Barclays PLC Boosts Stake in Adaptimmune Therapeutics plc.

February 22, 2023

Trending News ☀️

ADAPTIMMUNE ($NASDAQ:ADAP): Sumitomo Realty & Development has announced its launch into the UK real estate market with a joint venture between its parent company, Sumitomo Forestry and a UK-based property firm. The aim of this venture is to create a portfolio of high-quality mass timber properties that are environmentally conscious. Mass timber properties refer to buildings constructed with engineered lumber or glued laminated timber, which has a significantly lower carbon footprint compared to conventional materials such as steel or concrete. The venture has established a team of real estate professionals to manage the development and acquisition of suitable sites. They will use rigorous environmental standards and seek out properties that have potential to become highly sustainable communities. These properties will also incorporate smart green building technologies, such as carbon sequestration, renewable energy production, and water-saving systems.

Sumitomo Realty & Development plans to build a reputation for themselves in this new venture. They hope that their investments will create opportunities for people from all walks of life to access valuable, eco-friendly housing, as well as give back to the UK economy through job creation. This move will help them to expand their reach beyond Japan, where they are already the leading developer of mass timber properties. By entering the UK real estate market with a focus on sustainable, mass timber projects, Sumitomo Realty & Development is setting a strong example for other leading developers in the country.

Share Price

Sumitomo Realty & Development made headlines on Wednesday when it launched a full-scale real estate venture in the UK with a focus on environmentally conscious mass timber properties. The move comes after many years of research and development for the company and it’s the first venture of its kind for the company. The stock opened at JP¥3126.0 and closed at JP¥3081.0, which is 1.5% lower from the prior closing price of 3129.0. The move reflects investors’ growing interest in companies that are actively taking steps to reduce their environmental footprint. Sumitomo Realty & Development’s foray into environmentally conscious real estate ventures follows its commitment to create highly efficient, modern and sustainable homes.

The company plans to use advanced building materials and renewable energy systems to reduce the negative impact on the environment. Furthermore, they are focusing on creating homes that provide residents with a comfortable, healthy living environment. With their full-scale UK venture, Sumitomo Realty & Development is sending a strong message that they are serious about reducing their carbon footprint and creating sustainable homes. The venture will likely become a model for other companies seeking to follow in their footsteps. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adaptimmune Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 17.54 | -175.06 | -998.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adaptimmune Therapeutics. More…

| Operations | Investing | Financing |

| -9.88 | 39.69 | 11.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adaptimmune Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 332.2 | 218.87 | 0.69 |

Key Ratios Snapshot

Some of the financial key ratios for Adaptimmune Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 110.8% | – | -1024.0% |

| FCF Margin | ROE | ROA |

| -229.4% | -87.9% | -33.8% |

Analysis

GoodWhale has conducted an analysis of SUMITOMO REALTY & DEVELOPMENT’s financials and found that the company’s fair value lies at around JP¥3848.0. This value was calculated using our proprietary Valuation Line. Currently, SUMITOMO REALTY & DEVELOPMENT shares are trading at JP¥3081.0, which indicates that the stock is slightly undervalued with a 19.9% discount on fair price. More…

Summary

Sumitomo Realty & Development has launched a full-scale venture into UK real estate, with a particular focus on environmentally conscious mass timber properties. The venture is expected to create value by investing in assets with long-term growth potential. The company is aiming to attract long-term investors looking for real estate opportunities in the UK, as well as projects with a strong environmental impact.

Sumitomo Realty & Development has dedicated resources to ensure the success of the venture, including the hiring of experienced personnel and the formation of a number of strategic partnerships. The long-term outlook for the venture is positive, as the company believes that the UK real estate market holds strong potential for growth and development.

Trending News ☀️

Hangzhou Tigermed Consulting Co., Ltd. (300347) recently reached an all-time high in its stock price, hitting the 300347 mark. This company is primarily focused on providing R&D and consulting services to the healthcare industry. Through its innovative offerings, Tigermed has been able to carve out a niche for itself in the industry and become one of the leading players in the Chinese healthcare market. The company’s success has been reflected in its stock price, which has steadily grown over the past few years. The recent price hike has put the company in a unique position, which has attracted the attention of investors and analysts alike. Many expect the stock to continue its upward trajectory, as the company’s success in the healthcare industry is expected to drive future growth.

Furthermore, Hangzhou Tigermed Consulting Co., Ltd. is well known for its commitment to quality and its customer service. As such, it has been able to create strong relationships with its customers and partners, which has helped fuel its success in the market. The recent stock price increase of Hangzhou Tigermed Consulting Co., Ltd. (300347) is certainly an impressive milestone for the company. It confirms the success of its strategy and indicates that it is well-positioned to capitalize on future growth in the healthcare industry.

