United Therapeutics Intrinsic Value – Wedbush Raises United Therapeutics Price Objective to $307.00

August 10, 2023

☀️Trending News

Wedbush analysts recently raised United Therapeutics ($NASDAQ:UTHR)’ price target from $305.00 to $307.00 in a research report. United Therapeutics is a biotechnology company focused on discovering, developing, manufacturing, and commercializing innovative products to address unmet medical needs. The company develops products for pulmonary hypertension and other chronic and life-threatening conditions. Wedbush’s new price objective reflects their expectations of the company’s future growth and its potential to deliver strong returns for investors.

Price History

This news caused United Therapeutics stocks to open at $236.4 and close at $237.8, resulting in a 0.6% increase from the previous closing price of $236.4. The new price target reflects Wedbush’s confidence in the company’s growth potential and ability to deliver long-term value to its shareholders. With this new price objective, analysts expect United Therapeutics to continue to be an attractive investment, despite the current economic climate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for United Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 2.11k | 871.5 | 41.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for United Therapeutics. More…

| Operations | Investing | Financing |

| 867.9 | -731.6 | 135.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for United Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.68k | 1.27k | 115.34 |

Key Ratios Snapshot

Some of the financial key ratios for United Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.8% | 25.2% | 55.4% |

| FCF Margin | ROE | ROA |

| 31.9% | 13.9% | 10.9% |

Analysis – United Therapeutics Intrinsic Value

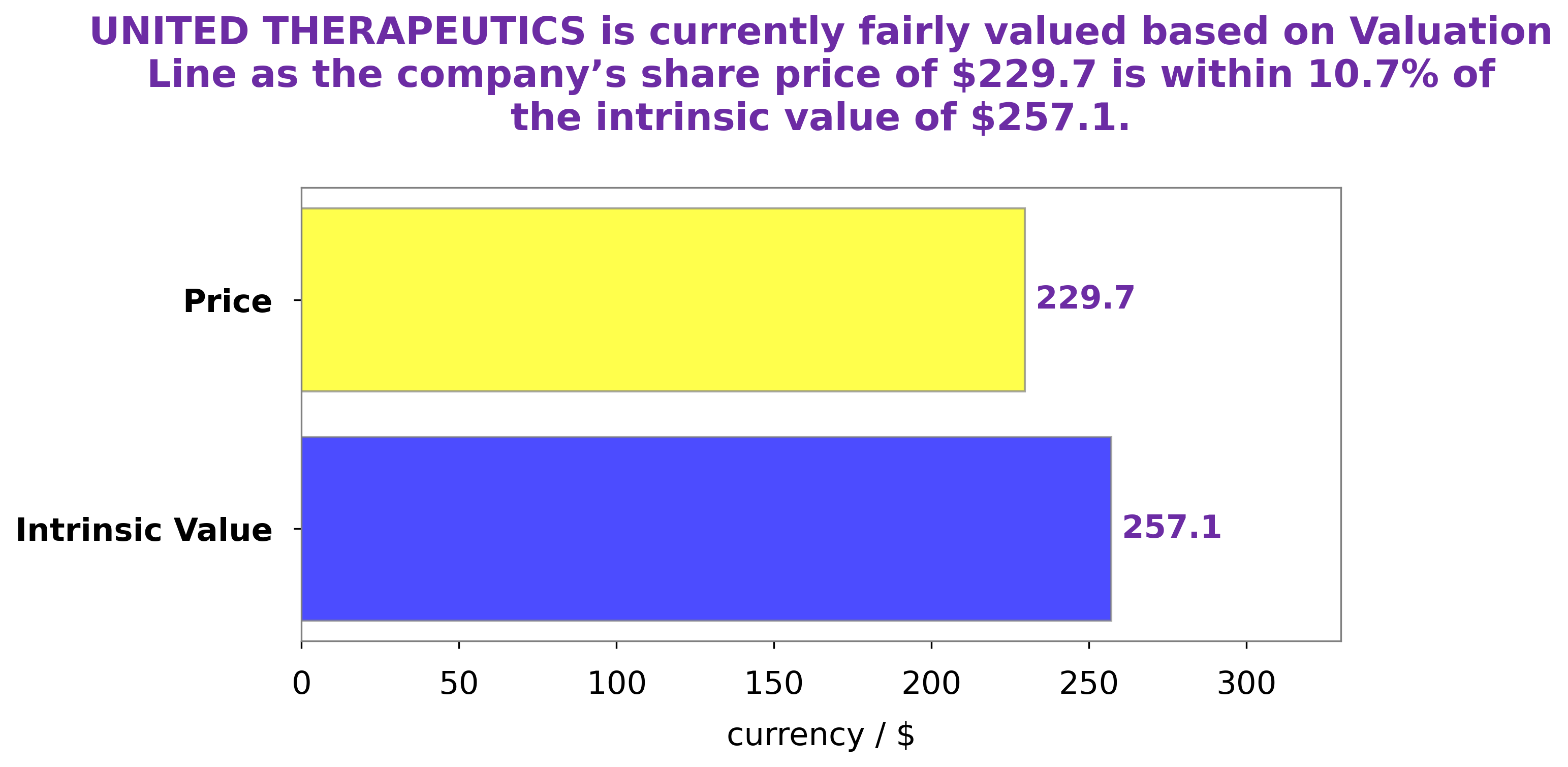

GoodWhale’s analysis of UNITED THERAPEUTICS‘s wellbeing has revealed that the intrinsic value of UNITED THERAPEUTICS share is around $229.9, calculated using our proprietary Valuation Line. This figure suggests that UNITED THERAPEUTICS stock is currently overvalued by 3.4%, as it is currently being traded at $237.8. We believe that this puts UNITED THERAPEUTICS stock at a fair but slightly overvalued price. More…

Peers

The company’s main competitors are MannKind Corp, Sanofi SA, Eli Lilly and Co.

– MannKind Corp ($NASDAQ:MNKD)

MannKind Corp. is a biopharmaceutical company, which engages in the discovery, development, and commercialization of therapeutics for diabetes and cancer. Its product pipeline includes Afrezza, MK-1293, and MK-3655. The company was founded by Alfred E. Mann on February 3, 1991 and is headquartered in Valencia, CA.

– Sanofi SA ($OTCPK:SNYNF)

Sanofi has a market cap of 98.97B as of 2022 and a Return on Equity of 7.56%. The company is a French multinational pharmaceutical company headquartered in Paris, France, and was founded in 1904. Sanofi is engaged in the research, development, manufacturing, and marketing of pharmaceutical products for the treatment of patients in the areas of cardiovascular, central nervous system, diabetes, internal medicine, oncology, and thrombosis.

– Eli Lilly and Co ($NYSE:LLY)

Lilly is a global healthcare leader that unites caring with discovery to make life better for people around the world. We were founded more than a century ago by a man committed to creating high-quality medicines that meet real needs, and today we remain true to that mission in all our work. Across the globe, Lilly employees work to discover and bring life-changing medicines to those who need them, improve the understanding and management of disease, and give back to communities through philanthropy and volunteerism.

The company’s market cap is $312.67 billion as of 2022 and its return on equity is 45.88%.

Summary

United Therapeutics has recently received an investment analysis upgrade from Wedbush, a leading stock analyst. Wedbush raised the company’s price target from $305 to $307, signifying a positive outlook for the stock. Investors should be pleased with the investment analysis upgrade, as it indicates a potential for stock appreciation in the future. With its strong fundamentals and attractive growth rates, United Therapeutics looks set to continue its success in the long-term.

Recent Posts