Asahi Group Holdings, Ltd. Stock Price Reaches Record High of 2502 in 2023

March 14, 2023

Trending News ☀️

The stock price of Asahi Group ($TSE:2502) Holdings, Ltd. has recently reached a record high of 2502 in 2023. Asahi Group Holdings, Ltd. is a diversified conglomerate with interests in food, beverage, and pharmaceuticals, and its businesses have been driving the company’s success over the past few years. The stock price of 2502 is the highest price achieved to date and it is a testament to the strong performance of the company. Asahi Group Holdings, Ltd. has maintained strong financial health throughout its growth and continues to invest in new projects to ensure its long-term success. The company’s forward-thinking strategy has enabled it to successfully navigate difficult times and capitalize on opportunities in the markets.

The recent surge in Asahi Group Holdings, Ltd. stock price is also reflective of the positive sentiments surrounding the company’s products and services, as well as its commitment to sustainability initiatives. Investors have shown increasing confidence in the company’s ability to generate returns and maintain its competitive advantage in the industry. Asahi Group Holdings, Ltd. also continues to invest in research and development to bring innovative products and services to the market. The company is well-positioned to become a leader in its respective industries, and investors should be confident that they are investing in a sound business with a bright future ahead.

Share Price

The Asahi Group has seen a surge in stock prices over the past few years, due to its consistent performance and strong financial standing. This growth has allowed them to expand and improve their product offerings, as well as boost their presence in key international markets. This milestone is a testament to the company’s commitment to long-term growth and stability, and their ability to maintain a competitive edge in the global market. As the stock continues to rise, it is likely that investors will remain confident in the company’s success for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Asahi Group. More…

| Total Revenues | Net Income | Net Margin |

| 2.47M | 143.39k | 5.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Asahi Group. More…

| Operations | Investing | Financing |

| 268.64k | -51.52k | -238.63k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Asahi Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.91M | 2.82M | 4.07k |

Key Ratios Snapshot

Some of the financial key ratios for Asahi Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | -0.4% | 8.5% |