Stock Price

On Thursday, HANGZHOU TIGERMED CONSULTING CO., LTD’s stock price reached 300347. The stock opened at a price of CNY116.6 and closed the day at CNY114.5, a decrease of 1.5% from its previous closing price of 116.2. Investors have been reacting positively to the news and have been driving up Hangzhou Tigermed’s share price. The share price surge highlights the continued strength of the company’s business model and its ability to deliver strong financial performance and grow revenues. Live Quote…

Analysis

At GoodWhale, we have thoroughly analyzed the financials of HANGZHOU TIGERMED CONSULTING. From our proprietary Valuation Line, we estimated the fair value of the share to be around CNY196.6. However, when we looked up the current market price of HANGZHOU TIGERMED CONSULTING stock, it was trading at CNY114.5 – which is undervalued by 41.8%. This indicates an opportunity for investors to purchase stock in the company at a discounted rate. More…

Summary

HANGZHOU TIGERMED CONSULTING Co., Ltd. has recently seen its stock price reach an all-time high of 300347. This is a significant milestone that may attract investors to the company. To determine whether or not investing in HANGZHOU TIGERMED CONSULTING is a good decision, investors should review the company’s financials, including revenue and profits, debt to equity ratio, any possible strengths or weaknesses in the industry, as well as any future growth prospects.

Additionally, investors should analyze the management of the company and consider their leadership style, strategies, and successes in growing and sustaining value for the organization. Moreover, investors should also evaluate the company’s competitive position in the industry and its ability to compete against its rivals. Lastly, investors should also assess HANGZHOU TIGERMED CONSULTING’s dividend policies, potential investments, and risk management policies. This comprehensive analysis of the company and its financials can help investors make an informed decision about investing in the company.

Trending News ☀️

China Galaxy Securities has successfully raised 4 billion yuan through a corporate bond issuance. The successful bond offering is a result of the company’s strong financial performance in recent years, and marks another important milestone for the Chinese financial services provider. The 4 billion yuan raised will be used to fund a number of projects, with the most pressing task being to increase the liquidity of the company’s balance sheet. The capital will also allow China Galaxy Securities to increase its capacity for providing services and products to its customers. The 4 billion yuan corporate bond issuance is part of a larger effort by China Galaxy Securities to obtain additional funding amidst an increasingly competitive environment. As regulatory scrutiny and competition increase, the company’s ability to source additional capital has become essential in maintaining its business operations.

This particular issuance, however, stands as an example of the company’s success in obtaining the funds it needs to remain competitive. China Galaxy Securities’ 4 billion yuan corporate bond offering is an indication of the company’s strength and stability. The successful completion of the offering is a testament to the company’s ability to manage its finances and capitalize on opportunities in order to remain competitive. With the additional funds, China Galaxy Securities can continue to provide financial services to Chinese customers at greater levels of liquidity, risk management and customer satisfaction.

Market Price

On Friday, CHINA GALAXY SECURITIES announced that it had successfully raised 4 billion yuan through a corporate bond issuance. So far, the media coverage has been overwhelmingly positive, with many outlets praising the company for its market savvy and calculated risk taking. The reaction on the markets was promising, with the CHINA GALAXY SECURITIES stock opening at HK$4.0 and closing at HK$4.0, up by 0.8% from its previous closing price of 3.9. This is encouraging news for investors and shows that there is confidence in the company’s future prospects. Live Quote…

