BIOMARIN PHARMACEUTICAL Reports 11.5% Increase in Revenue for Second Quarter of FY2023 with USD 595.3 Million Earnings

August 15, 2023

☀️Earnings Overview

BIOMARIN PHARMACEUTICAL ($NASDAQ:BMRN) reported total revenue of USD 595.3 million for their second quarter of FY2023 on June 30 2023, representing a 11.5% increase from the same period in the previous year. Additionally, net income amounted to USD 56.0 million, up 102.6% from the year before.

Analysis

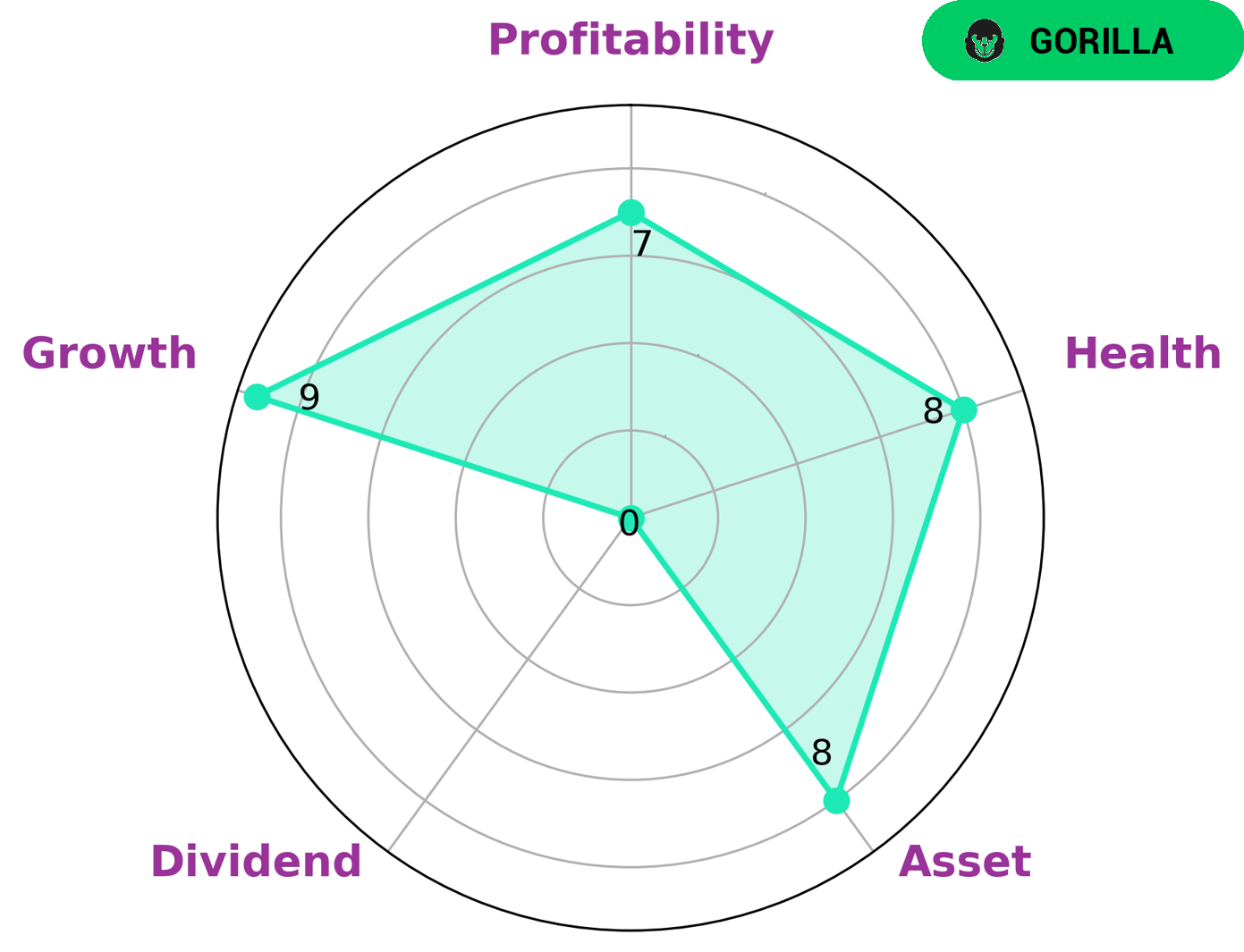

This makes BIOMARIN an attractive option for investors who are interested in long-term investments with promising returns. In terms of asset quality, growth, and profitability, BIOMARIN PHARMACEUTICAL scores highly; however, it is weak in terms of dividend yield. Nonetheless, BIOMARIN PHARMACEUTICAL has a high health score of 8/10 considering its cashflows and debt, indicating that it is more than capable of paying off its debts and funding future operations. This further highlights BIOMARIN PHARMACEUTICAL’s potential as a long-term investment option. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Biomarin Pharmaceutical. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | 99.99 | -4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Biomarin Pharmaceutical. More…

| Operations | Investing | Financing |

| 161.24 | -78.59 | -10.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Biomarin Pharmaceutical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.56k | 1.78k | 25.42 |

Key Ratios Snapshot

Some of the financial key ratios for Biomarin Pharmaceutical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.6% | – | 5.5% |

| FCF Margin | ROE | ROA |

| 1.8% | 1.6% | 1.2% |

Peers

The competition in the biopharmaceutical industry is fierce, with companies like Biomarin Pharmaceutical Inc, Sangamo Therapeutics Inc, Pfizer Inc, and Sanofi SA all vying for a piece of the pie. Each company has its own unique strengths and weaknesses, and it is up to the individual investor to decide which company is the best investment.

– Sangamo Therapeutics Inc ($NASDAQ:SGMO)

Sangamo Therapeutics is a clinical-stage biopharmaceutical company focused on developing and commercializing transformative genomic medicines to treat serious and life-threatening diseases. The company has a market cap of $674.74 million and a negative return on equity of 32.96%. Sangamo Therapeutics is headquartered in Richmond, California.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc. is an American multinational pharmaceutical corporation. It is one of the world’s largest pharmaceutical companies. The company was founded in 1849 by Charles Pfizer and Charles Erhart in New York City. Pfizer is a diversified company that operates in three main business segments: Pharmaceuticals, Animal Health, and Consumer Health.

– Sanofi SA ($OTCPK:SNYNF)

Sanofi SA is a French multinational pharmaceutical company headquartered in Paris, France, that covers seven major therapeutic areas: diabetes solutions, human vaccines, innovative drugs, consumer healthcare, emerging markets, animal health and Sanofi Genzyme. As of 2020, Sanofi has 104,000 employees worldwide.

The company’s market cap is $98.97B as of 2022 and its ROE is 7.56%. Sanofi is a global leader in the pharmaceutical industry, with a strong presence in emerging markets. The company has a diversified product portfolio and is a major player in the diabetes market. Sanofi is also active in the vaccine market, with a number of innovative products in its portfolio.

Summary

BIOMARIN PHARMACEUTICAL has reported strong FY2023 second quarter earnings, with total revenue of USD 595.3 million and net income of USD 56.0 million. This is a 11.5% increase in revenue from the same period in the previous year, and a 102.6% increase in net income. These figures indicate that BIOMARIN PHARMACEUTICAL is a strong investment option for investors looking for high returns. With a history of consistent revenue and net income growth, it is likely that BIOMARIN PHARMACEUTICAL will continue to be a profitable investment option in the future.

Recent Posts