Investors in Y-mAbs Therapeutics, With Losses Encouraged to Act Before Monday’s Deadline.

March 23, 2023

Trending News 🌧️

Y-MABS ($NASDAQ:YMAB): Investors in Y-mAbs Therapeutics, Inc. have been encouraged to act quickly before Monday’s deadline by The Schall Law Firm. Those investors who have experienced losses in the company are urged to contact The Schall Law Firm for a free evaluation of their potential legal rights. The law firm has launched an investigation into Y-mAbs Therapeutics, Inc., focusing on potential violations of securities laws by the company. The firm is investigating the potential breaches of fiduciary duty and other violations of state law by certain officers and directors at Y-mAbs Therapeutics, Inc. These investigations are based on allegations that the company and its executives made false and misleading statements to the public and its shareholders.

The firm encourages investors to contact them before Monday’s deadline so that they can investigate these claims and seek appropriate legal remedies. It is important for investors to act before Monday’s deadline as the law firm is actively investigating these matters and securing compensation for those who have experienced losses due to Y-mAbs Therapeutics, Inc. The Schall Law Firm urges investors to contact them so that they can fully understand their legal rights and options with regards to their investment in the company.

Stock Price

The current media exposure of Y-MABS THERAPEUTICS has been mostly positive. However, the stock opened at $3.2 on Monday and closed at $3.1, representing a 2.8% decrease from its previous closing price of $3.2. This substantial loss could be an indication that investors should take action before the deadline. It is important to note that any investor who feels they have been affected by the decrease in price should contact the company or their financial advisor for further advice. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Y-mabs Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 43.42 | -133.62 | -307.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Y-mabs Therapeutics. More…

| Operations | Investing | Financing |

| -101.12 | -0.46 | 0.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Y-mabs Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 143.91 | 36.02 | 2.47 |

Key Ratios Snapshot

Some of the financial key ratios for Y-mabs Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | -298.1% |

