the future prospects of the company, and investors can be confident that its leadership will continue to foster a culture of innovation and excellence to ensure future success.

Market Price

On Thursday, Y-MABS THERAPEUTICS reported impressive financial results, beating expectations. Their stock opened at $3.2 and closed at $3.3, up 1.5% from prior closing price of $3.2. The results are indicative of the success of the company’s efforts in developing innovative treatments for cancer and autoimmune diseases. The impressive financial performance of Y-MABS THERAPEUTICS is likely to encourage further research and development into these treatments, which could potentially benefit those suffering from these conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Y-mabs Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 43.42 | -133.62 | -307.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Y-mabs Therapeutics. More…

| Operations | Investing | Financing |

| -101.12 | -0.46 | 0.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Y-mabs Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 143.91 | 36.02 | 2.47 |

Key Ratios Snapshot

Some of the financial key ratios for Y-mabs Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | -298.1% |

| FCF Margin | ROE | ROA |

| -234.0% | -67.6% | -56.2% |

Analysis

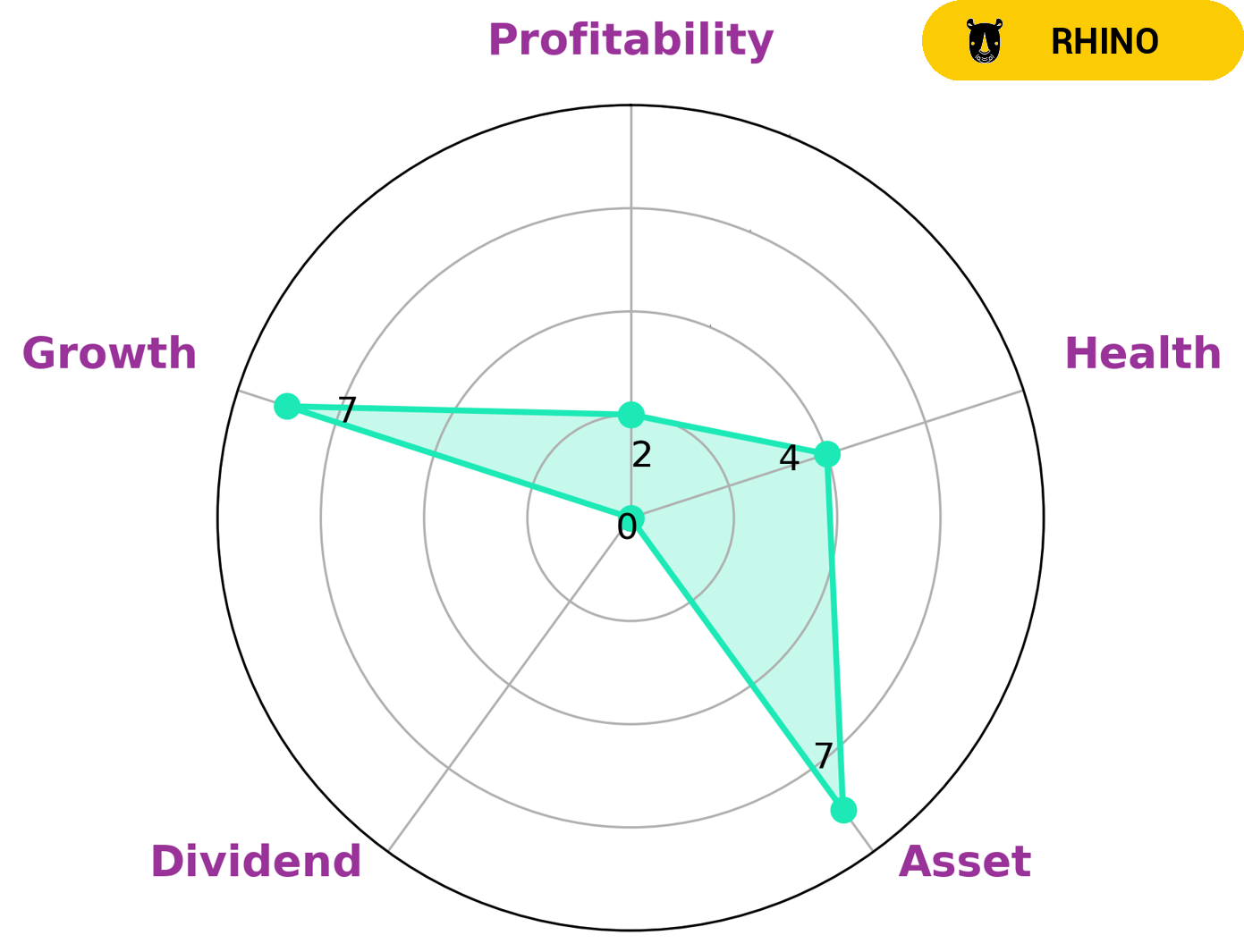

GoodWhale conducted an analysis of Y-MABS THERAPEUTICS, a company classified as ‘rhino’ by our Star Chart system. This indicates that the company has achieved moderate revenue and earnings growth. Our analysis of Y-MABS THERAPEUTICS reveals that it is strong in assets, growth and weak in dividend and profitability. The company’s intermediate health score of 4/10 with regards to its cashflows and debt suggests that it is likely to pay off debts and fund future operations. Given this assessment of Y-MABS THERAPEUTICS, we believe that investors who are looking for a company with moderate revenue and earnings growth, as well as a good balance sheet to support future operations, may be interested in this company. More…

Peers

The company’s lead product candidate, naxitamab, is in clinical development for the treatment of neuroblastoma, a rare and aggressive pediatric cancer. Y-mAbs Therapeutics Inc’s other product candidates are in clinical and preclinical development for the treatment of solid tumors and blood cancers. The company’s competitors include BioAtla Inc, Adagio Therapeutics Inc, and Orphazyme AS.

– BioAtla Inc ($NASDAQ:BCAB)

BioAtla Inc is a clinical-stage biopharmaceutical company that focuses on the discovery, development, and commercialization of immuno-oncology agents. The company’s market cap as of 2022 is 357.65M and its ROE is -41.59%. BioAtla’s main competitors are Bluebird bio, Inc. (NASDAQ: BLUE) and Celgene Corporation (NASDAQ: CELG).

– Adagio Therapeutics Inc ($NASDAQ:ADGI)

Orphazyme AS is a biotech company that focuses on developing treatments for rare diseases. The company has a market cap of 5.88M as of 2022 and a Return on Equity of -845.21%. Despite its negative ROE, Orphazyme AS’s market cap indicates that investors are confident in the company’s future prospects. This is likely due to the fact that Orphazyme AS is working on developing treatments for rare diseases, which is a highly lucrative market.

Summary

Y-mAbs Therapeutics has seen a positive quarter with their earnings coming out ahead of analysts’ expectations. While GAAP EPS was reported at -$2.19, it still beat estimates by $0.46. This is an encouraging sign for investors, as it suggests that the company is continuing to drive growth and remain competitive in the biotech arena. Going forward, investors should monitor the company’s progress and continue to look for profitable opportunities in the sector.

Recent Posts