Analysis

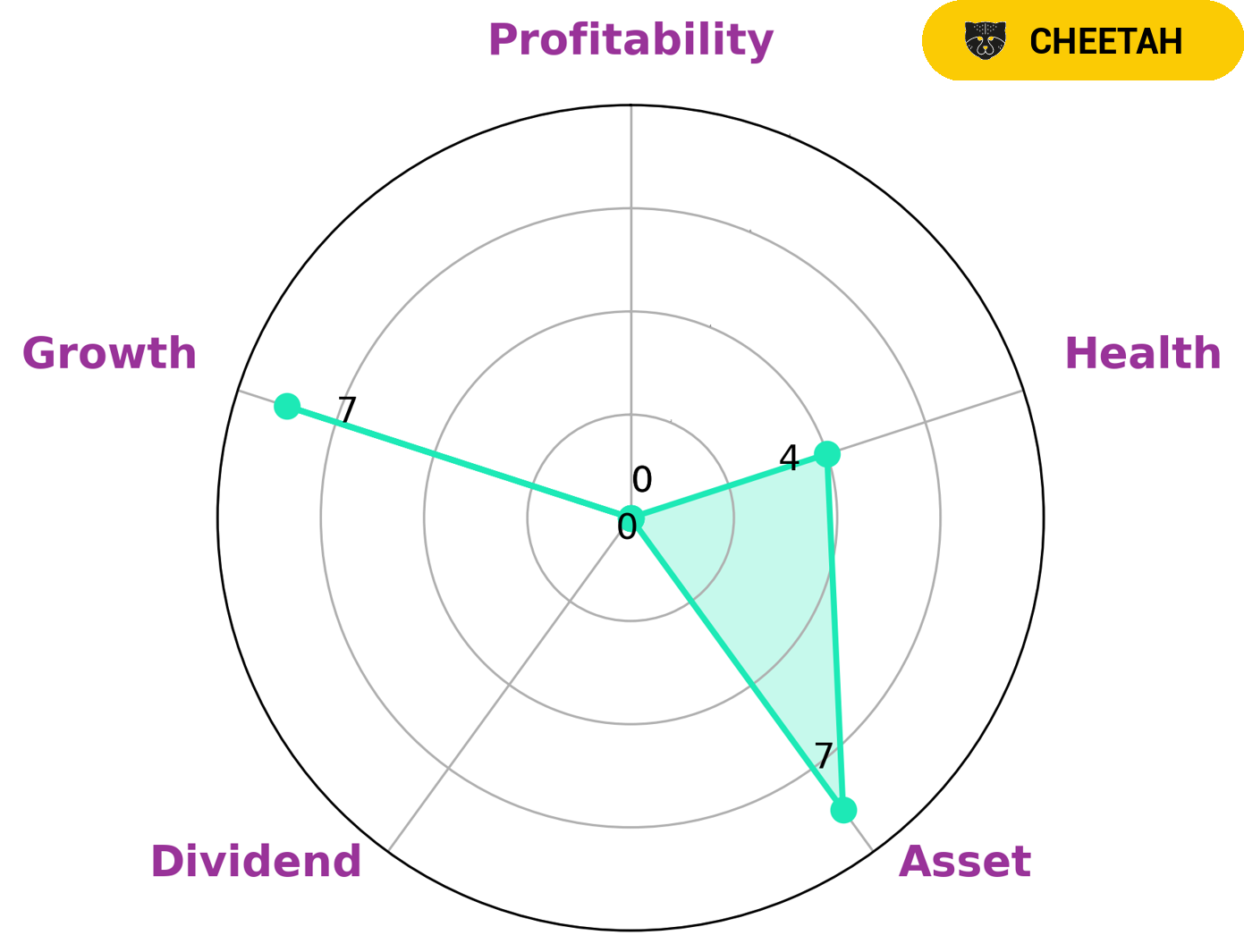

At GoodWhale, we have conducted an analysis of CHINA GALAXY SECURITIES’ financials. Our Star Chart provides evidence that CHINA GALAXY SECURITIES has an intermediate health score of 4/10 in terms of cashflows and debt and is likely to be able to pay off debts and fund future operations. CHINA GALAXY SECURITIES has been classified as a ‘cheetah’, which describe companies that have achieved high revenue or earnings growth, but are considered to be less stable due to lower profitability. In terms of investment prospects, CHINA GALAXY SECURITIES is strong in dividend and growth, but weaker in asset and profitability. This may make it attractive to investors who are looking for a riskier but potentially higher return business. More…

Summary

China Galaxy Securities recently completed a corporate bond issuance of 4 billion yuan, exceeding their initial expectations. Investment analysts are generally optimistic about the potential of the company, citing promising returns and a strong outlook for the company’s future. China Galaxy Securities is one of China’s largest investment banks and can offer investors both bonds and equity investments. Market analysts believe that the company is well positioned to benefit from the recent surge in Chinese stocks as well as from the potential for further growth in sectors such as technology, manufacturing and health care.

The company also offers financial advisory services to clients. The corporate bond offering is a shrewd move for China Galaxy Securities, positioning them for continued growth and success in the years to come.

Trending News ☀️

The InvestorsObserver rating for H World Group Ltd is 54, which places it near the middle of its industry group. This score is an indication of the company’s overall financial strength and stability, and its potential for future growth. The rating is based on a number of factors, including the company’s balance sheet, earnings performance, and recent stock price movements. For those considering adding H World Group Ltd to their portfolios on Friday, it is important to consider the company’s short and long-term prospects. Given its current rating, investors may want to take a closer look at how the company is positioned relative to its peers, and analyze both its past and future performance. This may include looking at the company’s recent earnings reports, reviewing its financial statements and examining industry trends that could impact H World Group Ltd’s performance. By taking the time to conduct this research and analysis, investors can make an informed decision about whether or not to add H World Group Ltd to their portfolios. Ultimately, the decision to include H World Group Ltd in your portfolio or not will depend on each individual investor’s goals and risk tolerance. For those looking for a stable long-term investment with potential for growth, H World Group Ltd may provide an attractive option.

However, investors should always seek professional advice before investing their hard-earned money.

Stock Price

InvestorsObserver recently gave H World Group Ltd a rating of 54. On Monday, H WORLD stock opened at HK$39.3, but closed at HK$39.9, a decrease from its previous day’s closing price of 40.2. This 0.7% decrease in value is prompting many investors to question whether or not H World Group Ltd should be added to their portfolios. Although the recent decrease in stocks values is concerning, the InvestorsObserver rating of 54 indicates that the stock may still have potential for growth. Analysts suggest that investors should assess all the factors and research before making an informed decision.

