Kinnate Biopharma Intrinsic Value Calculator – Kinnate Biopharma Shares Rise 9.13%, Can It Be A Safe Investment Now?

May 10, 2023

Trending News ☀️

Kinnate Biopharma ($NASDAQ:KNTE) Inc. has seen a surge in their stock prices in the last few days, with a 9.13% increase from Thursday’s close. This spike in the stock prices has left many investors wondering if this is a safe investment now. Kinnate Biopharma Inc. is a biotechnology company that focuses on the development of innovative therapies and treatments for cancer, neurological diseases, and rare genetic disorders. With extensive experience in drug discovery and development, the company has built a substantial portfolio of drug candidates for various therapeutic areas. Their efforts have been rewarded with recent regulatory approvals, and the company’s financials have been strong. The fact that the stock prices have surged indicates strong investor confidence in the company’s prospects. The strong financial performance, combined with the potential upside from their pipeline of drug candidates, provides both investors and potential investors with a significant opportunity to capitalize on the future growth of the company.

Additionally, with the company’s focus on developing novel treatments for serious diseases, there is potential for long-term success as well. All in all, investing in Kinnate Biopharma Inc. may indeed be a safe option right now. With the stock prices surging and strong fundamentals backing the company, both current and potential investors should consider taking advantage of the opportunity to capitalize on the future growth of this biotechnology giant.

