TSCAN THERAPEUTICS Reports Revenues Beating Expectations Despite Missed Earnings Forecast

May 11, 2023

Trending News 🌧️

TSCAN THERAPEUTICS ($NASDAQ:TCRX) is a biopharmaceutical company focused on developing innovative immunotherapeutic solutions for cancer and other life-threatening diseases. Despite this, the company reported a total revenue of $6.81M, which was $2.51M higher than the forecasted figure. He also stated that they remain committed to achieving their goals and are confident in their strategies to drive long-term growth.

Overall, while its earnings may have missed expectations, TSCAN THERAPEUTICS still managed to beat revenue forecasts. This is an encouraging sign that the company is on the right track and is well-positioned to achieve its goals in the near future.

Earnings

In their latest earnings report of FY2022 Q4 as of December 31 2022, TSCAN THERAPEUTICS reported total revenues of 3.1M USD, beating expectations in spite of a net income loss of 18.72M USD. This marks an 8.8% increase in total revenue relative to the previous year, and a remarkable achievement, considering the total revenue of TSCAN THERAPEUTICS has grown from a mere 0.8M USD to 3.1M USD within the last three years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tscan Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 13.54 | -66.22 | -489.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tscan Therapeutics. More…

| Operations | Investing | Financing |

| -66.5 | -4.22 | 29.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tscan Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 199.09 | 99.66 | 4.1 |

Key Ratios Snapshot

Some of the financial key ratios for Tscan Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -480.6% |

| FCF Margin | ROE | ROA |

| -522.6% | -37.6% | -20.4% |

Market Price

On Wednesday, TSCAN THERAPEUTICS reported financial results that exceeded revenue expectations, despite missing the earnings forecast. The stock opened at $4.3 and closed at $4.8, representing a rise of 42.6% from the previous closing price of $3.4. Despite the miss on the earnings forecast, the news of better-than-expected revenues sent the stock soaring to its highest in over two months. The revenue result was driven by a strong performance in the company’s clinical trials and partnerships with drug developers.

This positive news came in spite of the ongoing challenges brought on by the COVID-19 pandemic, which continues to limit the amount of in-person interactions that have traditionally helped the company’s business. Moving forward, investors are optimistic that TSCAN THERAPEUTICS will be able to continue its success and capitalize on its strong performance. Live Quote…

