Sunfonda Group Holdings Shareholders Suffer 31% Loss in 2023 as Earnings Decline.

March 11, 2023

Trending News 🌧️

Sunfonda Group ($SEHK:01771) Holdings, one of the world’s largest holding companies, has seen a significant reduction in its shareholders’ value over the past year. This substantial 31% loss in value has been attributed to a sharp decline in earnings over the same period. Despite the company’s attempts to combat this issue, its efforts have proven ineffective, resulting in a significant erosion of shareholder value. The main cause of this decline in earnings is a decrease in the demand for Sunfonda Group’s services and products. This decrease is due to a combination of factors, such as increased competition, changing market trends, and unfavorable macroeconomic conditions. Additionally, the company has been unable to take advantage of new opportunities due to a lack of capital and resources. Sunfonda Group’s management has responded to this situation by attempting to reduce costs and increase efficiency.

However, these efforts have not been enough to offset the decline in revenue and earnings. As a result, shareholders have suffered considerable losses over the past year. Despite these losses, Sunfonda Group Holdings remains committed to improving their financial performance and restoring its shareholders’ confidence in the company. Management is currently focused on mitigating the effects of the current economic downturn and developing new products that will drive future earnings. With an effective strategy and implementation, Sunfonda Group Holdings aims to restore its profitability and provide its shareholders with a positive return on their investments in the coming years.

Price History

Friday was a difficult day for Sunfonda Group Holdings shareholders as the company’s shares suffered a 31% drop in value. This dramatic decrease in earnings and share price came as a surprise to the majority of the market, with news coverage mostly mixed. At the open of trading on Friday, shares of Sunfonda Group Holdings opened at HK$1.2 and closed at HK$1.2, representing a 31% decrease in value from the start of the day. This stark decrease was due to the company’s failure to meet expectations for earnings and caused shareholders to suffer heavy losses.

The market’s response to this news was mixed, with some analysts optimistic of the company’s future prospects and others expressing concern over its current financial situation. While many investors sold their shares in response to this news, some held onto their investments and remain hopeful for a turnaround. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sunfonda Group. More…

| Total Revenues | Net Income | Net Margin |

| 10.67k | 203.06 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sunfonda Group. More…

| Operations | Investing | Financing |

| -31.28 | -227.63 | 442.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sunfonda Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.2k | 3.72k | 4.13 |

Key Ratios Snapshot

Some of the financial key ratios for Sunfonda Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.8% | 234.4% | 3.7% |