| FCF Margin | ROE | ROA |

| 6.9% | 6.3% | 2.7% |

Analysis

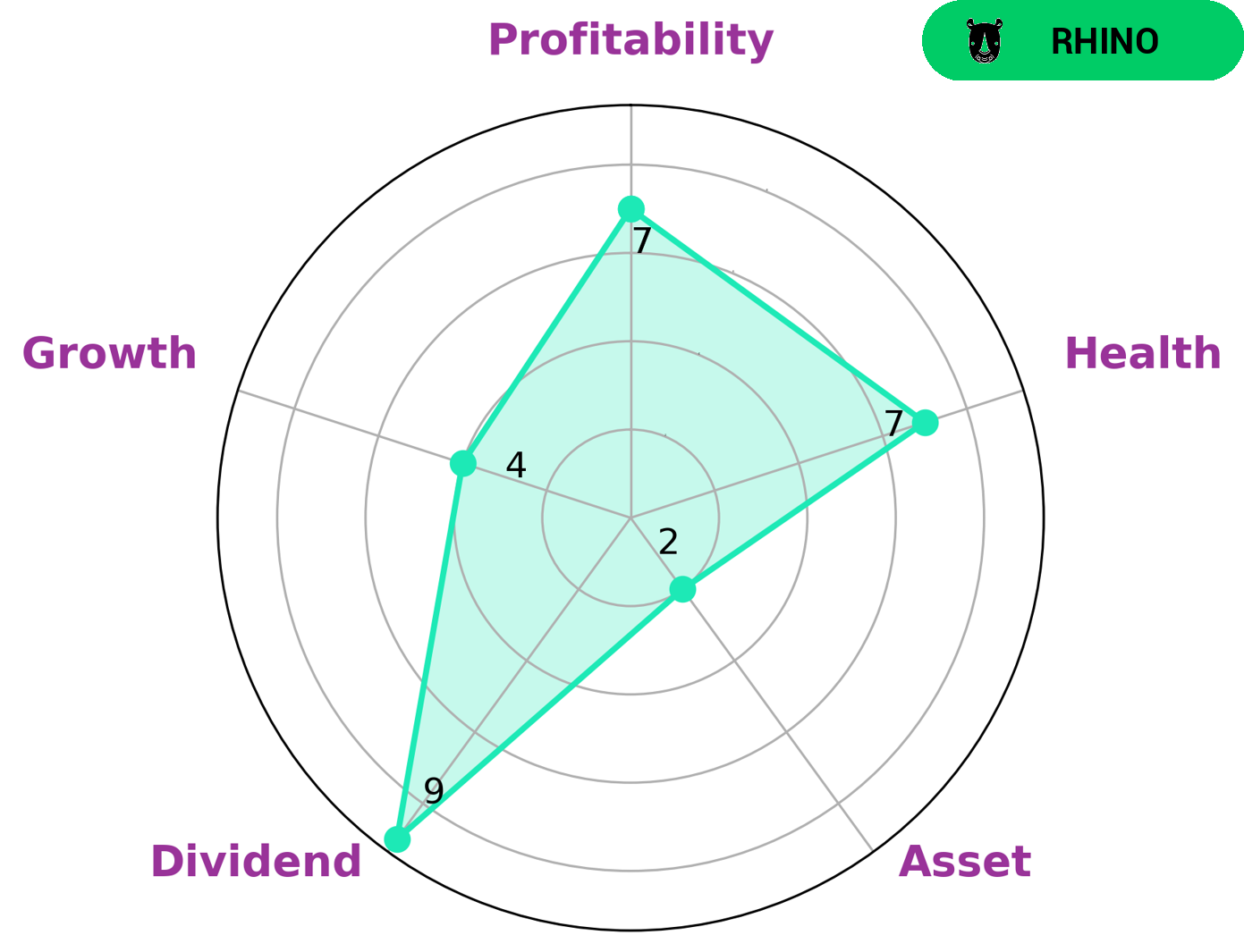

GoodWhale recently conducted an analysis of ASAHI GROUP‘s well-being. The Star Chart reveals that ASAHI GROUP is strong in dividend and profitability, and medium in growth. Unfortunately, the company is weak in asset. As a result, ASAHI GROUP is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Comparing their performance to other companies, ASAHI GROUP has a high health score of 7/10 with regard to its cashflows and debt. This means that ASAHI GROUP is capable to sustain future operations in times of crisis. With that said, this would be an attractive investment opportunity for conservative investors such as pension funds, mutual funds, and individual investors who are looking for steady returns over a long-term period. More…

Peers

It is one of the leading beverage companies in the world, competing with other major companies such as Budweiser Brewing Co APAC Ltd, Kirin Holdings Co Ltd, and Carlsberg A/S. Asahi Group Holdings Ltd has a wide range of products, including beer, soft drinks, bottled water, and alcoholic beverages. The company is committed to providing quality products and services to its customers around the world.

– Budweiser Brewing Co APAC Ltd ($SEHK:01876)

Budweiser Brewing Co APAC Ltd is a leading beer and beverage company operating in the Asia Pacific region. As of 2023, it had a market capitalization of 334.39 billion USD, making it one of the largest companies in the region. It also has an impressive Return on Equity (ROE) of 8.39%, which is higher than the industry average. The company is known for its wide range of products, including Budweiser beer and other popular beverages. It is also renowned for its commitment to sustainability and responsible practices. In addition, Budweiser Brewing Co APAC Ltd has a strong presence in the region and has established a loyal customer base.

– Kirin Holdings Co Ltd ($TSE:2503)

Kirin Holdings Co Ltd is a Japanese beverage and food company. It is the second largest beer producer in Japan and has a significant presence in the global beer market. As of 2023, Kirin Holdings Co Ltd had a market capitalization of 1.61T, making it one of the largest companies in Japan. The company also had a Return on Equity of 13.05%, indicating that the company is returning a good rate of return to its shareholders. The company has diversified operations in food and beverages, and also has international operations in Asia, Europe and North America.

– Carlsberg A/S ($OTCPK:CABHF)

Carlsberg A/S is a leading global brewer with a market cap of 20.54B as of 2023. It is one of the world’s largest brewers, with over 150 brands in over 150 countries. Carlsberg A/S’ strong financial performance is reflected in its impressive return on equity (ROE) of 18.81%. The company has consistently generated strong returns for its shareholders and is committed to rewarding them with dividends and share repurchases. In addition, Carlsberg A/S has a strong portfolio of beer and non-alcoholic brands, as well as an extensive international presence that allows it to grow quickly in new markets.

Summary

Asahi Group Holdings, Ltd. has seen its stock price skyrocket in 2023, reaching a record high of 2502. Investors are attracted to Asahi Group’s strong and consistent financial performance, with increased revenues and profits in recent years. Furthermore, the company’s diversified portfolio, which covers a wide range of industries as well as its consistent dividend payments to shareholders, have made it an attractive option for investors looking for long-term growth.

Analysts point to the company’s ability to navigate challenging business environments as well as its capacity to adapt quickly to shifting trends in order to remain competitive in the global market. Asahi Group is seen as a reliable and profitable investing option with a bright future.

Recent Posts