Penske Automotive Stock Intrinsic Value – Gamco Investors INC. ET AL Reduce Stake in Penske Automotive Group,

June 12, 2023

🌥️Trending News

Gamco Investors INC. and other investors recently reduced their stakes in Penske Automotive ($NYSE:PAG) Group, Inc. (NYSE:PAG). The company sells new and used vehicles, provides vehicle maintenance, parts and service, and arranges financing, insurance, and other related services. The recent reduction in stake comes as a surprise to the markets, given the strong performance of the stock over the past few months. With such impressive performance in the markets, investors are keen to see how the company will continue to perform post the stake reduction.

Stock Price

On Tuesday, PENSKE AUTOMOTIVE Group, Inc. saw a rise in their stock prices when it opened at $142.5 and closed at $147.0, which was up by 2.5% from its previous closing price of 143.4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Penske Automotive. More…

| Total Revenues | Net Income | Net Margin |

| 28.18k | 1.31k | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Penske Automotive. More…

| Operations | Investing | Financing |

| 1.46k | -641.7 | -798 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Penske Automotive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.4k | 10.04k | 60.06 |

Key Ratios Snapshot

Some of the financial key ratios for Penske Automotive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | 34.5% | 6.8% |

| FCF Margin | ROE | ROA |

| 4.2% | 28.9% | 8.3% |

Analysis – Penske Automotive Stock Intrinsic Value

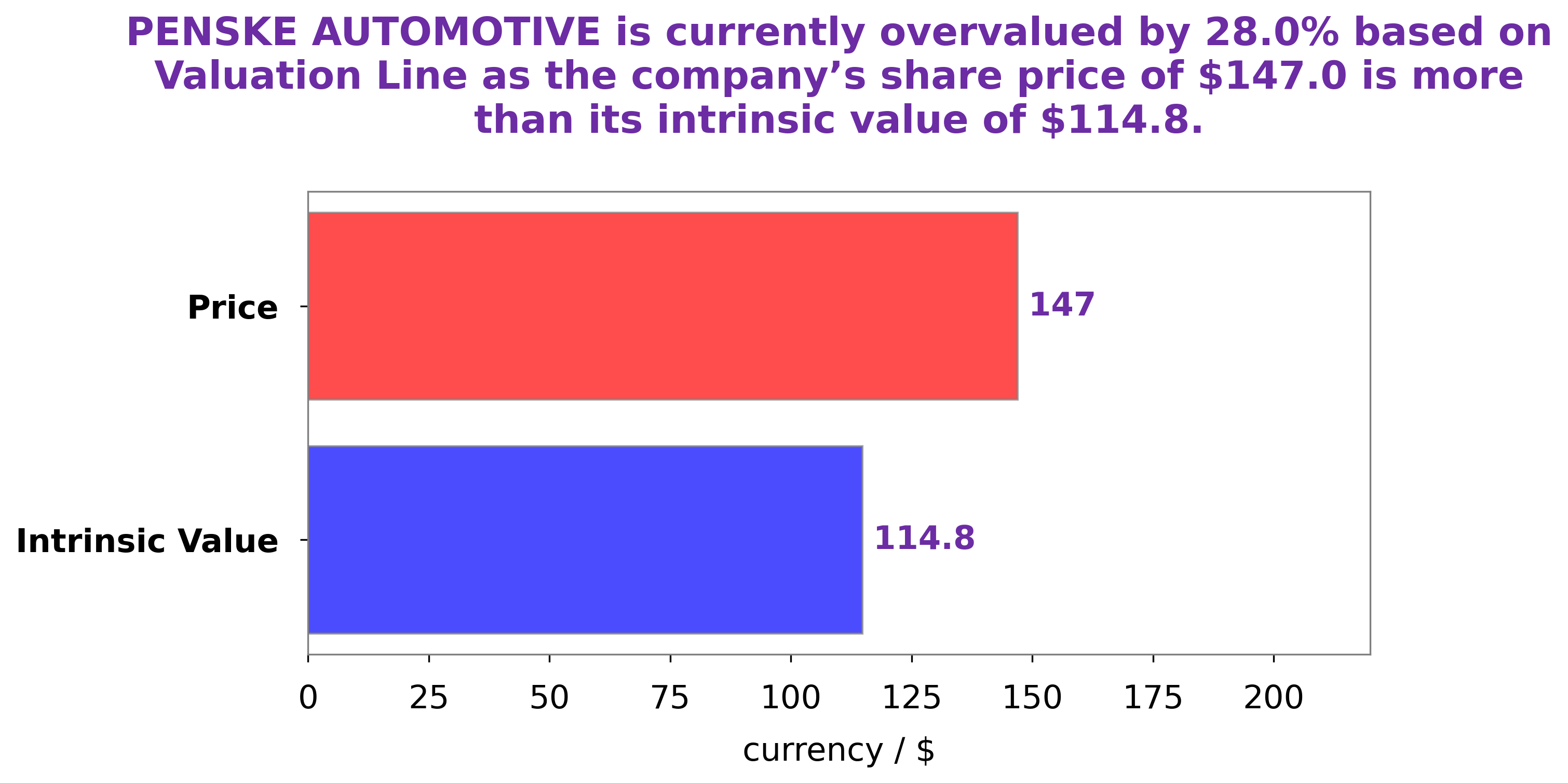

As GoodWhale, we have completed an analysis of PENSKE AUTOMOTIVE‘s financials. Our proprietary Valuation Line identifies the intrinsic value of PENSKE AUTOMOTIVE’s share to be around $114.8. However, at the current market rate, PENSKE AUTOMOTIVE is overvalued by 28.0% at $147.0. We believe that the stock may not be a good investment choice at this moment. More…

Peers

Penske Automotive Group Inc is an American automotive retailer. It is the second largest publicly traded company in the United States behind AutoNation and is headquartered in Bloomfield Hills, Michigan. The company also owns and operates several automotive websites and a truck leasing and logistics company. Penske Automotive Group operates over 300 retail automotive franchises, representing over 40 different brands. The company also operates in the United Kingdom, Australia, and Mexico. Sonic Automotive Inc is an American automotive retailer.Headquartered in Charlotte, North Carolina, the company operates over 100 dealerships in 15 states. Asbury Automotive Group Inc is an American automotive retailer. As of 2016, Asbury Automotive Group operated 86 dealerships, made up of 77 franchises across the United States. Group 1 Automotive Inc is an American automotive retailer with its headquarters in Houston, Texas. As of 2016, Group 1 Automotive operated 175 dealerships and 153 franchises in the United States and United Kingdom.

