Citizens Financial Commits to Enhancing Financial Well-Being with $2M Donation

April 6, 2023

Trending News 🌥️

CITIZENS FINANCIAL ($NYSE:CFG), a U.S.-based financial services company, has announced a major donation of $2M to support financial empowerment. CITIZENS FINANCIAL provides banking and financial solutions to individuals and businesses throughout the United States, offering a wide range of products and services including retail banking, mortgage banking, and investment management. This donation marks the latest commitment to enhancing the financial well-being of its customers, an initiative that aligns with CITIZENS FINANCIAL’s long-term mission to create more financially empowered individuals and communities. The $2M will go toward educating and providing resources for those who might not otherwise have access to the necessary knowledge and information to make sound financial decisions. The donation will also support research, both internally within CITIZENS FINANCIAL and in partnership with leading organizations, on how to best use technology to increase access to financial tools and resources.

It will help create more accessible and transparent products that meet customers’ needs and provide the best experience possible. In addition to its direct contribution, CITIZENS FINANCIAL is looking for other ways to support the financial well-being of its customers, including collaborating with existing organizations that are already providing resources to underserved individuals and communities. CITIZENS FINANCIAL’s commitment to enhancing the financial well-being of its customers demonstrates its dedication to creating a brighter future for everyone.

Market Price

This commitment demonstrates the company’s dedication to helping individuals and communities reach their financial goals. As part of this commitment, CITIZENS FINANCIAL will be donating to multiple organizations that focus on improving the financial literacy and well-being of individuals and communities. The stock opened at $28.6 and closed at $28.6, down by 1.9% from last closing price of 29.2, demonstrating the company’s commitment to financial well-being and investing in the community. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Citizens Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 1.96k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Citizens Financial. More…

| Operations | Investing | Financing |

| 4.12k | -12.64k | 9.91k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Citizens Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 226.73k | 203.04k | – |

Key Ratios Snapshot

Some of the financial key ratios for Citizens Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

