ATAI Stock Fair Value – ATAI LIFE SCIENCES NV Reports FY2023 Q2 Earnings Results on August 10th 2023

August 26, 2023

🌥️Earnings Overview

On August 10 2023, ATAI LIFE SCIENCES NV ($NASDAQ:ATAI) announced their results for FY2023 Q2, ending on June 30 2023. The company’s total revenue for the quarter was recorded as USD 0.2 million, unchanged from the same quarter one year ago. Net income for the period totaled USD -33.0 million, a decrease of -36.6 million from the same quarter the previous year.

Stock Price

On the same day, the company’s stock opened at $1.8 and closed at $1.7, declining by 2.8% from its prior closing price of $1.8. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ATAI. More…

| Total Revenues | Net Income | Net Margin |

| 0.27 | -145.08 | -54518.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ATAI. More…

| Operations | Investing | Financing |

| -102.28 | 140.12 | 18.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ATAI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 253.59 | 37.96 | 1.28 |

Key Ratios Snapshot

Some of the financial key ratios for ATAI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -53396.0% |

| FCF Margin | ROE | ROA |

| -38087.5% | -40.4% | -35.8% |

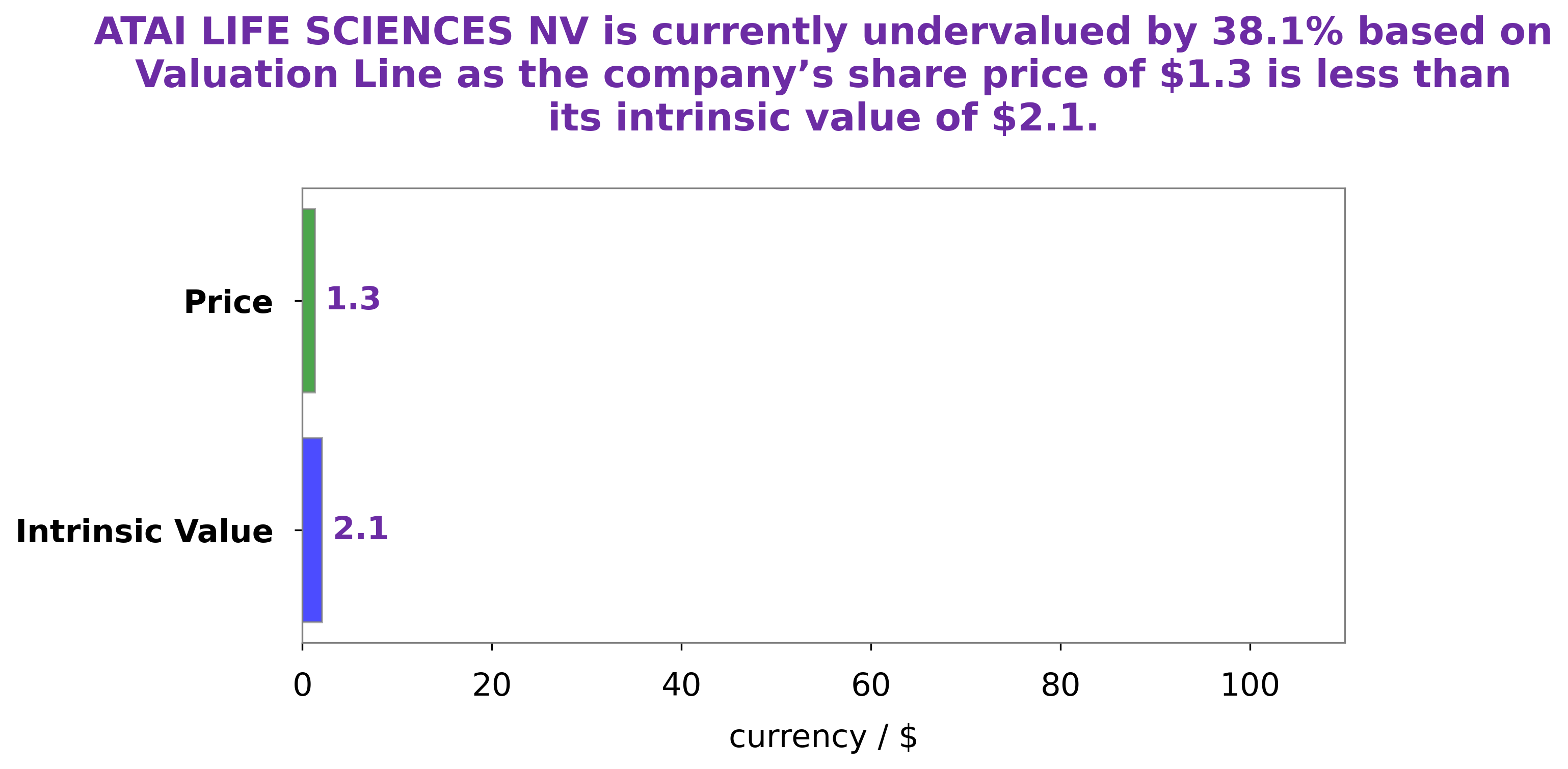

Analysis – ATAI Stock Fair Value

At GoodWhale, we specialize in analyzing the financials of publicly traded companies. We have recently analyzed ATAI LIFE SCIENCES NV, and our proprietary Valuation Line calculated a fair value of around $1.8 per share. At the current stock price of $1.7, ATAI LIFE SCIENCES NV is undervalued by 4.8%. This makes it a great opportunity to invest in ATAI LIFE SCIENCES NV while it is still trading at a discounted price. We recommend taking advantage of this opportunity and investing in ATAI LIFE SCIENCES NV now. More…

Peers

The company’s lead product candidate, ATAI-002, is a proprietary, orally-active small molecule that is being developed for the treatment of depression. ATAI Life Sciences NV has a strategic partnership with Janssen Pharmaceuticals, Inc. for the development and commercialization of ATAI-002. The company’s competitors include Evofem Biosciences Inc, Soligenix Inc, and Aerovate Therapeutics Inc.

– Evofem Biosciences Inc ($NASDAQ:EVFM)

Soligenix is a clinical-stage biopharmaceutical company committed to developing and commercializing therapeutics to treat serious inflammatory conditions and other diseases of the gastrointestinal tract. The company’s lead product candidates are SGX301, an investigational new drug for the treatment of cutaneous T-cell lymphoma, and SGX942, an investigational new drug for the treatment of oral mucositis.

– Soligenix Inc ($NASDAQ:SNGX)

Aerovate Therapeutics Inc is a clinical stage biopharmaceutical company developing gene therapies for the treatment of rare, life-threatening diseases. The company’s most advanced product candidate is AERO-101, an adeno-associated virus (AAV) based gene therapy in development for the treatment of alpha-1 antitrypsin deficiency (AATD). AATD is a rare, inherited disease that can lead to liver damage and lung disease. There are currently no approved treatments for AATD.

Aerovate has a market cap of 513.41M as of 2022 and a return on equity of -15.06%. The company is developing gene therapies for the treatment of rare, life-threatening diseases.

Summary

Investors should take into account the reduced income before making any investing decisions. However, the company’s strong focus on innovation and development could indicate potential for growth in the future, and investors should keep an eye out for further updates from the company. Additionally, their focus on healthcare solutions and products could make them an attractive long-term investment option.

Recent Posts