FDA Panel to Evaluate BrainStorm Cell Therapeutics’ NurOwn Therapy for ALS

June 8, 2023

🌥️Trending News

BRAINSTORM ($NASDAQ:BCLI): BrainStorm Cell Therapeutics is an innovative biotechnology company that is dedicated to developing novel autologous cellular therapies for neurodegenerative diseases. The company focuses on developing treatments for ALS, also known as Lou Gehrig’s disease, using its NurOwn technology. This technology involves harvesting a patient’s own cells, manipulating them in the lab, and then reinjecting them into the patient for therapeutic benefit. Now, the US Food and Drug Administration (FDA) will review BrainStorm’s NurOwn therapy for ALS in a panel hearing. The FDA panel will review data from a randomized, double-blind, placebo-controlled clinical trial of BrainStorm’s NurOwn therapy in ALS patients.

The findings of this trial showed that compared to the placebo, NurOwn had statistically significant improvements in patient functional status as well as levels of various cytokines. The FDA panel will also consider the safety of NurOwn as a treatment for ALS. If the panel finds the therapy to be safe and effective, it could pave the way for approval of NurOwn as a treatment for ALS in the United States.

Price History

On Tuesday, the FDA panel convened to evaluate BRAINSTORM CELL THERAPEUTICS’ NurOwn therapy for the treatment of amyotrophic lateral sclerosis (ALS). The stock opened at $3.2 and closed at $3.0, rising 1.0% from the prior closing price of 3.0. The panel is expected to review the safety data from clinical trials in which NurOwn was administered to ALS patients. Results from these trials could indicate whether NurOwn could become a viable treatment for patients suffering from ALS. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BCLI. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -23.98 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BCLI. More…

| Operations | Investing | Financing |

| -19.62 | 3.02 | 3.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BCLI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.87 | 12.71 | -0.13 |

Key Ratios Snapshot

Some of the financial key ratios for BCLI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | 389.8% | -194.5% |

