TPX.B stock dividend – MOLSON COORS Canada Inc Announces 0.41 Cash Dividend

March 19, 2023

Dividends Yield

On March 1, 2023, MOLSON COORS Canada Inc announced a 0.41 cash dividend to be paid to all shareholders. This dividend represents a 1.5 USD dividend per share and a 2.87% dividend yield for the year 2022-2023. For investors interested in dividend stocks, this announcement provides an opportunity to invest in a reliable and profitable company. MOLSON COORS CANADA ($TSX:TPX.B) is one of the largest and most successful beer companies in the world. The company has a long-standing history of providing quality beverages and has been an attractive option for investors looking for dividend stocks.

With a consistent dividend payout and a strong track record of success, MOLSON COORS CANADA is a viable option for those looking to build a portfolio of dividend stocks. The dividend payment is just one of the ways that MOLSON COORS CANADA continues to be a leader in the industry. The company also provides a variety of products and services that make it an attractive choice for customers, including extensive marketing campaigns and innovative product development strategies.

Share Price

The stock opened at CA$72.4 and closed at the same price, with no significant changes on the day’s trading. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TPX.B. More…

| Total Revenues | Net Income | Net Margin |

| 10.7k | -175.3 | 3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TPX.B. More…

| Operations | Investing | Financing |

| 1.5k | -625.1 | -889.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TPX.B. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.87k | 12.95k | 58.67 |

Key Ratios Snapshot

Some of the financial key ratios for TPX.B are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | -11.1% | 1.8% |

