Wedbush Analysts Increase Earnings Estimates for Celsius Holdings, for FY2023

August 12, 2023

☀️Trending News

Celsius Holdings ($NASDAQ:CELH), Inc. is a leading global health and fitness company that specializes in producing calorie-burning beverages. On Tuesday, Wedbush analysts released a report which significantly increased their forecasted earnings per share for the company’s fiscal year 2023. The report cited a number of factors driving the upgrades to Celsius Holdings’ earnings estimates. These include the company’s strong sales momentum in the first quarter of 2021, the successful launch of several new products, and a robust marketing strategy that has resulted in higher customer acquisition rates. Wedbush analysts also highlighted the potential for Celsius Holdings to benefit from a rebound in the sports and wellness industry due to the recent reopening of many gyms and fitness centers across the US. The report notes that as more people become active and return to their pre-pandemic habits, there will be more demand for Celsius Holdings’ beverages.

In addition, the report points to the company’s ability to capitalize on the rising trend towards healthier lifestyles and healthier beverage choices. Overall, Wedbush analysts have a very positive outlook for Celsius Holdings’ performance in FY2023, and expect the company to continue to capitalize on the current trends in the health and fitness industry. Investors should keep their eyes on Celsius Holdings, as the company is well-positioned to benefit from the long-term growth in the sector.

Earnings

Wedbush Analysts recently increased their earnings estimates for Celsius Holdings, Inc. for FY2023, based on their Q2 2021 earnings report. According to the report, CELSIUS HOLDINGS earned 65.07M USD in total revenue and 3.96M USD in net income for the quarter ending June 30 2021, showing a 57.8% decrease in total revenue and a 56.8% decrease in net income compared to the same period last year. Despite these decreases, CELSIUS HOLDINGS has seen a remarkable growth in total revenue over the past three years, with revenues reaching 325.88M USD for the period. These increases are what have motivated the Wedbush analysts to raise their estimates for CELSIUS HOLDINGS’ FY2023.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Celsius Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 952.02 | -142.27 | -11.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Celsius Holdings. More…

| Operations | Investing | Financing |

| 111.1 | -9.38 | 519.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Celsius Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.4k | 443.7 | 12.44 |

Key Ratios Snapshot

Some of the financial key ratios for Celsius Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 110.0% | – | -6.8% |

| FCF Margin | ROE | ROA |

| 10.3% | -4.4% | -2.9% |

Price History

On Monday, Celsius Holdings, Inc. (CELSIUS HOLDINGS) stock opened at $142.5 and closed at $143.2, up 0.4% from the last closing price of $142.6. This jump in stock price came after Wedbush analysts increased their earnings estimates for the company for fiscal year 2023. Live Quote…