– Sonic Automotive Inc ($NYSE:SAH)

Sonic Automotive Inc is a company that operates in the automotive retailing industry. As of 2022, it had a market capitalization of 1.77 billion dollars and a return on equity of 32.11%. Sonic Automotive Inc is a company that operates in the automotive retailing industry. It is based in Charlotte, North Carolina, and was founded in 1997. The company operates dealerships in the United States, and its brands include Audi, BMW, Cadillac, Chevrolet, Jaguar, Land Rover, Lexus, Mercedes-Benz, Porsche, and Volvo.

– Asbury Automotive Group Inc ($NYSE:ABG)

Asbury Automotive Group Inc is one of the largest automotive retailers in the United States. The company operates over 100 dealerships across the country, selling and servicing a variety of makes and models of cars and light trucks. Asbury’s return on equity is impressive, coming in at over 31%. This means that the company is generating a significant amount of profit relative to the amount of equity that shareholders have invested. Asbury’s market cap is just over $3.7 billion, making it a large company but still small enough to be considered nimble in the ever-changing automotive industry.

– Group 1 Automotive Inc ($NYSE:GPI)

Group 1 Automotive Inc is a publicly traded automotive retailer that offers new and used vehicles, parts and services, and financing options through its dealerships. As of 2022, the company had a market capitalization of 2.6 billion dollars and a return on equity of 33.54%. Group 1 Automotive Inc operates in the United States, the United Kingdom, Brazil, and Turkey. The company was founded in 1995 and is headquartered in Houston, Texas.

Summary

Gamco Investors INC. This reduction could be seen as a sign of diminishing confidence in the company’s future prospects, as investors are now less willing to hold onto a larger portion of the stock.

However, despite the recent sell-off, Penske Automotive still remains one of the most attractive investments in the automotive industry. The company has performed consistently well over the years with solid revenue growth and a strong balance sheet.

Additionally, it has an experienced management team and a favorable geographic presence. As such, Penske Automotive is still a worthwhile option to consider for potential investors seeking exposure to the automotive industry.

Recent Posts