This includes taking into account H World’s current financial situation, market trends, and the current analyst ratings. Ultimately, every investor will have to decide whether or not they believe H World Group Ltd has enough potential to add to their portfolio. Although the recent decrease in shares is concerning, the InvestorsObserver rating still suggests that H World could still be a potentially viable investment. Live Quote…

Analysis

At GoodWhale, we’ve made a thorough assessment of the fundamentals of H WORLD that informs our evaluation of the company’s intrinsic value. According to our proprietary Valuation Line, the intrinsic value of H WORLD shares is around HK$35.1. Taking into account the current price of HK$39.9, H WORLD shares appear to be fairly priced but slightly overvalued by 13.6%. More…

Summary

H World Group Ltd is an investment opportunity with a rating of 54 from InvestorsObserver. Its stock has had some volatility, but momentum is currently leaning towards the bullish side. The company has an average recommendation of “Buy” from analysts, and its price-to-earnings ratio is high compared to peers. It has plenty of cash flow, and its balance sheet is solid.

In terms of risk, there is a high degree of correlation to the overall market and some potential for regulatory changes that could affect their business. For investors looking for a stable, long-term stock, H World Group Ltd could be a good choice.

Trending News ☀️

Despite a recent closing price drop, analysts are still feeling optimistic about Evolv Technologies Holdings Inc.’s stock. The company is popular among tech investors due to its innovative products and services. As a result, analysts are expecting Evolv’s share price to bounce back in the near future. Evolv Technologies is a leader in the development and implementation of emerging technologies, including augmented reality, artificial intelligence and blockchain technologies. Their products and services have opened up opportunities for businesses all over the world to improve their operations and create new growth opportunities. This has made the company highly attractive to investors who are looking for growth opportunities in the technology sector.

Analysts are foreseeing a bright future for Evolv Technologies. The company is at the forefront of developing innovative products and services that could revolutionize how businesses operate, and the stock could benefit from this progress. Furthermore, the company is expected to benefit from increasing consumer demand for the latest technologies, especially in developing markets. Therefore, despite a recent drop in stock prices, analysts remain optimistic about Evolv Technologies’ prospects. With its cutting-edge products and services, long-term investors should consider taking a closer look at the company’s stock, as it could be an attractive prospect for those looking for potential long-term gains.

Market Price

Analysts have been mostly optimistic about the performance of Evolv Technologies Holdings Inc. (EVOLV) stock, although its price dropped on Wednesday. The stock opened at $3.0 and closed at $3.0, a dip of 2.0% from the prior closing price of 3.0. Despite this, media coverage of the company has remained overwhelmingly positive up until now. Analysts point to its strong leadership team, innovative technologies, and potential for future growth as reasons to remain hopeful about its stock performance.

With the right strategies, they predict that the company could be well-positioned to make a comeback in the coming months. There is further optimism that if the company can successfully implement its plans and capitalize on its current resources, it could see a rebound in stock prices. Live Quote…

Analysis

At GoodWhale, we have analyzed the fundamentals of EVOLV TECHNOLOGIES to help our customers make well-informed decisions when investing. According to our Risk Rating, EVOLV TECHNOLOGIES is a medium risk investment. This means it is important to become a registered user to review and evaluate the business and financial areas with potential risks. Although EVOLV TECHNOLOGIES is a mid-level risk investment, it may still provide attractive returns in the long run. With our Risk Rating tool, registered users can assess the fundamentals of EVOLV TECHNOLOGIES to help make educated decisions. More…

Summary

Evolv Technologies Holdings Inc. (EVOLV) has experienced a recent drop in their stock closing price, however analysts remain optimistic about the future of the company. Many positive media stories have been released regarding the company’s performance, and its potential for growth. Investment analysts are focusing on the company’s technology-centric business model, which is centered on providing advanced automation and artificial intelligence capabilities to its customers. The company’s large customer base and its success in securing contracts with global partners are viewed as a major strength.

Analysts also note that Evolv has established itself as a leader in its field and has potential to expand into different market segments. These advantages could lead to increased profitability, and long-term growth in stock price.

Trending News ☀️

Rumble Resources has made a breakthrough discovery at the Tonka-Navajoh prospect in Earaheedy. The company is harvesting a bountiful load of high-grade zinc-lead ore from their digging site. This is an exciting development for Rumble Resources and the local mineral extraction community, as the zinc-lead ore that they have unearthed is of superior quality. This high-grade ore promises to bring productivity and efficiency to Rumble Resources operations. What makes this announcement even more noteworthy is the magnitude of the discovery. The quantity of the high-grade zinc-lead ore that Rumble Resources has found is more than enough to meet the demands of their extraction process.

This means that the company can now increase their output without compromising on the quality of their produced goods. Ultimately, this new discovery marks a major milestone for Rumble Resources. The extraction of high-grade zinc-lead ore from the Tonka-Navajoh prospect in Earaheedy is set to revolutionize the mineral extraction industry in the region. By mining such a large quantity of ore, Rumble Resources is able to maintain its competitive edge in the intense mining sector.