Analysis

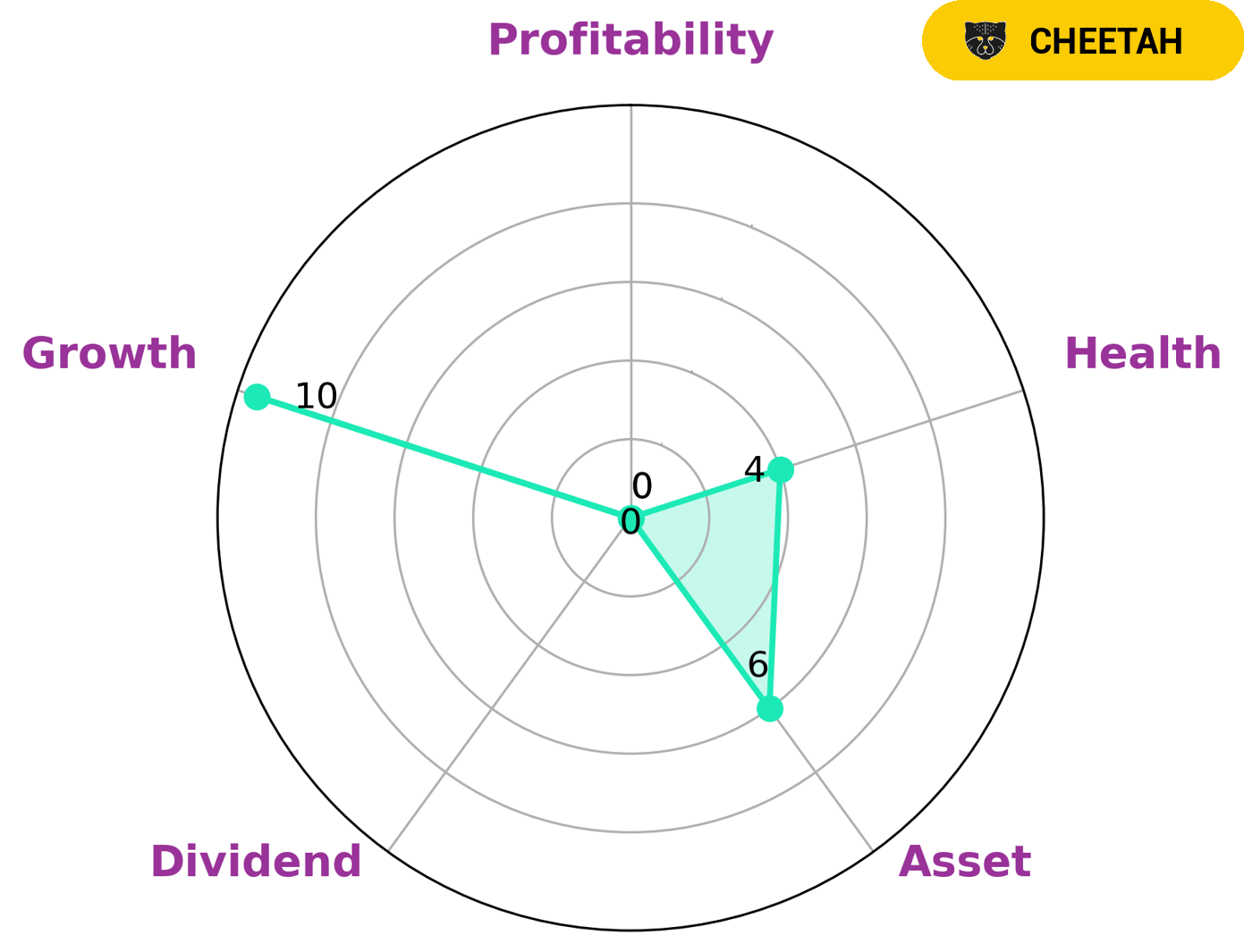

GoodWhale is here to analyze the financials of TSCAN THERAPEUTICS, and our Star Chart reveals that the company has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it may be able to safely ride out any crisis without the risk of bankruptcy. Based on our classification, TSCAN THERAPEUTICS is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. For TSCAN THERAPEUTICS, this means that it is strong in growth, medium in asset and weak in dividend, profitability. For investors looking for high growth potential, TSCAN THERAPEUTICS may be an interesting option. However, they should be aware of the potential risks of investing in a company that is not as stable and profitable as competitors. More…

Peers

TScan Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the development and commercialization of its proprietary T cell receptor scanning technology for the treatment of cancer and autoimmune diseases. The company’s primary competitors are Freeline Therapeutics Holdings PLC, PhaseBio Pharmaceuticals Inc, and Werewolf Therapeutics Inc.

– Freeline Therapeutics Holdings PLC ($NASDAQ:FRLN)

Freeline Therapeutics Holdings PLC is a biopharmaceutical company that focuses on the development and commercialization of gene therapies for chronic liver diseases. The company has a market cap of $42.89 million and a return on equity of -1.18%. Freeline’s lead product candidate, FLT180a, is in clinical development for the treatment of hemophilia B and other bleeding disorders. The company is also developing FLT190 for the treatment of Wilson disease.

– PhaseBio Pharmaceuticals Inc ($NASDAQ:PHAS)

Bio Pharmaceuticals is a clinical-stage biopharmaceutical company focused on the development of therapeutics for the treatment of cancer. The company’s lead product candidate is BIO-1402, a small molecule inhibitor of the PI3K/mTOR pathway. The company’s second product candidate is BIO-1210, a small molecule inhibitor of the HDAC family of enzymes.

– Werewolf Therapeutics Inc ($NASDAQ:HOWL)

Werewolf Therapeutics Inc is a clinical-stage biopharmaceutical company focused on developing novel cancer immunotherapies. The company’s lead product candidate, WTX-124, is a monoclonal antibody that targets the protein CD47, which is overexpressed on the surface of cancer cells and inhibits the body’s natural immune response to cancer. Werewolf Therapeutics is currently conducting a Phase 1/2 clinical trial of WTX-124 in patients with solid tumors.

The company’s market cap as of 2022 is 112.8M. The company has a Return on Equity of -28.8%.

Summary

Despite a GAAP EPS of -$0.93, the company reported revenue of $6.81M which beat expectations by $2.51M. The news sent the stock soaring as investors were encouraged by the strong revenue numbers. When analyzing TScan Therapeutics as an investment, some key points to consider include the company’s long-term prospects and overall market position.

Additionally, it is important to examine the financial health of TScan Therapeutics in order to determine whether the current stock price is a good value or not. Other pertinent aspects to consider include the management team and the competitive landscape. With these factors in mind, investors must then make a decision whether to invest in TScan Therapeutics or not.

Recent Posts