Considering Investing in Atai Life Sciences N.V.? Here’s What You Need to Know!

February 20, 2023

Trending News 🌥️

Atai Life Sciences ($NASDAQ:ATAI) N.V. is a biopharmaceutical company that is focused on the development and commercialization of innovative therapies for mental health disorders and psychedelic medicines. The company has a strong portfolio of compounds and preclinical and clinical programs in development, with the potential to have a major impact on treating a variety of mental health disorders. When considering investing in Atai Life Sciences N.V., here are some important things to consider.

First, it is important to understand the track record of the company. Atai Life Sciences has a strong history of delivering groundbreaking treatments and therapies that are based on science and evidence. They have developed and launched several compounds that have been approved by regulatory bodies around the world and are now being used to treat various mental health disorders.

Additionally, they have several clinical trials underway that are expected to yield results in the coming years. Second, it is important to consider the financials of Atai Life Sciences. The company is well-funded and has a solid balance sheet, which allows them to pursue their research and development initiatives without having to worry about cash flow issues. Additionally, they have a strong management team with extensive experience in the biopharmaceutical industry, so investors can be confident that their money is being managed wisely. Finally, investors should consider the risks associated with investing in Atai Life Sciences N.V. The company is still relatively new, so there are certain risks associated with investing in a biopharmaceutical company. Additionally, the potential for FDA approval for its products is a major risk that must be considered before investing in Atai Life Sciences N.V. Overall, Atai Life Sciences N.V. is an exciting biopharmaceutical company that has the potential to revolutionize the treatment of mental health disorders and psychedelic medicines. When considering investing in Atai Life Sciences N.V., it is important to do thorough research into the company and its financials, as well as weigh the risks associated with investing in a biopharmaceutical company. With careful consideration, investors can make an informed decision about whether or not to invest in Atai Life Sciences N.V.

Price History

Until now, news sentiment surrounding the company has been mostly positive, with the stock price maintaining its value on the market. On Friday, the stock opened at $1.8 and closed at $1.8, down by 0.6% from the previous closing price of $1.8. Atai Life Sciences N.V. is an international company based in the Netherlands, specializing in mental health research, development and commercialization of psychedelic-assisted therapies. The company is focused on addressing a range of mental health conditions with novel treatments, such as depression, anxiety, addiction and post-traumatic stress disorder (PTSD). Atai Life Sciences N.V. is led by a team of experienced industry professionals. The company has established relationships with leading experts in the field and is working to create a comprehensive platform for the research, development and commercialization of psychedelic-assisted therapies.

Atai Life Sciences N.V. has a strong balance sheet with no debt and ample cash reserves to support strategic investments and operations. This provides investors with added security should any unforeseen events arise in the future. Overall, Atai Life Sciences N.V. appears to be a strong investment prospect, particularly considering its positive news sentiment, strong financial performance and secure balance sheet. With a market capitalization of over $2 billion and a proven track record, it could be worth considering investing in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ATAI. More…

| Total Revenues | Net Income | Net Margin |

| 0.42 | -196.25 | -46317.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ATAI. More…

| Operations | Investing | Financing |

| -94.47 | -215.53 | 23.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ATAI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 342.6 | 46.52 | 1.74 |

Key Ratios Snapshot

Some of the financial key ratios for ATAI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -34233.9% |

