LITHIA MOTORS Reports Lower-Than-Expected Q3 Earnings and Revenue

April 21, 2023

Trending News 🌥️

The company, which operates a network of automotive dealerships across the United States, posted a Non-GAAP EPS of $8.44 per share, which was $0.37 lower than the estimated figure. Similarly, total revenue of $7 billion fell short of expectations by $280 million. Lithia Motors ($NYSE:LAD) is one of the largest automotive retailers in the United States and has been operating for nearly a century. The company operates a network of dealerships in the U.S., which sells new and used vehicles, parts and services to consumers. Additionally, the company offers financing and insurance products to customers through its Driveway platform.

Market Price

On Wednesday, LITHIA MOTORS announced that its third quarter earnings and revenue had fallen below expected levels. The company’s stock opened at $212.5 and closed at $221.5, down by 2.2% from its previous closing price of 226.4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lithia Motors. More…

| Total Revenues | Net Income | Net Margin |

| 28.46k | 1.14k | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lithia Motors. More…

| Operations | Investing | Financing |

| -685.4 | -1.33k | 2.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lithia Motors. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.42k | 10.94k | 190.7 |

Key Ratios Snapshot

Some of the financial key ratios for Lithia Motors are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.1% | 54.9% | 6.2% |

| FCF Margin | ROE | ROA |

| -3.3% | 21.3% | 6.8% |

Analysis

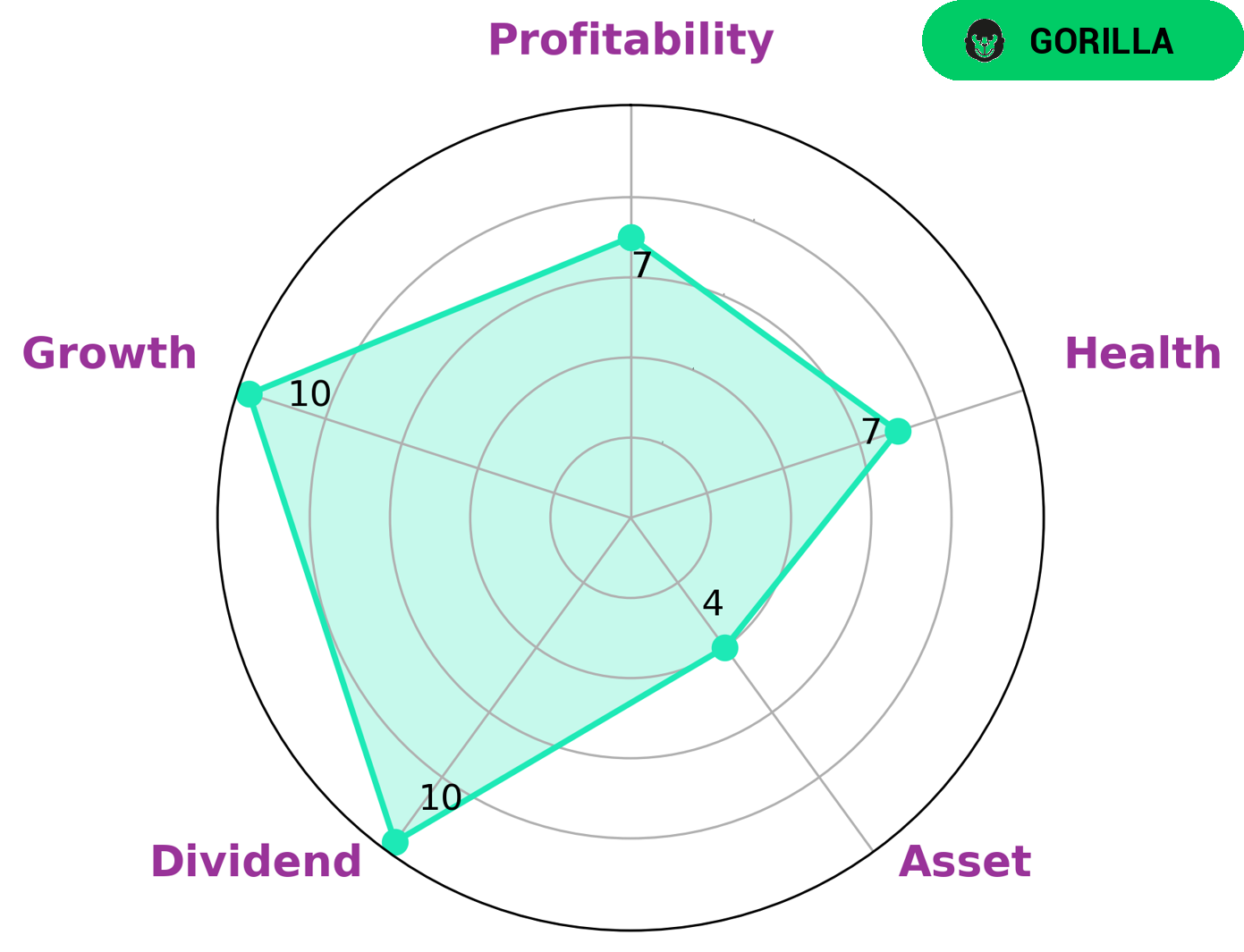

At GoodWhale, we have conducted an analysis of LITHIA MOTORS‘ financials. Our star chart classified the company as “gorilla” type; which we conclude is indicative of a strong competitive advantage, and stable and high revenue or earning growth. As such, investors who are looking for high dividend, growth and profitability may be interested in LITHIA MOTORS. In addition, the company is also medium in asset. Furthermore, we have concluded that LITHIA MOTORS has a notably high health score of 7 out of 10. This establishes that the company is well-prepared to safely ride out any financial crisis without the risk of bankruptcy, due to its sound cashflows and debt. More…

Peers

Lithia Motors Inc, AutoNation Inc, Group 1 Automotive Inc, and Penske Automotive Group Inc are all leading automotive retailers. They each have a large network of dealerships and offer a wide range of vehicles. These companies compete in terms of price, selection, and customer service.

– AutoNation Inc ($NYSE:AN)

AutoNation is the largest automotive retailer in the United States. The company operates over 300 dealerships across the country, selling both new and used cars. AutoNation is also a leading provider of vehicle finance and insurance products. The company’s market cap is 5.47B as of 2022, and its ROE is 56.13%. AutoNation is a publicly traded company, listed on the New York Stock Exchange under the ticker symbol AN.

– Group 1 Automotive Inc ($NYSE:GPI)

Group 1 Automotive Inc is a publicly traded automotive retailer that offers a range of automotive products and services, including new and used vehicles, financing, insurance, and parts and service. As of 2022, the company had a market capitalization of 2.53 billion and a return on equity of 32.9%. Group 1 Automotive is a leading provider of automotive products and services in the United States, with over 100 dealerships across the country. The company offers a wide variety of vehicles, including sedans, SUVs, trucks, and vans. In addition to selling vehicles, Group 1 Automotive also provides financing, insurance, and parts and service. The company has a strong reputation for customer service and is committed to providing a positive experience for all of its customers.

– Penske Automotive Group Inc ($NYSE:PAG)

Penske Automotive Group Inc is an American automotive retailer with a market cap of 7.28B as of 2022 and a ROE of 29.75%. The company operates in the United States, United Kingdom, and Australia. It sells and services vehicles through its dealerships.

Summary

Lithia Motors is a publicly traded automotive retailer. A recent financial report has demonstrated the company’s struggle to meet their expectations for the quarter. Investors should monitor the company’s sales performance, operating costs, and market conditions to better understand its future performance.

Recent Posts