CWB dividend yield – Canadian Western Bank Declares 0.32 Cash Dividend

March 24, 2023

Dividends Yield

On March 3, 2023, Canadian Western Bank ($TSX:CWB) declared a 0.32 cash dividend to shareholders. This makes it a great choice for those investors seeking dividend-paying stocks. Over the past three years, the bank has maintained an impressive dividend yield rate of 3.76%, which amounts to an annual dividend per share of 1.22 CAD.

The ex-dividend date for the upcoming year is March 8, 2023. This provides investors with a great opportunity to benefit from the company’s steady and reliable dividend payout.

Stock Price

On Friday, the stock opened at CA$26.5 and closed at CA$26.8, up by 1.7% from last closing price of 26.3. This dividend is an indication of the strong financial performance of the bank, as well as its consistent growth in the past few quarters. The board of directors has also announced a stock repurchase program to boost shareholder value.

This move indicates a healthy capital structure and a long-term vision for the bank’s future growth. With this dividend, CANADIAN WESTERN BANK is further cementing its position as one of the most successful banks in Canada. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CWB. More…

| Total Revenues | Net Income | Net Margin |

| – | 317.02 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CWB. More…

| Operations | Investing | Financing |

| 764.25 | -911.97 | 152.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CWB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 41.71k | – | – |

Key Ratios Snapshot

Some of the financial key ratios for CWB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.7% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

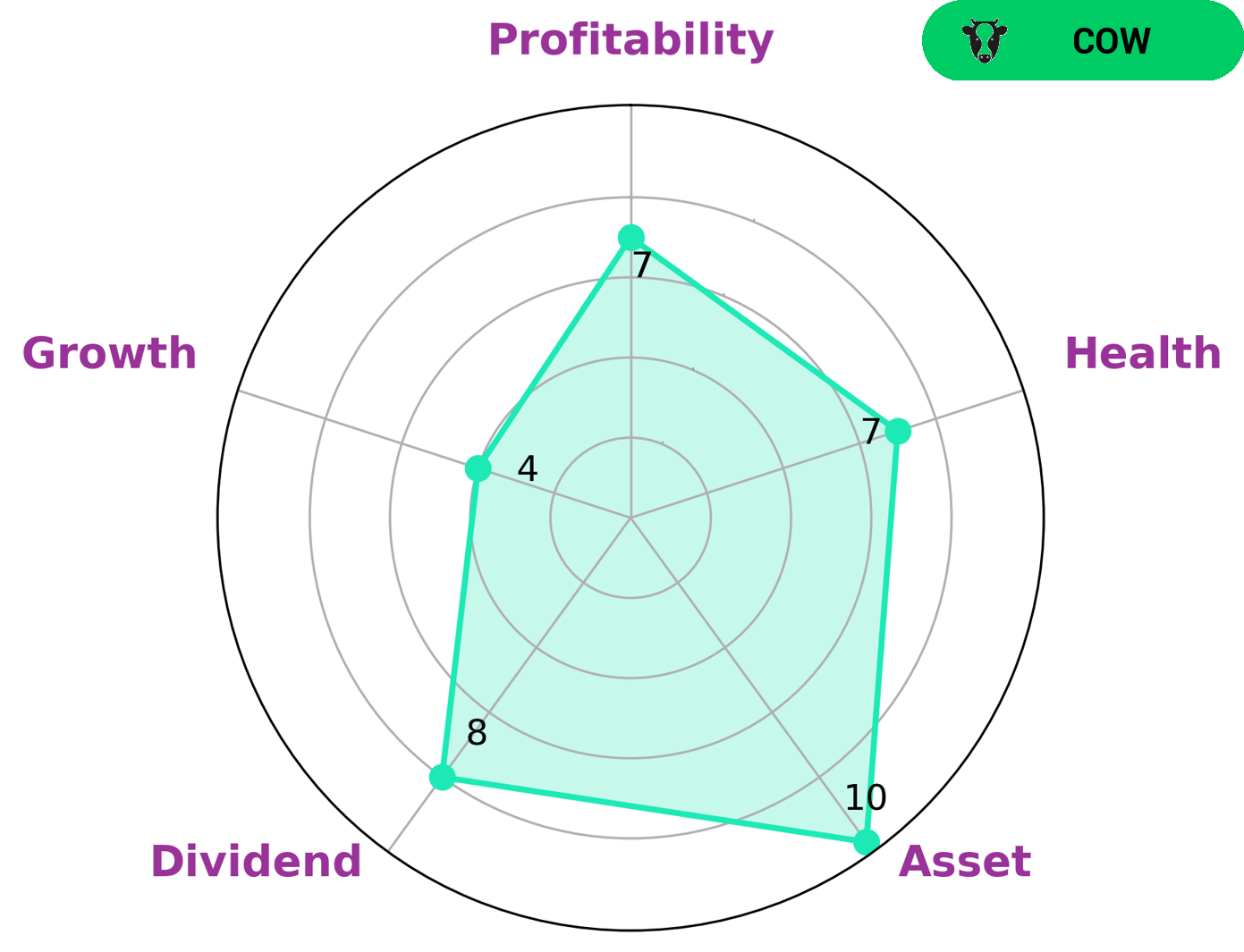

GoodWhale recently conducted an analysis of Canadian Western Bank’s wellbeing, and carried out a Star Chart to determine its classification. We concluded that Canadian Western Bank is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are looking for reliable dividends and long-term income streams may be interested in such companies. In terms of its financial health score, Canadian Western Bank scored 7/10 due to its strong cashflows and manageable debt. This indicates that the company is capable to pay off debt and is able to fund future operations. Moreover, in terms of its Star Chart, Canadian Western Bank is strong in profitability, asset, dividend, and medium in growth. More…

Peers

In this highly competitive market, Canadian Western Bank strives to stay ahead of its competitors by providing superior customer service and innovative financial solutions.

– First Financial Bancorp ($NASDAQ:FFBC)

First Financial Bancorp is a Cincinnati-based bank holding company with over $10 billion in assets. The company operates through its subsidiary, First Financial Bank, and provides full-service banking services to individuals and businesses. As of 2022, First Financial Bancorp has a market cap of 2.31 billion, making it one of the largest banking companies in the Cincinnati area. The company’s stock has consistently been performing well and has seen a steady increase in market capitalization over the past few years.

– Hope Bancorp Inc ($NASDAQ:HOPE)

Hope Bancorp Inc. is a financial holding company that provides a wide range of banking services through its banking subsidiaries. As of 2022, the company has a market cap of 1.56B, making it one of the largest regional banks in the United States. The company’s operations are focused on commercial banking, consumer banking, small business banking and wealth management services. Hope Bancorp Inc has been in business since 1975 and has grown to be one of the leading regional banks in the United States. It operates in California, Washington, Oregon, and Texas and has more than $20 billion in assets. The company provides its customers with competitive products and services, including lending, deposit accounts, cash management, and trust services. Its services are tailored to meet the unique needs of its customers and the communities it serves.

Summary

CANADIAN WESTERN BANK is an attractive stock for dividend investors. Over the past three years, it has paid out an average dividend per share of 1.22 CAD, providing a yield of 3.76%. The stock has been stable over the same period and offers a steady dividend payout.

The dividend is also higher than the industry average. It is important to note, however, that past performance is not a guarantee of future returns and that investors should consider other factors when making their investing decisions.

Recent Posts