Analysis – Kinnate Biopharma Intrinsic Value Calculator

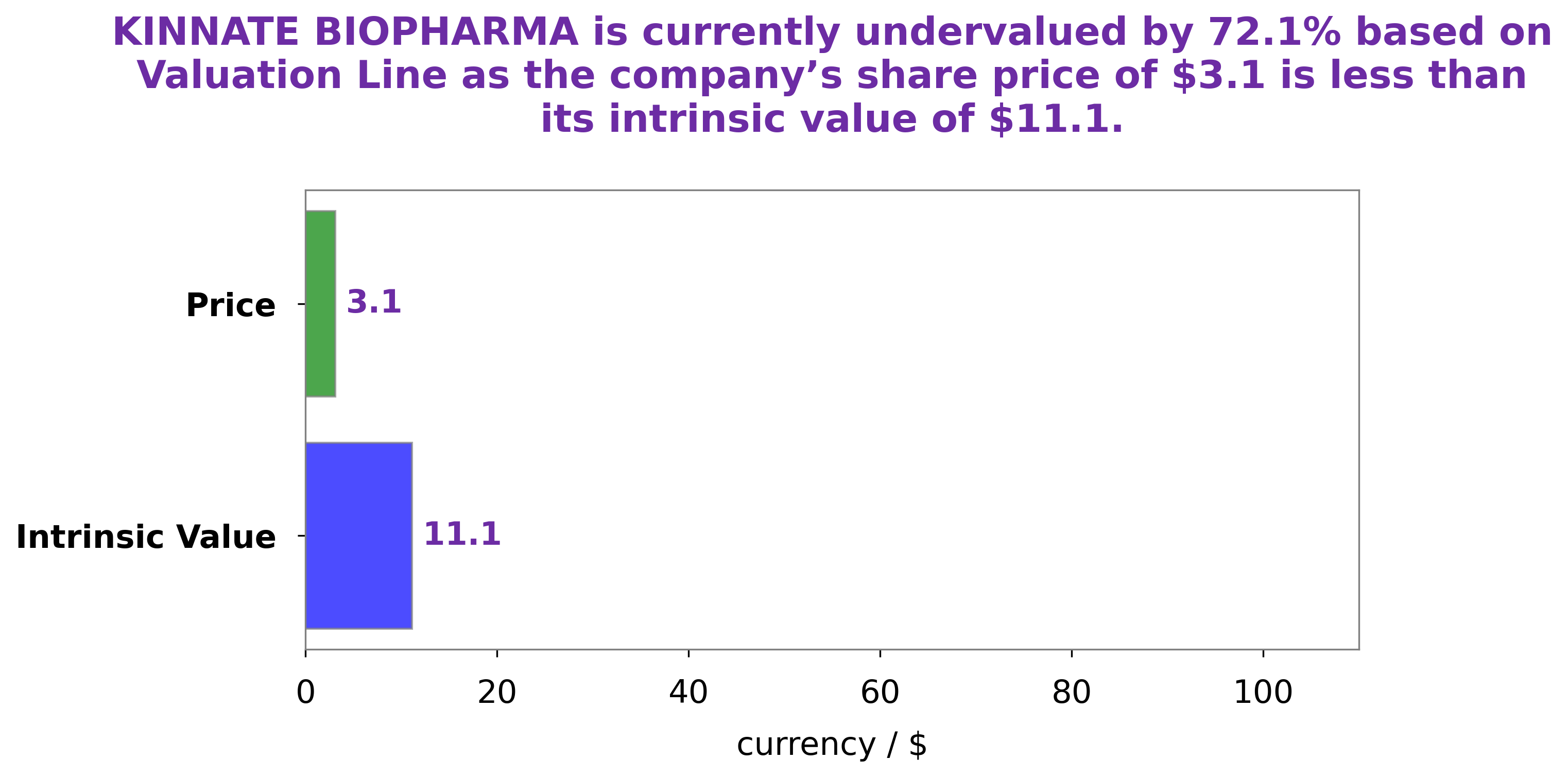

GoodWhale analyzed KINNATE BIOPHARMA‘s financials and found that the fair value of KINNATE BIOPHARMA share is around $11.1, as calculated by our proprietary Valuation Line. This figure is significantly higher than the current stock price of $3.1. In other words, KINNATE BIOPHARMA stock is undervalued by 72.2%. This may present a good opportunity for investors to consider buying KINNATE BIOPHARMA stock for a long-term hold or a short-term gain. Through GoodWhale, investors can conduct comprehensive analysis of KINNATE BIOPHARMA’s financials and compare it with the stock price. This helps them to make informed decisions and capitalize on the current undervaluation of the stock. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kinnate Biopharma. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -116.27 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kinnate Biopharma. More…

| Operations | Investing | Financing |

| -89.03 | -6.83 | 1.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kinnate Biopharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 278.83 | 20.36 | 5.04 |

Key Ratios Snapshot

Some of the financial key ratios for Kinnate Biopharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -31.4% | -26.6% |

Peers

The company’s lead product candidate, IPI-549, is an orally-available, small molecule inhibitor of PI3Kγ. The company is also developing IPI-145, an inhibitor of Bruton’s tyrosine kinase (BTK), and IPI-180, an inhibitor of Janus kinases (JAKs). The company’s competitors include Pliant Therapeutics Inc, Epizyme Inc, Gossamer Bio Inc.

– Pliant Therapeutics Inc ($NASDAQ:PLRX)

Pliant Therapeutics, Inc. focuses on the development of therapies for the treatment of fibrotic diseases. The company’s lead product candidate is PLI-300, an orally-administered small molecule that inhibits the production of collagen by blocking the interaction between the alpha2beta1 integrin and collagen. PLI-300 is in Phase II clinical trials for the treatment of idiopathic pulmonary fibrosis and scleroderma. The company was founded in 2015 and is headquartered in San Francisco, California.

– Epizyme Inc ($NASDAQ:GOSS)

Gossamer Bio Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing therapeutics in the disease areas of immunology, inflammation and oncology. The company’s market cap is $990.28 million and its ROE is -1952.91%. Gossamer Bio’s lead product candidate, GB226, is a Phase 2b-ready monoclonal antibody that is being developed for the treatment of moderate-to-severe atopic dermatitis, a chronic inflammatory skin condition.

Summary

Kinnate Biopharma Inc. has seen a positive shift in their stock price, with the market closing 9.13% higher than the day before. This could be a good time for investors to consider an investment in this company, as it may be an attractive way to diversify a portfolio.

However, investors should look into the company’s financials and other factors before making any investment decision. Researching the company’s past performance, management team, and financial outlook can provide a more detailed analysis of the potential returns on an investment. It’s also important to consider any risk factors that could potentially affect the stock price and consider how those risks fit into an investment strategy.

Recent Posts