Nongfu Spring Stock Intrinsic Value – 337.2K Shares of NONGFU SPRING Traded at HK$41.85, Turnover of HK$14.112M in Bearish Block Trade

May 14, 2023

Trending News 🌧️

On Tuesday afternoon, a block trade of 337.2K shares of NONGFU SPRING ($SEHK:09633) was conducted at a price of HK$41.85, resulting in a turnover of HK$14.112M. This bearish sentiment was noted as the stock had dropped to its lowest level in the past three months. NONGFU SPRING is a Hong Kong-listed beverage manufacturer and distributor from the Chinese mainland. It remains to be seen how this will affect the stock’s price in the coming weeks, as investors keep a close eye on the company’s situation.

Stock Price

The stock opened at HK$42.8 and closed at HK$41.8, recording a 2.1% decrease from the prior closing price of HK$42.8. It is apparent that the sentiment towards NONGFU SPRING was bearish on this day. Many active traders were taking the opportunity to take profit or reduce their exposure to the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nongfu Spring. More…

| Total Revenues | Net Income | Net Margin |

| 33.24k | 8.5k | 25.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nongfu Spring. More…

| Operations | Investing | Financing |

| 12.04k | -9.43k | -5.37k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nongfu Spring. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 39.25k | 15.17k | 1.79 |

Key Ratios Snapshot

Some of the financial key ratios for Nongfu Spring are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.4% | 14.9% | 33.5% |