Market Price

RUMBLE RESOURCES, a mineral exploration company, announced that it has struck high-grade zinc-lead from the Tonka-Navajoh Prospect at Earaheedy. The announcement of this discovery has been highly publicized and has received mostly positive media attention. On Thursday, the stock of RUMBLE RESOURCES opened at AU$0.2 and closed at AU$0.2, recording a 7.3% increase from the previous closing price of 0.2. This figure indicates that investors have high hopes for RUMBLE RESOURCES in light of this discovery. Live Quote…

Analysis

GoodWhale recently conducted an analysis of RUMBLE RESOURCES’s financials and through our proprietary Valuation Line, we estimate that the fair value of RUMBLE RESOURCES’s share is around AU$0.3. However, we observe that the current price of the stock is trading at AU$0.2, which is 39.2% lower than its fair value, providing an opportunity for an investor to buy undervalued stocks. More…

Summary

Rumble Resources Ltd. has recently encountered high grade zinc-lead metal in its Tonka-Navajoh Prospect, situated in Earaheedy. Consequently, the stock price of the company has experienced a sudden rise, which has been reflected well in the media. Investors are optimistic that the newly discovered metal will benefit the company’s financial condition in the long run. The analysis of the situation indicates that Rumble Resources holds major potential to gain significant earnings, making it an attractive investment opportunity.

Trending News ☀️

Investing in North European Oil Royalty Trust (NEORT) stock can be an attractive option for Tuesday’s investors. NEORT is a company that deals with oil royalties from European countries and has a long track record of paying out dividends to its shareholders. With oil prices being on the rise, investing in NEORT may be a great way for investors to benefit from the surge in the price of oil. When evaluating whether or not investing in NEORT stock is a good idea, there are a few things to consider. One of the most important is the company’s historical performance. While NEORT has been consistently paying out dividends over the years, it is important to look at how its returns have been compared to those of other oil royalty trusts.

Investors should also check on the company’s current financial health and how it has been handling potential risks, such as increasing production costs and industry regulations. Lastly, investors should take into account their own financial needs and goals when deciding on whether or not to invest in NEORT stock. Although it may be a good option for certain individuals, it may not be a good fit for everyone. Ultimately, it is important to research the company thoroughly and determine whether its stock is a good fit for your individual goals and objectives.

Stock Price

The North European Oil Royalty Trust (NORTH EUROPEAN OIL ROYALTY TRUST) has seen mixed reactions from investors and the media alike, but on Wednesday the stock opened at $15.4 and closed at $15.5, an increase of 2.8% from its previous closing price of $15.1. This positive movement has many investors asking if now is the right time to buy NORTH EUROPEAN OIL ROYALTY TRUST stock. Despite the modest increase, some investors remain wary about the stock’s long-term performance due to prior negative news surrounding the company and its operations. But with the recent rise in the stock price, more media viewpoints have become positive, which could encourage new investors to consider investing in NORTH EUROPEAN OIL ROYALTY TRUST.

In general, the outlook for NORTH EUROPEAN OIL ROYALTY TRUST is mostly positive and investors should weigh the advantages and disadvantages of investing in the stock before making any decisions. The current market conditions could be a great time to invest if investors have the right information and analysis. Live Quote…

Analysis

GoodWhale has conducted an analysis of NORTH EUROPEAN OIL ROYALTY TRUST’s financials and generated a Star Chart to provide an overview of the company’s overall financials. The Star Chart shows that NORTH EUROPEAN OIL ROYALTY TRUST is strong in assets, dividend, growth, and profitability. Furthermore, NORTH EUROPEAN OIL ROYALTY TRUST has a high health score of 9/10 with regards to its cashflows and debt, indicating that the company is able to pay off its debt and fund future operations. In addition, NORTH EUROPEAN OIL ROYALTY TRUST is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such companies should consider investing in NORTH EUROPEAN OIL ROYALTY TRUST, as it has the potential to deliver high returns. More…

Summary

North European Oil Royalty Trust (NOR) is an income vehicle investing in oil-rich North European countries, promising high yields and impressive dividends for investors. Investment analysts have observed that the stock of NOR has seen a sharp rise in value in recent months, leading to speculation that now may be the perfect time to invest. Media sentiment has been positive overall, and several experts have pointed to the strong performance of NOR’s underlying assets and the potential for future growth. Investors should look into the growth prospects of the trust, consider their own risk tolerance, and conduct a full analysis before deciding whether to buy into the stock.

Trending News ☀️

HC Wainwright recently announced that they have maintained their Buy rating on Cara Therapeutics, yet adjusted their price target from $30 to $25. The investment firm pointed to Cara’s progress on its lead product, Korsuva, as a key reason for their bullish outlook. In particular, HC Wainwright noted the consistent clinical results that Korsuva has provided in Phase 2 studies and the upcoming Phase 3 data. They also highlighted the potential cost savings that the drug could bring to the healthcare system. Overall, HC Wainwright’s analysis was generally positive in regards to Cara Therapeutics and its prospects in the industry.

The firm believes that Cara is positioned to continue expanding its reach and making strides in drug design, research, and development. While they have reduced their price target, they are still optimistic in the near-term future of the company. Investors should keep a close eye on Cara as they await more news on Korsuva and any other developments in the pipeline.

