Kinnate Biopharma Secures Financial Stability Through Early 2025

April 18, 2023

Trending News ☀️

Kinnate Biopharma ($NASDAQ:KNTE) is a biotechnology company focused on developing treatments for cancer and rare diseases. They have recently announced that their cash reserves will remain sufficient to fund their activities until the beginning of 2025. This financial stability will enable Kinnate to continue to pursue the development of new treatments and explore potential opportunities in the biotechnology industry. Kinnate Biopharma has made a commitment to delivering innovative therapies to patients in need of effective treatments. This commitment is mirrored in their financial strategy, which emphasizes long-term sustainability. This strategy has proven successful, as Kinnate’s cash reserves will be sufficient to fund their activities for the next four years.

This will give Kinnate the necessary financial security to continue their research and development efforts and explore potential opportunities. The financial stability secured by Kinnate Biopharma through the beginning of 2025 will provide the company with much-needed assurance as they continue to pursue innovative treatments for cancer and rare diseases. This will enable them to move forward confidently and make important investments that can help benefit future generations of patients in need of effective treatments. With their sound financial strategy, Kinnate Biopharma is well-positioned to make a lasting impact on the biotechnology industry.

Stock Price

On Monday, Kinnate Biopharma reported that they had secured their financial stability through early 2025. This news was met with a 3.3% decline in their stock price, as the stock opened at $5.5 and closed at $5.3, down from its prior closing price of $5.5. Kinnate Biopharma’s financial stability was ensured through a combination of strategic investments, debt restructuring, and expansion of existing corporate partnerships. With this new stability, Kinnate Biopharma is now capable of pursuing further growth opportunities and executing their long-term roadmap.

This news reflects a significant milestone for Kinnate Biopharma and will be the foundation for their mission to develop innovative medicines and treatments for serious conditions. With strong financial stability in place through early 2025, Kinnate Biopharma can now focus on creating solutions that can improve patient outcomes and quality of life. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kinnate Biopharma. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -116.27 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kinnate Biopharma. More…

| Operations | Investing | Financing |

| -89.03 | -6.83 | 1.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kinnate Biopharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 278.83 | 20.36 | 5.04 |

Key Ratios Snapshot

Some of the financial key ratios for Kinnate Biopharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -31.4% | -26.6% |