| FCF Margin | ROE | ROA |

| -234.0% | -67.6% | -56.2% |

Analysis

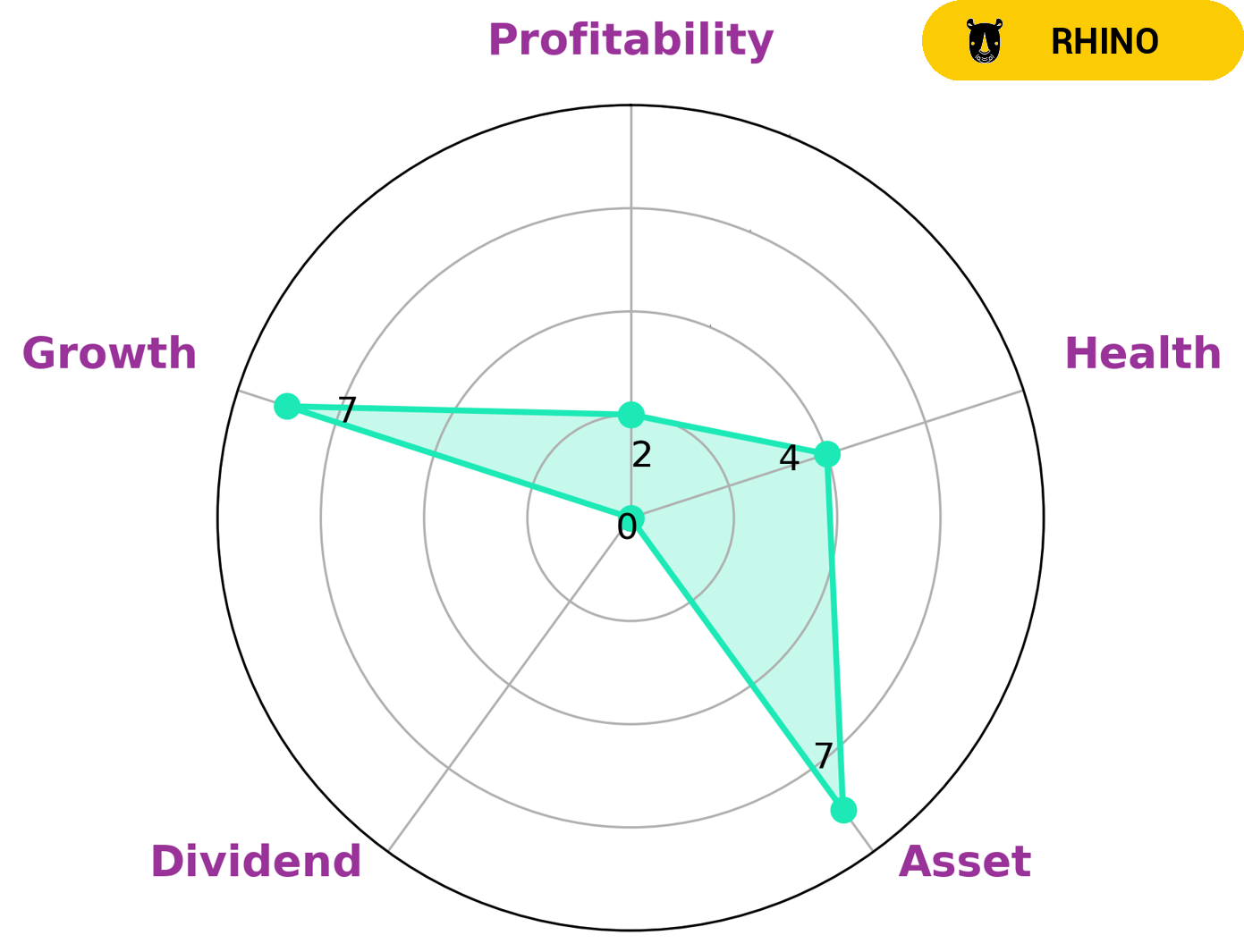

GoodWhale’s analysis of Y-MABS THERAPEUTICS‘ financials shows that the company is strong in the areas of assets and growth, but weak in dividend and profitability. We classify Y-MABS THERAPEUTICS as a ‘rhino’, a type of company that we conclude has achieved moderate revenue or earnings growth. This suggests that investors seeking long-term capital appreciation with an intermediate risk appetite may find Y-MABS THERAPEUTICS an appealing investment opportunity. Additionally, Y-MABS THERAPEUTICS has an intermediate health score of 4/10 with regard to its cashflows and debt, suggesting it likely has the financial security to sustain future operations in times of crisis. More…

Peers

The company’s lead product candidate, naxitamab, is in clinical development for the treatment of neuroblastoma, a rare and aggressive pediatric cancer. Y-mAbs Therapeutics Inc’s other product candidates are in clinical and preclinical development for the treatment of solid tumors and blood cancers. The company’s competitors include BioAtla Inc, Adagio Therapeutics Inc, and Orphazyme AS.

– BioAtla Inc ($NASDAQ:BCAB)

BioAtla Inc is a clinical-stage biopharmaceutical company that focuses on the discovery, development, and commercialization of immuno-oncology agents. The company’s market cap as of 2022 is 357.65M and its ROE is -41.59%. BioAtla’s main competitors are Bluebird bio, Inc. (NASDAQ: BLUE) and Celgene Corporation (NASDAQ: CELG).

– Adagio Therapeutics Inc ($NASDAQ:ADGI)

Orphazyme AS is a biotech company that focuses on developing treatments for rare diseases. The company has a market cap of 5.88M as of 2022 and a Return on Equity of -845.21%. Despite its negative ROE, Orphazyme AS’s market cap indicates that investors are confident in the company’s future prospects. This is likely due to the fact that Orphazyme AS is working on developing treatments for rare diseases, which is a highly lucrative market.

Summary

Y-mAbs Therapeutics, Inc. is an emerging biotechnology company focused on developing treatments for cancer and other serious diseases. Recently, investors in the company have been encouraged to act before the Monday deadline due to potential losses. Media coverage has been predominantly positive, signaling strong investor confidence in the company and its potential for success.

Analysts cite Y-mAbs’ promising portfolio of cancer drugs, which are in different stages of development, as well as their large network of collaborations with other biopharmaceutical companies as evidence of their potential long-term growth. With continued research and development, analysts believe Y-mAbs could be well-positioned to become a major player in the biotechnology sector.

Recent Posts