Analysis

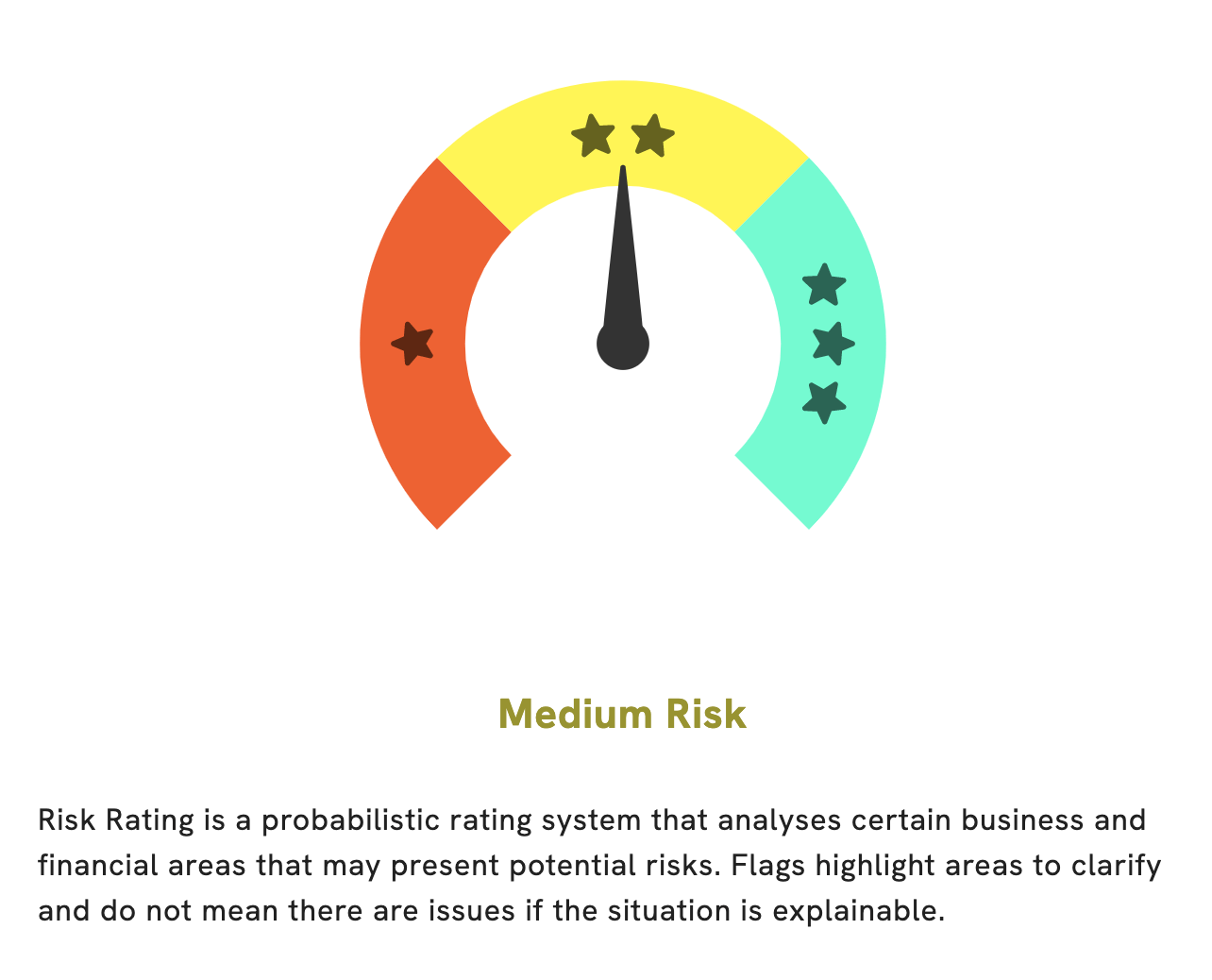

GoodWhale has recently conducted an assessment of BRAINSTORM CELL THERAPEUTICS’ wellbeing. After a thorough review of the company’s financial records and business operations, we have come to the conclusion that BRAINSTORM CELL THERAPEUTICS is a medium risk investment. We have identified 4 potential risk warnings in the company’s income sheet, balance sheet, cashflow statement, and financial journal. All of these risks should be taken into consideration when assessing the viability of an investment. If you would like to learn more about the details of our analysis, please visit our website at goodwhale.com. Here, you can view the full risk report and find out more about how we assess companies. More…

Peers

The competition in the cell therapy market is heating up as more and more companies are vying for a piece of the pie. Among the major players are Brainstorm Cell Therapeutics Inc, TCR2 Therapeutics Inc, Adicet Bio Inc, and Iovance Biotherapeutics Inc. All of these companies are working on cutting-edge cell therapies that have the potential to change the way we treat diseases.

– TCR2 Therapeutics Inc ($NASDAQ:TCRR)

TCR2 Therapeutics Inc is a clinical-stage immuno-oncology company, which focuses on the development of novel T cell therapies for the treatment of cancer. The company has a market cap of $54.51M and a ROE of -24.78%. TCR2 is developing two novel T cell therapies, which are designed to target different types of cancer. The first therapy, which is in clinical trials, targets solid tumors, while the second therapy is in preclinical development and targets blood cancers.

– Adicet Bio Inc ($NASDAQ:ACET)

Adicet Bio Inc is a clinical-stage biopharmaceutical company focused on the development of immune cell therapies for cancer and other diseases. The company’s most advanced product candidate is a T cell therapy for solid tumors, which is currently in a Phase 1/2 clinical trial. The company has a market cap of $871.6M as of 2022 and a Return on Equity of -11.39%.

– Iovance Biotherapeutics Inc ($NASDAQ:IOVA)

Iovance Biotherapeutics Inc is a late-stage biopharmaceutical company focused on the development and commercialization of novel cancer immunotherapy products based on tumor-infiltrating lymphocyte (TIL) technology.

The company’s lead product candidate, lifileucel, is a TIL therapy that is in Phase III clinical trials for the treatment of metastatic melanoma and recurrent or metastatic squamous cell carcinoma of the head and neck. Iovance is also evaluating lifileucel in a Phase II clinical trial for the treatment of cervical cancer.

Iovance has a market cap of 1.19B as of 2022. The company’s Return on Equity is -56.45%.

Summary

BrainStorm Cell Therapeutics is a biotechnology company focused on developing autologous stem cell therapies for neurodegenerative diseases. The company’s FDA-approved therapy, NurOwn, is being evaluated in clinical trials for the treatment of ALS (amyotrophic lateral sclerosis). Investment analysis of BrainStorm Cell Therapeutics shows that the company has a solid balance sheet with a healthy cash position, a solid pipeline of products, and an experienced management team.

Investors should expect the company to generate revenue from its current products and new products in development, though the timeline is uncertain. BrainStorm Cell Therapeutics has various potential catalysts for growth, such as partnerships and collaborations with other companies, that could unlock the value of the business and provide significant returns for investors.

Recent Posts