Price History

On Tuesday, CARA THERAPEUTICS stock opened at $11.1 and closed at $10.7, down by 4.0% from its prior closing price of 11.1. Despite the stock’s drop in price, HC Wainwright has maintained its Buy rating on CARA THERAPEUTICS and adjusted its price target to $25. This suggests that HC Wainwright is still bullish on the future potential of CARA THERAPEUTICS. In addition to the existing Buy rating and the adjusted price target, HC Wainwright sought to recognize the company’s continued efforts to develop novel therapeutics for pain and pruritus management. Live Quote…

Analysis

GoodWhale has conducted an analysis of CARA THERAPEUTICS’ financials and it looks like they have a strong standing in the asset and growth categories. Additionally, they are medium in profitability, but are weak in dividend. Upon further examination of the company’s cashflows and debt, GoodWhale has deemed their health score to be 4/10, meaning they are likely to sustain future operations in times of crisis. Furthermore, CARA THERAPEUTICS is classified as ‘rhino’, indicating that they have achieved moderate revenue or earnings growth. This type of company may be attractive to value investors, who look for companies with strong intrinsic value and an undervalued stock price. Additionally, CARA THERAPEUTICS may also be attractive to growth investors who prioritize potential earnings and cashflows in the future. More…

Summary

Cara Therapeutics Inc. is a biopharmaceutical company that focuses on developing and commercializing pain-relieving medicines. On Tuesday, analysts at HC Wainwright maintained their “Buy” rating for Cara Therapeutics, while adjusting their price target to $25. This rating suggests that Cara Therapeutics could outperform the market and achieve gains in the near future.

Despite this, the stock price dropped on Tuesday following the report’s release. Analysts believe that this could be due to profit taking following the stock’s recent gains.

Trending News ☀️

Mears Group, a leading provider of social housing and care services in the UK, has seen its stock price surpass the 200-day moving average and reach a new high of $199.83. The upward trend in Mears Group’s stock price is no surprise, as the company has recorded strong financial results recently, with healthy profits and increasing revenues. The company has also announced a number of initiatives to enhance its portfolio, including investing in new ventures and signing new contracts. The recent surge in Mears Group’s stock price is also largely attributed to investor confidence in the company’s prospects as it is well-positioned to capitalize on the growth opportunities in the UK’s housing and care services market. Mears is an established player with a strong track record of delivering value to its shareholders, and this latest surge further reinforces investor confidence. The strong performance of Mears Group’s stock price is indicative of the company’s ability to navigate the current market conditions and remain competitive.

The company has invested in technology to improve its efficiency and meet the ever-changing needs of its customers. It has also taken proactive steps to expand its service offerings by entering into new markets and forging strategic partnerships with peers. Overall, the stock price of Mears Group has surpassed the 200-day moving average, reaching a new high of $199.83, and is an encouraging sign for its investors. The strong financial performance and strategic partnerships that the company has entered into demonstrate its commitment to delivering value to its shareholders. As Mears continues to grow and expand, investors can expect its stock price to remain strong in the coming months.

Stock Price

On Wednesday, MEARS GROUP stock opened at £2.1 and closed at £2.1, up by 2.4% from prior closing price of 2.1. Investors have noted that this increase is a sign of confidence in the company’s performance and future outlook. The stock price has continued to climb and is currently at £199.83, demonstrating substantial growth in the past few months. This impressive jump in the stock price also reflects a broader market trend in the industry as a whole, which could further fuel future growth for MEARS GROUP. Live Quote…

Analysis

At GoodWhale we recently conducted an analysis of MEARS GROUP’s fundamentals. Our proprietary Valuation Line suggests that the intrinsic value of the MEARS GROUP share is around £1.9. Currently, the stock is traded at £2.1, meaning there is an 11.4% price premium over the theoretical value of the share. Therefore, we believe the current price of MEARS GROUP is a fair price and slightly overvalued. More…

Summary

Mears Group has seen its stock price soar, recently surpassing its 200 day moving average to reach a new high of $199.83. This indicates a positive trend in the company’s growth, as the average measures a stock’s performance over a period of time. Analysts are optimistic about the company’s prospects and many suggest that investors take advantage of the current market conditions to purchase Mears Group stock. While the stock is still a risk, the steady growth indicates potential for potential investors to find good returns.

Short-term investors should consider diversifying their portfolio and adding Mears Group to it. Long-term investors may also find benefits from investing in the company, as indications are pointing toward a generally positive future outlook.

Trending News ☀️

The California Public Employees Retirement System (CalPERS) has made a major investment in Zai Lab Limited (Zai Lab), a biopharmaceutical company focused on the research, development, and commercialization of novel drugs to transform the treatment of cancer, infectious diseases, and autoimmune disorders. The stock position held by CalPERS in Zai Lab is worth $6.97 million. This investment by CalPERS is part of its strategy to expand its portfolio and become a leader in global investments. CalPERS has identified Zai Lab as a potentially lucrative investment that is well positioned for growth due to its focus on innovative drug development and commercialization. This also allows CalPERS to diversify its portfolio and reduce risk by investing in a different sector from traditional holdings. Zai Lab has an extensive portfolio of drugs in the pipeline aimed at improving patient outcomes with improved treatments. The company has already achieved success with its recent FDA approvals that have allowed several of its therapies to be made available to patients in the US.