Analysis

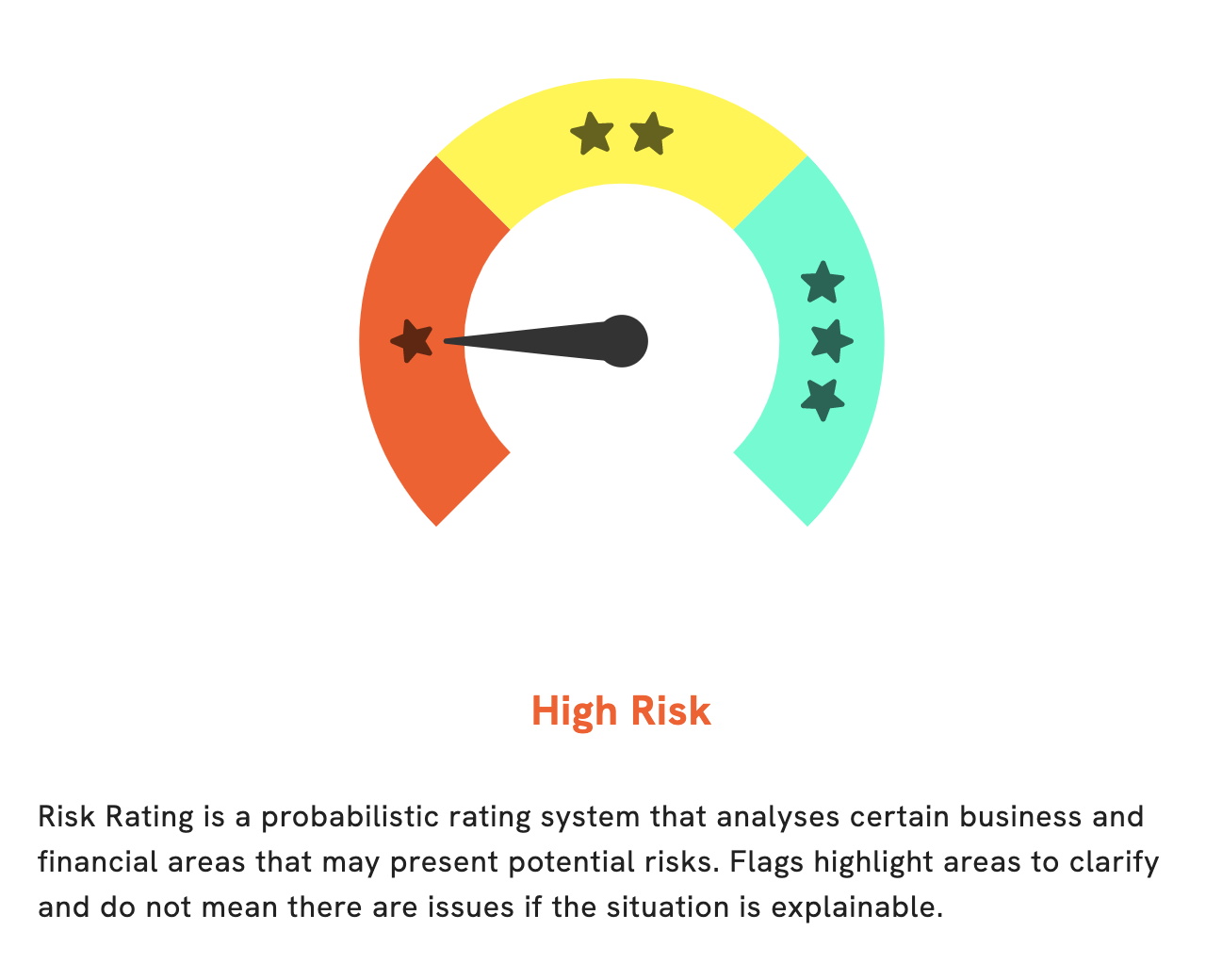

At GoodWhale, we recently conducted an analysis of CELSIUS HOLDINGS‘s wellbeing. Our analysis shows that CELSIUS HOLDINGS is a high risk investment in terms of financial and business aspects. We detected 4 risk warnings in CELSIUS HOLDINGS’s income sheet, balance sheet, cashflow statement, and financial journal. If you are interested in learning more about our findings, please visit goodwhale.com to see an in-depth report. At GoodWhale, we take pride in helping people make informed decisions when it comes to investing. With our comprehensive analysis, you can rest assured that you have all the information you need to make an educated decision about whether to invest in CELSIUS HOLDINGS. We look forward to helping you make investment decisions with confidence. More…

Peers

Celsius Network is a cryptocurrency platform that enables users to earn interest on their digital assets and borrow cash without selling their crypto.

– Monster Beverage Corp ($NASDAQ:MNST)

Beverage Corporation is an American multinational corporation that manufactures, markets, and distributes energy drinks, soda, and juice. The company was founded in 1987 and currently operates in more than 30 countries. Beverage Corporation’s products are sold under the Monster Energy, Hansen’s Natural, and Lost Energy brands. In addition to its own brands, the company also distributes and markets products from other companies, such as Red Bull and Rockstar.

Beverage Corporation has a market capitalization of 53.82 billion as of 2022 and a return on equity of 14.71%. The company’s products are sold in more than 30 countries and its brands include Monster Energy, Hansen’s Natural, and Lost Energy.

– Coca-Cola Co ($NYSE:KO)

Coca-Cola Co has a market cap of 269.63B as of 2022. It is a publicly traded company with a 35.17% return on equity. The company is headquartered in Atlanta, Georgia, and is a provider of nonalcoholic beverages.

– PepsiCo Inc ($NASDAQ:PEP)

PepsiCo Inc is a food and beverage company with a market cap of 254.66B as of 2022. The company has a Return on Equity of 45.25%. PepsiCo Inc is a food and beverage company with a portfolio of brands that includes Pepsi, Gatorade, Quaker, and Tropicana. The company operates in more than 200 countries and employs more than 285,000 people.

Summary

Investment analysts at Wedbush have recently increased their earnings per share estimates for Celsius Holdings, Inc. for the fiscal year of 2023. This is seen as a positive sign for investors considering Celsius as an investment option, as it indicates that analysts are predicting good earnings growth for the company in the upcoming years. It is wise for potential investors to consider the long-term outlook for Celsius and research its financial performance and business strategies before investing. Analysts recommend keeping an eye on the company’s progress in terms of research and development, product launches, and executive changes, as these factors can all influence the company’s future prospects.

Recent Posts