Analysis

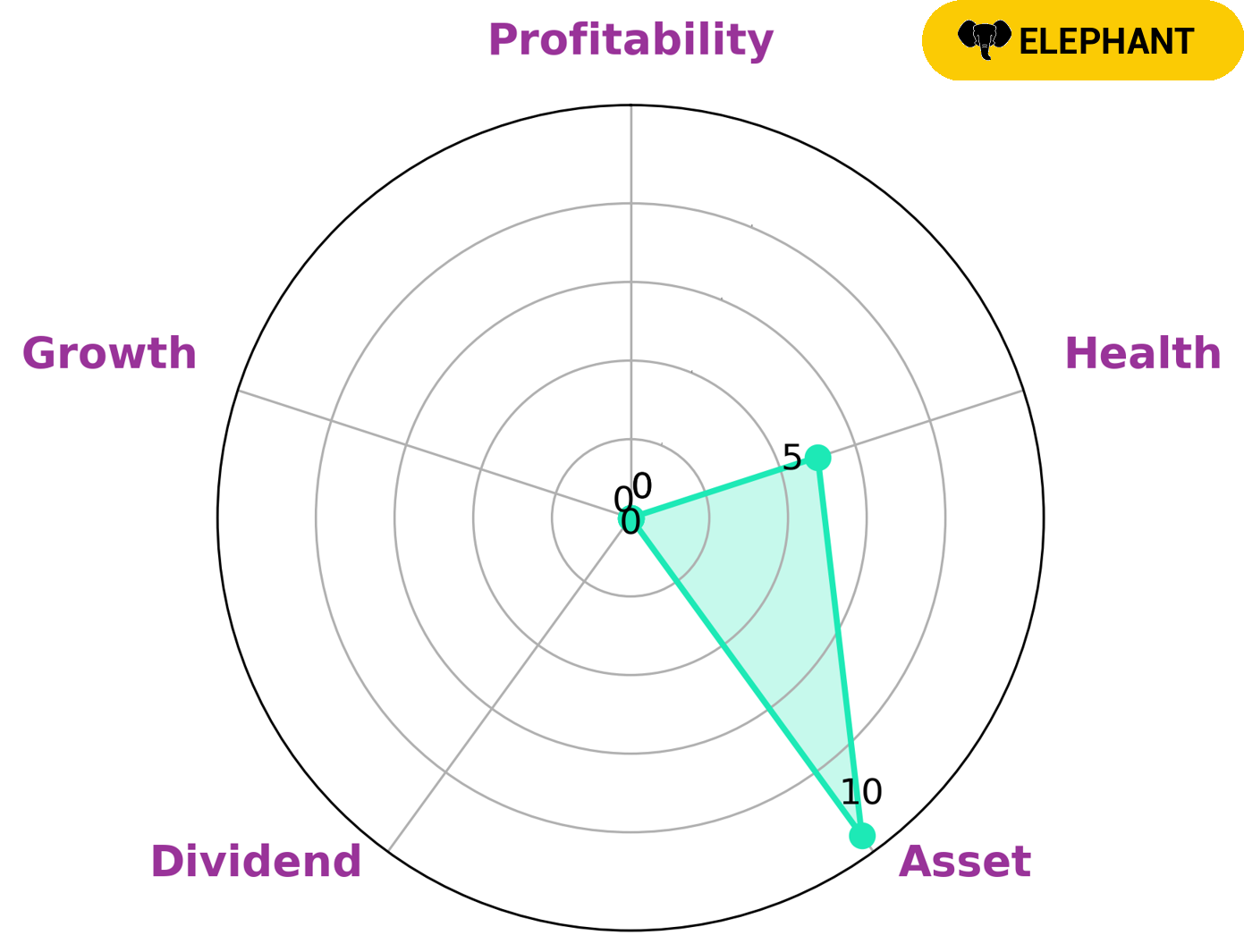

GoodWhale has taken a deep dive into the financials of KINNATE BIOPHARMA and done a detailed analysis. Our Star Chart shows that KINNATE BIOPHARMA has an intermediate health score of 5/10 with regard to its cashflows and debt, and may potentially be able to pay off its debt and fund future operations. Our analysis classifies KINNATE BIOPHARMA as an ‘elephant’, a type of company which is rich in assets after deducting off liabilities. Given these insights, we believe that KINNATE BIOPHARMA would be an attractive proposition for investors who are looking for strong assets, but who may not necessarily be seeking dividend, growth or profitability. As such, we recommend that potential investors take a closer look at KINNATE BIOPHARMA. More…

Peers

The company’s lead product candidate, IPI-549, is an orally-available, small molecule inhibitor of PI3Kγ. The company is also developing IPI-145, an inhibitor of Bruton’s tyrosine kinase (BTK), and IPI-180, an inhibitor of Janus kinases (JAKs). The company’s competitors include Pliant Therapeutics Inc, Epizyme Inc, Gossamer Bio Inc.

– Pliant Therapeutics Inc ($NASDAQ:PLRX)

Pliant Therapeutics, Inc. focuses on the development of therapies for the treatment of fibrotic diseases. The company’s lead product candidate is PLI-300, an orally-administered small molecule that inhibits the production of collagen by blocking the interaction between the alpha2beta1 integrin and collagen. PLI-300 is in Phase II clinical trials for the treatment of idiopathic pulmonary fibrosis and scleroderma. The company was founded in 2015 and is headquartered in San Francisco, California.

– Epizyme Inc ($NASDAQ:GOSS)

Gossamer Bio Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing therapeutics in the disease areas of immunology, inflammation and oncology. The company’s market cap is $990.28 million and its ROE is -1952.91%. Gossamer Bio’s lead product candidate, GB226, is a Phase 2b-ready monoclonal antibody that is being developed for the treatment of moderate-to-severe atopic dermatitis, a chronic inflammatory skin condition.

Summary

Investors have recently been reacting to the news that Kinnate Biopharma has stated their cash runway will last through early 2025. This is encouraging for investors, as it shows the company is financially stable, working on longer-term projects, and has sufficient resources to reach the next milestones. At the same time, the stock price of Kinnate Biopharma moved down, indicating that investors may not be as confident in the company’s prospects as initially thought. To determine whether there is a good opportunity to invest in Kinnate Biopharma, investors should analyze their financials and product pipeline.

In addition, they should consider the competitive environment and market conditions, as well as any potential partnerships and collaborations. Investors should also watch for any news related to scientific breakthroughs or upcoming clinical trials, as these could have a significant impact on the stock price in the future.

Recent Posts