| FCF Margin | ROE | ROA |

| -5.2% | 10.0% | 4.0% |

Analysis

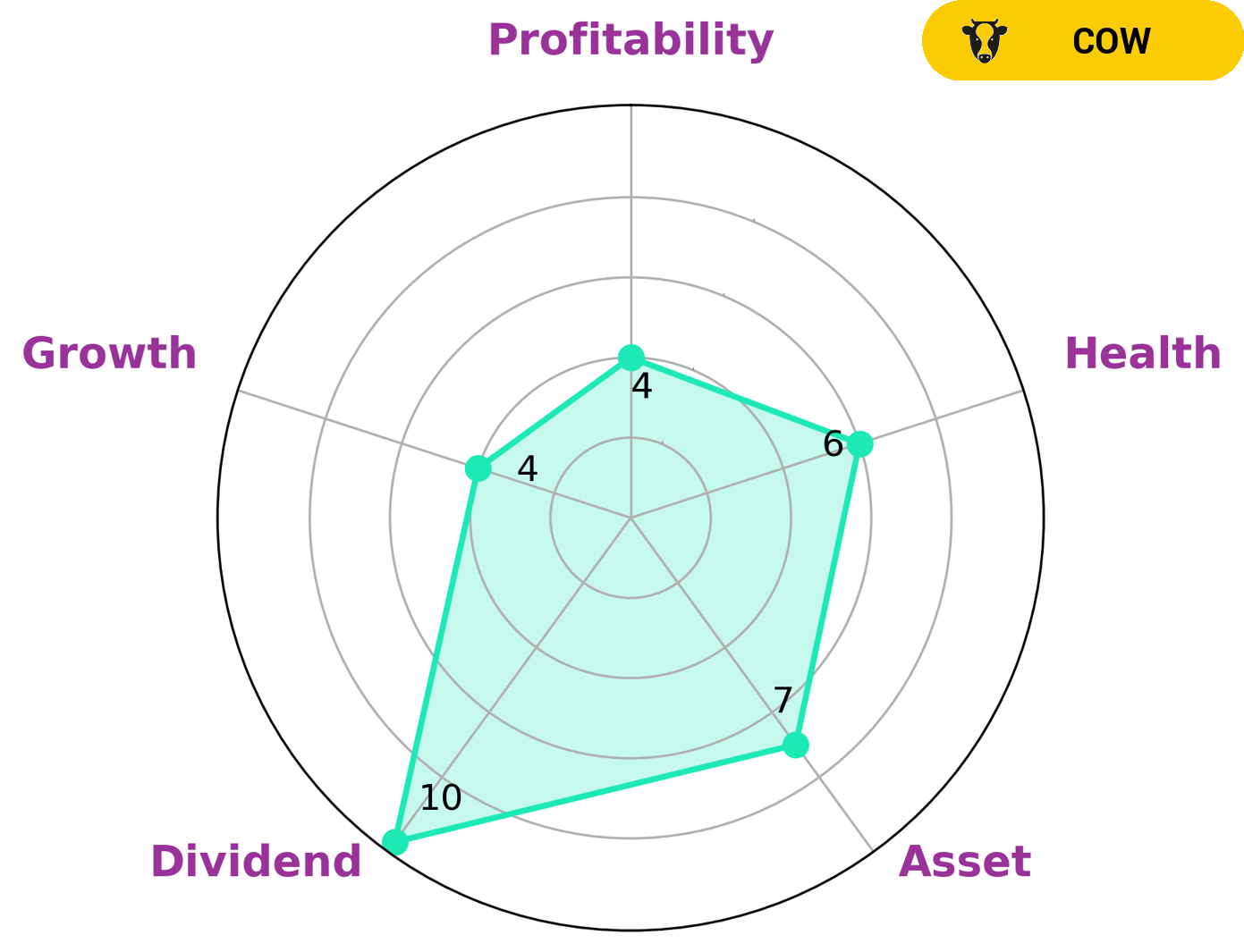

GoodWhale has conducted an analysis of SUNFONDA GROUP‘s financials, and based on our Star Chart they are classified as a ‘cow’, meaning they have a track record of paying out consistent and sustainable dividends. This makes them an attractive investment option for investors looking for steady, reliable returns. Our analysis shows that SUNFONDA GROUP is strong in asset, dividend, and medium in growth, profitability. Additionally, they have an intermediate health score of 6/10 considering their cashflows and debt, meaning that they may be able to safely ride out any crisis without the risk of bankruptcy. This makes them a great choice for investors looking for secure, low-risk investments with the potential for decent returns. More…

Peers

Sunfonda Group Holdings Ltd is a leading retailer in China that operates in the country’s rapidly growing economy. The company offers a broad range of products and services, including automotive, home improvement, and lifestyle products. Sunfonda competes against China MeiDong Auto Holdings Ltd, Lifestyle China Group Ltd, and Grand Ocean Retail Group Ltd.

– China MeiDong Auto Holdings Ltd ($SEHK:01268)

As of 2022, MeiDong Auto Holdings Ltd has a market cap of 14.34B and a ROE of 24.6%. The company is engaged in the business of automobile sales and services in China. It is one of the leading automobile retailers in China with a nationwide network of over 300 sales and service outlets. The company offers a wide range of products and services including new and used car sales, car financing, car insurance, after-sales service and parts sales.

– Lifestyle China Group Ltd ($SEHK:02136)

Lifestyle China Group Ltd is a Hong Kong-based investment holding company principally engaged in the retail businesses. The Company operates its businesses through four segments. The Retail segment is engaged in the sale of branded consumer products, including garments, footwear, leather goods, eyewear, watches and jewelry, health and beauty products, fragrances and cosmetics through its own mono-brand stores, multi-brand outlets and duty-free shops. The Wholesale segment is engaged in the sale of branded consumer products to department stores, specialty stores and other retailers. The E-commerce segment is engaged in the online sale of branded consumer products. The Others segment is engaged in the provision of management services.

– Grand Ocean Retail Group Ltd ($TWSE:5907)

Ocean Retail Group is a leading retailer in the Asia-Pacific region with over 2,000 stores across 12 markets. The company offers a wide range of products and services, including food, fashion, electronics, and home furnishings. Ocean Retail Group is listed on the Hong Kong Stock Exchange and is a constituent of the Hang Seng Index.

As of 2022, Ocean Retail Group has a market capitalization of HK$2.58 billion and a return on equity of 2.84%. The company has a strong presence in Hong Kong, China, and Taiwan, and is expanding its operations into other markets in the region. Ocean Retail Group is well-positioned to capitalize on the growing consumer demand in the Asia-Pacific region.

Summary

Investing analysis of Sunfonda Group Holdings reveals a 31% loss in earnings in 2023. The news coverage on the matter has been mixed, with some investors being apprehensive about the financial performance of the company.

However, despite the decline, Sunfonda Group Holdings remains a stable company and is actively pursuing various strategies to improve its financial performance. Investors who can stomach volatility should still consider investing in the company’s stocks as its long-term prospects remain solid. Sunfonda Group Holdings also has a history of delivering positive returns for investors in both bull and bear markets.

Recent Posts