In addition, Zai Lab has leveraged its partnerships with large pharmaceutical companies to make its treatments more widely available globally. The $6.97 million investment by CalPERS provides Zai Lab with significant resources to continue to develop new therapies and bring them to market. This is likely to be beneficial for both sides as it gives CalPERS potential returns while giving Zai Lab access to the capital they need to further develop and launch their drugs. Ultimately, this could enable both parties to benefit from increased stock value and new treatments that have the potential to transform the lives of patients worldwide.

Market Price

Monday was a notable day for ZAI LAB, a biopharmaceutical company based in Shanghai, China. Amidst the turbulent news of the current market, the California Public Employees Retirement System (CalPERS) invested $6.97 million in Zai Lab Limited. This news resulted in the company’s stock price shooting up 7.4%, from a closing price of HK$29.6 to HK$31.8 at the end of the trading day. The $6.97 million investment was in the form of an equity investment, and ZAI LAB’s stock rose notably as a result of this news. Live Quote…

Analysis

At GoodWhale, we analysed ZAI LAB’s wellbeing and our results may give some insight about what type of investors may be interested in this company. Our Star Chart depicts that ZAI LAB has an intermediate health score of 5/10 that might indicate it can safely ride out any crisis without the risk of bankruptcy. When looked at the specifics, we found that ZAI LAB is strong in asset and growth, but weak in dividend and profitability. Hence, they are classified as ‘cheetah’, a type of company that achieved high revenue or earnings but is considered less stable because of the lower profitability. In conclusion, these findings make ZAI LAB suitable for investors who are looking for a company with high growth rate and are willing to take the risk of having lower profitability. More…

Summary

Zai Lab Limited has recently seen a significant investment of $6.97 million from the California Public Employees Retirement System (CalPERS), despite the current market conditions which are volatile and fraught with negative news. On the same day of the announcement, the stock price of Zai Lab Limited saw an increase, indicating positive sentiment from investors. This analysis shows that investors remain confident in the long-term potential of Zai Lab Limited and its ability to navigate current market conditions.

Trending News ☀️

SAMSONITE INTERNATIONAL S.A. recently unveiled its collaboration with New Balance in the Asia Pacific region. This partnership brings together the renowned luggage and accessories brand and the renowned sporting goods and lifestyle brand, to deliver an exclusive collection of products to consumers. The collaborative effort will see both Samsonite and New Balance releasing a range of items that combine the strengths of both companies, including travel goods and products for outdoor activities. The range will feature both stylish and functional designs that are sure to appeal to a broad range of customers.

Additionally, all products will be made from high-quality materials and craftsmanship, ensuring maximum performance and durability. The new collection is scheduled to be released sometime in the near future, and it is expected to be a hit among Samsonite and New Balance fans in Asia Pacific. The collaboration combines the two brands’ expertise in their respective fields, and promises to deliver an exciting range of products that will satisfy consumers’ needs for both style and function. Both Samsonite and New Balance are highly respected global brands, and this collaboration is sure to be a great success in the Asia Pacific region. With its combination of quality products, modern designs, and unbeatable performance, the range from this collaboration is sure to be highly sought after by both fashionistas and sports enthusiasts alike.

Stock Price

SAMSONITE INTERNATIONAL S.A recently announced a collaboration with New Balance in Asia Pacific, and the media has thus far responded positively. On Friday, SAMSONITE INTERNATIONAL S.A stock opened at HK$23.6 and closed at the same rate, representing a 0.6% decrease from the previous day’s closing price of 23.8. With the new collaboration in place, the company is expected to gain more exposure ahead. Live Quote…

Analysis

At GoodWhale, we conducted an analysis of SAMSONITE INTERNATIONAL S.A.’s wellbeing. Using our proprietary Valuation Line, we determined that the fair value of SAMSONITE INTERNATIONAL S.A.’s share is around HK$17.7. Currently, SAMSONITE INTERNATIONAL S.A’s stock is being traded at HK$23.6, which is overvalued by 33.3%. It is thus essential to keep an eye on the stock to ensure that it does not appreciates too much or depreciates drastically. Our analysis can help investors make an informed decision on whether to invest in SAMSONITE INTERNATIONAL S.A, and consequently manage their portfolio in the most profitable way. More…

Summary

SAMSONITE INTERNATIONAL S.A., a global luggage manufacturer, recently announced a collaboration with New Balance in Asia Pacific. The collaboration has received positive media exposure, and may be a major investment opportunity. Therefore, this may be a good time to invest in SAMSONITE INTERNATIONAL S.A., as their brand recognition and product portfolio are sure to benefit from this collaboration in the near future.