| FCF Margin | ROE | ROA |

| 23.1% | 31.4% | 17.7% |

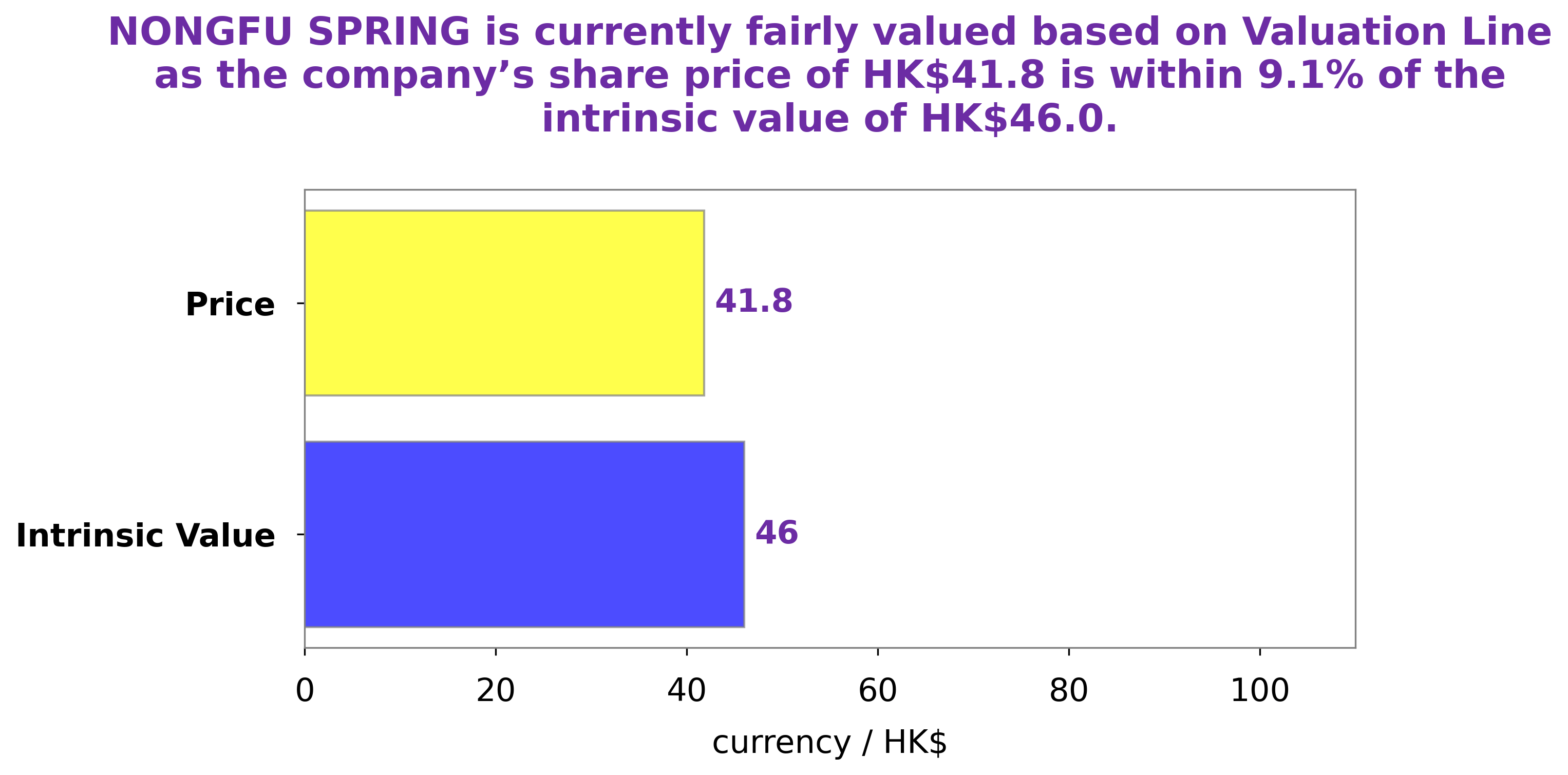

Analysis – Nongfu Spring Stock Intrinsic Value

At GoodWhale, we recently conducted an analysis of NONGFU SPRING‘s wellbeing. After meticulously examining their financials, we concluded that NONGFU SPRING’s intrinsic value is around HK$46.0, which we calculated using our proprietary Valuation Line. Currently, NONGFU SPRING stock is traded at HK$41.8, a fair price that is undervalued by 9.1%. This represents a great opportunity for potential investors to capitalize on this good bargain. We believe it is a good time to buy the stock of NONGFU SPRING and benefit from its potential gains in the future. More…

Peers

Nongfu Spring Co Ltd is a leading bottled water company in China. It has a wide range of products and a strong distribution network. The company competes with Nakamuraya Co Ltd, Oceanic Beverages Co Inc, and PT Tri Banyan Tirta Tbk.

– Nakamuraya Co Ltd ($TSE:2204)

Nakamuraya Co Ltd is a Japanese company that operates in the food and beverage industry. The company has a market cap of 18.57B as of 2022 and a Return on Equity of 1.04%. Nakamuraya is best known for its popular line of traditional Japanese sweets and snacks. The company has a long history, dating back to the Meiji period, and its products are popular both in Japan and overseas.

– Oceanic Beverages Co Inc ($TWSE:1213)

Oceanic Beverages Co Inc is a company that manufactures and sells beverages. It has a market cap of 391.26M as of 2022 and a Return on Equity of -13.78%. The company has been in business for over 100 years and is headquartered in the United States.

– PT Tri Banyan Tirta Tbk ($IDX:ALTO)

PT Tri Banyan Tirta Tbk is one of Indonesia’s leading integrated water companies. It has a market cap of 370.43B as of 2022. The company is engaged in the exploration, development, production, distribution and sale of water for domestic, industrial and commercial use. It also has a wastewater treatment business. The company has a strong presence in the Indonesian water market and is expanding its operations to other countries in Southeast Asia.

Summary

Investors in NONGFU SPRING should take note of a bearish block trade which occurred on 04:08p.m. on the Hong Kong Stock Exchange. Analysts are expecting a downward trend for NONGFU SPRING, due to the bearish sentiment of this large trade. Investors should look out for further news regarding the company, and updates on its overall performance. It is important to thoroughly review all available financial information before making any investment decisions in this stock.

Recent Posts