| FCF Margin | ROE | ROA |

| 7.9% | 0.9% | 0.5% |

Analysis

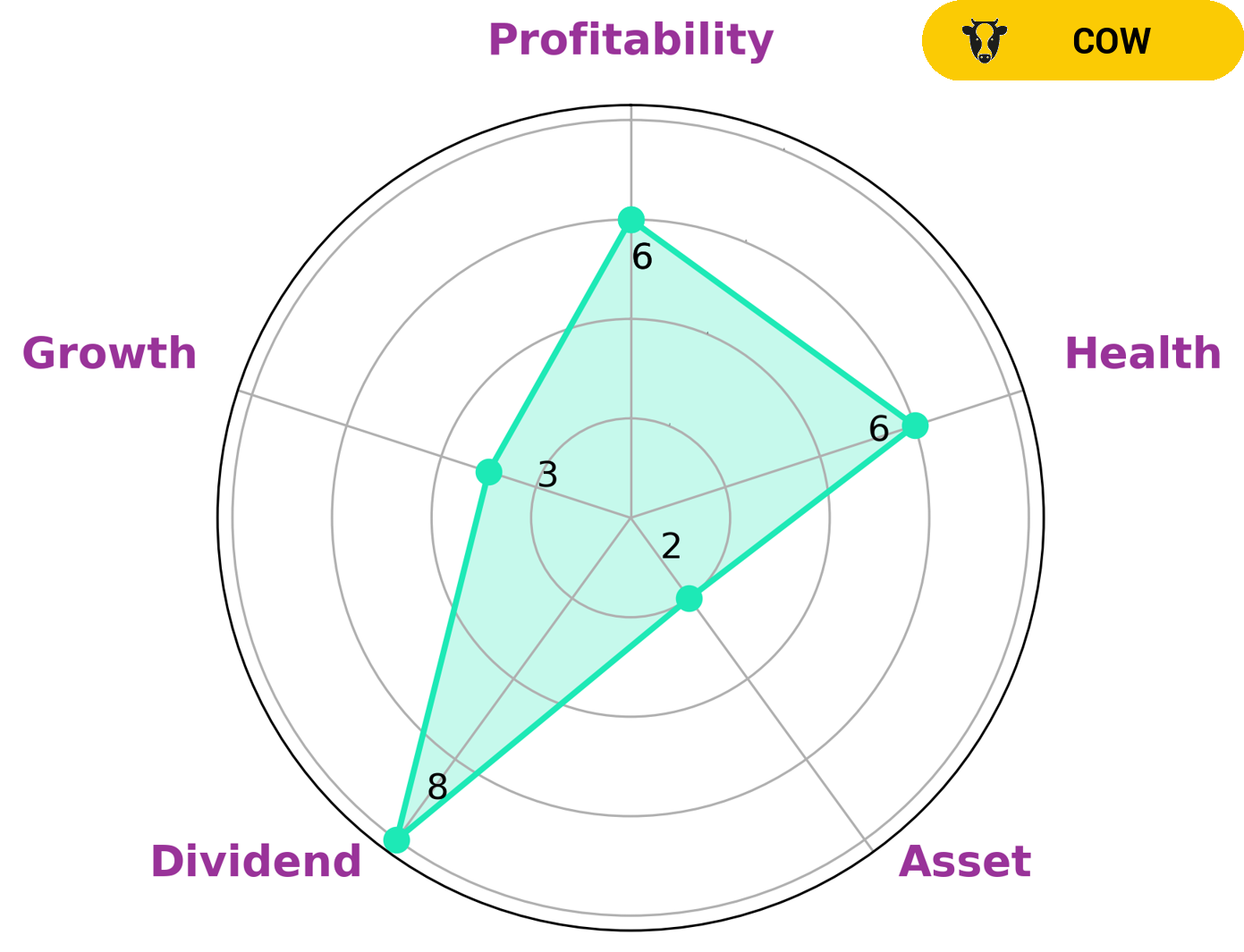

GoodWhale recently conducted an analysis of MOLSON COORS CANADA’s wellbeing. Our Star Chart showed that MOLSON COORS CANADA has an intermediate health score of 6/10 considering its cashflows and debt, which may indicate that they could sustain future operations in times of crisis. After reviewing the company’s performance, we classified MOLSON COORS CANADA as a ‘cow’, meaning it has the track record of paying out consistent and sustainable dividends. This could make the company attractive to investors looking for investments that provide a steady income. Overall, MOLSON COORS CANADA is strong in dividend, medium in profitability and weak in asset and growth. This combination of performance indicators may be attractive to investors who are looking for investments that provide a stable return but do not require significant growth investments. More…

Peers

Molson Coors Canada Inc is one of the world’s leading brewers, competing in a crowded market with companies such as Heineken Holding NV, Molson Coors Beverage Co, and Carlsberg A/S. These companies are major players in the global beer industry, producing popular brands that are found in bars, restaurants, and stores worldwide. With its strong portfolio of brands, Molson Coors has carved out a competitive position among these giants, offering quality beer and other beverages to consumers around the world.

– Heineken Holding NV ($LTS:0NBD)

Heineken Holding NV is a Netherlands-based company engaged in the production and distribution of beer. It is one of the world’s leading brewers and has a portfolio of over 250 international, regional, local and specialty beers. As of 2023, the company has a market cap of 23.15 billion dollars and a Return on Equity (ROE) of 30.35%. This indicates that Heineken Holding NV is generating favorable returns on capital employed, indicating strong financial performance. The company’s strong financial performance over the years has enabled it to attract more investors and expand its business operations.

– Molson Coors Beverage Co ($NYSE:TAP)

Molson Coors Beverage Co is an international brewing company that produces beer, alcohol and non-alcoholic beverages. The company has a market cap of 10.83 billion as of 2023 and a return on equity of 0.91%. This market cap indicates the overall value of the company and its ability to generate profits from its operations. The return on equity shows the company’s ability to generate returns from invested capital and its effectiveness at utilizing shareholders’ funds. The company has a diversified portfolio of brands and has operations in the US, Canada, Europe and beyond.

– Carlsberg A/S ($OTCPK:CABHF)

Carlsberg A/S is a Danish brewing company with a market cap of 20.7 billion US dollars as of 2023. The company produces some of the world’s most popular beer brands, such as Carlsberg, Tuborg, Somersby, and 1664. Carlsberg A/S has a strong and profitable financial performance, as evidenced by its return on equity (ROE) of 20.4%. This indicates that the company is able to convert its shareholders’ investments into cash rewards quickly and efficiently. The company has also continued to make investments in acquisitions and expansion, which reflects its commitment to growth and market opportunities.

Summary

Molson Coors Canada is an attractive option for investors looking for dividend income. Over the past three years, the company has consistently paid a dividend of 1.5 USD per share for a yield of 2.87%. The company is well established and has a history of steady dividend payments, making it an ideal choice for conservative investors. For those looking for more growth potential, the company’s wide array of products and extensive market reach make it a sound investment.

Additionally, with its strong financial performance, Molson Coors Canada is well positioned to continue to reward investors with regular dividend payments in the future.

Recent Posts