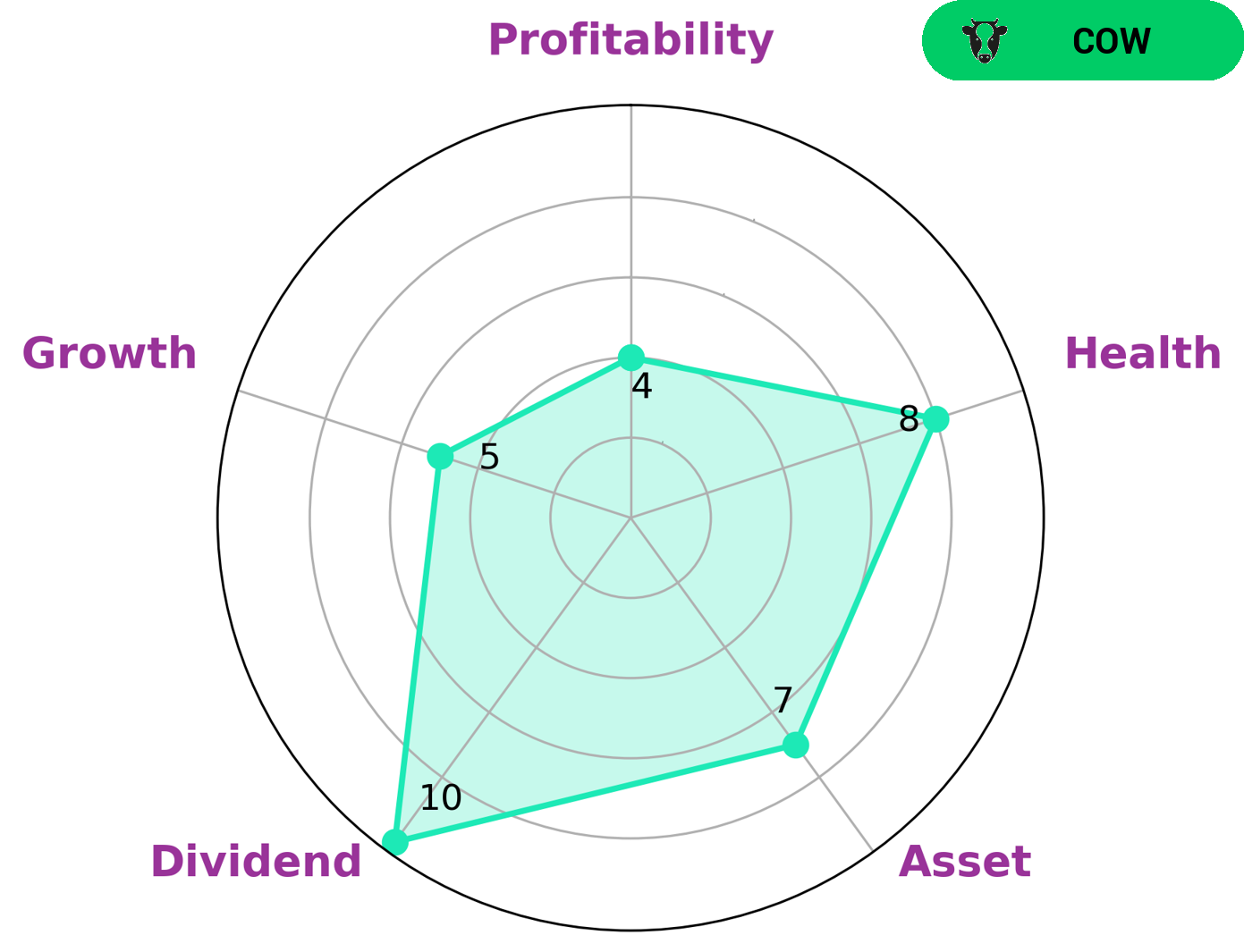

GoodWhale has analyzed CITIZENS FINANCIAL‘s fundamentals and according to our Star Chart, the company is classified as a ‘cow’. This means it has a track record of paying out consistent and sustainable dividends. This type of company may be attractive to investors who are looking for steady income from dividends. CITIZENS FINANCIAL is particularly strong in asset and dividend metrics, but also has a medium rating in terms of growth and profitability. Furthermore, it has a high health score of 8/10 considering its cashflows and debt, which shows that it is capable of paying off debts and funding future operations. Therefore, investors looking for reliable income streams may find this stock attractive. More…

Peers

In recent years, the banking industry has become increasingly competitive. This is especially true for regional banks, which are facing increased competition from larger banks as well as online-only banks. Citizens Financial Group is one of the largest regional banks in the United States, with over $150 billion in assets. The company operates in more than 20 states and has over 1,200 branches. Its main competitors are NBT Bancorp, Keiyo Bank, and Southern Missouri Bancorp. All three of these banks are smaller than Citizens, but they have been growing rapidly in recent years.

– NBT Bancorp Inc ($NASDAQ:NBTB)

NBT Bancorp Inc. is a financial holding company that operates through its subsidiaries, which include NBT Bank, NBT Insurance Agency, and Penn Square Partners. The company has a market capitalization of $1.84 billion as of 2022. NBT Bancorp is headquartered in Norwich, New York and has more than 160 branches across upstate New York, northwestern Vermont, western Massachusetts, and northeastern Pennsylvania. The company’s primary business activities include commercial banking, retail banking, and asset management.

– Keiyo Bank Ltd ($TSE:8544)

Keiyo Bank Ltd is a Japanese bank with a market cap of 62.52B as of 2022. The company has over 2,000 branches and provides banking services to individuals and businesses. Services include savings and checking accounts, loans, credit cards, and investment products.

– Southern Missouri Bancorp Inc ($NASDAQ:SMBC)

Southern Missouri Bancorp Inc is a bank holding company that operates through its subsidiary, Southern Bank. The company offers a range of banking services to clients in Missouri, Arkansas, and Tennessee. As of 2022, the company had a market cap of 499 million dollars.

Summary

Citizens Financial Group recently announced plans to contribute $2 million to support financial empowerment initiatives in the communities it serves. The funds will be invested in programs focused on increasing financial literacy, expanding access to affordable loans and credit, and providing economic opportunities for underserved populations. Additionally, the company will work with local governments and community partners to develop innovative solutions to financial issues. Citizens Financial aims to help people across the country build a brighter financial future through responsible investment and education.

Recent Posts