| FCF Margin | ROE | ROA |

| -22500.9% | -30.3% | -26.5% |

Analysis

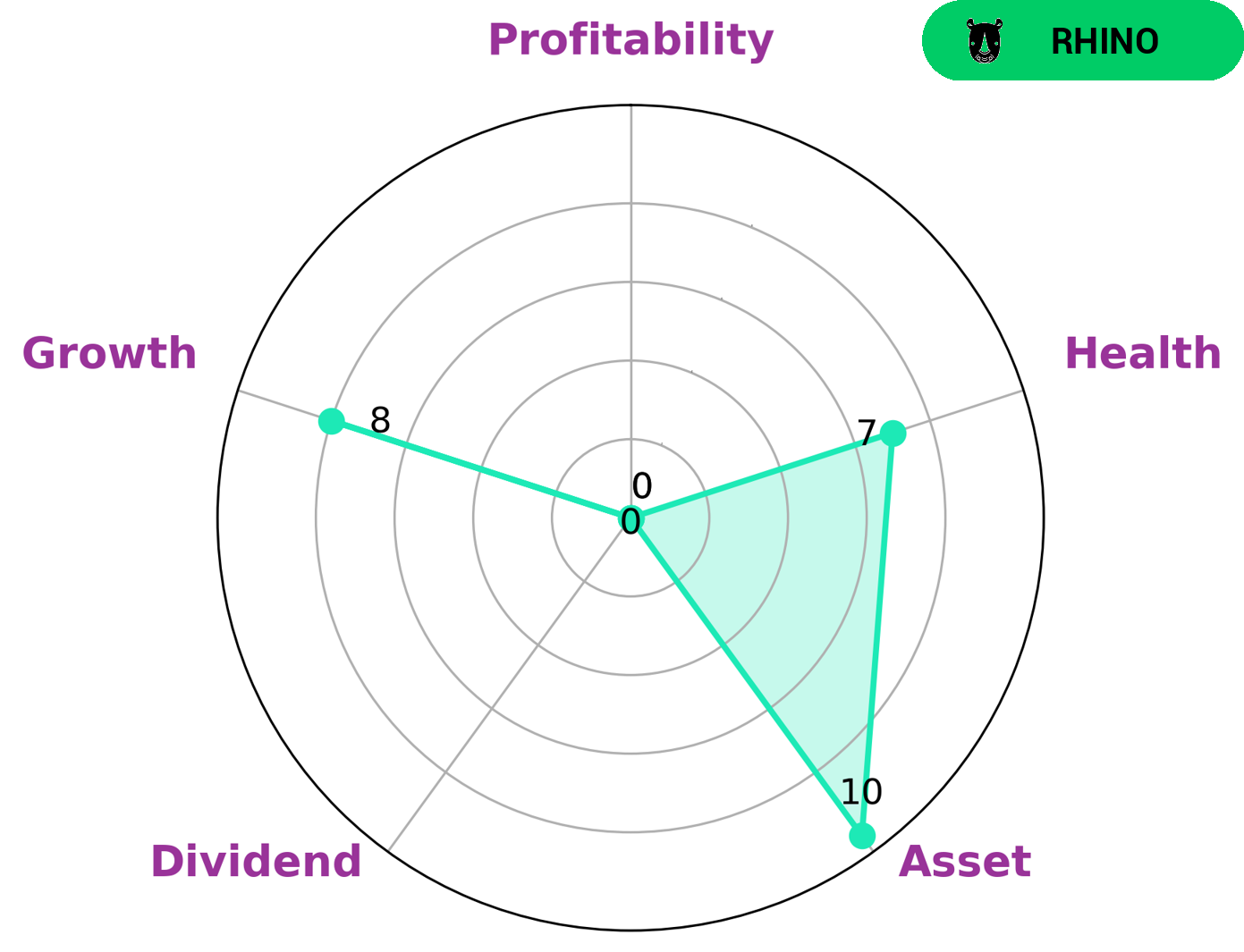

GoodWhale is a great tool to help analyze the fundamentals of ATAI LIFE SCIENCES N.V. According to its Star Chart, the company has a high health score of 7 out of 10, indicating that its cashflows and debt are strong and are able to sustain future operations in times of crisis. It is classified as ‘rhino’, a company that has achieved moderate revenue or earnings growth. Investors in such companies typically focus on its asset and growth, but overlook its inability to provide high dividends or profitability. ATAI LIFE SCIENCES N.V has demonstrated solid performance in terms of asset, growth rate, and market capitalization. Its strong balance sheet shows that it has adequate liquid assets to cover any short-term liabilities. Furthermore, its consistent growth rate means that it is capable of expanding its business without relying entirely on external capital. Therefore, ATAI LIFE SCIENCES N.V is ideal for long-term investors who are looking for steady returns and capital appreciation, rather than short-term profits or dividends. Growth-oriented investors, such as venture capitalists and private equity firms, may be interested in ATAI LIFE SCIENCES N.V. They are more likely to focus on its potential future growth and value creation, rather than its current profitability or dividend-paying ability. Overall, ATAI LIFE SCIENCES N.V has a strong foundation and looks attractive to long-term investors. With careful financial management, it can become a successful enterprise and generate attractive returns for its shareholders. More…

Peers

The company’s lead product candidate, ATAI-002, is a proprietary, orally-active small molecule that is being developed for the treatment of depression. ATAI Life Sciences NV has a strategic partnership with Janssen Pharmaceuticals, Inc. for the development and commercialization of ATAI-002. The company’s competitors include Evofem Biosciences Inc, Soligenix Inc, and Aerovate Therapeutics Inc.

– Evofem Biosciences Inc ($NASDAQ:EVFM)

Soligenix is a clinical-stage biopharmaceutical company committed to developing and commercializing therapeutics to treat serious inflammatory conditions and other diseases of the gastrointestinal tract. The company’s lead product candidates are SGX301, an investigational new drug for the treatment of cutaneous T-cell lymphoma, and SGX942, an investigational new drug for the treatment of oral mucositis.

– Soligenix Inc ($NASDAQ:SNGX)

Aerovate Therapeutics Inc is a clinical stage biopharmaceutical company developing gene therapies for the treatment of rare, life-threatening diseases. The company’s most advanced product candidate is AERO-101, an adeno-associated virus (AAV) based gene therapy in development for the treatment of alpha-1 antitrypsin deficiency (AATD). AATD is a rare, inherited disease that can lead to liver damage and lung disease. There are currently no approved treatments for AATD.

Aerovate has a market cap of 513.41M as of 2022 and a return on equity of -15.06%. The company is developing gene therapies for the treatment of rare, life-threatening diseases.

Summary

ATAI Life Sciences N.V. is a biotechnology company focused on developing treatments and therapies for central nervous system disorders. Investors are interested in this company due to its potential for providing innovative treatments and therapies. Analysts suggest that the company has a strong management team, a focused strategy, and an experienced team of scientists and clinicians to deliver results. Despite the risk associated with investing in a biotechnology company, many investors are optimistic about ATAI’s potential and view it as a long-term investment opportunity.

Recent Posts