Trending News ☀️

Adaptimmune Therapeutics plc has recently experienced a surge in investing interest, specifically from Barclays PLC. Barclays PLC has increased its stake in the company to create a stronger financial investment. This increase in investment is seen as a sign of confidence in the company’s potential. Adaptimmune Therapeutics plc is a global biopharmaceutical company that is focused on developing unique T-cell therapies for cancer and other diseases. Its leading therapy platform is generating a promising pipeline of treatments that have the potential to target and treat solid tumors with higher efficacy than existing therapies.

The increase in stake by Barclays PLC not only provides Adaptimmune Therapeutics plc with additional capital, but it also signals growing optimism about the company’s potential for growth and success. This can be seen as a vote of confidence in the company’s unique T-cell therapies, which are paving the way for innovative cancer treatments that have greater efficacy than existing therapies. The increased investment will help Adaptimmune Therapeutics plc to continue to develop its out-of-the-box treatments and grow its global presence in the healthcare industry.

Price History

By the closing bell, Adaptimmune stock opened at $1.6 and closed at the same price, which was 0.6% lower than the prior closing price of $1.7. This could possibly indicate investor uncertainty about the company’s upcoming performance, although it is unclear what other factors may have contributed to the mild drop in stock prices. Nonetheless, Adaptimmune’s prospects look promising as they continue to develop and perfect their innovative therapies. Live Quote…

Analysis

GoodWhale conducted an in-depth analysis of ADAPTIMMUNE THERAPEUTICS‘s growth and profitability. Based on our Star Chart, ADAPTIMMUNE THERAPEUTICS exhibits above-average performance in terms of asset growth, but comes in lower than average when it comes to dividends and profitability. As a result, ADAPTIMMUNE THERAPEUTICS, is classified as a ‘cheetah’ type of company, meaning that they have achieved high revenue or earnings growth, while somehow being relatively unstable due to having lower profitability. Investors interested in such companies are likely to be looking for potential novations and/or quick returns. Additionally, given that ADAPTIMMUNE THERAPEUTICS has an intermediate health score of 4/10 with regards to its cashflows and debt, the investors should look carefully at the company’s ability to sustain future operations in times of crisis. More…

Peers

The company’s T-cell therapy platform harnesses the body’s own immune system to target and kill cancer cells. Adaptimmune’s lead product candidate, ADAPT-101, is in clinical trials for the treatment of solid tumors. The company is also developing product candidates for the treatment of blood cancers. Adaptimmune’s main competitors are Iovance Biotherapeutics Inc, TCR2 Therapeutics Inc, and Adicet Bio Inc. All three companies are developing T-cell therapies for the treatment of cancer.

– Iovance Biotherapeutics Inc ($NASDAQ:IOVA)

Iovance Biotherapeutics Inc is a biopharmaceutical company that focuses on the development and commercialization of cancer immunotherapy products. The company has a market cap of 1.24B as of 2022 and a Return on Equity of -56.45%. The company’s products are based on its proprietary technology platform, which harnesses the power of the body’s immune system to recognize and kill cancer cells. Iovance Biotherapeutics Inc’s products are in clinical and commercial development stages for the treatment of various solid tumor types.

– TCR2 Therapeutics Inc ($NASDAQ:TCRR)

The company’s market cap is 49.48 million as of 2022, a return on equity of -24.78%. The company is focused on the development of immunotherapies for the treatment of cancer.

– Adicet Bio Inc ($NASDAQ:ACET)

Adicet Bio Inc is a clinical stage biopharmaceutical company focused on developing next-generation cell therapies for cancer and other intractable diseases. The company’s lead product candidate, ADI-001, is a universal donor platform cell therapy using allogeneic, or donor-derived, gamma delta T cells that can be used to treat any patient, without the need for human leukocyte antigen (HLA) matching. The company is also developing ADI-002, a natural killer cell therapy platform for the treatment of solid tumors.

Adicet Bio Inc has a market cap of 836.46M as of 2022, a Return on Equity of -9.85%. Adicet Bio is a clinical stage biopharmaceutical company focused on developing next-generation cell therapies for cancer and other intractable diseases. The company’s lead product candidate, ADI-001, is a universal donor platform cell therapy using allogeneic, or donor-derived, gamma delta T cells that can be used to treat any patient, without the need for human leukocyte antigen (HLA) matching. The company is also developing ADI-002, a natural killer cell therapy platform for the treatment of solid tumors.

Summary

Barclays PLC recently increased its stake in Adaptimmune Therapeutics plc, a clinical-stage biopharmaceutical company specialized in the development of novel cancer immunotherapy treatments. Investing analysis shows that the company is focused on designing therapies to target and reprogram the body’s own immune system to fight cancer. Adaptimmune’s most advanced clinical program, NY-ESO SPEAR T-cells, is aimed at treating multiple solid tumor indications raising potential for long-term commercial success.

This potential had been promising to investors, as the Barclays’ investment reflects confidence in Adaptimmune’s vision and product portfolio. While further clinical development is needed to validate this, the current investing analysis suggests that Adaptimmune has gained widespread acknowledgement for its propriety technologies and targeted treatments for cancer patients.

Recent Posts